When you would like to fill out pa rev 65, there's no need to download and install any sort of software - simply use our PDF tool. The editor is constantly maintained by our staff, acquiring awesome functions and turning out to be better. This is what you would have to do to get going:

Step 1: Press the "Get Form" button at the top of this webpage to access our editor.

Step 2: As soon as you open the file editor, you'll see the form prepared to be filled in. Apart from filling in various blanks, you may also do several other things with the Document, including adding custom textual content, modifying the original textual content, adding illustrations or photos, affixing your signature to the PDF, and more.

It's easy to fill out the pdf using this practical tutorial! Here is what you need to do:

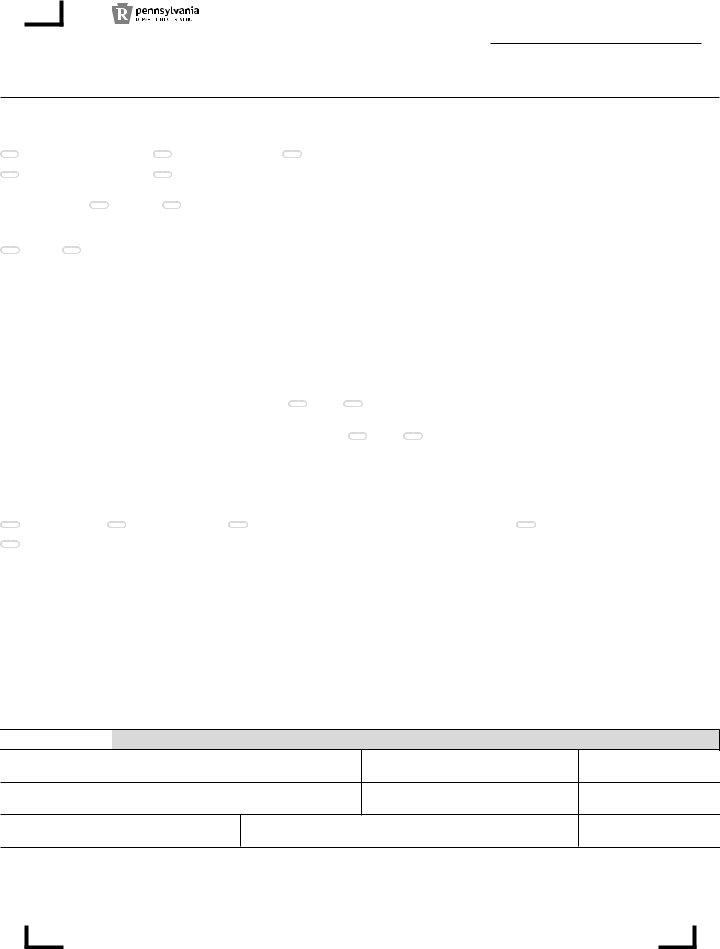

1. The pa rev 65 involves specific information to be entered. Ensure that the subsequent fields are completed:

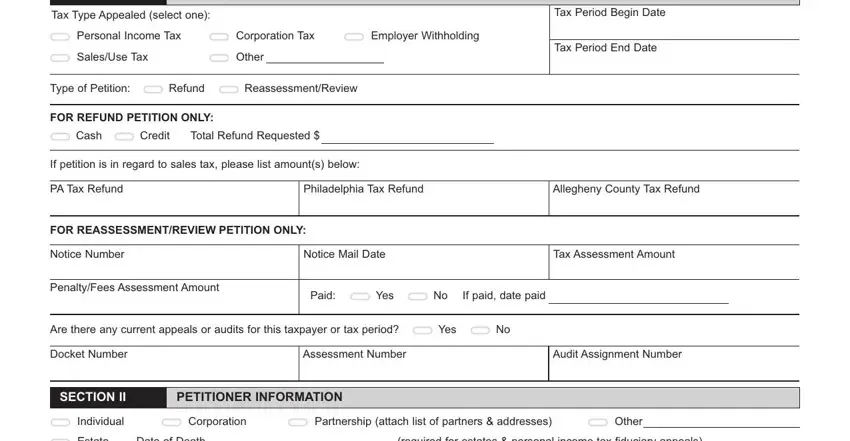

2. Just after this part is filled out, proceed to enter the applicable details in all these: Legal Name for individual, Trade Name or DBA if different, Mailing Address, City, State, ZIP Code, Country, SSN, FEIN, Account ID, Revenue ID, Contact Person Name, Contact Email Address, Contact Telephone Number, and SECTION III.

