You can fill out Simple Ira Salary Form easily in our online PDF editor. To make our tool better and more convenient to work with, we consistently come up with new features, with our users' suggestions in mind. With a few easy steps, you may begin your PDF editing:

Step 1: Just click the "Get Form Button" at the top of this webpage to launch our pdf editing tool. This way, you'll find all that is needed to work with your document.

Step 2: With the help of this advanced PDF editor, it is possible to do more than merely complete blank fields. Try each of the features and make your docs look faultless with custom textual content added in, or optimize the original content to excellence - all that comes with an ability to add stunning pictures and sign the file off.

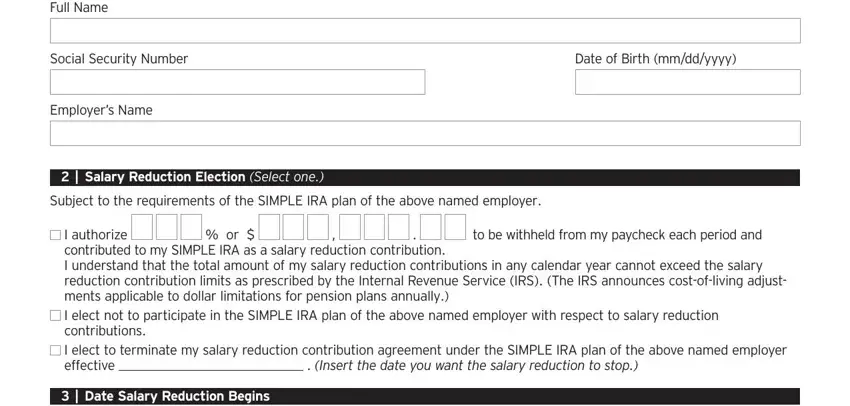

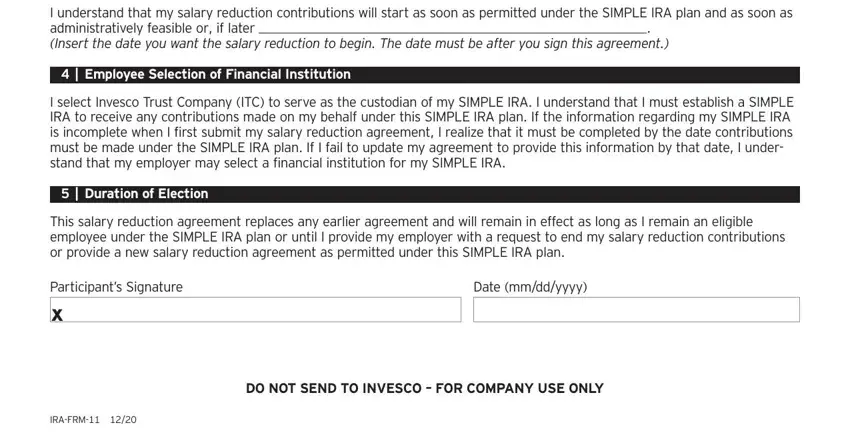

With regards to the blanks of this specific form, here is what you should consider:

1. Whenever completing the Simple Ira Salary Form, be certain to include all important fields in its associated form section. This will help to expedite the process, making it possible for your details to be processed without delay and accurately.

2. Once your current task is complete, take the next step – fill out all of these fields - I understand that my salary, Employee Selection of Financial, I select Invesco Trust Company ITC, Duration of Election, This salary reduction agreement, Participants Signature x, IRAFRM, Date mmddyyyy, and DO NOT SEND TO INVESCO FOR with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can certainly make a mistake when filling out the DO NOT SEND TO INVESCO FOR, so make sure that you look again prior to when you submit it.

Step 3: Prior to submitting your form, it's a good idea to ensure that all blanks were filled in correctly. When you believe it's all good, click “Done." Go for a free trial account at FormsPal and acquire instant access to Simple Ira Salary Form - download or edit from your personal account page. Whenever you work with FormsPal, you can certainly complete forms without having to get worried about personal data leaks or entries getting distributed. Our protected platform helps to ensure that your private data is kept safely.