taxable income from a distribution reported on 1099-R form(s) bearing codes 1D, 2D, 3D, 4D, 6 or 7D in other classes of income. Codes 1D, 2D, 3D, 4D or 7D are reported as taxable interest income on PA-40 Schedule A. If cash or boot is involved in the transaction for Code 6 distributions, report any gain on the transaction on PA-40 Schedule D. Refer to the PA Personal Income Tax Guide – Interest and PA Personal Income Tax Guide – Net Gains or Losses from the Sale, Exchange or Disposition of Property and the in- structions for PA-40 Schedules A and D.

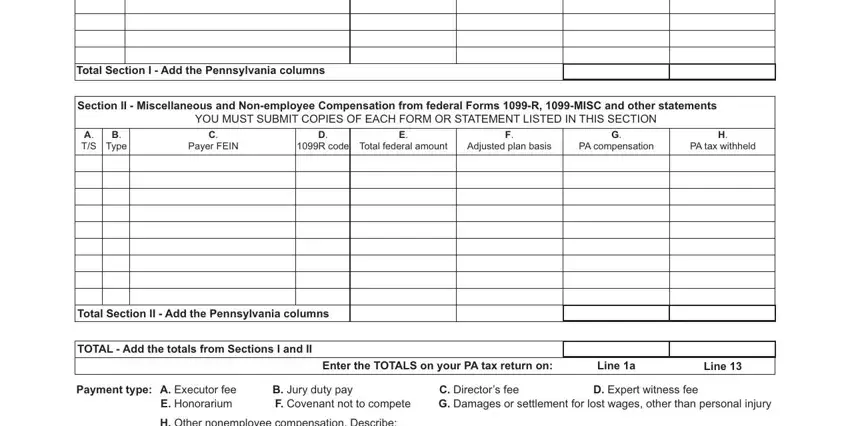

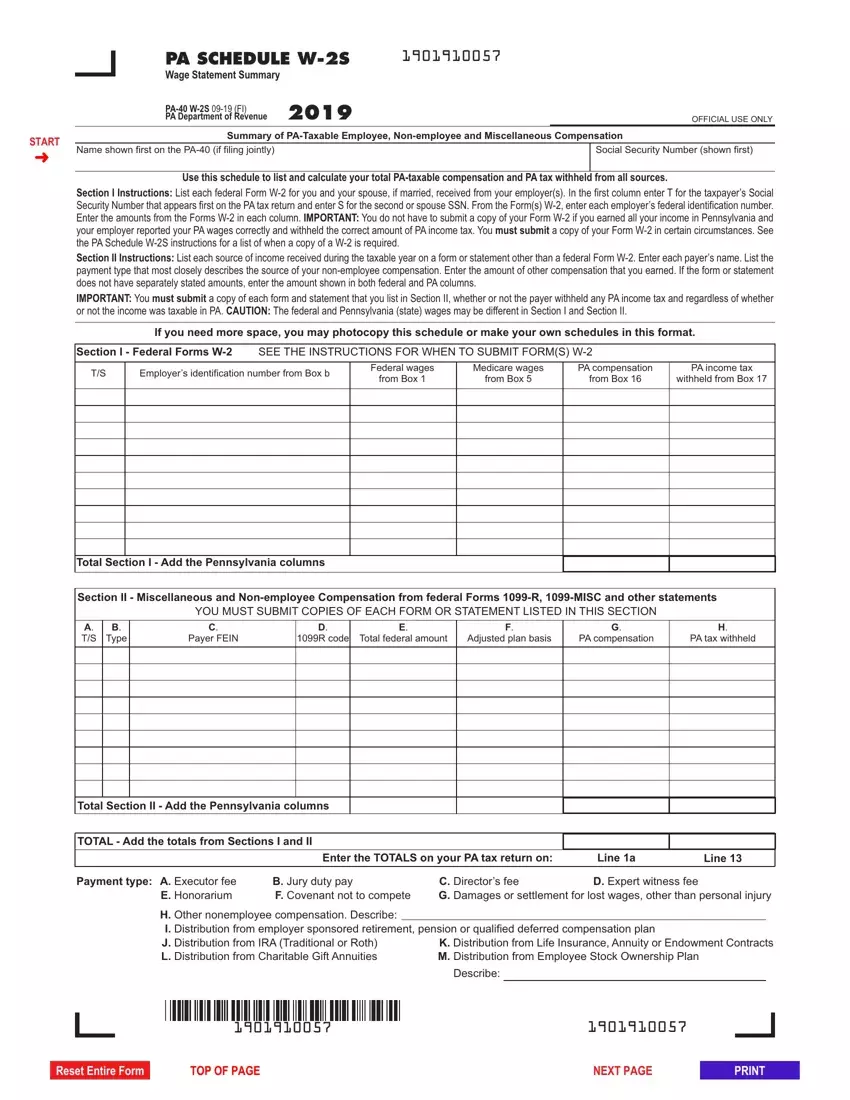

COLUMN H

If the payer withheld PA state income tax from the distribu- tion or payment, enter the amount withheld from that distri- bution or payment. If PA state income tax was withheld from any payment, a copy of the 1099-R or 1099-MISC must be included with the return.

