With the help of the online PDF editor by FormsPal, it is possible to fill out or alter Pa Rct 101 Form right here. In order to make our tool better and less complicated to use, we constantly develop new features, considering feedback coming from our users. To get the process started, go through these basic steps:

Step 1: Hit the "Get Form" button above. It's going to open our tool so that you could begin completing your form.

Step 2: As you access the editor, there'll be the document all set to be completed. Besides filling in various blank fields, it's also possible to do many other actions with the PDF, particularly writing your own text, editing the initial textual content, inserting images, putting your signature on the document, and much more.

It will be simple to fill out the document with our practical tutorial! This is what you should do:

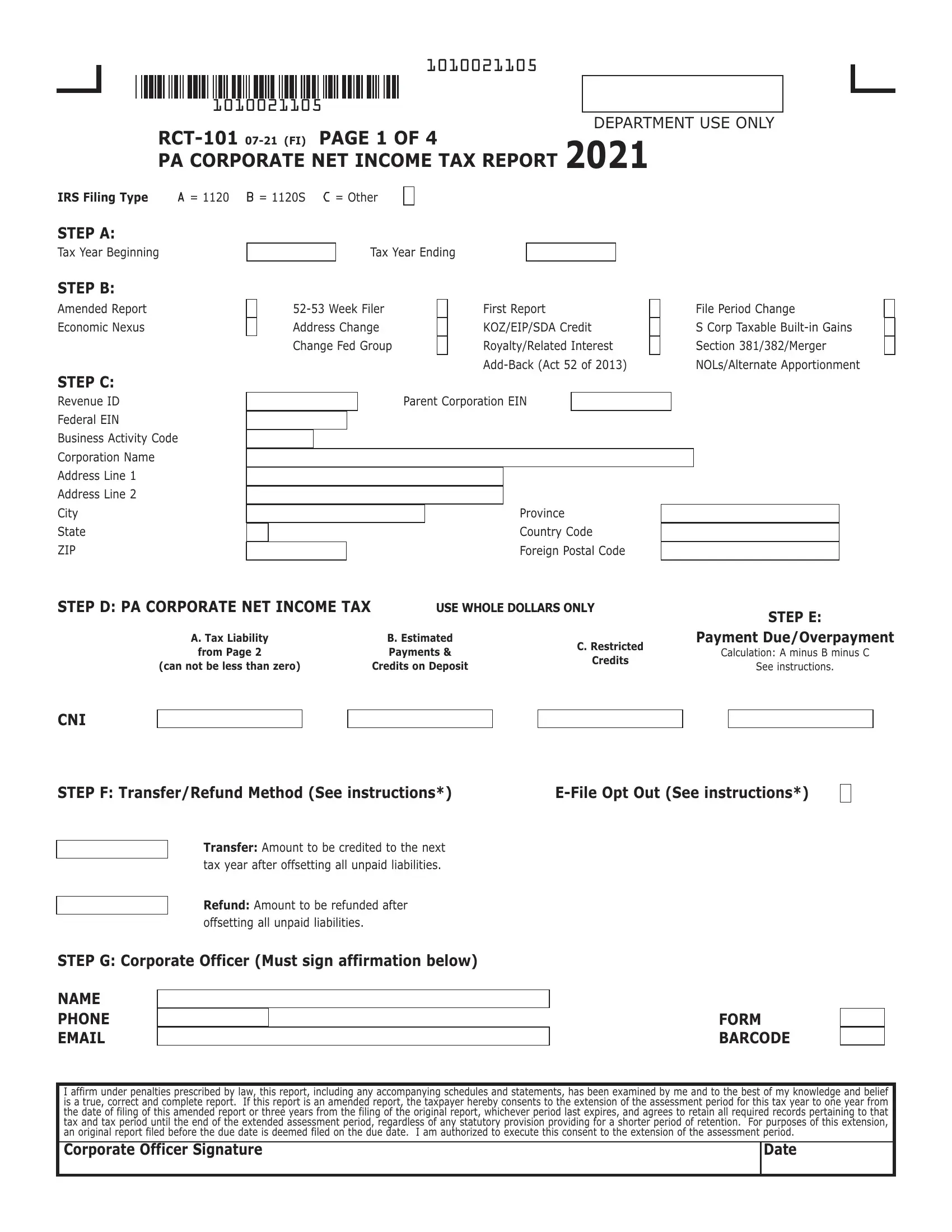

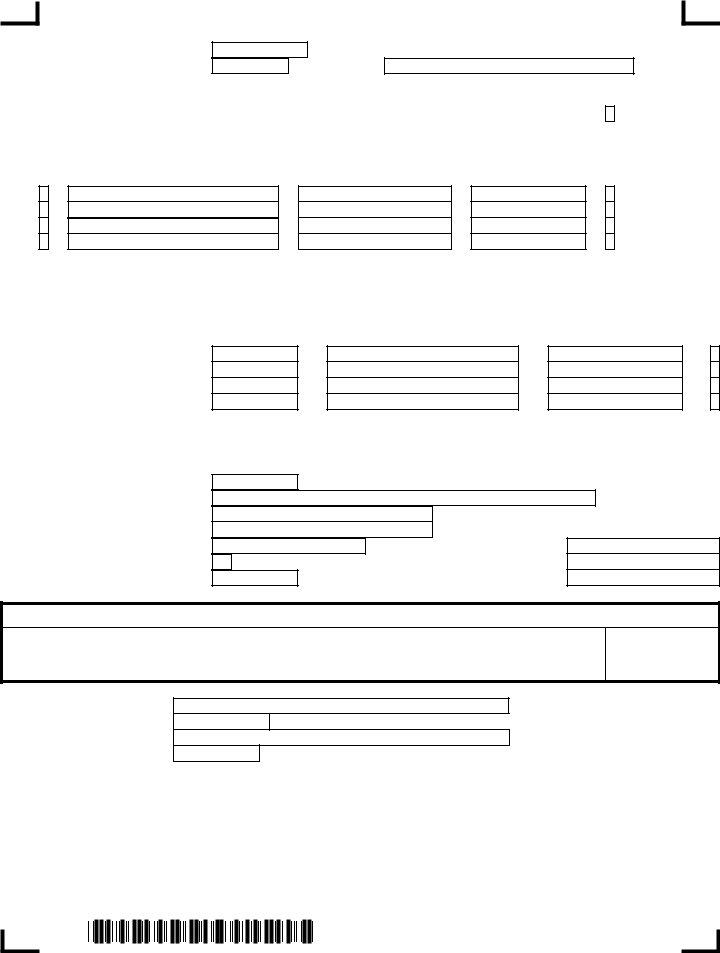

1. Firstly, once filling out the Pa Rct 101 Form, beging with the section with the following blank fields:

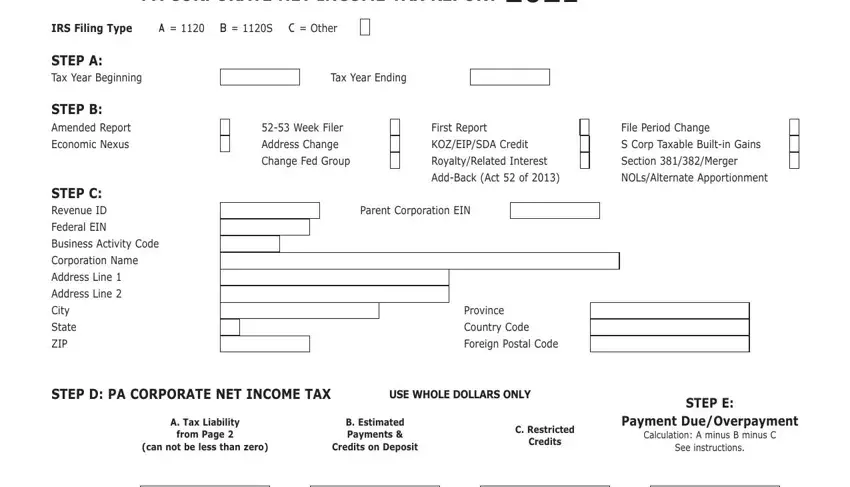

2. Given that the previous section is completed, you should insert the essential specifics in CNI, sTep F TransferRefund Method see, eFile opt out see instructions, Transfer Amount to be credited to, Refund Amount to be refunded after, sTep g Corporate officer Must sign, NaMe phoNe eMaIl, FoRM BaRCoDe, and I affirm under penalties so you're able to proceed further.

