You can work with pag ibig multi purpose loan form 2021 fillable easily by using our PDFinity® online tool. Our tool is consistently developing to give the best user experience achievable, and that's due to our dedication to constant improvement and listening closely to feedback from users. With some simple steps, you are able to begin your PDF editing:

Step 1: Hit the orange "Get Form" button above. It is going to open up our tool so you can begin completing your form.

Step 2: With this state-of-the-art PDF editing tool, it is possible to accomplish more than merely fill in forms. Express yourself and make your documents appear great with custom text added in, or modify the original input to perfection - all that backed up by an ability to incorporate stunning pictures and sign the file off.

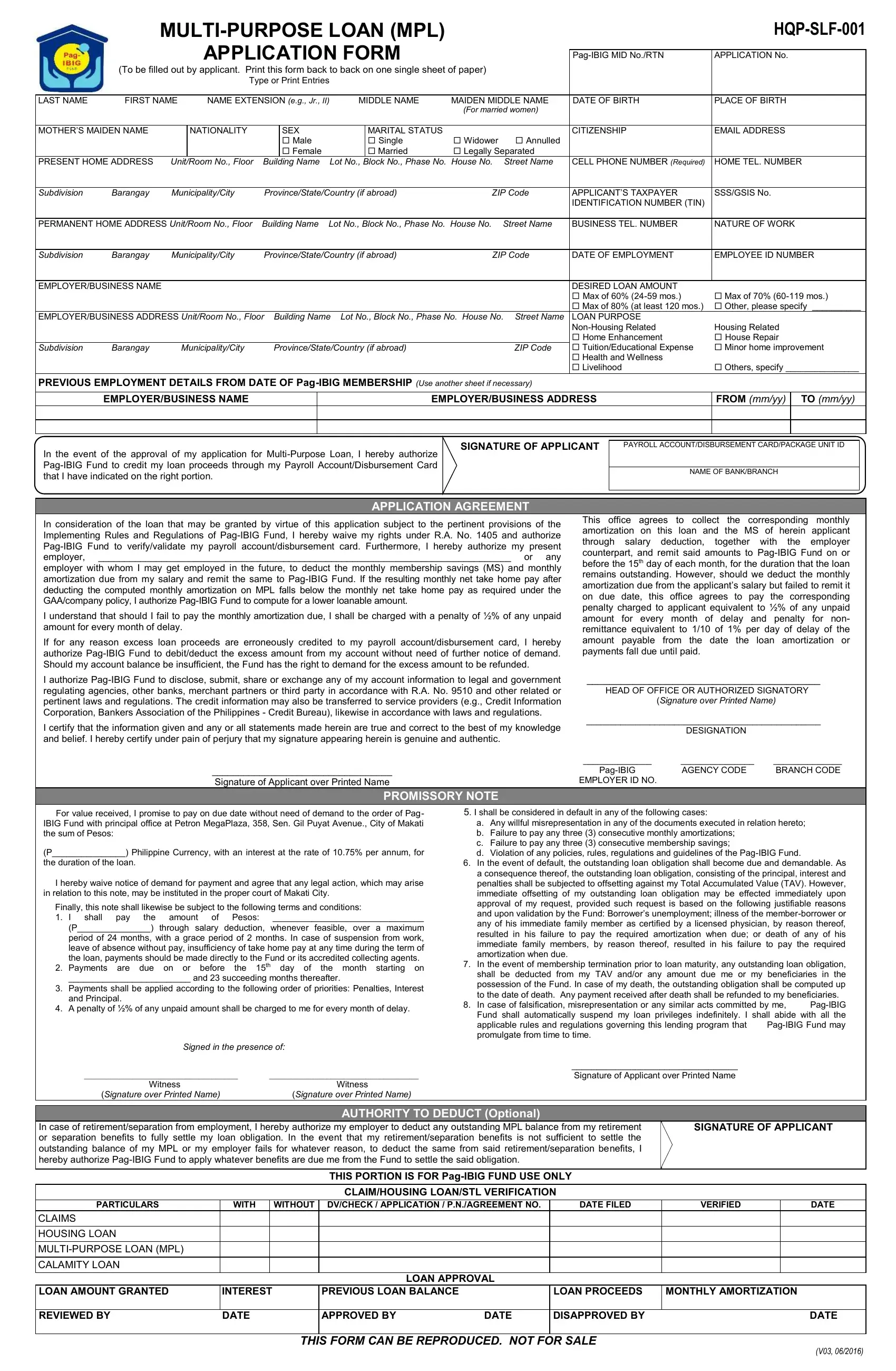

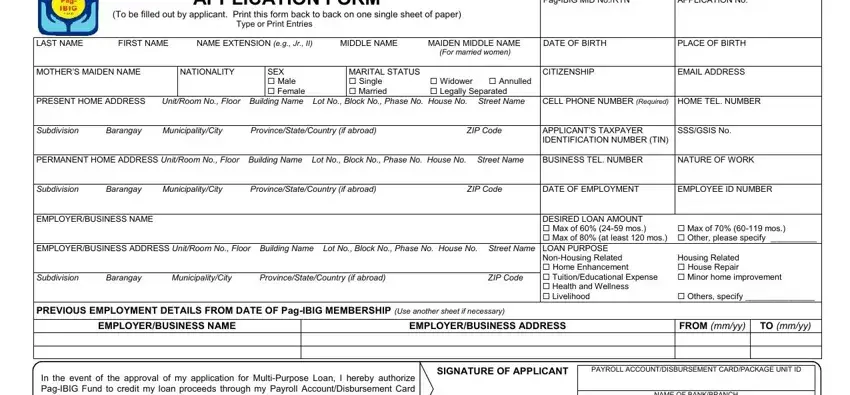

As for the blanks of this precise document, here's what you need to do:

1. The pag ibig multi purpose loan form 2021 fillable will require certain details to be entered. Ensure that the subsequent blank fields are complete:

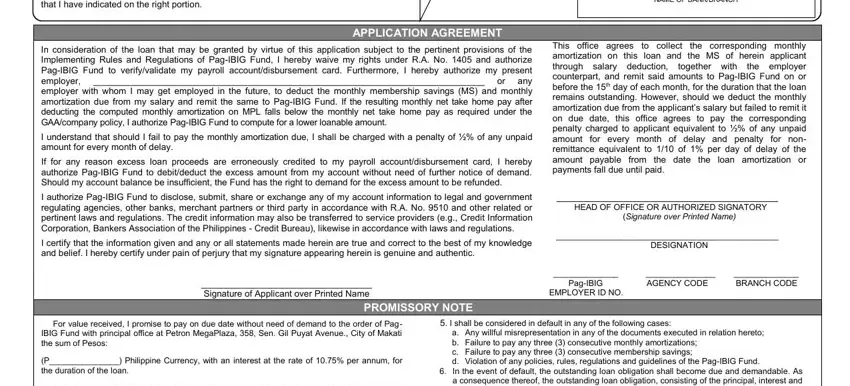

2. Your next step is to fill in all of the following blanks: In the event of the approval of my, APPLICATION AGREEMENT, In consideration of the loan that, I understand that should I fail to, If for any reason excess loan, I authorize PagIBIG Fund to, I certify that the information, Signature of Applicant over, PROMISSORY NOTE, NAME OF BANKBRANCH, together with, This office agrees to collect the, HEAD OF OFFICE OR AUTHORIZED, Signature over Printed Name, and DESIGNATION.

