|

|

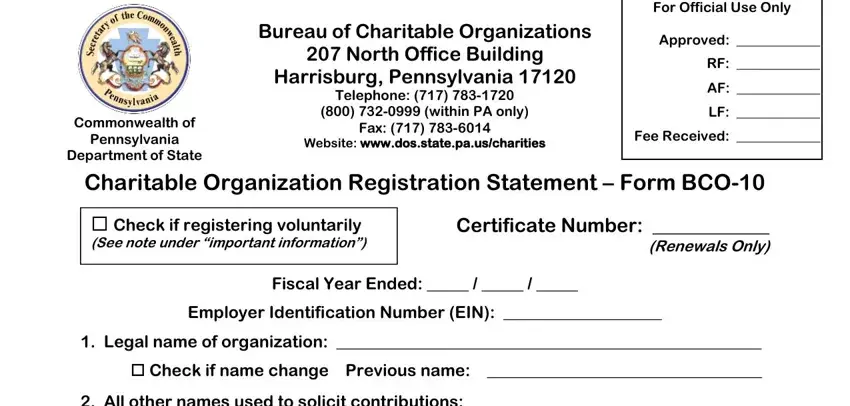

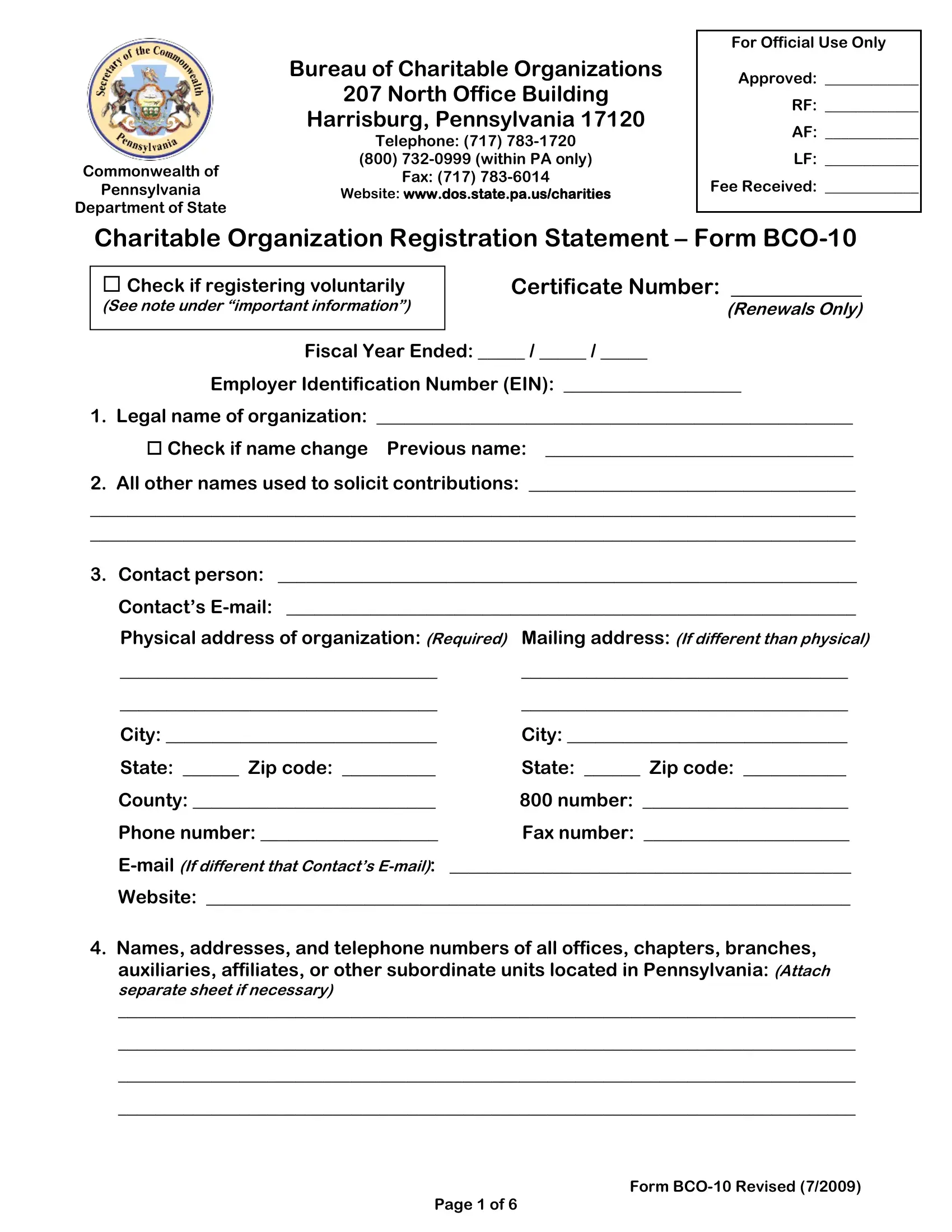

Bureau of Charitable Organizations |

|

|

207 North Office Building |

|

|

Harrisburg, Pennsylvania 17120 |

|

|

Telephone: (717) 783-1720 |

|

Commonwealth of |

(800) 732-0999 (within PA only) |

|

Fax: (717) 783-6014 |

|

Pennsylvania |

|

Website: www.dos.state.pa.us/charities |

|

Department of State |

|

For Official Use Only

Approved: ____________

RF: ____________

AF: ____________

LF: ____________

Fee Received: ____________

Charitable Organization Registration Statement – Form BCO-10

Check if registering voluntarily

(See note under “important information”)

Certificate Number: ____________

(Renewals Only)

Fiscal Year Ended: _____ / _____ / _____

Employer Identification Number (EIN): ___________________

1. Legal name of organization: ___________________________________________________

Check if name change Previous name: _________________________________

2.All other names used to solicit contributions: ___________________________________

__________________________________________________________________________________

__________________________________________________________________________________

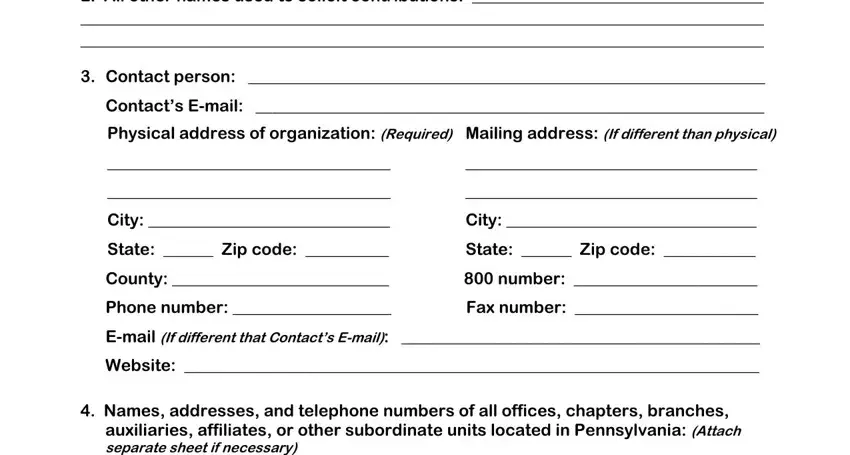

3.Contact person: ______________________________________________________________

Contact’s E-mail: _____________________________________________________________

Physical address of organization: (Required) Mailing address: (If different than physical)

