In the bustling city of Owensboro and the wider Daviess County, businesses are required to navigate the complexities of local tax regulations, one of which is the Owensboro E-1 Form. This crucial document is designed for employers to report and remit the license fee withholdings from their employees' earnings. Its significance cannot be understated, as it ensures that both the City of Owensboro and Daviess County receive the necessary funds to support community services. The form is straightforward in its layout, asking for total gross wages, adjustments for compensations not subject to license fees, and calculations for the license fees due, including adjustments for cafeteria plans under Section 125. Importantly, it also contains sections for penalties and interest for late filings or payments, emphasizing the importance of meeting due dates. Employers must adhere to specific guidelines on what constitutes earnings subject to these fees, including various benefits and compensations, while also noting exempt earnings. The process, though detailed, is structured to make compliance as manageable as possible for employers, facilitating the support of local governmental operations through occupational license fees.

| Question | Answer |

|---|---|

| Form Name | Owensboro Form E 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | city of owensboro ky form e 1, https, Multiplied, city of owensboro and e 1 form |

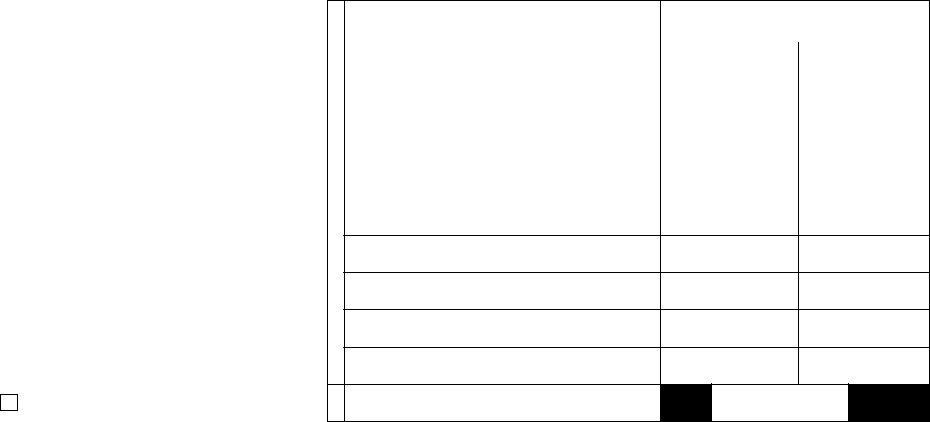

FORM

City of Owensboro/Daviess County Fiscal Court

Employers Return of License Fee Withheld

Make Checks Payable and Mail to:

Occupational Tax Administrator

PO BOX 10008

Owensboro, KY

Phone: (270)

SEE INSTRUCTIONS ON BACK

CHANGE OF ADDRESS

|

|

|

RETURN THIS COPY WITH PAYMENT |

||

|

Account No: |

Due Date: |

|

|

|

|

|

|

CITY OF |

DAVIESS |

|

|

Period Beginning: |

Type: |

OWENSBORO |

COUNTY |

|

|

|

|

|||

|

Period Ending: |

|

Column A |

Column B |

|

1. |

Total Gross Wages, Salaries and Other Compensation Paid…. |

|

|

||

2. |

Less: Compensation not Subject to License Fee………………. |

|

|

||

3. |

Earnings Subject to License Fee (Line 1 minus Line 2) |

|

|

||

|

(Include Section 125 “Cafeteria Benefits” as subject)……… |

|

|

||

|

License Fee Rate (Daviess County Rate in Column B is |

1.33% |

.35% |

||

4. .5% for periods ending 7/31/05 thru 12/31/06)…… |

|||||

|

|

||||

5.License Fee Due (Line 3 Multiplied by Line 4)……………..

6.Penalty (5% per month not to exceed 25%) $25 Minimum..

7.Interest (1% per calendar month or fraction thereof)

8.Total Amount Due ( Add Lines 5,6, and 7)………………….

9.Payment Amount (Add Line 8 Column A to Line 8 Column B)….

I hereby certify that the information statements contained herein and any schedules or exhibits attached are true and correct to the best of my knowledge.

_______________________________________ |

____________________ |

______________________ |

_______________ |

Signature |

Phone |

Title |

Date |

WHO MUST FILE – Each employer who employs one or more individuals shall withhold the occupational license fee due from each employee on salaries, wages, commissions and other compensation for work done or services performed or rendered in the City of Owensboro and/or Daviess County.

WHEN TO FILE – The employer shall make a return and pay the license fee in accordance with the following due dates:

a.) Returns required to be filed monthly shall be due on or before the 15th day of the month next following each monthly period, except the return for the last month of the calendar year, which shall be due on January 31.

b.) Returns required to be filed quarterly shall be due on or before the last day of the month following each quarterly period.

OTHER SUBJECT EARNINGS – The occupational license fee shall be withheld on compensation paid by the employer to the employee including, but not limited to:

a.) |

Deferred compensation under Sections 403(b), 401(k), or 457 of the Internal Revenue |

|

Code. |

b.) |

Employee elections under Section 125 “cafeteria plans”. |

c.) |

Disability, sickness and accident benefits paid by the employer. |

d.) |

Vacation and/or holiday benefits |

e.) |

Cash and |

f.) |

Separation payments including an employer administered unemployment plan. |

g.) |

Life insurance premium for coverage in excess of $50,000, where premiums are paid by |

|

the employer. |

EXEMPT EARNINGS

a.) Domestic Servants

b.) Ordained Minister of Religion

c.) Disability, sickness and accident benefits paid by a third party. d.) Workers compensation benefits.

e.) Unemployment benefit payments made by the State or other government agency. f.) Earnings of an employee who has not yet attained age 16

g.) Death benefits payable by an employer to the beneficiary of an employee or to his estate.

INSTRUCTIONS

Important Note: Calculate the occupational license fee due from compensation earned within the corporate city limits of the City of Owensboro in Column A of FORM

LINE 1: Enter compensation paid to employees, regardless of when or where earned.

LINE 2: Enter the amount included in Line 1 which represents payment for services performed:

-Outside the corporate city limits of the City of Owensboro on Line 2 of Column A

-Outside Daviess County on Line 2 of Column B. (Should include compensation earned in the corporate limits of the City of Owensboro).

-Also include other compensation not subject to license fee.

LINE 3: Enter total earnings subject to license fee. (Line 1 minus Line 2 in each column).

LINE 4: License fee rate. (Note: Daviess County Rate is .5% for periods ending 7/31/05

Thru 12/31/06.

LINE 5: Enter the license fee due. (Line 3 multiplied by Line 4 in each column).

LINE 6: Applicable percentage of penalty multiplied by Line 5. ($25 minimum) (Any licensee who fails to file and/or pay the license fee by the due date shall pay penalty

at the rate of 5% per calendar month, not to exceed 25% of the total license fee due, however penalty will always be a minimum of $25)

LINE 7: Applicable percentage of interest multiplied by Line 5. (Any licensee who fails to pay the license fee by the due date shall pay interest at the rate of 1% per calendar month, or fraction thereof, of any license fee due.

LINE 8: Total license fee, interest and penalty due. (Add Lines 5, 6 and 7 in each column).

LINE 9: Total Payment due. ( Add Line 8 Column A to Line 8 Column B and enter on Line 9)

(PAY THIS AMOUNT WITH THE RETURN)