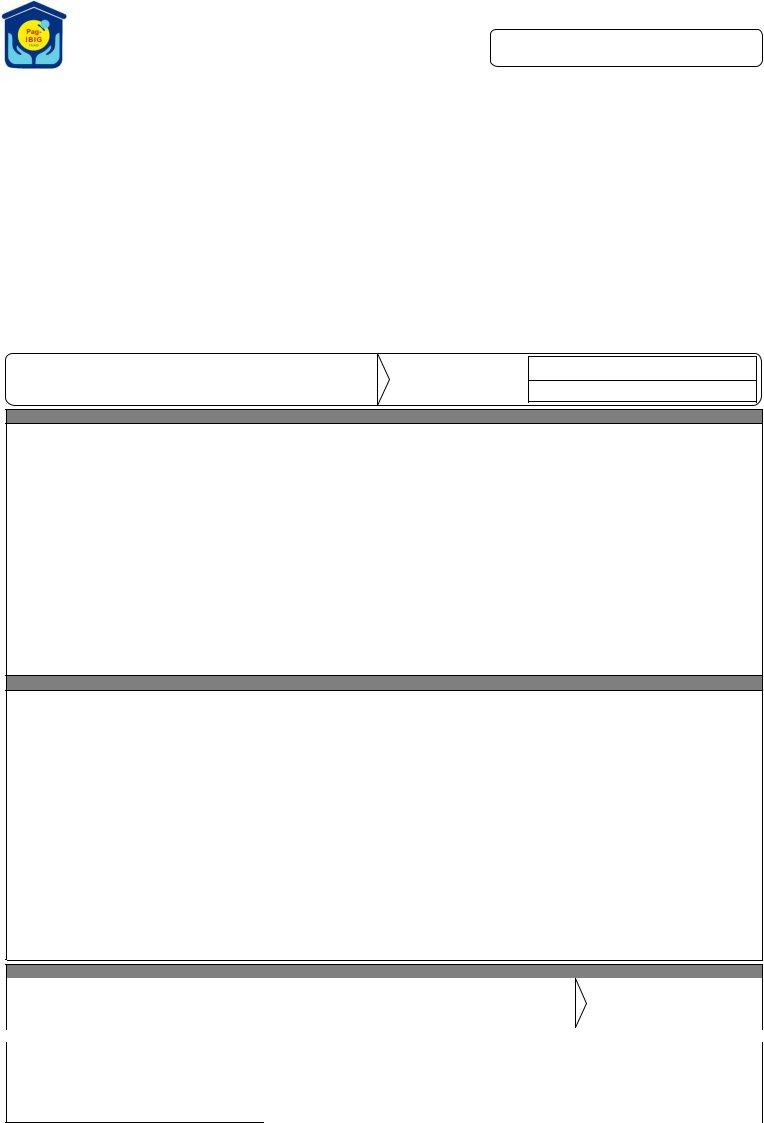

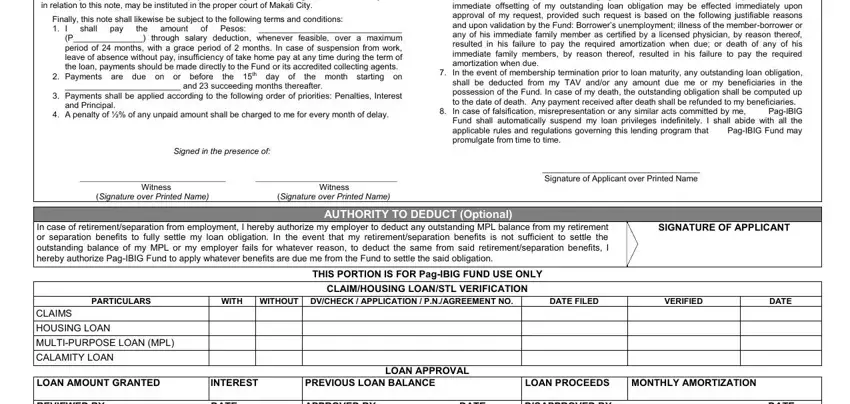

3. This third step is typically rather easy, I hereby waive notice of demand, in relation to this note may be, shall, pay, the, Finally this note shall likewise, P through salary deduction, of Pesos, amount, Payments are due on or before, the th day of, the month starting on, and succeeding months thereafter, Payments shall be applied, and and Principal - every one of these empty fields needs to be filled in here.

