Any time you want to fill out form pd24, you don't need to install any kind of software - simply use our online tool. In order to make our tool better and less complicated to work with, we consistently develop new features, taking into account suggestions coming from our users. Starting is effortless! Everything you should do is take the next easy steps below:

Step 1: Hit the "Get Form" button in the top area of this page to get into our PDF editor.

Step 2: Once you start the file editor, you will notice the form all set to be filled out. Apart from filling in various blank fields, you can also do many other actions with the form, such as adding your own textual content, editing the original text, inserting images, putting your signature on the form, and much more.

So as to fill out this form, be sure you provide the information you need in every blank:

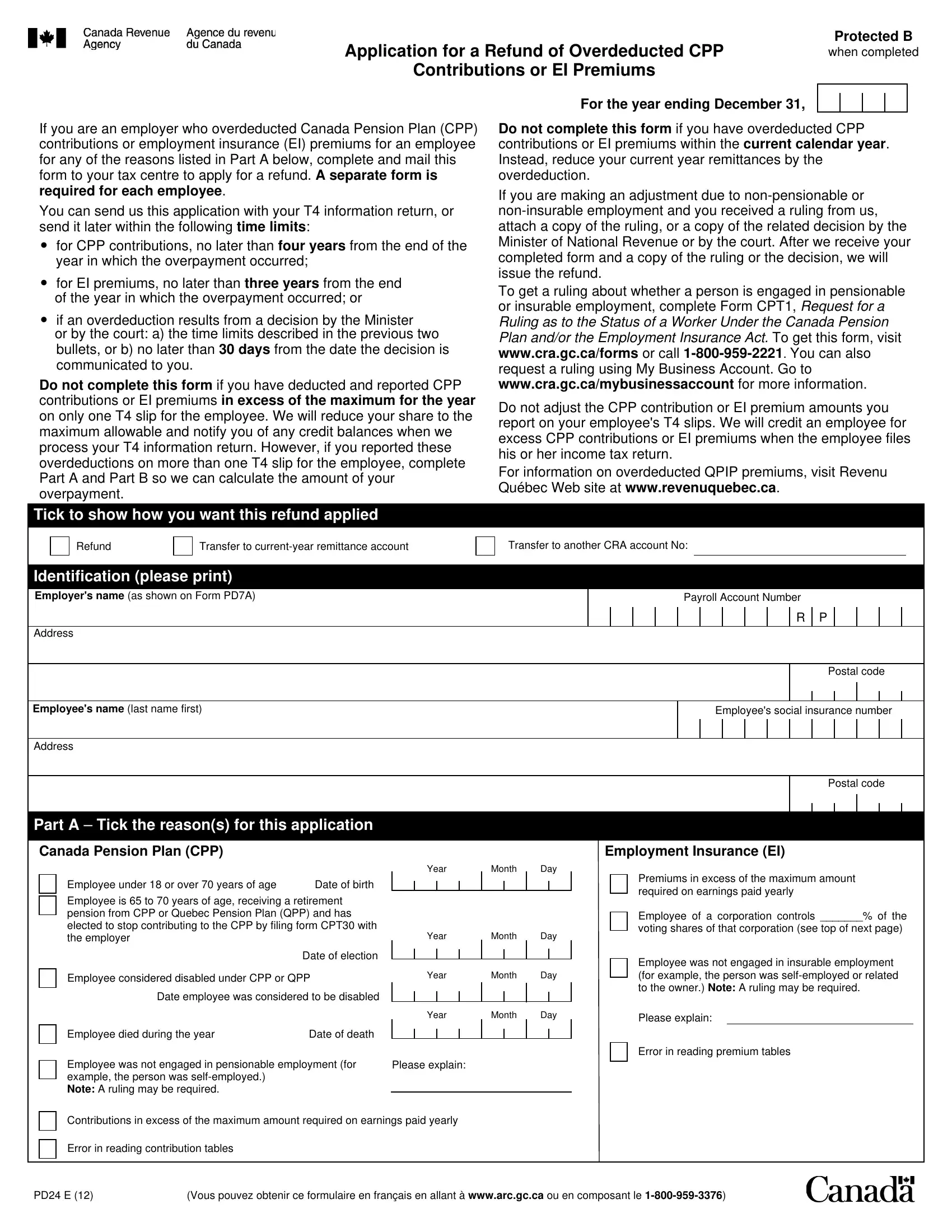

