You'll be able to fill in cis template word effectively in our online PDF editor. To maintain our editor on the cutting edge of practicality, we strive to implement user-driven capabilities and improvements on a regular basis. We're at all times happy to receive feedback - play a vital role in revolutionizing PDF editing. To get started on your journey, consider these simple steps:

Step 1: Click the "Get Form" button above on this webpage to get into our PDF editor.

Step 2: This tool will let you modify PDF documents in a range of ways. Modify it by adding customized text, correct what is already in the document, and place in a signature - all within the reach of several clicks!

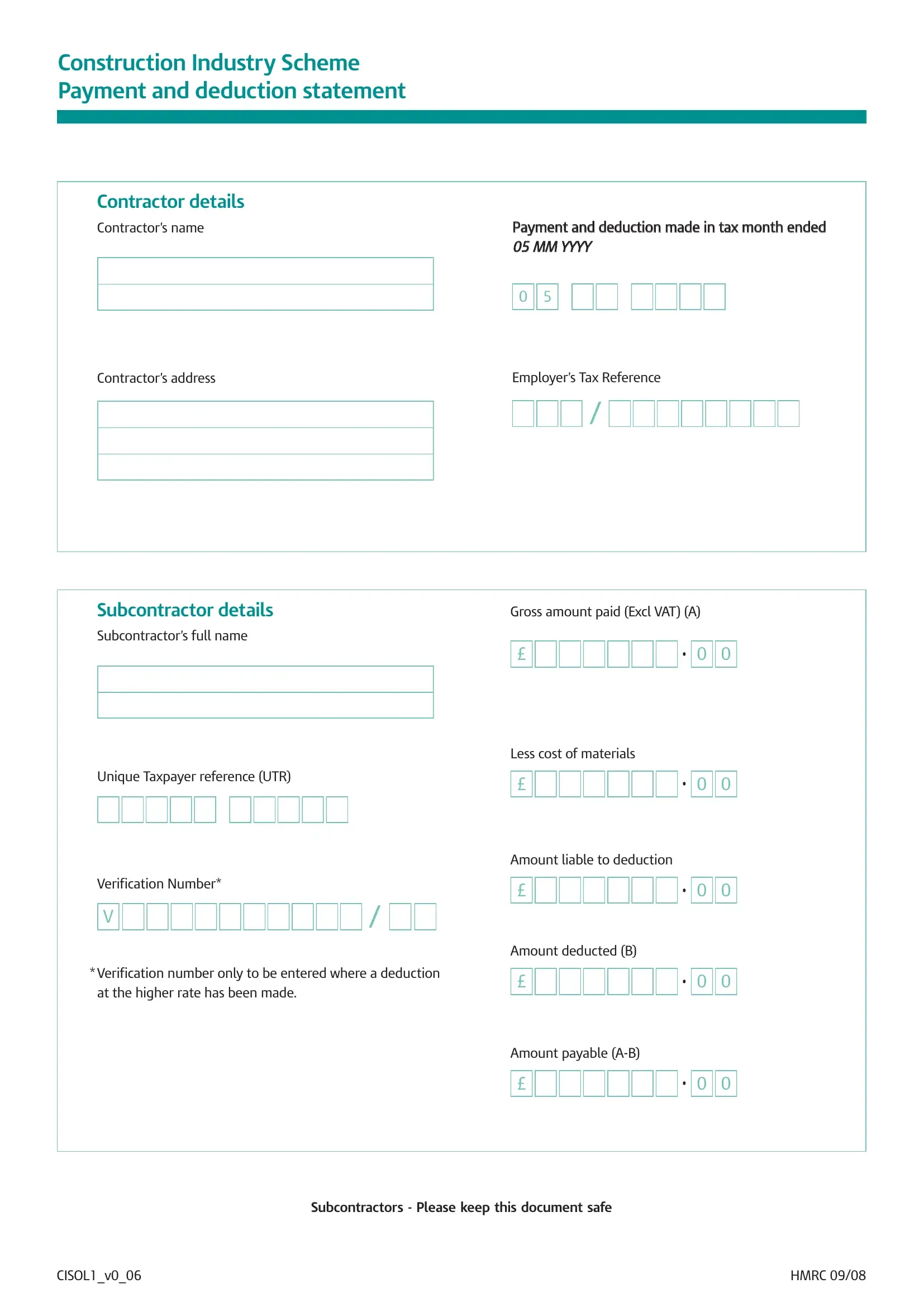

In order to fill out this form, make sure that you type in the information you need in every single blank:

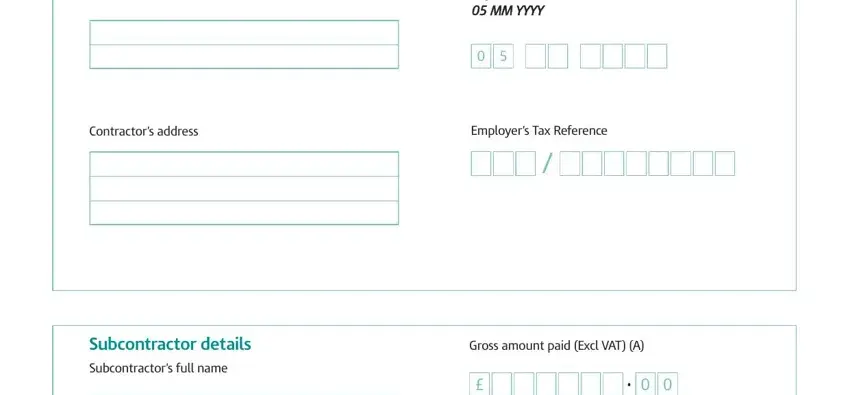

1. It is important to fill out the cis template word properly, therefore be attentive while filling in the sections including these particular fields:

