Understanding the PC 243 form, titled "Statement in Lieu of Account," is fundamental for individuals navigating through the probate process in the State of Connecticut. When managing the estate of a deceased person, fiduciaries or executors are often required to provide detailed accounts of their financial activities to the Probate Court. However, there are circumstances where the PC 243 form can streamline this process. This document allows fiduciaries to present a summary statement when certain conditions are met, such as being a residuary distributee, ensuring all debts and expenses have been paid, and fulfilling bequests. It outlines the necessity for fiduciaries to declare the payment of funeral expenses, taxes, debts, and the distribution of assets, alongside an itemized list of said expenses. Furthermore, it requests the court to discharge the fiduciary from further liability concerning the estate's accounting and seeks the issuance of a Certificate of Devise, Descent, or Distribution for real property involved in the estate. Completing this form with accuracy is critical as it is made under penalties of false statement, emphasizing the gravity and legal seriousness of the declarations within.

| Question | Answer |

|---|---|

| Form Name | Pc 243 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | testamentary, distributee, distributees, Fiduciarys |

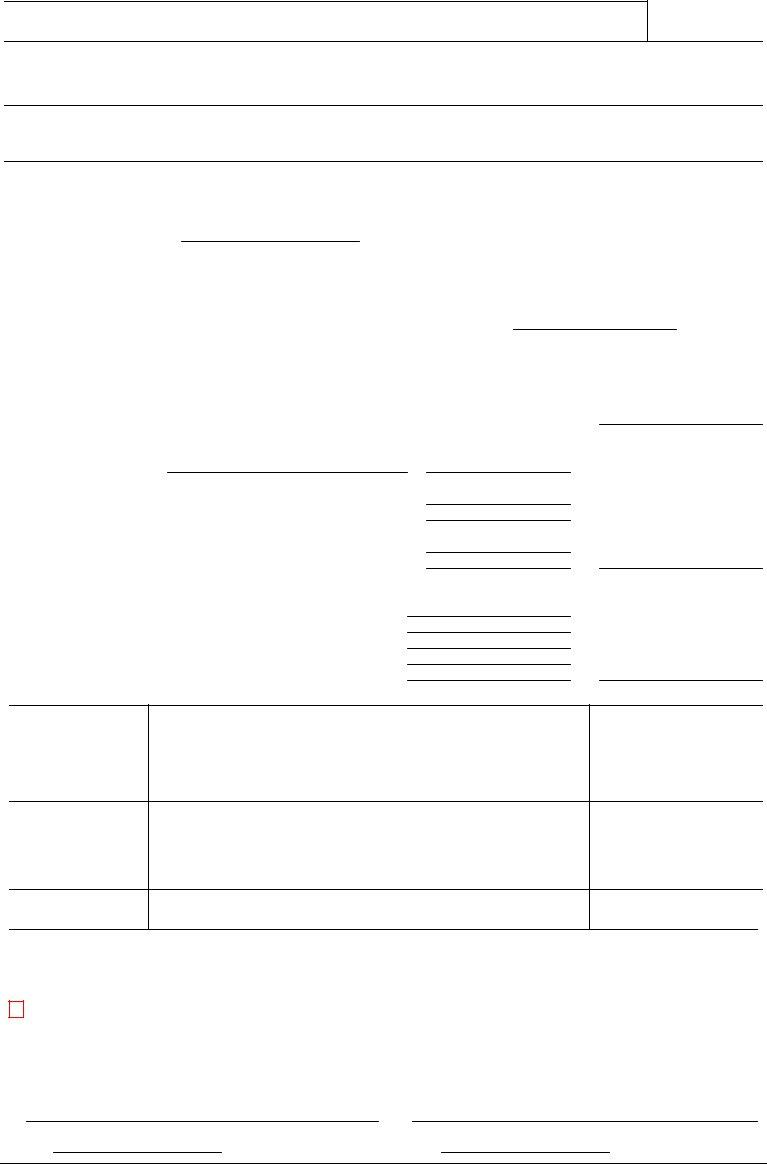

STATEMENT IN LIEU OF ACCOUNT

STATE OF CONNECTICUT |

RECORDED: |

COURT OF PROBATE |

|

[Type or print in black ink.]

TO: COURT OF PROBATE, DISTRICT OF |

DISTRICT NO. |

ESTATE OF

in said district, deceased.

FIDUCIARY(IES) [Name(s), address(es), zip code(s), and telephone number(s)]

THE FIDUCIARY(IES) HEREBY REPRESENTS UNDER PENALTIES OF FALSE STATEMENT THAT:

At least one fiduciary is a residuary distributee in his /her own right, and no part of the residue is distributable to a testamentary or living trust.

The total amount inventoried is $

All debts, funeral expenses, taxes, and expenses of administration have been paid.

All specific bequests have been or will be paid in full.

The amount reported on the Return of Claims and List of Notified Creditors, |

and has been |

paid as indicated. |

|

All distributees have a copy of this statement.

An itemized list of all funeral expenses, taxes, and expenses of administration is as follows:

Funeral Expenses:

Taxes:

1)Town of

2)State of Connecticut

a)Succession and estate taxes

b)Income tax

3)Internal Revenue Service

a)Estate Tax

b)Income Tax

Administration Expenses: Probate Court Costs Fiduciary Bond Premium Recording and advertising costs Fiduciarys' fees and disbursements Attorneys' fees and disbursements

Other [Attach second sheet, if necessary.]

$

$

$

$

$

$$

$

$

$

$

$$

Bequests already made to: Name [Include specific and

residuary beneficiaries.]

$

Proposed distribution to: Name

$

Show any reserve remaining:

$

WHEREFORE SAID FIDUCIARY(IES) REQUESTS discharge from further liability for accounting and return to this court, pursuant to C.G.S.

The fiduciary also requests the issuance of a Certificate of Devise, Descent, or Distribution of the real property described in the Inventory to the extent not sold or otherwise conveyed.

[If part of the real property has been sold or otherwise conveyed, explain fully and attach revised legal description thereto.]

The representations contained herein are made under the penalties of false statement.

Fiduciary's Signature |

Fiduciary's Signature |

Date |

Date |

STATEMENT IN LIEU OF ACCOUNT