You are able to fill out p87 claim form without difficulty with the help of our online editor for PDFs. FormsPal is aimed at making sure you have the ideal experience with our tool by consistently adding new features and upgrades. Our tool is now much more useful with the newest updates! Currently, editing PDF forms is a lot easier and faster than before. Starting is effortless! All you should do is follow the next basic steps directly below:

Step 1: Hit the "Get Form" button in the top part of this webpage to access our PDF editor.

Step 2: As you access the tool, you'll notice the form made ready to be filled in. In addition to filling out different fields, you can also perform other things with the Document, such as writing any words, changing the original text, inserting images, putting your signature on the form, and much more.

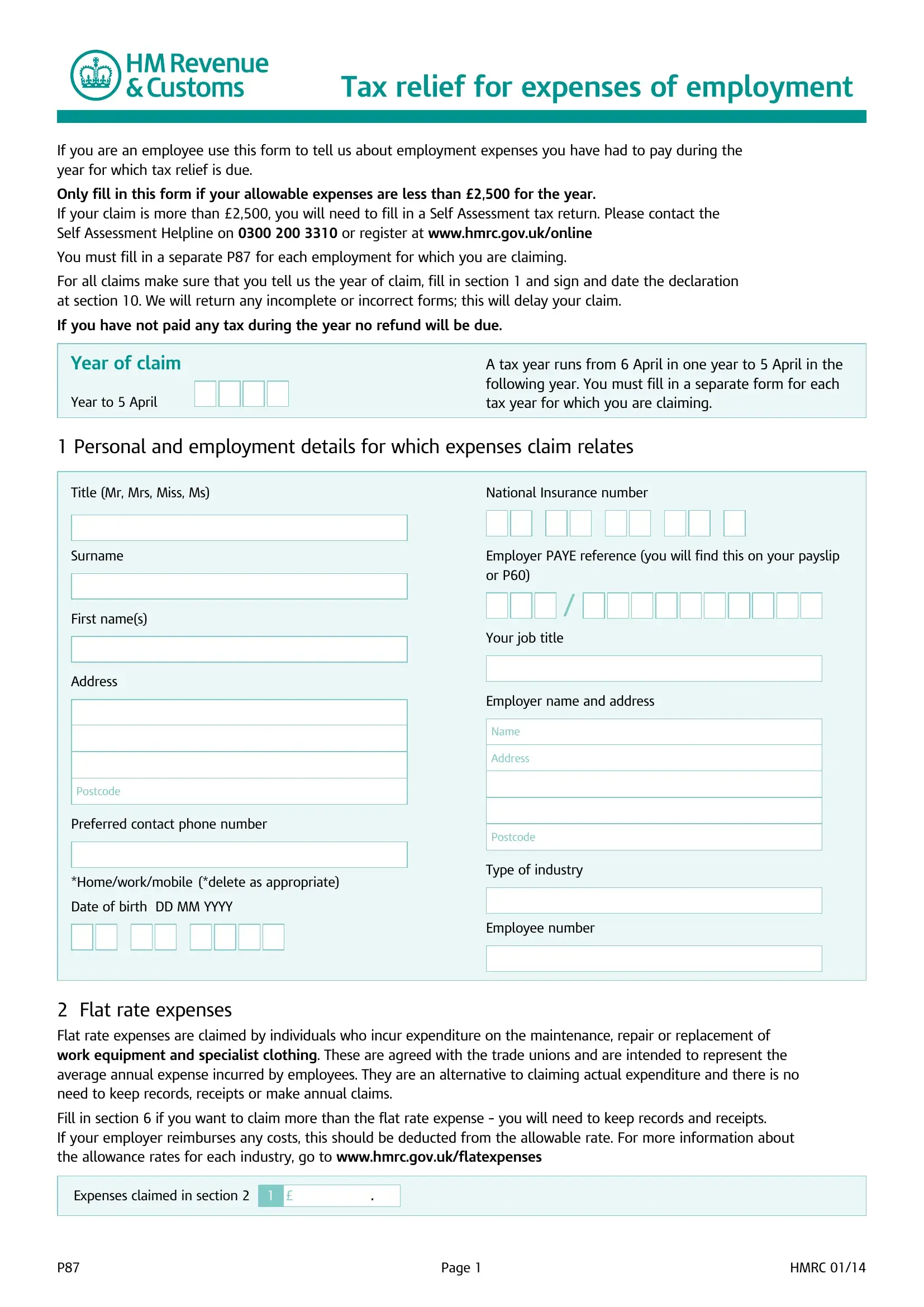

This form will involve specific details; in order to ensure accuracy, make sure you consider the guidelines further on:

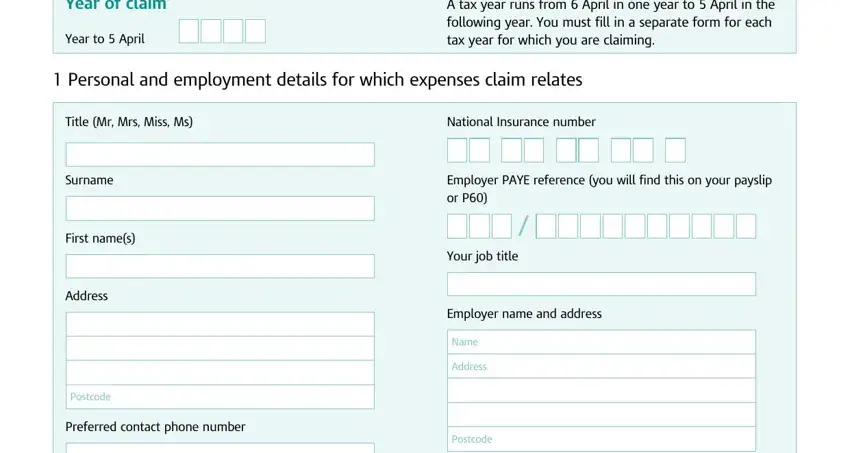

1. To get started, while filling out the p87 claim form, beging with the form section that has the subsequent blank fields:

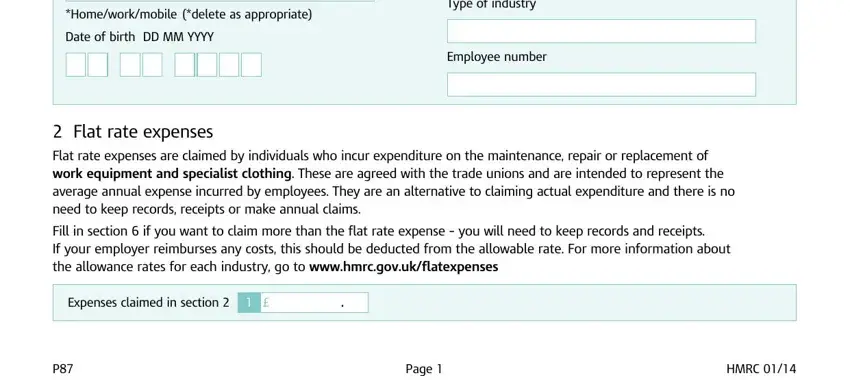

2. Once your current task is complete, take the next step – fill out all of these fields - Homeworkmobile delete as, Date of birth DD MM YYYY, Type of industry, Employee number, Flat rate expenses Flat rate, Fill in section if you want to, Expenses claimed in section, Page, and HMRC with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be really mindful when filling out Expenses claimed in section and Homeworkmobile delete as, since this is the part in which many people make a few mistakes.