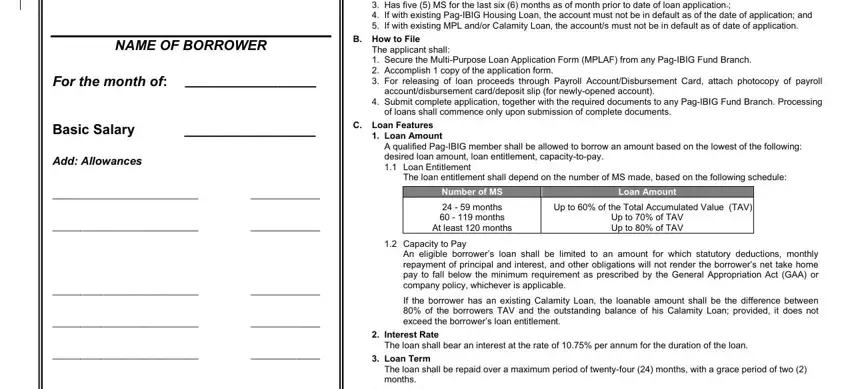

4. Now proceed to this fourth portion! In this case you have these NAME OF BORROWER, For the month of Basic Salary, Add Allowances, Gross Monthly Income Less, Up to of the Total Accumulated, Capacity to Pay, B How to File, C Loan Features, Loan Amount, accountdisbursement carddeposit, of loans shall commence only upon, Interest Rate, The loan shall bear an interest at, The loan entitlement shall depend, and Loan Amount empty form fields to fill out.

Be extremely careful when filling in Up to of the Total Accumulated and NAME OF BORROWER, since this is where many people make a few mistakes.

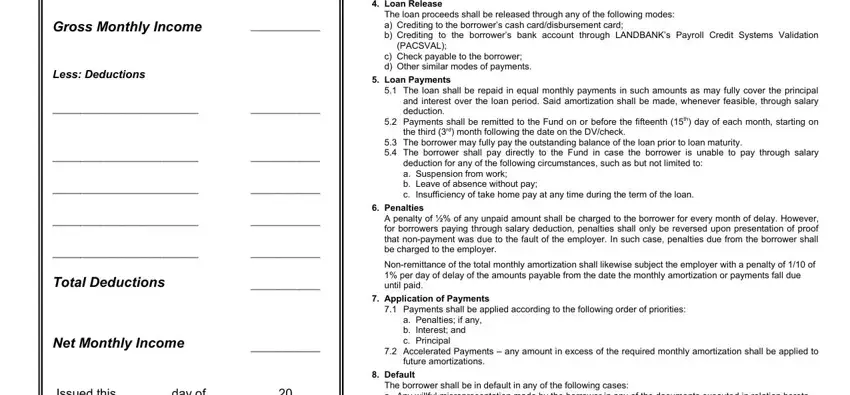

5. To conclude your form, the particular subsection has several additional blanks. Entering Gross Monthly Income Less, Total Deductions Net Monthly, Issued this day of I certify, Loan Release, Loan Payments, PACSVAL, c Check payable to the borrower d, The loan proceeds shall be, A Who May File Loan Term, The borrower shall be in default, A penalty of of any unpaid amount, The loan shall be repaid in equal, deduction for any of the following, The borrower may fully pay the, and Accelerated Payments any amount is going to finalize the process and you're going to be done quickly!

Step 3: Before moving forward, you should make sure that blanks are filled out the correct way. When you determine that it is good, press “Done." Right after getting a7-day free trial account at FormsPal, it will be possible to download pag ibig multi purpose loan form 2021 fillable or email it right off. The PDF file will also be accessible in your personal account with all your changes. FormsPal ensures your data privacy via a secure system that in no way saves or distributes any type of private data provided. Be assured knowing your documents are kept confidential any time you work with our editor!