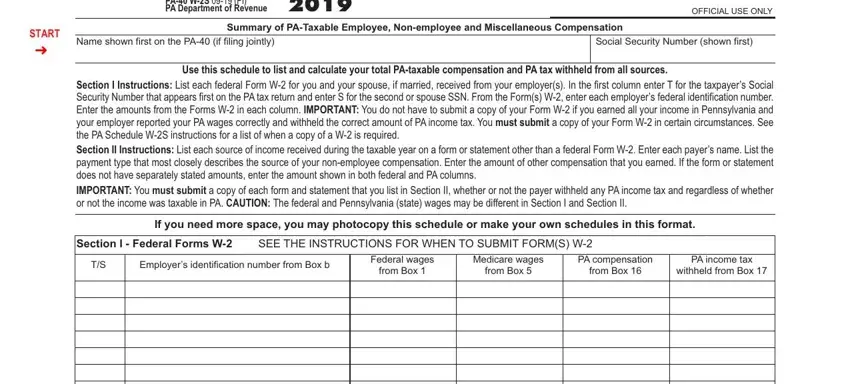

WHEN TO SUBMIT FORM(S) 1099-R, 1099-MISC OR OTHER DOCUMENTS

Copies of Form 1099-R, Distributions from Pensions, Annu- ities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., must be included with paper and e-filed PA- 40, Personal Income Tax Returns, regardless of whether the 1099-R includes PA income tax withheld or whether or not the distribution amount is taxable. For electronically filed re- turns, copies of the 1099-R are not required to be included if the 1099-R includes federal tax withheld. However, if the 1099-R does not include federal tax withheld, a copy of the 1099-R must be provided with the filing of the PA-40, Per- sonal Income Tax Return. In addition, any 1099-R that in- cludes PA income tax withheld must be provided to the department even if the form includes federal withholding. See “How to Submit Form(s) W-2, 1099-R, 1099-MISC or Other Documents” for additional information.

Copies of Form 1099-MISC, Miscellaneous Income, must also be included with paper and e-filed PA-40, Personal In- come Tax Returns, if the income is reported in Section II of PA-40 Schedule W-2S. Do not include Form 1099-MISC for income reported on PA-40 Schedules C, E or F unless the form includes PA income tax withheld. See “How to Submit Form(s) W-2, 1099-R, 1099-MISC or Other Documents” for additional information.

Copies of other documents supporting income reported as honorarium, executor/executrix fees, jury duty fees, direc- tor’s fees, damages for lost wages, etc. not reported on Form 1099-MISC must also be included with paper and e- filed PA-40, Personal Income Tax Returns, if the income is reported in Section II of PA-40 Schedule W-2S. See “How to Submit Form(s) W-2, 1099-R, 1099-MISC or Other Doc- uments” for additional information.

The following filing tips are provided to assist with the completion of PA-40 Schedule W-2S Sections I and II.

1099-R DISTRIBUTION CODE 2

A taxpayer with a distribution Code 2 on Form(s) 1099-R must determine if he/she received the distribution from an eligible employer-sponsored retirement or pension or retire- ment plan eligible for PA tax purposes. Additionally, the tax- payer must have been eligible by meeting the age or service

conditions of the plan. If these conditions are met, the tax- payer should input the same amount in Column F as was reported in Column E. Otherwise, the cost or adjusted basis of the plan must be included in Column F.

A taxpayer with distribution code 1 or 2 on Form(s) 1099-R from a retirement plan from the State Employees’ Retire- ment System, the Pennsylvania School Employees’ Retire- ment System, the Pennsylvania Municipal Employees’ Retirement System or the U.S. Civil Service Commission Retirement Disability Plan should input the same amount in Column F as was reported in Column E.

IRA CONVERSIONS

A taxpayer with a conversion of a traditional IRA to a Roth IRA (or vice versa) with distribution code 1 in Box 7 of the 1099-R may be eligible to report the amount as nontaxable income when a direct transfer from trustee to trustee occurs and/or the when the entire distribution from the original IRA account (including taxes withheld) is paid into the new IRA account within 60 days of the date of the distribution. In such cases, input the same amount in Column F as reported in Column E. If the distribution is not a direct transfer from trustee to trustee, or the entire distribution is not paid into the new IRA account as a result of the conversion of the original IRA account, the distribution must be reported as two separate distributions on PA Schedule W-2S. The dis- tributions will be reported on separate lines of Column E with the net amount converted into the new IRA (gross distribu- tion from Box 1 of the Form 1099-R less amounts not repaid into the new IRA account) being reported as the first distri- bution and amounts not repaid into the new IRA account re- ported as the second distribution. The amount reported in Column E for the first distribution will not be taxable (input the same amount in Column F as reported in Column E). The amount reported in Column E for the second distribution may be taxable since Column F will reflect the cost or ad- justed basis of the IRA.

DISTRIBUTIONS FROM ANNUITY OR

ENDOWMENT CONTRACTS AND CHARITABLE GIFT ANNUITIES

A taxpayer with distributions from an annuity purchased from a commercial insurance or mutual company, an endowment contract or a charitable gift annuity having a distribution code 7 or 7D in Box 7 of the 1099-R must record the distributions on PA Schedule W-2S and also report the amount of income taxable for federal income tax purposes as PA-taxable in- terest income. When recording the distribution on PA Sched- ule W-2S, input the same amount in Column F as reported in Column E. Report the federal taxable amount of any an- nuities or endowments on Line 11 of PA Schedule A. Report the federal taxable amount of any charitable gift annuities on Line 12 of PA Schedule A.

DISTRIBUTIONS FROM AN EMPLOYEE

STOCK OWNERSHIP PLAN

A taxpayer with a distribution from an employee stock own- ership plan (ESOP) should enter the amount of the distribu- tion in Column G if the stock in the ESOP has not been

R is not known, contact the payer for more information regarding the distribution to properly report the type of pay- ment. For distributions from an IRA, the box next to Box 7 on the

R is not known, contact the payer for more information regarding the distribution to properly report the type of pay- ment. For distributions from an IRA, the box next to Box 7 on the