Working with PDF documents online is actually a breeze with this PDF tool. Anyone can fill in getting paid reinforcement worksheet here and use a number of other functions we offer. FormsPal development team is continuously endeavoring to enhance the tool and help it become even better for clients with its many functions. Enjoy an ever-improving experience now! All it takes is a few easy steps:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" in the top section of this site.

Step 2: This tool allows you to modify most PDF documents in various ways. Change it with any text, correct what is originally in the document, and put in a signature - all readily available!

Completing this document will require attentiveness. Ensure all required blanks are filled in correctly.

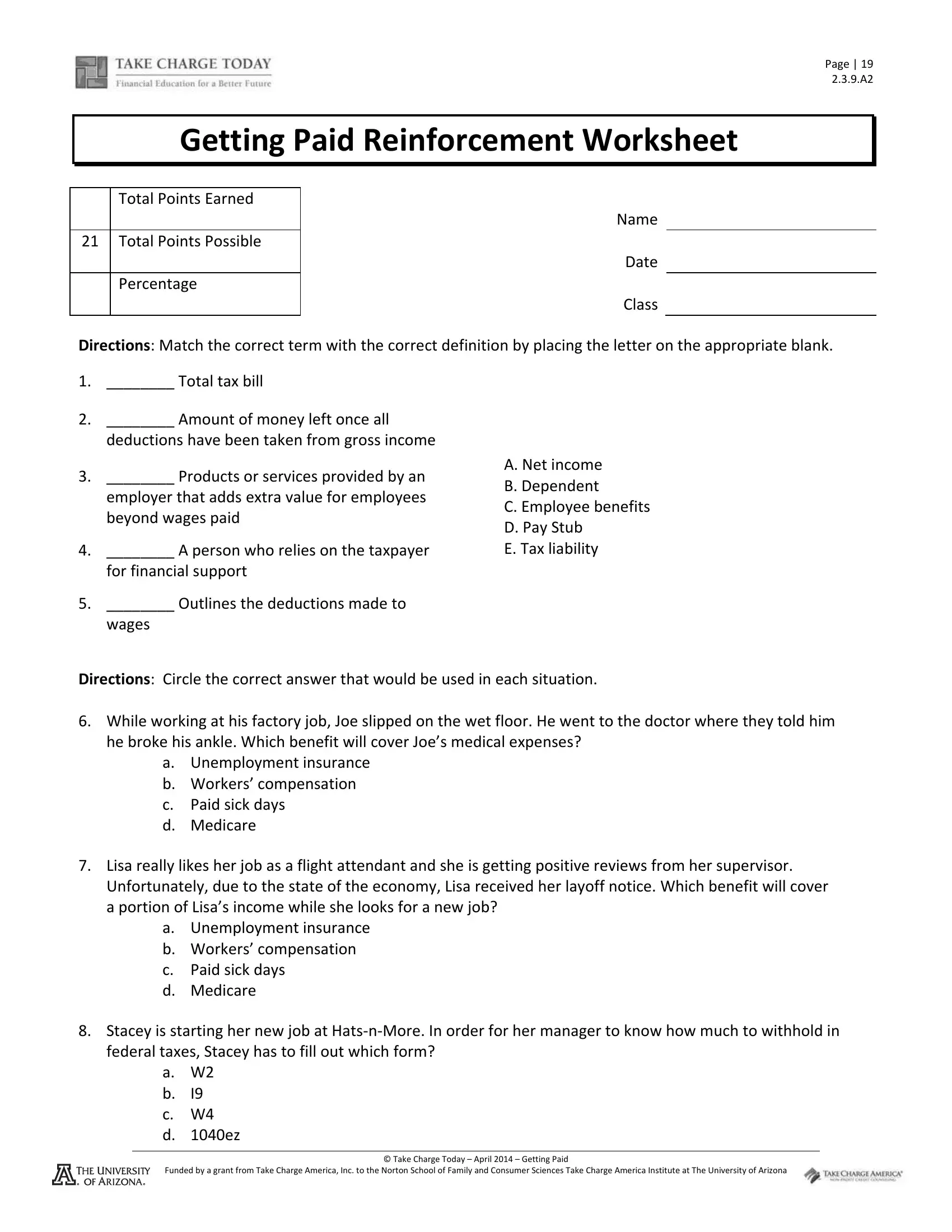

1. The getting paid reinforcement worksheet involves particular details to be entered. Ensure the next blank fields are complete:

