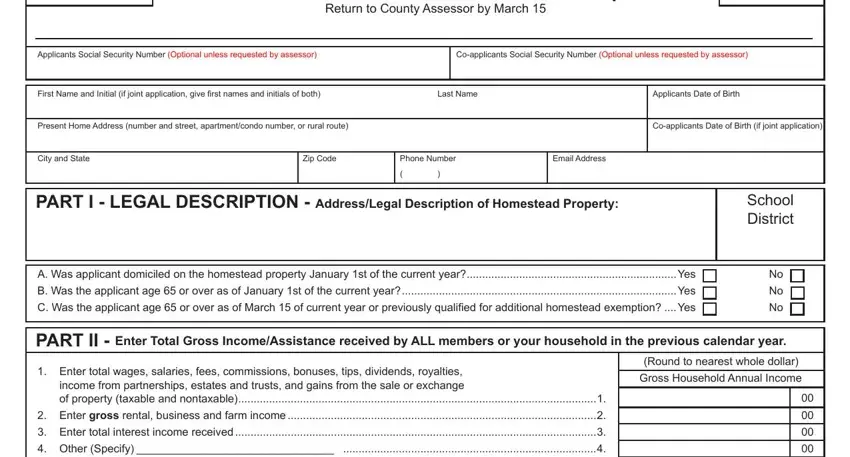

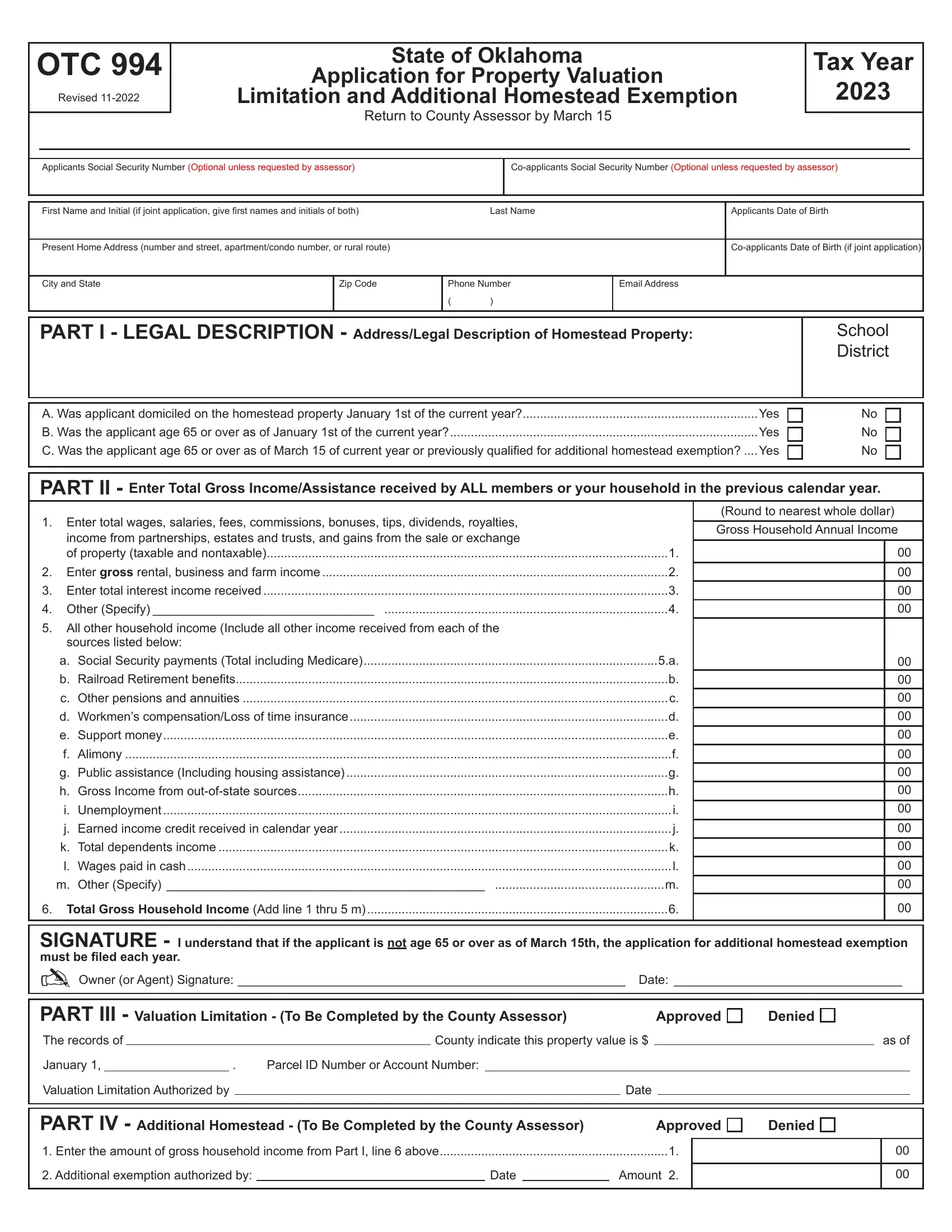

State of Oklahoma

Application for Property Valuation

Limitation and Additional Homestead Exemption

Return to County Assessor by March 15

Applicants Social Security Number (Optional unless requested by assessor) |

|

|

Co-applicants Social Security Number (Optional unless requested by assessor) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name and Initial (if joint application, give first names and initials of both) |

|

Last Name |

|

Applicants Date of Birth |

|

|

|

|

|

|

|

|

Present Home Address (number and street, apartment/condo number, or rural route) |

|

|

|

|

Co-applicants Date of Birth (if joint application) |

|

|

|

|

|

|

|

|

City and State |

Zip Code |

Phone Number |

Email Address |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I - LEGAL DESCRIPTION - Address/Legal Description of Homestead Property: |

|

|

School |

|

|

|

|

|

|

|

|

District |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Was applicant domiciled on the homestead property January 1st of the current year? |

|

Yes |

No |

B. Was the applicant age 65 or over as of January 1st of the current year? |

|

|

Yes |

No |

C. Was the applicant age 65 or over as of March 15 of current year or previously qualified for additional homestead exemption? Yes.... |

No |

|

|

|

|

|

|

|

|

|

PART II - Enter Total Gross Income/Assistance received by ALL members or your household in the previous calendar year.

1. |

Enter total wages, salaries, fees, commissions, bonuses, tips, dividends, royalties, |

|

(Round to nearest whole dollar) |

|

Gross Household Annual Income |

|

income from partnerships, estates and trusts, and gains from the sale or exchange |