__________________________________ |

___________________________________ |

__________________________________ |

___________________________________ |

City: _____________________________ |

City: ______________________________ |

State: ______ Zip code: __________ |

State: ______ Zip code: ___________ |

County: __________________________ |

800 number: ______________________ |

Phone number: ___________________ |

Fax number: ______________________ |

E-mail (If different that Contact’s E-mail): |

___________________________________________ |

Website: _____________________________________________________________________

4. Names, addresses, and telephone numbers of all offices, chapters, branches, auxiliaries, affiliates, or other subordinate units located in Pennsylvania: (Attach

separate sheet if necessary)

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

Form BCO-10 Revised (7/2009)

Page 1 of 6

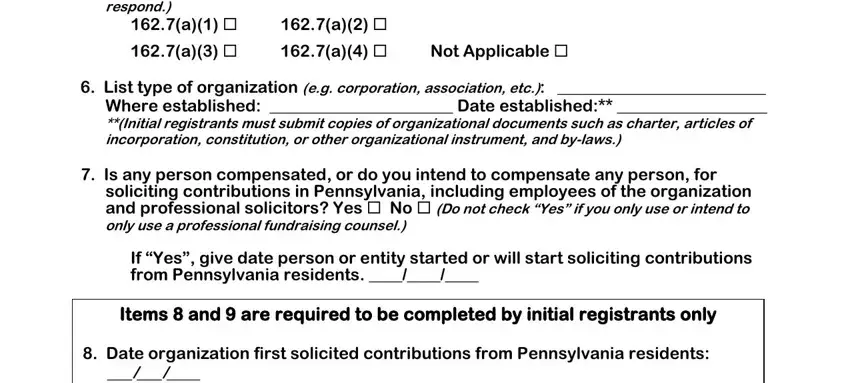

5.For Organizations described in Section 162.7(a) of the Act, check section that

describes organization: (See footnote #2 of instructions. Volunteer registrants do not

respond.) |

|

|

162.7(a)(1) |

162.7(a)(2) |

|

162.7(a)(3) |

162.7(a)(4) |

Not Applicable |

6. List type of organization (e.g. corporation, association, etc.): _________________________

Where established: ______________________ Date established:** __________________

**(Initial registrants must submit copies of organizational documents such as charter, articles of incorporation, constitution, or other organizational instrument, and by-laws.)