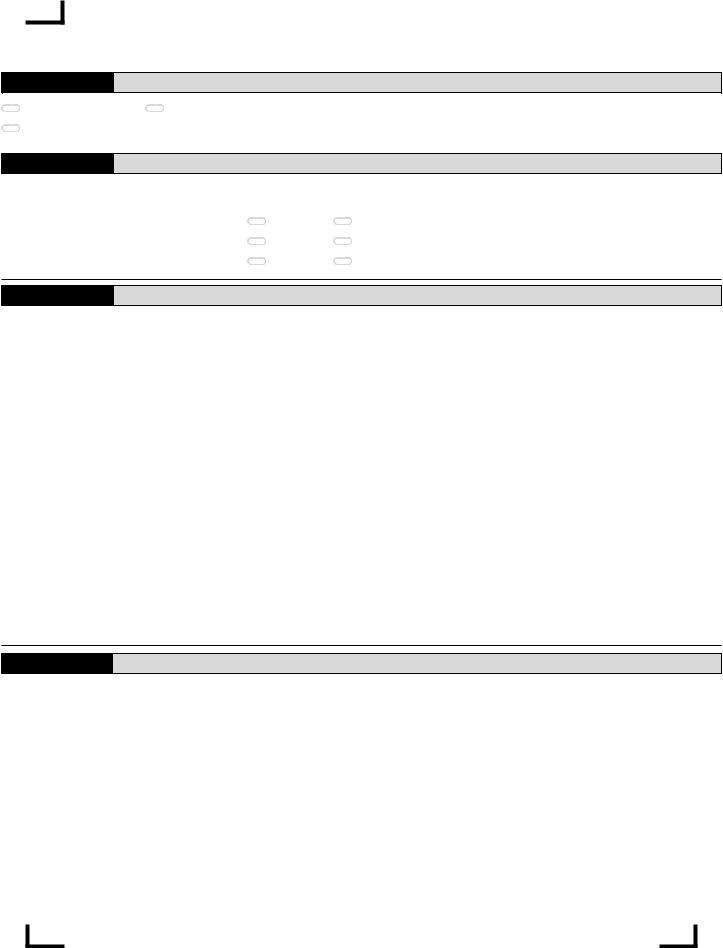

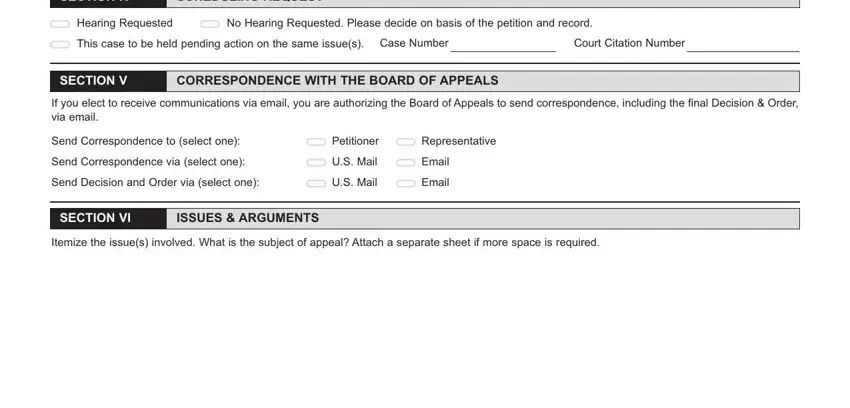

3. Throughout this stage, check out SECTION IV, SCHEDULING REQUEST, Hearing Requested, No Hearing Requested Please decide, This case to be held pending, Case Number, Court Citation Number, SECTION V, CORRESPONDENCE WITH THE BOARD OF, If you elect to receive, Send Correspondence to select one, Petitioner, Representative, Send Correspondence via select one, and Send Decision and Order via select. All of these are required to be taken care of with highest accuracy.

It's easy to make errors when completing the CORRESPONDENCE WITH THE BOARD OF, thus make sure you go through it again prior to deciding to finalize the form.

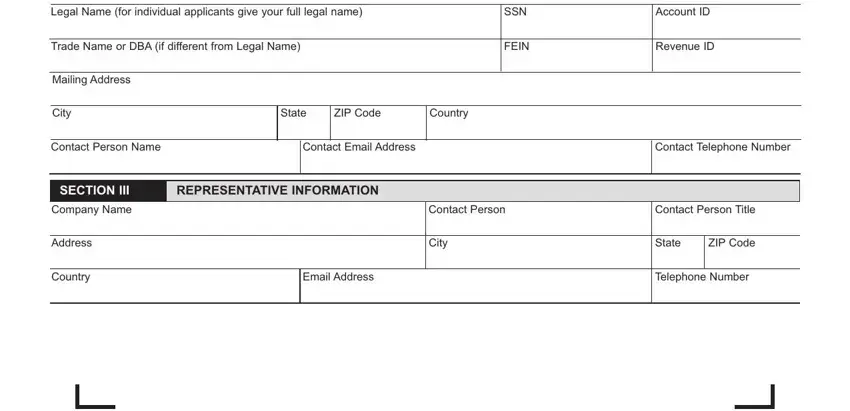

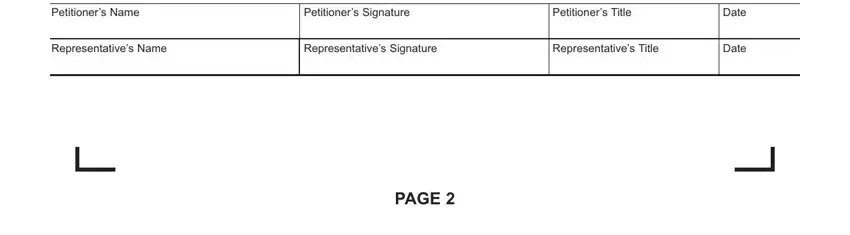

4. To move ahead, the next section requires filling out several fields. Examples of these are Petitioners Name, Petitioners Signature, Petitioners Title, Representatives Name, Representatives Signature, Representatives Title, Date, Date, and PAGE, which are key to continuing with this process.

Step 3: Prior to getting to the next step, you should make sure that blanks are filled in the right way. As soon as you’re satisfied with it, click “Done." Join FormsPal now and immediately obtain pa rev 65, prepared for downloading. All alterations made by you are preserved , helping you to edit the form at a later point if required. FormsPal provides protected form editor devoid of personal information record-keeping or distributing. Rest assured that your information is secure here!