|

|

|

|

|

|

of property (taxable and nontaxable) |

1. |

|

00 |

2. |

Enter gross rental, business and farm income |

2. |

|

00 |

3. |

Enter total interest income received |

3. |

|

00 |

4. |

Other (Specify) ________________________________ |

|

00 |

5. |

All other household income (Include all other income received from each of the |

|

|

|

|

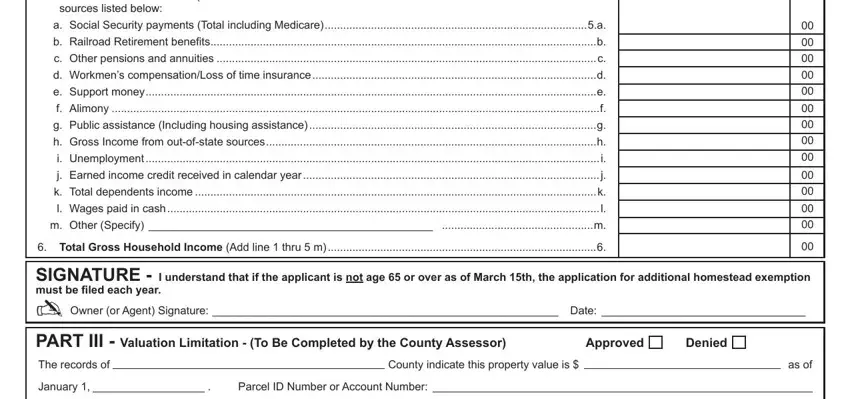

sources listed below: |

|

|

|

|

a. Social Security payments (Total including Medicare) |

5.a. |

|

00 |

|

b. Railroad Retirement benefits |

b. |

|

00 |

|

c. Other pensions and annuities |

c. |

|

00 |

|

|

|

|

|

|

d. Workmen’s compensation/Loss of time insurance |

d. |

|

00 |

|

|

|

|

|

|

e. Support money |

e. |

|

00 |

|

|

|

|

|

|

f. Alimony |

f. |

|

00 |

|

g. Public assistance (Including housing assistance) |

|

00 |

|

h. Gross Income from out-of-state sources |

h. |

|

00 |

|

i. Unemployment |

i. |

|

00 |

|

|

|

|

|

|

j. Earned income credit received in calendar year |

j. |

|

00 |

|

|

|

|

|

|

k. Total dependents income |

k. |

|

00 |

|

|

|

|

|

|

l. Wages paid in cash |

l. |

|

00 |

|

m. Other (Specify) ______________________________________________ |

|

|

|

|

00 |

6. |

Total Gross Household Income (Add line 1 thru 5 m) |

|

00 |

|

|

|

|

|

SIGNATURE - I understand that if the applicant is not age 65 or over as of March 15th, the application for additional homestead exemption must be filed each year.

✍ Owner (or Agent) Signature: ________________________________________________________ |

Date: _________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III - Valuation Limitation - (To Be Completed by the County Assessor) |

|

Approved |

Denied |

The records of |

|

|

|

|

|

County indicate this property value is $ |

|

|

|

as of |

January 1, |

|

|

. |

Parcel ID Number or Account Number: |

|

|

|

|

|

|

|

Valuation Limitation Authorized by |

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV - Additional Homestead - (To Be Completed by the County Assessor) |

Approved |

Denied |

|

|

|

|

|

|

|

1. Enter the amount of gross household income from Part I, line 6 above |

|

1. |

|

|

00 |

2. Additional exemption authorized by: |

Date |

Amount 2. |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

Application for Property Valuation Limitation and Additional Homestead Exemption - Page 2

Instructions

Eligibility Requirements:

(1)Head-of-household must be age 65 or over as of January 1st of current year when filing for property valuation limitation, or March 15 when filing for additional homestead.

(2)Head-of-household must be an owner of and occupy the homestead property on January 1.

(3)Valuation Limitation: Gross household income (collective income of all persons living in the homestead residence) must not exceed the amount determined by the United States Department of Housing and Urban Development (H.U.D.) as the qualification income for your individual county of residence. These qualification income levels may be different for each county and are subject to change each year. Contact your county assessor for the exact qual- ification income.

(4)Maximum household income qualification for the Additional Homestead Exemption is $25,000.00 for all counties.

(5)If age 65 or over and have been granted an Additional Homestead Exemption no application is required unless your gross household income exceeded $25,000.00.

Part I. Identification of Real Property Affected by Application

The physical address or legal description should be entered here to properly identify the homestead residence.

The applicant is to sign and date the application.

Part II. Gross Household Income

Income from all sources of each individual who lives on the homesteaded property is to be included in this section.

(See definition for “gross household income” listed below.) The applicant may be required to provide sufficient proof to

substantiate the validity of the income statement.

Part III. Valuation Limitation - (To Be Completed by the County Assessor)

Valuation Limitation: A limitation in valuation for homestead property for persons 65 years of age or over as of Janu- ary 1 with gross household income not exceeding the H.U.D. qualifying income for the preceding year.

You must be age 65 or over as of January 1st to qualify. (Reference 68 O.S. §2890.1)

Part IV. Additional Homestead - (To Be Completed by County Assessor)

The application for the Additional Homestead Exemption and Senior Valuation Limitation shall be made each year before March 15 or thirty (30) days after the receipt of a change in valuation notice, whichever is later. The application must be made to the county assessor of the county where the homestead property is located. If the applicant is six- ty-five (65) years of age or more as of March 15th and who has previously qualified for the exemption or limitation, no annual application is required. If the gross household income for any calendar year exceeds the qualification amount specified, the applicant shall notify the county assessor, and the exemption will not be allowed for the applicable year. (Ref. 68 O.S. Section 2890; 2890.1)

Definitions

“Head-of-household” is defined in 68 O.S. §2890 as “a person who as owner or joint owner maintains a home and furnish- es support for the home, furnishings, and other material necessities.”

“Gross household income” is defined in 68 O.S. §2890 as “the gross amount of income of every type, regardless of the source, received by all persons occupying the same household, whether such income was taxable or nontaxable for fed- eral or state income tax purposes, including pensions, annuities, federal Social Security, unemployment payments, public

assistance payments, alimony, support money, workers’ compensation, loss-of-time insurance payments, capital gains and any other type of income received; and excluding gifts. The term “gross household income” shall not include any veterans’

disability compensation payments.

Part II, III, IV of this form is to be completed by the county assessor.