Using PDF documents online is super easy with our PDF tool. Anyone can fill out form frm ira dist distribution here effortlessly. FormsPal professional team is always endeavoring to enhance the editor and help it become much easier for clients with its handy functions. Uncover an ceaselessly innovative experience today - take a look at and discover new possibilities as you go! With some simple steps, you may start your PDF journey:

Step 1: Click the "Get Form" button above on this page to get into our PDF tool.

Step 2: As you start the tool, you will find the document all set to be filled out. Other than filling in various blanks, you may also perform various other actions with the form, including adding custom text, editing the initial textual content, inserting graphics, affixing your signature to the document, and more.

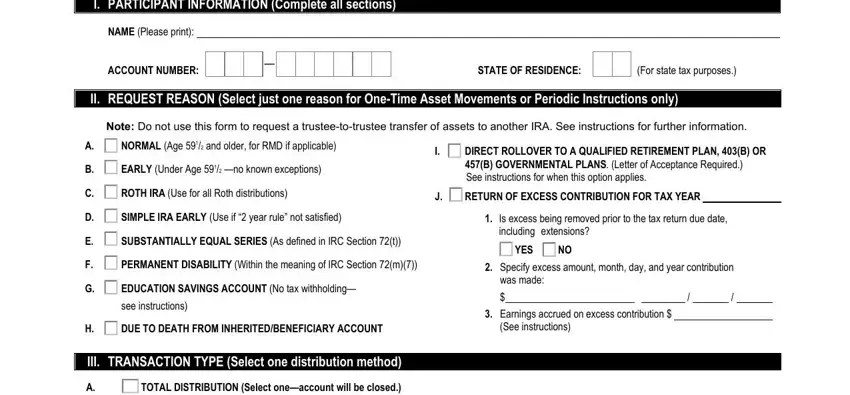

This PDF will require specific data to be filled out, hence make sure to take whatever time to fill in what's required:

1. The form frm ira dist distribution needs particular details to be typed in. Ensure that the subsequent blank fields are completed:

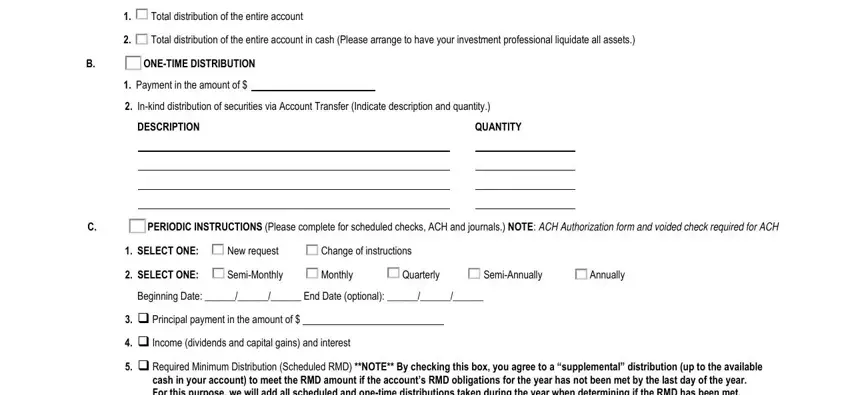

2. After the previous segment is finished, you're ready to put in the required specifics in Total distribution of the entire, Total distribution of the entire, ONETIME DISTRIBUTION, Payment in the amount of, Inkind distribution of securities, DESCRIPTION, PERIODIC INSTRUCTIONS Please, QUANTITY, SELECT ONE New request, Change of instructions, SELECT ONE SemiMonthly Monthly, Quarterly, SemiAnnually, Annually, and Beginning Date End Date optional so that you can progress to the 3rd step.

Those who work with this document generally get some points wrong when filling in SELECT ONE New request in this area. Be sure to re-examine whatever you type in here.

