(Rev. 5-09)

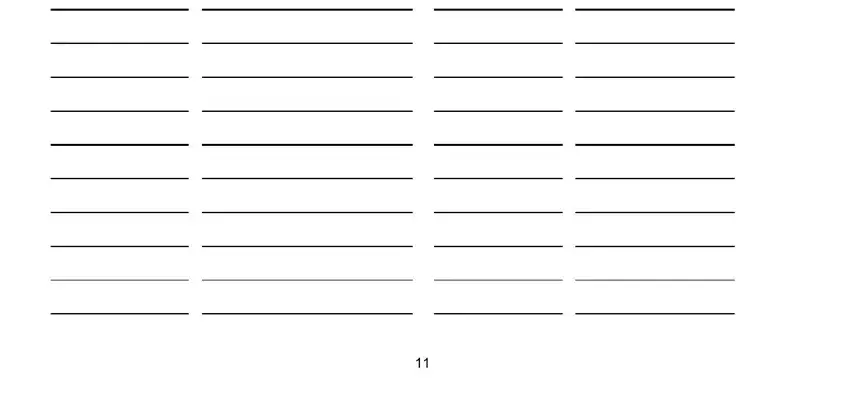

PENNSYLVANIA PUBLIC DISCLOSURE FORM BCO-23

|

|

ORGANIZATION NAME: |

|

|

|

|

|

|

CERTIFICATE NUMBER: |

|

FOR FISCAL YEAR ENDED: |

|

|

|

|

|

|

|

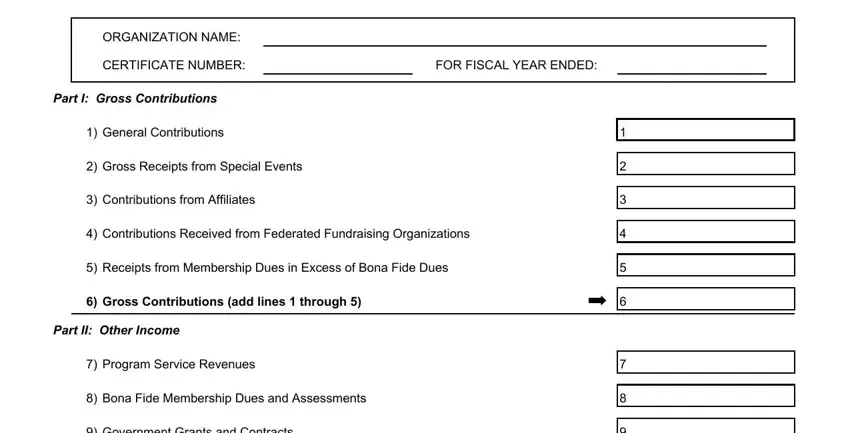

Part I: Gross Contributions |

|

|

|

|

|

|

|

|

|

1) |

General Contributions |

|

1 |

|

|

|

|

|

|

|

2) |

Gross Receipts from Special Events |

|

2 |

|

|

|

|

|

|

|

3) |

Contributions from Affiliates |

|

3 |

|

|

|

|

|

|

4) |

Contributions Received from Federated Fundraising Organizations |

4 |

|

|

|

|

|

|

5) |

Receipts from Membership Dues in Excess of Bona Fide Dues |

5 |

|

|

|

|

|

|

|

6) |

Gross Contributions (add lines 1 through 5) |

|

6 |

|

|

|

|

|

|

|

Part II: |

Other Income |

|

|

|

|

|

|

|

|

|

7) |

Program Service Revenues |

|

7 |

|

|

|

|

|

|

|

8) |

Bona Fide Membership Dues and Assessments |

|

8 |

|

|

|

|

|

|

|

9) |

Government Grants and Contracts |

|

9 |

|

|

|

|

|

|

|

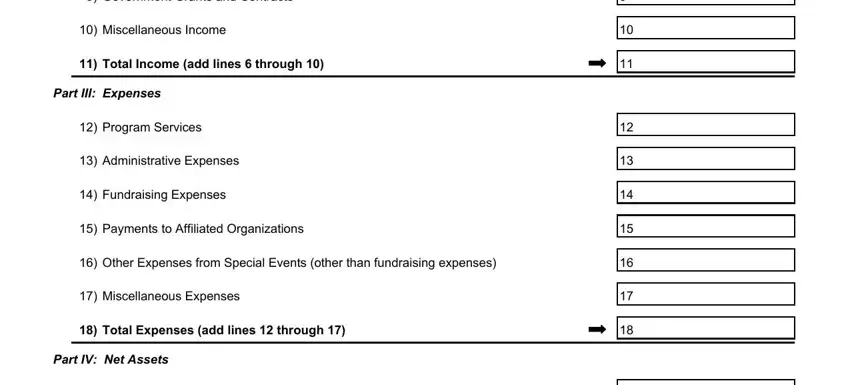

10) |

Miscellaneous Income |

|

10 |

|

|

|

|

|

|

|

11) |

Total Income (add lines 6 through 10) |

|

11 |

|

|

|

|

|

|

|

Part III: |

Expenses |

|

|

|

|

|

|

|

|

|

12) |

Program Services |

|

12 |

|

|

|

|

|

|

|

13) |

Administrative Expenses |

|

13 |

|

|

|

|

|

|

|

14) |

Fundraising Expenses |

|

14 |

|

|

|

|

|

|

|

15) |

Payments to Affiliated Organizations |

|

15 |

|

|

|

|

|

|

16) |

Other Expenses from Special Events (other than fundraising expenses) |

16 |

|

|

|

|

|

|

|

17) |

Miscellaneous Expenses |

|

17 |

|

|

|

|

|

|

|

18) |

Total Expenses (add lines 12 through 17) |

|

18 |

|

|

|

|

|

|

|

|

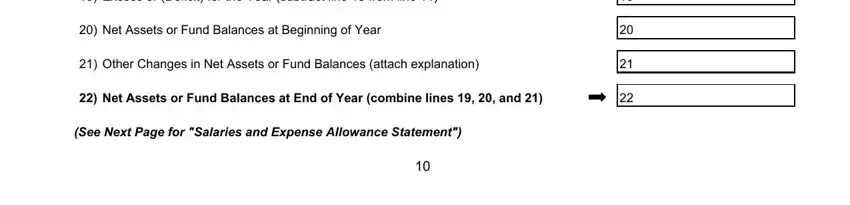

Part IV: Net Assets

19)Excess or (Deficit) for the Year (subtract line 18 from line 11)

