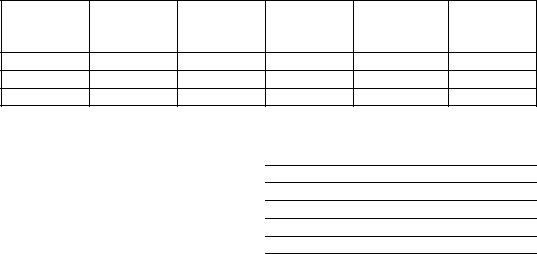

In the realm of employer obligations and tax documentation within Malaysia, the PCB 2 form holds a crucial position as it serves as an official statement of payment by the employer. This document, addressed to the Chief Executive Officer or Director General of the Inland Revenue Board of Malaysia, meticulously records tax deductions made on behalf of employees throughout the fiscal year. It encompasses the identity and tax details of the employee, including their new identity card or passport numbers, alongside their income tax and staff numbers. Employers are required to detail deductions for each month, covering both the current and preceding year's income, using specified formats such as MTD (Monthly Tax Deduction) and CP38 (special tax deduction). By listing amounts, receipt or bank slip numbers, and transaction dates, it provides a comprehensive overview of the tax deductions executed by the employer. This form not only facilitates compliance with Malaysian tax laws but also ensures transparency between the employer, employee, and tax authorities, making it a pivotal document in the landscape of employment-related financial reporting.

| Question | Answer |

|---|---|

| Form Name | Pcb 2 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | basic design 2 3 pcb, pcb online registration, pcb2, pcb 2 |

STATEMENT OF PAYMENT BY EMPLOYER |

PCB |

|||||

To: |

Tarikh: |

|||||

Chief Executive Officer/Director General Inland Revenue |

|

|

|

|||

|

|

|

||||

Inland Revenue Board Of Malaysia |

|

|

|

|||

Branch |

|

|

|

|||

|

|

|

|

|

|

|

Sir, |

|

|

|

|||

Tax Deduction Made During The Year |

|

|

|

|

||

Name Of Employee |

|

|

|

|||

|

|

|

|

|

||

New Identity Card No./Passport No. |

|

|

|

|||

|

|

|

|

|

||

Employee Income Tax No. |

|

|

|

|

||

Staff No. |

|

|

|

|

||

Employer's No. (E) |

|

|

|

|||

|

|

|

|

|

||

The above matter is hereby referred. |

|

|

|

|||

2. Deductions that have been made to the above employee in the current year are as followed:

Year |

Amount (RM) |

Receipt No./Bank Slip No./ |

Receipt Date/Transaction Date |

||||

Transaction No. |

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

MTD |

CP38 |

MTD |

CP38 |

MTD |

CP38 |

|

January |

|

|

|

|

|

|

|

February |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April |

|

|

|

|

|

|

|

May |

|

|

|

|

|

|

|

June |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August |

|

|

|

|

|

|

|

September |

|

|

|

|

|

|

|

October |

|

|

|

|

|

|

|

November |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

3.Deductions that have been made to the above employee for the preceeding year income in the current year are as followed:

Type Of Income

Month

Year

MTD Amount

(RM)

Receipt No./

Bank Slip No./

Transaction No.

Receipt Date/

Transaction

Date

Thank you.

Name Of Officer

Designation

Telephone No.

Name And Address Of Employer