1. The form pd24 needs specific information to be entered. Make certain the subsequent blank fields are finalized:

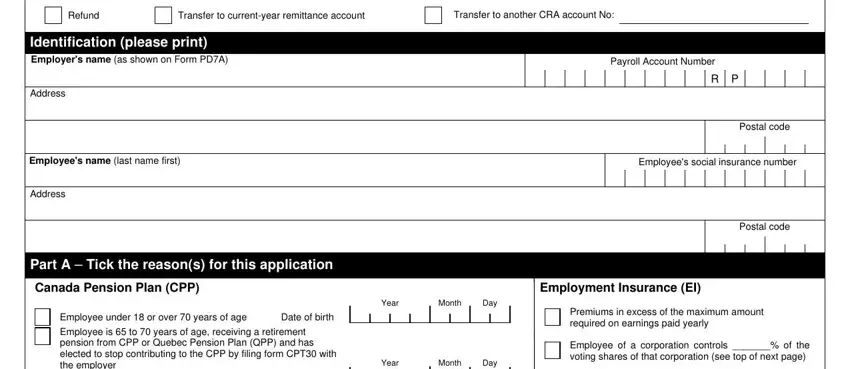

2. The third part would be to fill out all of the following fields: Refund, Transfer to currentyear remittance, Transfer to another CRA account No, Identification please print, Address Adresse, Employees name last name first, Address, Payroll Account Number, R P, Postal code, Employees social insurance number, Postal code, Part A Tick the reasons for this, Canada Pension Plan CPP, and Employment Insurance EI.

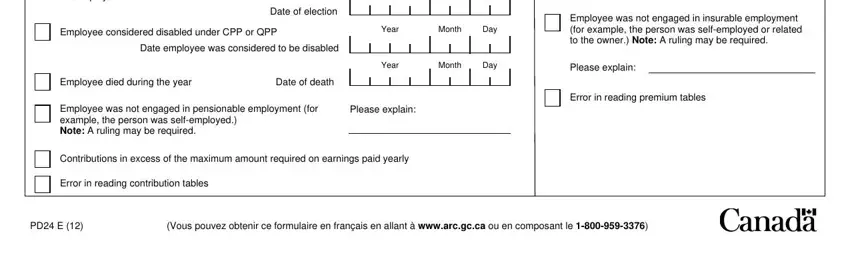

3. This 3rd segment should be rather simple, Employee is to years of age, Date of election, Employee considered disabled under, Year, Month, Day, Date employee was considered to be, Employee was not engaged in, Year, Month, Day, Please explain, Employee died during the year, Date of death, and Employee was not engaged in - these form fields will have to be filled in here.