People often get some things incorrect while filling out eFile opt out see instructions in this section. Ensure you go over everything you type in right here.

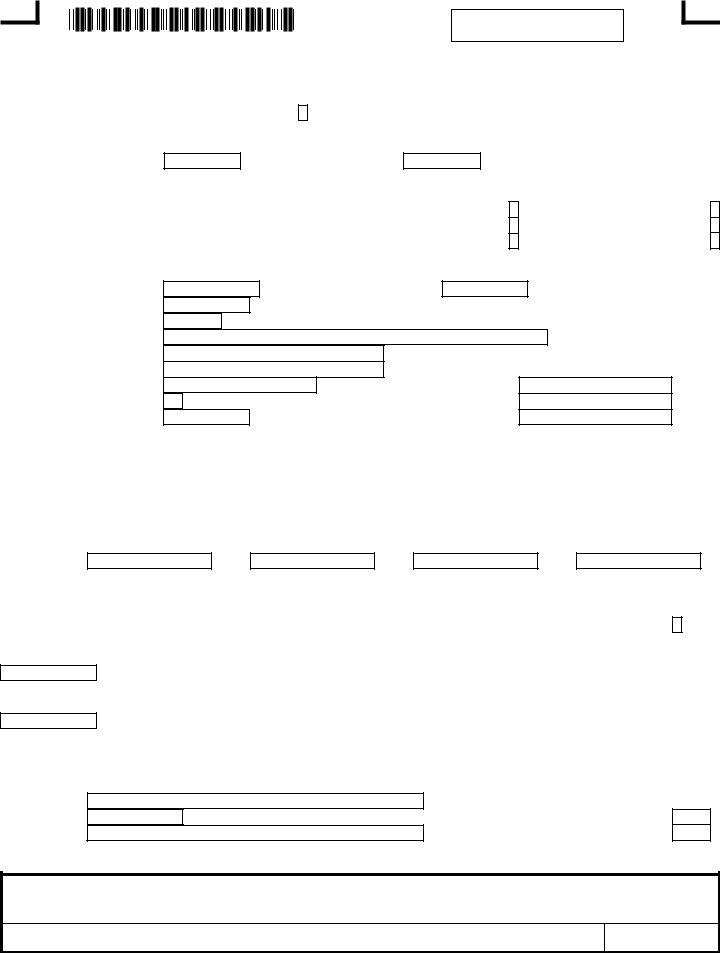

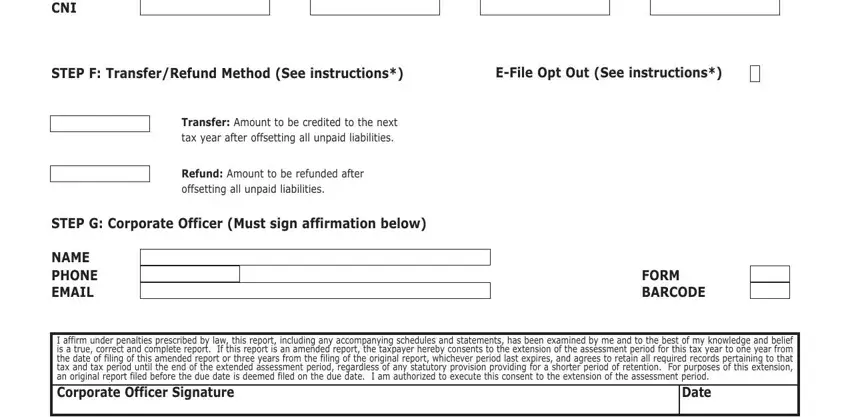

3. Within this part, look at ReVeNue ID Tax yeaR eND, NaMe, RCT FI page oF pa CoRpoRaTe NeT, use whole DollaRs oNly, seCTIoN a BoNus DepReCIaTIoN, Current year federal depreciation, Current year adjustment for, Other adjustments, seCTIoN B pa CoRpoRaTe NeT INCoMe, DeDuCTIoNs, a Corporate dividends received, B Interest on US securities GROSS, C Current yr addtl PA deprec plus, D Other from REV Schedule OD See, and ToTal DeDuCTIoNs Add Lines A. These need to be filled in with highest precision.