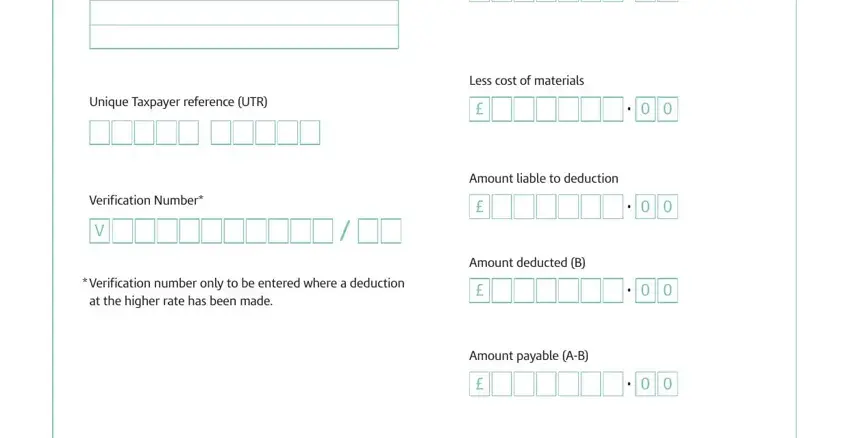

2. The third stage is usually to complete the next few blanks: Unique Taxpayer reference UTR, Verification Number, Verification number only to be, at the higher rate has been made, Less cost of materials, Amount liable to deduction, Amount deducted B, and Amount payable AB.

Always be extremely careful when filling out Amount deducted B and Verification number only to be, as this is the section where most users make some mistakes.

Step 3: Prior to submitting the form, check that blanks have been filled out the proper way. As soon as you believe it's all fine, click “Done." Make a free trial plan with us and obtain instant access to cis template word - with all adjustments preserved and accessible inside your FormsPal cabinet. FormsPal ensures your information confidentiality with a secure system that in no way saves or shares any sort of private data provided. Feel safe knowing your documents are kept protected every time you use our tools!