7.Is any person compensated, or do you intend to compensate any person, for soliciting contributions in Pennsylvania, including employees of the organization

and professional solicitors? Yes No (Do not check “Yes” if you only use or intend to

only use a professional fundraising counsel.)

If “Yes”, give date person or entity started or will start soliciting contributions from Pennsylvania residents. ____/____/____

Items 8 and 9 are required to be completed by initial registrants only

8.Date organization first solicited contributions from Pennsylvania residents:

___/___/____

9.If organization solicited Pennsylvania residents and received gross* contributions totaling more than $25,000 during the fiscal year covered by this registration statement, or during its current fiscal year, give date contributions first totaled more than $25,000. ____/____/____

*Includes contributions received both within and outside Pennsylvania

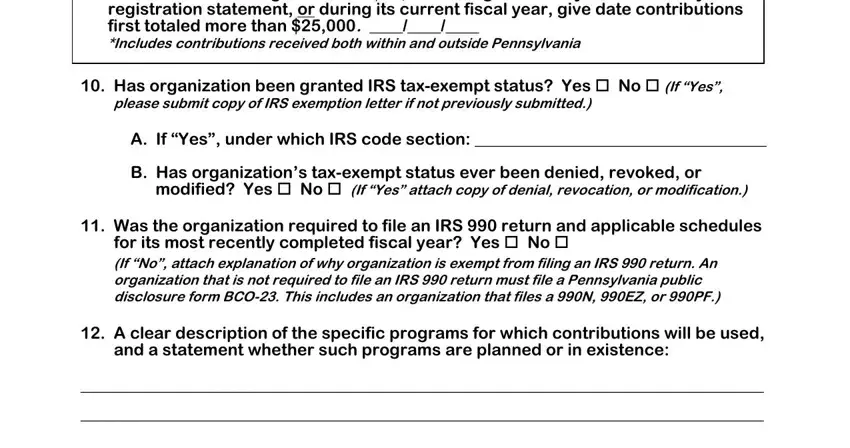

10. Has organization been granted IRS tax-exempt status? Yes No (If “Yes”,

please submit copy of IRS exemption letter if not previously submitted.)

A.If “Yes”, under which IRS code section: ___________________________________

B.Has organization’s tax-exempt status ever been denied, revoked, or

modified? Yes No (If “Yes” attach copy of denial, revocation, or modification.)

11.Was the organization required to file an IRS 990 return and applicable schedules for its most recently completed fiscal year? Yes No

(If “No”, attach explanation of why organization is exempt from filing an IRS 990 return. An organization that is not required to file an IRS 990 return must file a Pennsylvania public disclosure form BCO-23. This includes an organization that files a 990N, 990EZ, or 990PF.)

12.A clear description of the specific programs for which contributions will be used, and a statement whether such programs are planned or in existence:

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

Form BCO-10 Revised (7/2009)

Page 2 of 6

13.Manner in which contributions are solicited (e.g. direct mail, telephone, internet, etc.):

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

14.Is organization registered to solicit contributions in any other state or

municipality? Yes No (If “Yes”, list all states and municipalities. Attach separate

sheet if necessary.)

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

15.Names, addresses, and telephone numbers of all professional solicitors you use or intend to use to solicit contributions from Pennsylvania residents. For each entry, include the beginning and ending dates of all contracts, and dates Pennsylvania residents were first solicited, or will be solicited: (Attach separate

sheet if necessary. Refer to “Definitions” for definition of a professional solicitor)

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

16.Names, addresses, and telephone numbers of all professional fundraising counsels you use or intend to use to provide services with respect to the solicitation of contributions from Pennsylvania residents. For each entry, include the beginning and ending dates of all contracts, and dates services began, or will begin, with respect to soliciting contributions from Pennsylvania residents:

(Attach separate sheet if necessary. Refer to “Definitions” for definition of a fundraising counsel)

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

17.Names, addresses, and telephone numbers of any commercial coventurers under contract with your organization:

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

Form BCO-10 Revised (7/2009)

Page 3 of 6

18.If you are a parent organization located in Pennsylvania, do you elect to file a combined registration covering all of your Pennsylvania affiliates?