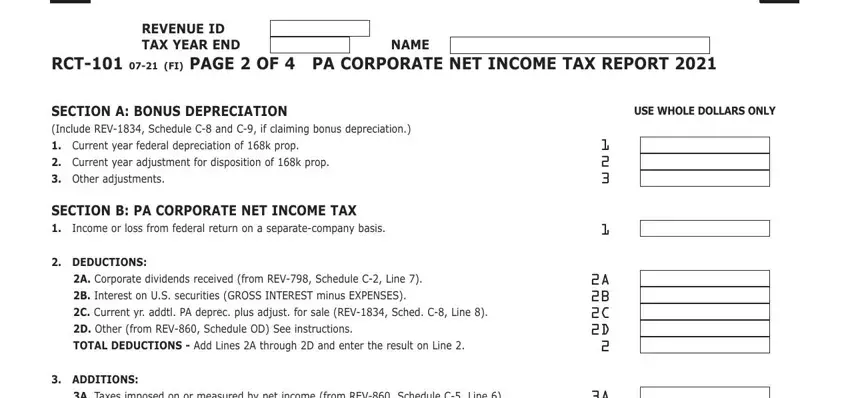

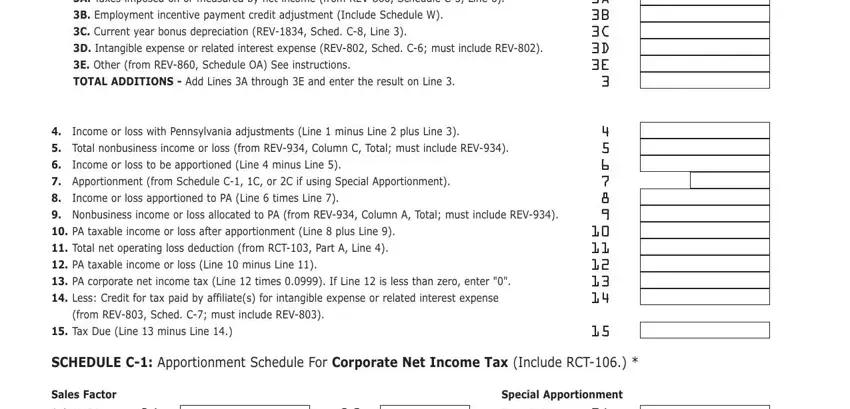

4. The following paragraph needs your details in the subsequent areas: a Taxes imposed on or measured by, B Employment incentive payment, C Current year bonus depreciation, D Intangible expense or related, e Other from REV Schedule OA See, ToTal aDDITIoNs Add Lines A, Income or loss with Pennsylvania, Total nonbusiness income or loss, Income or loss to be apportioned, Apportionment from Schedule C C, Income or loss apportioned to PA, Nonbusiness income or loss, PA taxable income or loss after, Total net operating loss, and PA taxable income or loss Line. Ensure that you fill in all of the requested information to go forward.

