Using the online tool for PDF editing by FormsPal, it is easy to complete or change wh 38 fillable form here. FormsPal professional team is relentlessly endeavoring to improve the editor and insure that it is even better for clients with its cutting-edge features. Take full advantage of the latest progressive opportunities, and discover a trove of emerging experiences! Starting is effortless! All you need to do is take the following basic steps below:

Step 1: Simply click on the "Get Form Button" above on this site to get into our form editor. This way, you'll find everything that is required to fill out your file.

Step 2: When you open the online editor, you'll notice the document ready to be filled out. Apart from filling out different blanks, it's also possible to perform various other actions with the file, particularly writing your own textual content, modifying the initial textual content, adding images, signing the form, and more.

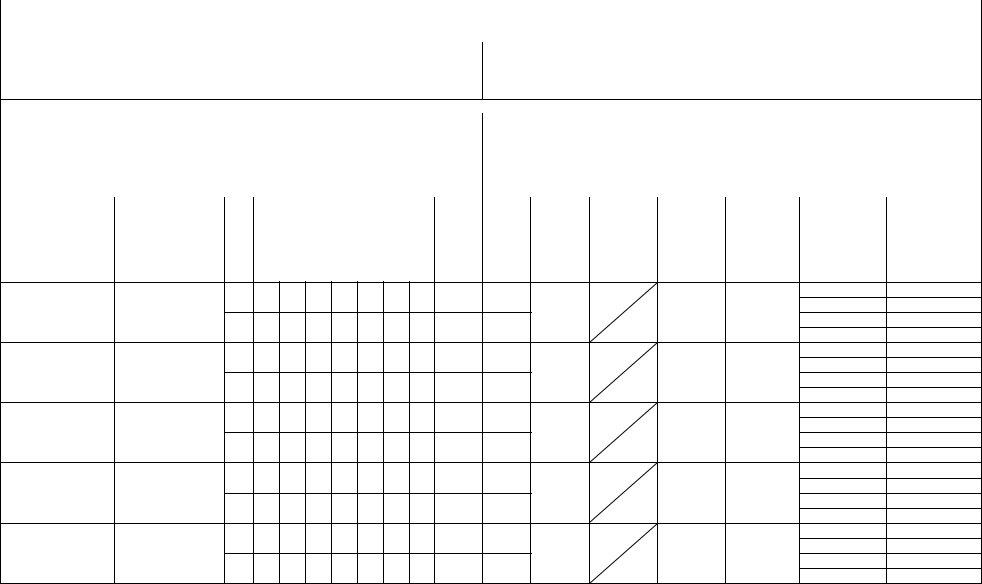

This PDF form requires specific information to be filled out, thus ensure that you take your time to type in what's asked:

1. While filling out the wh 38 fillable form, be certain to include all essential blanks within its relevant section. This will help hasten the process, making it possible for your information to be handled without delay and appropriately.