Yes No Not Applicable (See note under “important information”)

If “Yes”, give all names and certificate numbers of your affiliate organizations:

(For each affiliate whose parent organization files a Form IRS 990 group return, it must file a form BCO-23, in addition to filing a copy of the organization’s Form IRS 990 return.)

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

19.Are you a Pennsylvania affiliate of a parent organization, which elected to file a combined registration on your behalf? Yes No (See note under “important

information”)

If “Yes”, provide the name and, if available, certificate # of your parent

organization. (For each affiliate whose parent organization files a Form IRS 990 group return, it must file a form BCO-23, in addition to filing a copy of the organization’s Form IRS 990 return.)

________________________________________ |

______________________________ |

(Legal name of parent organization) |

(Certificate #) |

20.Does your organization share contributions or other revenue with any other nonprofit corporation or unincorporated association? Yes No (If “Yes”, attach

an explanation listing name, address, type of organization, and relationship to your organization.)

21.Does your organization share formal governance with any other nonprofit corporation or unincorporated association? Yes No (If “Yes”, attach an

explanation listing name, address, type of organization, and relationship to your organization.)

22.Does any other domestic or foreign organization own a 10% or greater interest in

your organization? Yes No (If “Yes”, attach the following information for each other

domestic or foreign organization: name and type of organization, whether organization is for- profit or nonprofit, and relationship of organization to your organization.)

23. Does your organization own a 10% or greater interest in any other domestic or

foreign organization? Yes No (If “Yes”, attach the following information for each other domestic or foreign organization: name and type of organization, whether organization is for-profit or nonprofit, and relationship of organization to your organization.)

24.Provide the names and addresses of all officers, directors, trustees, and principal salaried executive staff officers: (Attach separate sheet if necessary)

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Form BCO-10 Revised (7/2009)

Page 4 of 6

25.Names and addresses for: (Attach separate sheet if necessary)

A.Individual(s) in charge of solicitation activities:

____________________________________________________________________________

____________________________________________________________________________

B.Individual(s) with final responsibility for the custody of contributions:

____________________________________________________________________________

____________________________________________________________________________

C.Individual(s) with final responsibility for final distribution of contributions:

____________________________________________________________________________

____________________________________________________________________________

D.Individual(s) responsible for custody of financial records:

____________________________________________________________________________

____________________________________________________________________________

26.If you answer “Yes” to any of the following, attach a list of related individuals with names, business, and residence addresses of related parties. Are any officers, directors, trustees, or employees related by blood, marriage, or adoption to:

A.Any other officer, director, trustee, or employee? Yes No

B.Any officer, agent, or employee of any professional fundraising counsel or solicitor under contract with organization? Yes No

C.Any supplier or vendor providing goods or services? Yes No

27.If you answer “Yes” to any of the following, attach full written explanations, including reasons for actions, and copies of all relevant documents. Has organization or any of its present officers, directors, executive personnel, trustees, employees, or fundraisers:

A.Been found to have engaged in unlawful practices in the solicitation of contributions or administration of charitable assets or been enjoined from soliciting contributions or are such proceedings pending in this or any other jurisdiction? Yes No

B.Had its registration or license to solicit contributions denied, suspended, or revoked by any governmental agency? Yes No

C.Entered into any legally enforceable agreement such as a consent agreement, an assurance of voluntary compliance or discontinuance with any district attorney, Office of Attorney General, or other local or state governmental agency? Yes No

Form BCO-10 Revised (7/2009)

Page 5 of 6

I certify that the information provided in this registration, including all statements and documentation, is true and correct. I understand that the falsification of any statement or documentation is subject to criminal penalties for unsworn falsifications pursuant to 18 PA. C.S. § 4904.

____________________________________ |

Date _____________________ |

Signature of Chief Fiscal Officer |

|

_____________________________________ |

|

Type or Print Name and Title of Chief |

|

Fiscal Officer |

|

_______________________________________ |

Date ______________________ |

Signature of Another Authorized Officer |

|

_____________________________________ |

|

Type or Print Name and Title of |

|

Another Authorized Officer |

|

|

|

|

Checklist |

|

Original Registration Statement |

|

Properly Signed and Dated |

|

A Copy of Form IRS 990 Return and |

|

Required Schedules Signed and |

|

Dated by an Authorized Officer |

|

Form BCO-23, if Required |

|

Applicable Financial Statements |

|

Registration Fee and any Late Filing |

|

Fees |

|

Additional Filings, if an Initial |

|

Registrant |

|

|

Form BCO-10 Revised (7/2009)

Page 6 of 6