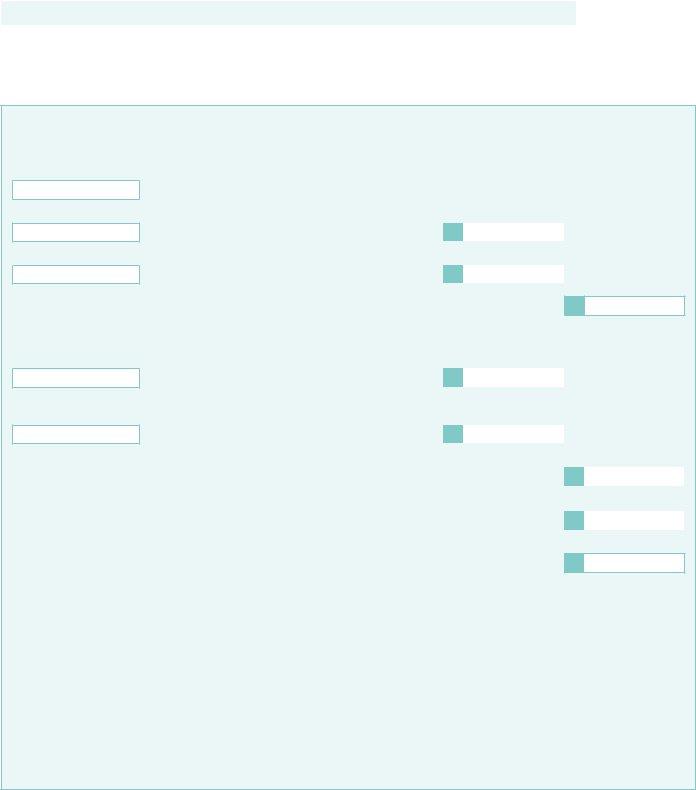

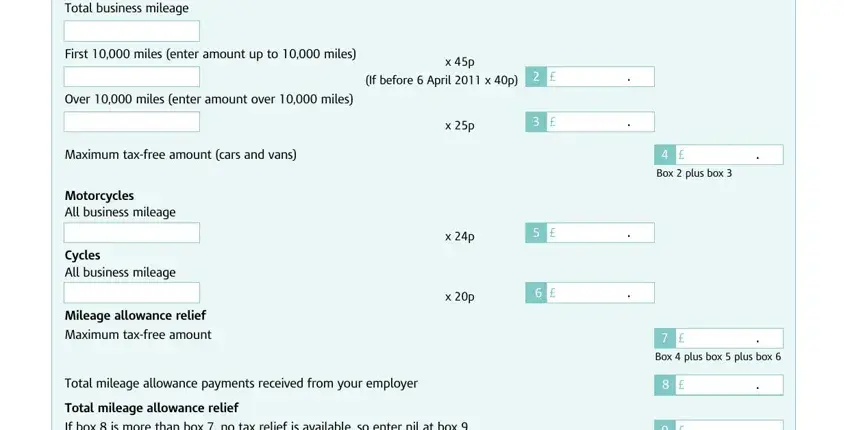

3. This next portion will be about Total business mileage, First miles enter amount up to, Over miles enter amount over, Maximum taxfree amount cars and, Motorcycles All business mileage, Cycles All business mileage, Mileage allowance relief, Maximum taxfree amount, x p, If before April x p, x p, x p, x p, Total mileage allowance payments, and Total mileage allowance relief - fill out every one of these empty form fields.