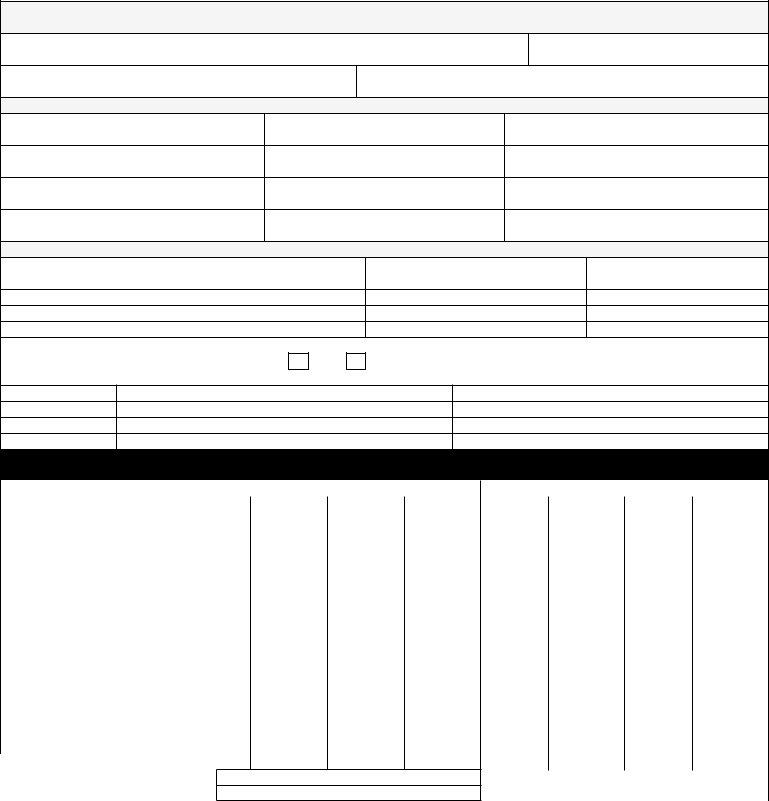

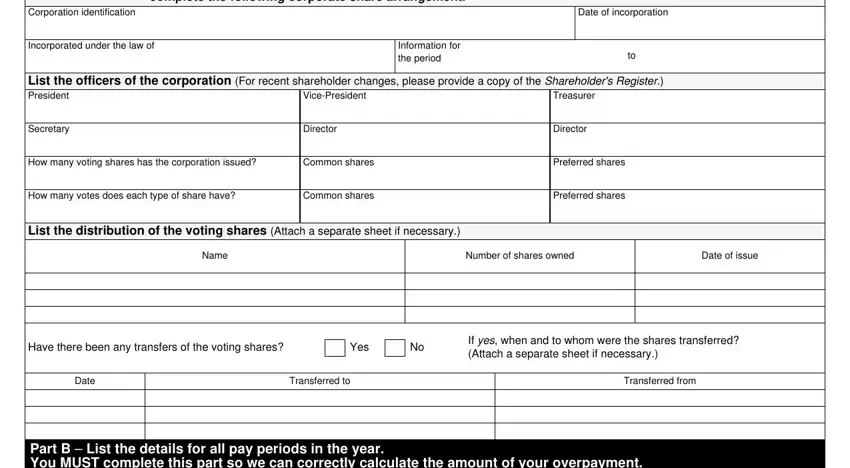

4. To move ahead, the next stage requires filling in a couple of empty form fields. These comprise of Part A continued If you ticked, Date of incorporation, Incorporated under the law of, Information for the period, List the officers of the, VicePresident, Treasurer, Secretary, Director, Director, How many voting shares has the, Common shares, Preferred shares, How many votes does each type of, and Common shares, which are key to carrying on with this particular document.

Always be very mindful while filling out Treasurer and List the officers of the, because this is the section in which a lot of people make mistakes.

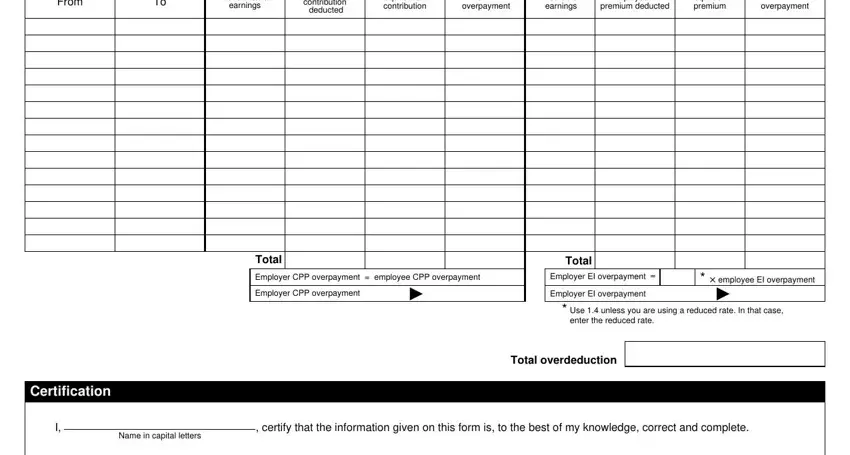

5. Because you near the completion of this document, there are a couple more requirements that have to be met. Particularly, From, Pensionable, earnings, contribution deducted, Required CPP, contribution, CPP, overpayment, Insurable earnings, Employee EI, premium deducted, Required EI, premium, overpayment, and Total must all be done.

Step 3: Right after going through the fields and details, press "Done" and you are good to go! Try a free trial option at FormsPal and obtain instant access to form pd24 - downloadable, emailable, and editable in your FormsPal account page. FormsPal provides protected document tools without personal information record-keeping or distributing. Rest assured that your data is secure here!