In the complex landscape of taxation and regulatory adherence, the Government of the District of Columbia's Office of Tax and Revenue has established several forms, amongst which the OTR-553, or Contractor’s Exempt Purchase Certificate, plays a pivotal role for contractors and subcontractors operating within the jurisdiction of the District of Columbia. Designed as a fill-in form to streamline the certification process, the OTR-553 form outlines a stringent procedure that prohibits handwritten data outside of the required signature, emphasizing its structured and official nature. The form effectively serves as a communication medium between vendors and purchasers, specifically contractors or subcontractors, detailing necessary exemptions from the District of Columbia Sales and Use Tax under various categories such as government projects, semipublic institutions, and foreign governments. With sections meticulously designed to capture details ranging from the Federal Identification Number (FEIN) and tax account IDs to specific project identifiers and exemption statuses, the OTR-553 plays a critical role in ensuring that all purchases made for the construction of real property for exempt organizations adhere to the set tax exemptions. Usage of this form is strictly regulated, providing exemptions solely for materials meant for permanent physical incorporation into the project, explicitly excluding equipment rentals and non-permanent materials. Further compliance is ensured by a mandatory prerequisite requiring filing with the Office of Tax and Revenue. This form encapsulates the District's tax code's complexity and specificity, striking a balance between regulatory compliance and facilitation of construction and development projects by exempt entities.

| Question | Answer |

|---|---|

| Form Name | Otr 553 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dc exempt purchase certificate, dc otr 553, dc contractor certificate, district of columbia exemption certificate |

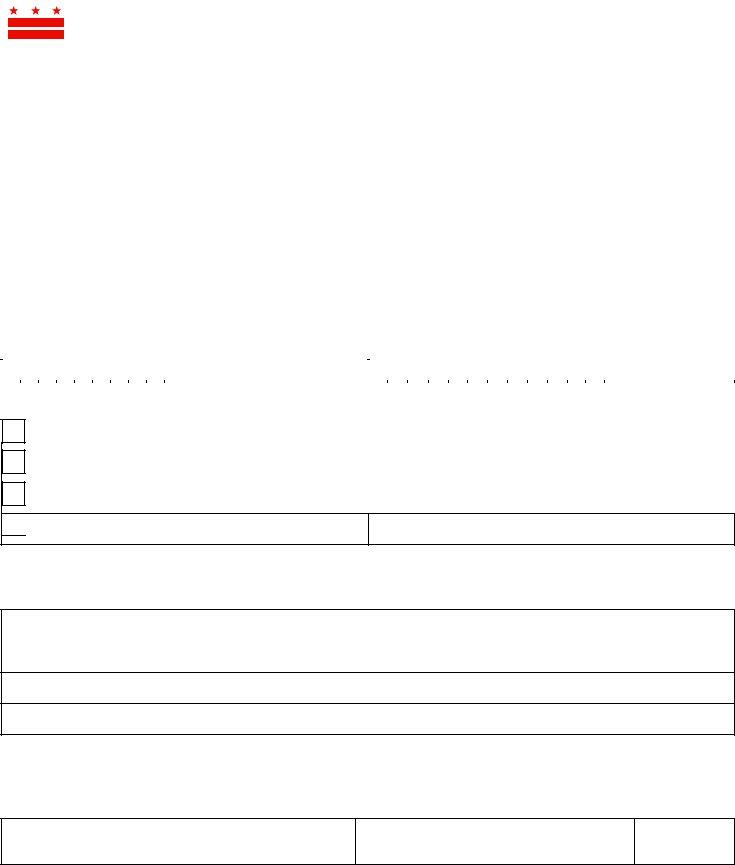

This is a

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF TAX AND REVENUE

DISTRICT OF COLUMBIA SALES AND USE TAX

TO: |

|

|

ISSUED BY: |

|

|

VENDOR |

|

|

PURCHASER (CONTRACTOR OR SUBCONTRACTOR) |

||

|

|

|

|

|

|

VENDORS’ STREET ADDRESS |

|

TRADE NAME (IF ANY) |

|

|

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

PURCHASER’S STREET ADDRESS |

|

|

|

|

|

|

|

|

SELLER MUST KEEP THIS CERTIFICATE |

|

CITY |

STATE |

ZIP CODE |

|

TO SUBSTANTIATE EXEMPT STATUS |

|

|

|

|

|

|

|

|

|

||

FEIN |

|

|

DC SALES AND USE TAX ACCOUNT ID NUMBER |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPES OF EXEMPTION |

|

|

|

|

|

|

|

|

FEDERAL GOVERNMENT |

|

FEDERAL CONTRACT # |

|

|

|

|

|

|

|

DC GOVERNMENT |

|

DC CONTRACT # |

|

|

|

|

|

|

|

|

|

|

|

|

SEMIPUBLIC INSTITUTION |

|

EXEMPTION # OF SEMIPUBLIC INSTITUTION |

|

|

|

|

|

|

|

|

|

|

FOREIGN GOVERNMENT

EXEMPTION #

PROJECT IDENTIFICATION

NAME OF U.S. OR DC AGENCY OR INSTRUMENTALITY, SEMIPUBLIC INSTITUTION OR FOREIGN GOVERNMENT

ORGANIZATION STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

NAME AND TYPE OF PROJECT

PROJECT LOCATION

I/we certify that as issuer of this certificate I/we have entered into a contract for the construction of real property for the exempt organization indicated and that all materials purchased are for physical incorporation in this project are exempt from DC Sales and Use Tax.

AUTHORIZED SIGNATURE |

TITLE |

DATE |

This certificate does not extend to equipment rentals or any sales of materials whose nature precludes physical incorporation as a permanent part of the real property. To be eligible to use this certificate, you must file DC Form