20)Net Assets or Fund Balances at Beginning of Year

21)Other Changes in Net Assets or Fund Balances (attach explanation)

22)Net Assets or Fund Balances at End of Year (combine lines 19, 20, and 21)

(See Next Page for "Salaries and Expense Allowance Statement")

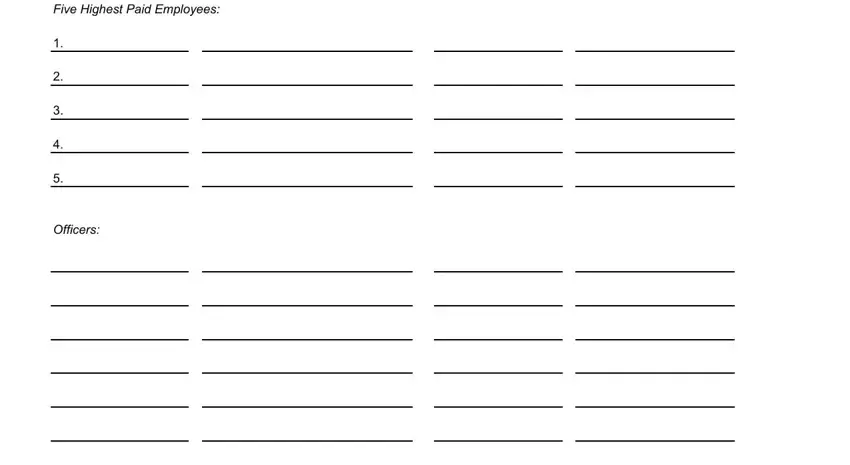

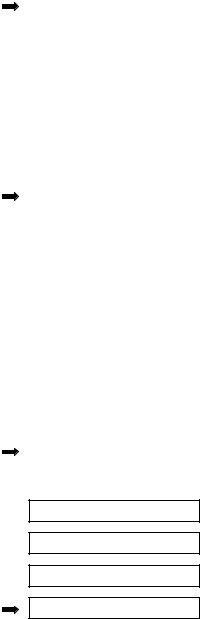

SALARIES AND EXPENSE ALLOWANCE STATEMENT

Report salaries paid and expenses allowed to the five highest paid employees. Additionally, include salaries paid and expenses allowed to any and all compensated officers of the organization.

23) Salaries and Expense:

Name of Individual |

|

Title and Average Hours Per Week |

|

|

Devoted to Position |

Five Highest Paid Employees:

1.

2.

3.

4.

5.

Expense Account and

Other Allowances

(Rev. 5-09) |

INSTRUCTIONS FOR COMPLETING FORM BCO-23 |

An organization which is not required to file an IRS 990 Return must file a BCO-23 Form. This includes an organization that files a 990N, 990EZ, or 990PF, or an affiliate whose parent organization files a 990 group return must file a BCO-23 Form in addition to filing a copy of the organization’s IRS 990 Return.

1)General Contributions: Enter the total gross contributions, gifts, grants and similar amounts received, including contributions from individuals, commercial co-ventures, corporations and other businesses, foundations, public charities, exempt organizations (do not include amounts received from fundraising organizations or affiliates), trusts, and estates. Also include noncash contributions such as donated land, buildings, property, equipment, and materials (exclude the value of services donated to the organization and the free use of materials, equipment or facilities). Noncash items should be valued at their fair market values on the date of their contribution to the organization.

Exclude government grants and contracts.