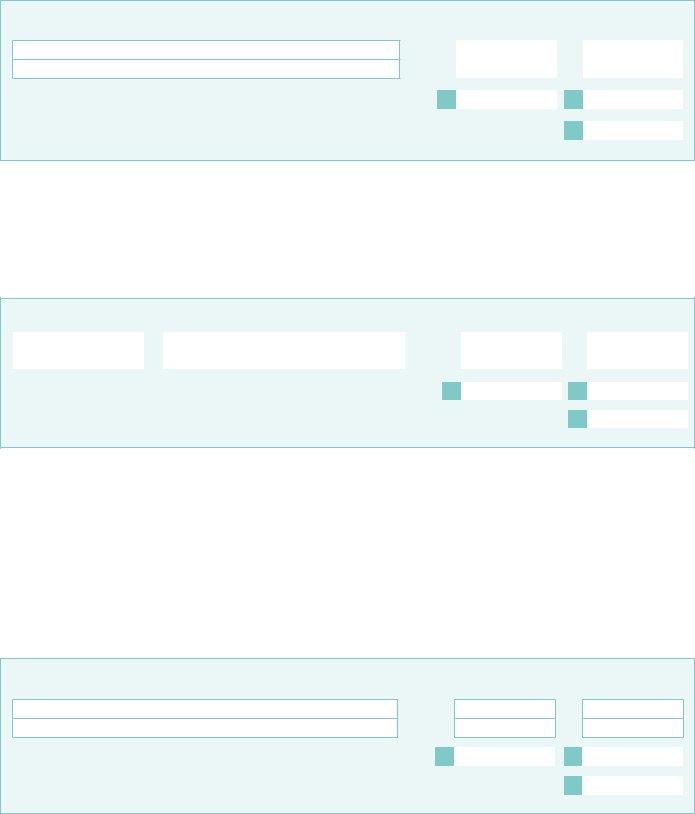

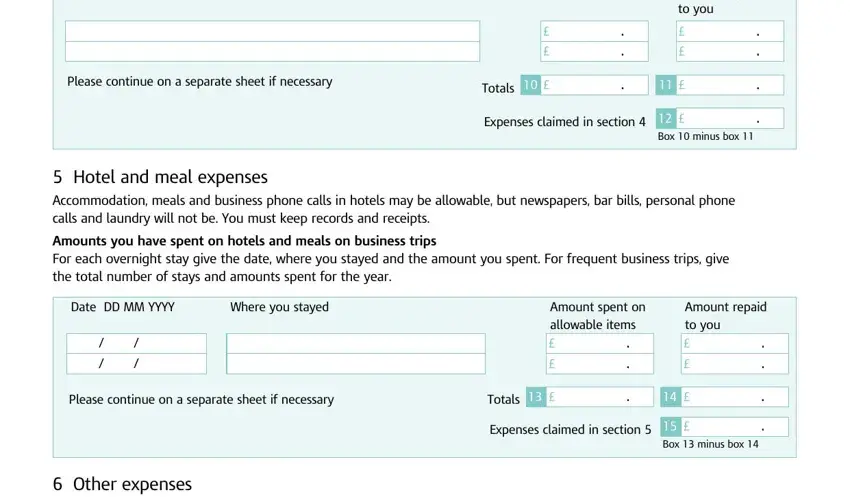

4. This next section requires some additional information. Ensure you complete all the necessary fields - Please continue on a separate, Amount repaid Amount repaid to you, Totals Totals, Expenses claimed in section, Hotel and meal expenses, Amounts you have spent on hotels, Date DD MM YYYY, Where you stayed, Amount spent on allowable items, Amount repaid to you, Please continue on a separate, Totals, Expenses claimed in section, and Other expenses Fill in section - to proceed further in your process!

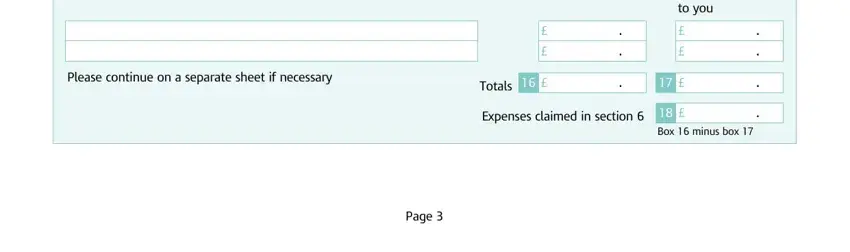

5. This form has to be wrapped up by filling out this part. Below you can find a comprehensive list of blanks that require correct information for your document usage to be faultless: Please continue on a separate, Amount repaid to you, Totals, Expenses claimed in section, Box minus box, and Page.

Step 3: Make sure that the information is right and just click "Done" to continue further. Right after getting afree trial account at FormsPal, you'll be able to download p87 claim form or send it through email immediately. The document will also be easily accessible in your personal cabinet with all of your modifications. We don't share or sell the information that you type in when filling out documents at our site.