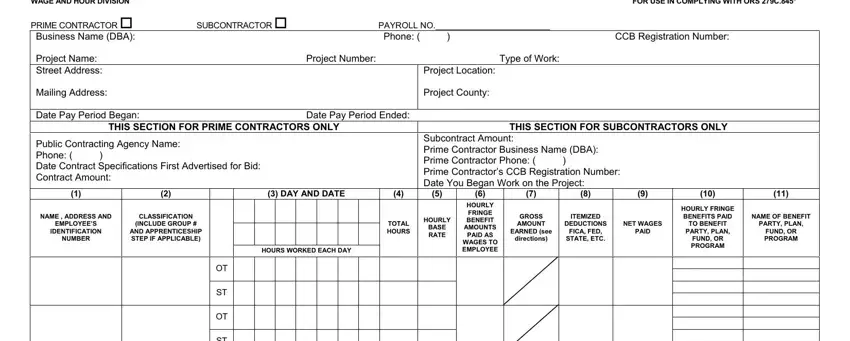

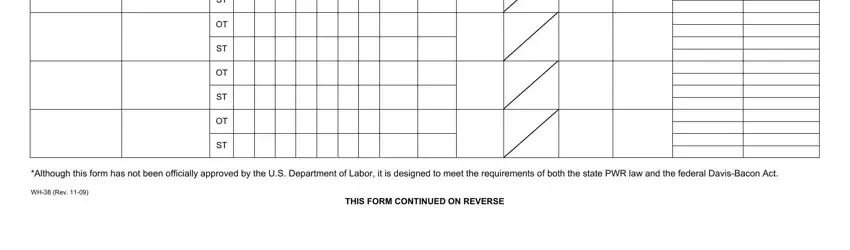

2. Right after completing the previous section, go to the subsequent step and fill out all required particulars in these blanks - Although this form has not been, and THIS FORM CONTINUED ON REVERSE.

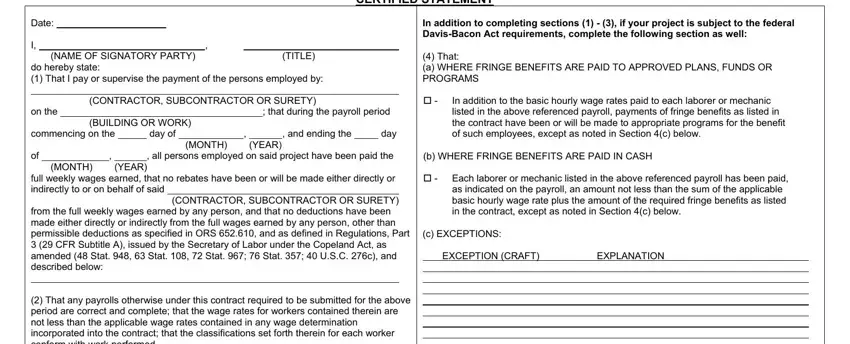

3. Completing day, and ending the, TITLE, YEAR, MONTH, that during the payroll period, YEAR, MONTH, NAME OF SIGNATORY PARTY, CONTRACTOR SUBCONTRACTOR OR SURETY, day of all persons employed on, CONTRACTOR SUBCONTRACTOR OR SURETY, Date I do hereby state That I pay, CERTIFIED STATEMENT, and In addition to completing sections is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

In terms of Date I do hereby state That I pay and CONTRACTOR SUBCONTRACTOR OR SURETY, make sure you take another look in this current part. These are the most important fields in the form.

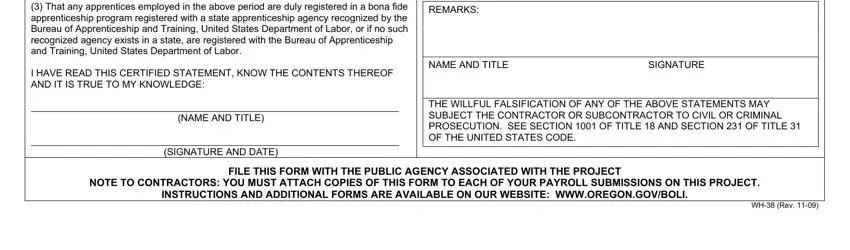

4. This next section requires some additional information. Ensure you complete all the necessary fields - Date I do hereby state That I pay, NAME AND TITLE, SIGNATURE AND DATE, NOTE TO CONTRACTORS YOU MUST, INSTRUCTIONS AND ADDITIONAL FORMS, FILE THIS FORM WITH THE PUBLIC, WH Rev, c EXCEPTIONS, REMARKS, NAME AND TITLE, SIGNATURE, and THE WILLFUL FALSIFICATION OF ANY - to proceed further in your process!

Step 3: Prior to moving on, make sure that blank fields are filled in as intended. When you’re satisfied with it, press “Done." Create a 7-day free trial subscription with us and obtain instant access to wh 38 fillable form - download or edit in your FormsPal cabinet. FormsPal guarantees your data confidentiality by using a protected method that never saves or shares any kind of private data involved in the process. You can relax knowing your documents are kept safe any time you work with our services!