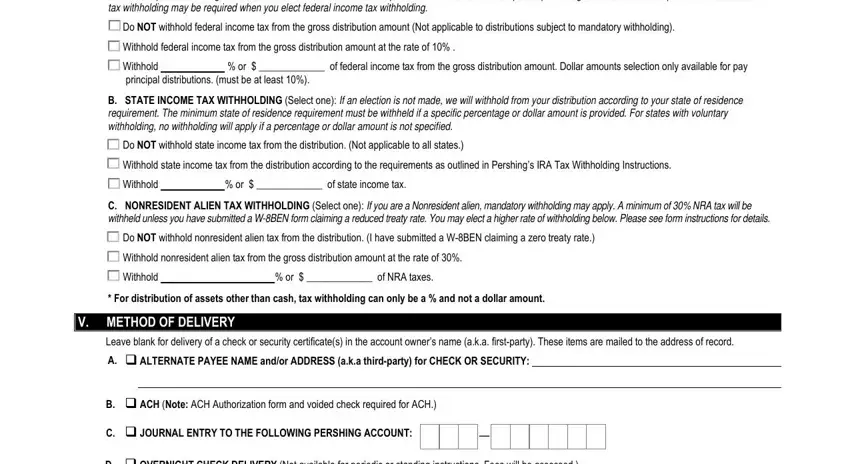

3. Completing A FEDERAL INCOME TAX WITHHOLDING, or of federal income tax from, B STATE INCOME TAX WITHHOLDING, or of state income tax, C NONRESIDENT ALIEN TAX, or of NRA taxes, V METHOD OF DELIVERY, Leave blank for delivery of a, B ACH Note ACH Authorization form, and D OVERNIGHT CHECK DELIVERY Not is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

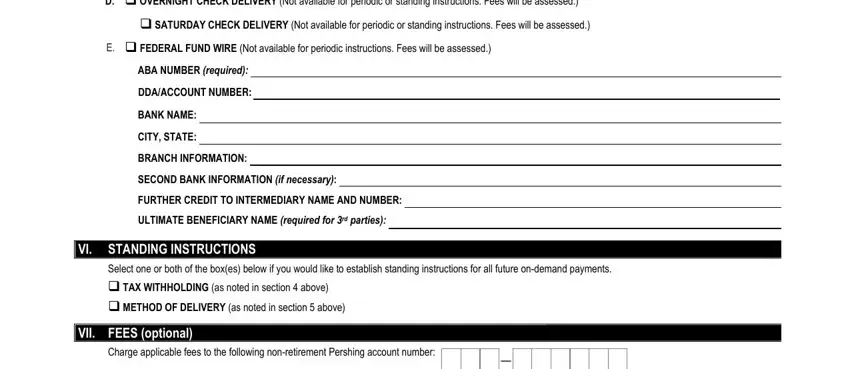

4. It's time to begin working on this fourth section! Here you will have all these D OVERNIGHT CHECK DELIVERY Not, SATURDAY CHECK DELIVERY Not, FEDERAL FUND WIRE Not available, BANK NAME, CITY STATE, BRANCH INFORMATION SECOND BANK, VI STANDING INSTRUCTIONS Select, TAX WITHHOLDING as noted in, VII FEES optional, and Charge applicable fees to the blank fields to fill out.

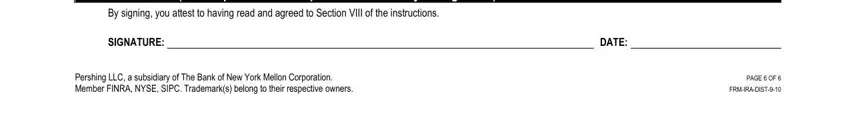

5. This last step to complete this PDF form is integral. Make sure that you fill out the necessary blank fields, and this includes VIII SIGNATURE This request cannot, By signing you attest to having, SIGNATURE, DATE, Pershing LLC a subsidiary of The, and PAGE OF FRMIRADIST, before finalizing. If not, it may give you an incomplete and potentially incorrect document!

Step 3: When you have reread the information provided, simply click "Done" to finalize your form at FormsPal. Get hold of your form frm ira dist distribution after you sign up at FormsPal for a 7-day free trial. Easily access the pdf file in your FormsPal cabinet, along with any modifications and adjustments conveniently saved! FormsPal guarantees your data confidentiality by having a secure method that never records or distributes any private data used. Feel safe knowing your files are kept protected any time you use our tools!