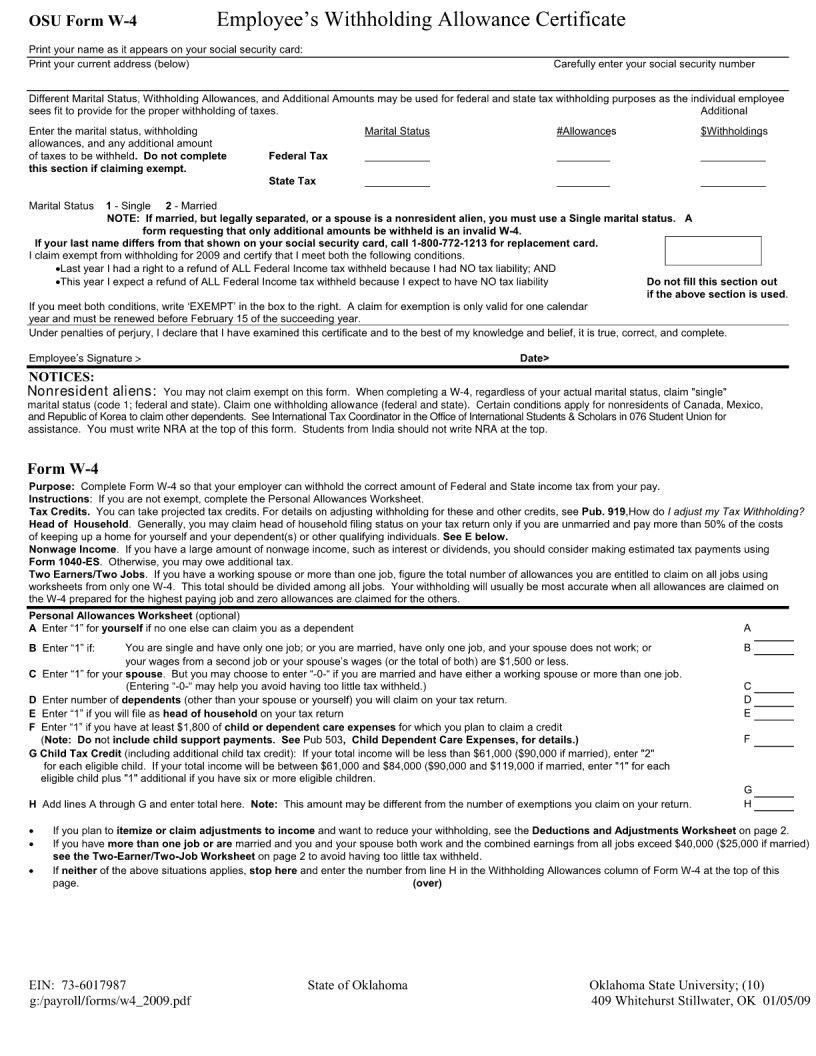

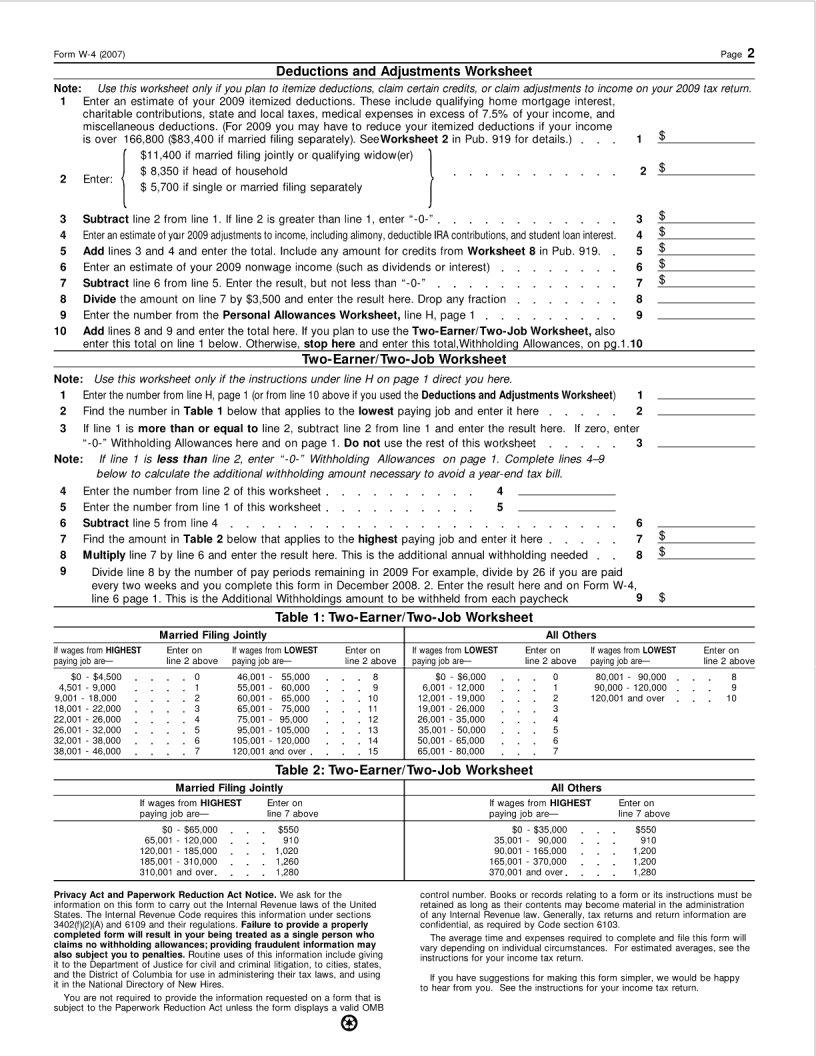

Embarking on a new job journey brings its set of challenges and one crucial step in this process, especially for individuals starting positions at Ohio State University (OSU), involves completing the OSU W-4 form. This pivotal document, a cornerstone for proper payroll processing, enables accurate federal and state tax withholdings. Understandably, the importance of filling out this form correctly cannot be overstated as it directly impacts one's take-home pay and potential end-of-year tax liabilities. The form itself is designed to be comprehensive, asking for personal information, including filing status, and the number of allowances one is claiming, which in turn determines the amount of money withheld from each paycheck for taxes. Additional sections allow for further customization based on individual financial situations, such as additional income, deductions, and any extra amount one wishes to have withheld. For new hires at OSU, navigating the complexities of this form is a critical step towards ensuring a smooth transition into their roles, making it essential to approach this task with a clear understanding of one's financial picture and the potential implications of the choices made on the form.

| Question | Answer |

|---|---|

| Form Name | Osu Form W 4 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | oklahoma state tax withholding form 2019, oklahoma w4, oklahoma state tax withholding form, oklahoma state withholding form 2019 |