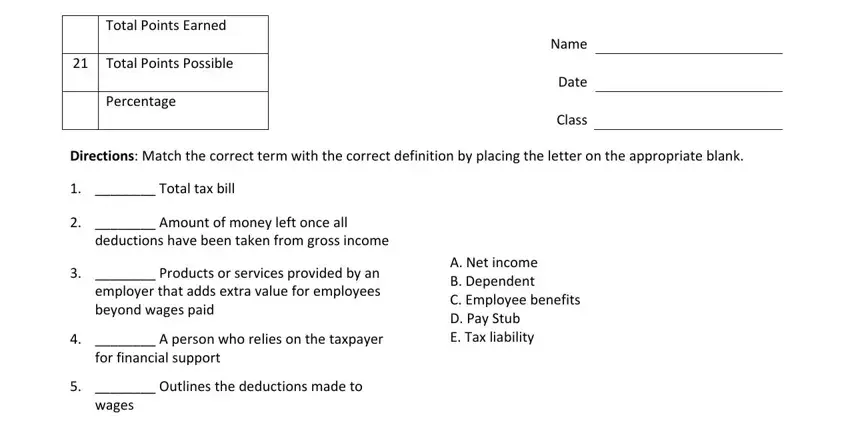

2. Immediately after this section is completed, proceed to enter the suitable details in these - he broke his ankle Which benefit, Lisa really likes her job as a, Unfortunately due to the state of, a Unemployment insurance b Workers, a Unemployment insurance b Workers, Stacey is starting her new job at, federal taxes Stacey has to fill, a W b c W d ez Funded by a grant, and Take Charge Today April.

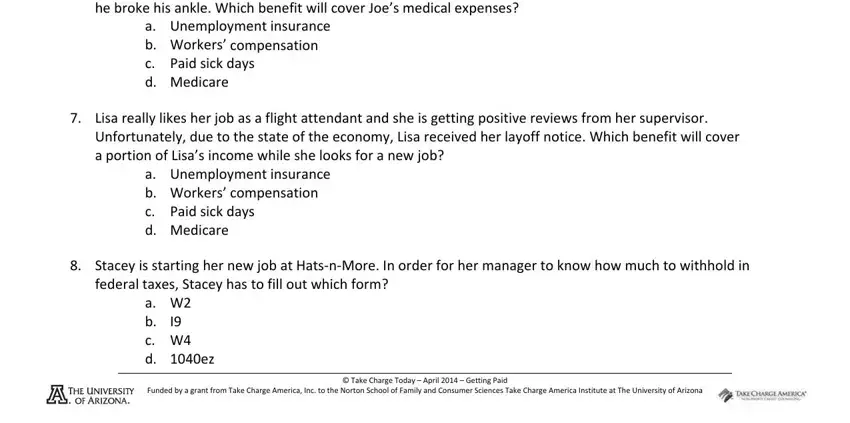

3. Throughout this stage, review disadvantage for each method, and Why are employee benefits. These must be filled in with greatest precision.

4. Filling in taxes on an ongoing format, Who benefits more from being paid, and points is paramount in the fourth step - always be patient and fill in every blank!

Regarding points and Who benefits more from being paid, be certain you don't make any errors in this section. Both of these are definitely the key fields in this form.

Step 3: Ensure that your details are accurate and click "Done" to progress further. Go for a free trial account at FormsPal and obtain immediate access to getting paid reinforcement worksheet - accessible from your personal cabinet. We do not share or sell the information you provide while working with documents at FormsPal.