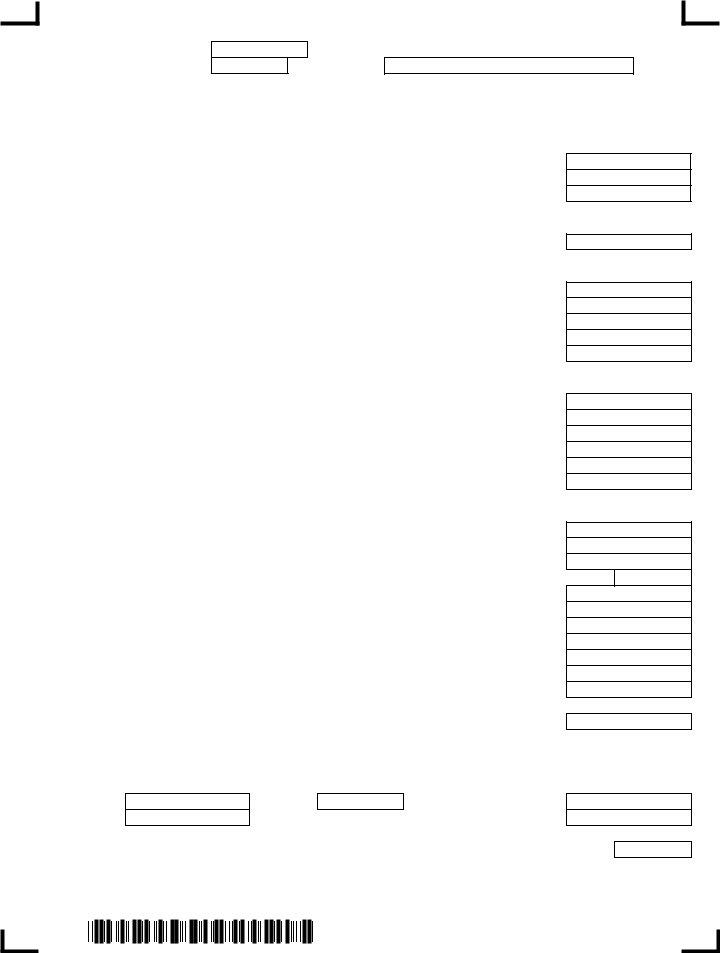

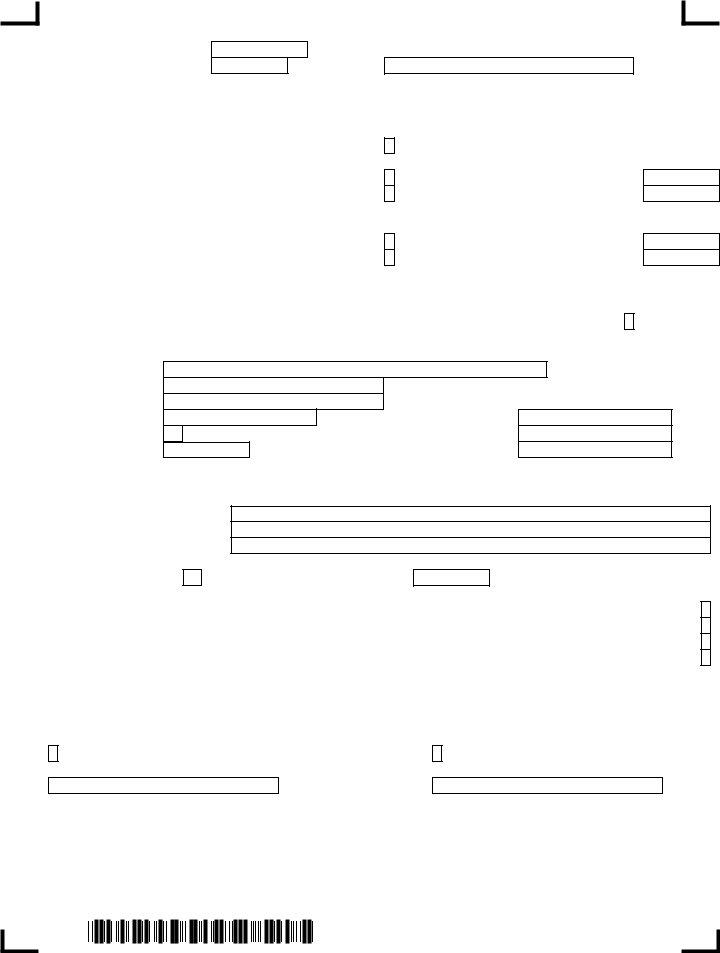

5. While you reach the end of this document, you will find just a few extra things to do. Particularly, Sales PA, Sales Total, Numerator, Denominator, Apportionment, Proportion, and Refer to REV PA Corporate Net must all be filled out.

Step 3: Look through all the details you have inserted in the blank fields and then click on the "Done" button. Go for a free trial plan at FormsPal and obtain direct access to Pa Rct 101 Form - available inside your FormsPal cabinet. When you use FormsPal, you can complete forms without the need to worry about personal data breaches or data entries being distributed. Our protected platform ensures that your private details are kept safe.