2)Gross Receipts from Special Events: Enter the total gross amounts received from all special events and activities conducted by the organization, or on its behalf. Include amounts received from events that were conducted primarily to raise funds to finance the organization’s exempt activities. Events and activities include, but are not limited to, carnivals, dinners, dances, raffles, shows, sales to the public, bingo games, and other gambling activities. Do not reduce the total gross amounts received by any expenses related to the events or activities. These expenses should be included on lines 14 or 16.

3)Contributions from Affiliates: Enter the total contributions received from associated organizations such as affiliates, national organizations, or parent organizations.

4)Contributions Received from Federated Fundraising Organizations: Enter the total contributions received from fundraising organizations such as United Way, United Fund, and Community Chests.

5)Receipts from Membership Dues in Excess of Bona Fide Dues: Include only those dues that represent contributions from the public. Dues are considered to be contributions to the extent that they exceed the monetary value of the benefits available to the member. Do not include the amounts received up to the value of the benefits available to the member. These amounts are bona fide membership dues and should be included on line 8.

6)Gross Contributions: Add lines 1 through 5.

7)Program Service Revenues: Enter the gross amount of fees and revenues earned by the organization for providing services or performing activities that fulfill the organization’s stated mission or purpose. Include income earned for providing a government agency with a service, product, or facility that directly benefited only the government agency.

Do not include any amounts received from a government agency that are used to serve the needs of the general public. These amounts should be included on line 9.

8)Bona Fide Membership Dues and Assessments: Include only those dues and assessments received that do not exceed the monetary value of the benefits available to the member. Do not include dues received by the organization to the extent that they exceed the monetary value of the benefits available to the member. These amounts should be included on line 5. If a member pays dues mainly to support the organization (not to obtain benefits) include this amount on line 5.

9)Government Grants and Contracts: Include total grants or other payments received from a federal, state, or local governmental unit if its primary purpose is to enable the organization to provide a service, product, or maintain a facility for the primary benefit of the general public. Do not include any amounts received that are used to serve the needs of the governmental agency. These amounts should be included on line 7.

CONTINUED ON PAGE #13

12

10)Miscellaneous Income: This figure represents the total income from all sources not covered by lines 1 through 5 and lines 7 through 9, including, but not limited to, interest, dividends and interest from securities, gross rental income, gross amounts from the sale of assets other than inventory, and gross sales of inventory (this does not include items that were sold through a special event or activity).

11)Total Income: Add lines 6 through 10.

12)Program Services: Include total costs of services or activities performed by the organization that fulfill its charitable purposes. Include any donations, grants, scholarships, or similar amounts given out in fulfillment of the organization’s stated purposes. United Way and similar fundraising organizations should include allocations to participating agencies on this line. Include allocated administrative expenses, if any. See instructions to line 13.

13)Administrative Expenses: Include costs related to the overall administration and management of the organization.

If a portion of these costs relate to program services or fundraising, a reasonable allocation should be made among the applicable functions.

14)Fundraising Expenses: Include costs incurred in soliciting contributions, gifts, grants, and similar amounts. Fundraising expenses normally include, but are not limited to, costs of acquiring and maintaining mailing lists, the cost of printing and mailing solicitation materials, as well as the expense of unsolicited merchandise sent out to encourage contributions. Include fundraising expenses related to the organization’s special events. Do not include expenses directly attributable to furnishing the goods or services sold at a special event. These expenses should be included on line 16. Include allocated administrative expenses, if any. See instructions to line 13.

15)Payments to Affiliated Organizations: Include all payments to organizations affiliated, associated, or closely- related to the reporting organization. Include dues paid to an affiliated state or national organization, including predetermined quota support and dues.

16)Other Expenses from Special Events (other than fundraising expenses): Include only those expenses directly attributable to the goods or services the buyer received from a special event. Do not include fundraising expenses related to the organization’s special events. These expenses should be included on line 14.

17)Miscellaneous Expenses: Include expenses that are not reportable on lines 12 thru 16, including all expenses that are attributable to the income reported on line 10.

18)Total Expenses: Add lines 12 through 17.

19)Excess or (Deficit) for the Year: Enter the difference between lines 11 and 18. If line 18 is greater than line 11, enter the difference in parentheses.

20)Net Assets or Fund Balances at Beginning of Year: Organizations using fund accounting should report the total sum of the various fund balances at the beginning of the reporting year on this line. Organizations not using fund accounting should report their net assets, which is the difference between total assets and total liabilities. These amounts should agree with the ending fund balance of the prior fiscal year.

21)Other Changes in Net Assets or Fund Balances: Attach a schedule explaining any changes in net assets or fund balances between the beginning and end of the year that were not accounted for by the amount on line 19. Amounts to report here include, but are not limited to, adjustments of earlier years’ activity, unrealized gains and losses on investments carried at market value, and any differences between fair market value and book value of property given out as an award or grant.

22)Net Assets or Fund Balances at End of Year: Combine lines 19, 20, and 21.

23)Salaries and Expense Allowance Statement: Refer to Form BCO-23 for instructions.

13