PT-50P (revised 1/18/2017)

OFFICIAL TAX MATTER

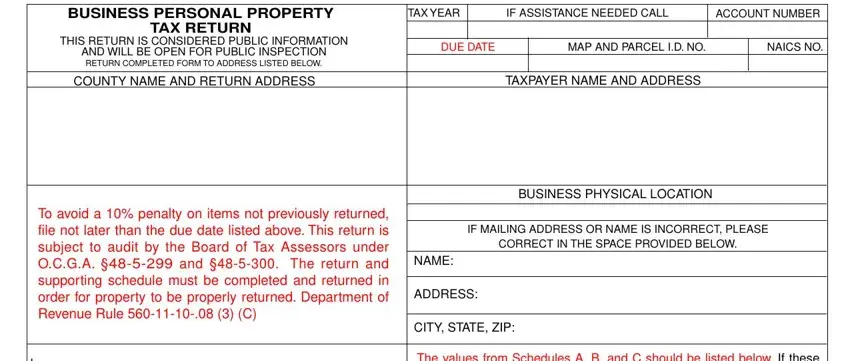

TANGIBLE PERSONAL PROPERTY TAX RETURN AND SUPPORTING SCHEDULES

INSTRUCTION SHEET

INSTRUCTIONS FOR PAGE ONE - BUSINESS PERSONAL PROPERTY TAX RETURN

1.If taxpayer name or address has changed or is incorrect, provide correct name and address in the space provided.

2.To avoid a 10% penalty on assets that have not been previously returned, this return must be filed no later than date listed under the due date column on page one.

3.Taxpayer return value: Georgia Law (O.C.G.A.§ 48-5-6) requires the taxpayer to return property at its fair market value. If the values indicated from Schedules A, B, or C do not in your opinion reflect fair market value, you may list your opinion here. Attachments must be provided by you listing the reasons for change.

4.Value from Schedule A, B, & C: Schedules A, B, & C should be completed and the total values from these schedules should be listed in this column.

5.Taxpayers Declaration: This declaration must be signed by the taxpayer or agent and dated in order for this to be a valid return.

INSTRUCTIONS FOR PAGE TWO - GENERAL INFORMATION AND IMPORTANT INFORMATION

1.The information requested in the general information section is very important. This area should be completed in detail. The information in this section is open for public inspection.

2.The information found in the reference information section may be of great interest to the taxpayer. This section contains information about various laws and exemptions that may be available to the taxpayer.

INSTRUCTIONS FOR PAGE THREE - SCHEDULE A - FURNITURE / FIXTURES / MACHINERY / EQUIPMENT

1.This section provides for the uniform calculation of value for all assets of the business owned on January 1 of this year. Expensed assets as well as capitalized assets should be listed and valued using indicated schedule. Leasehold improvements personal property in nature and trade fixtures should also be reported on this schedule. Leasehold improvements such as walls, doors, floor covering, electrical, plumbing, heating and air distribution systems, ceiling and lighting that are attached to and form an integral part of the building should not be reported as personal property.

2.The indicated basic cost approach value of assets for tax purposes is computed by multiplying the total adjusted original cost new by the composite conversion factor of each year’s acquisition listed in the appropriate economic life group. Cost amounts are subject to audit. Cost should include installation, trade-in allowances, sales tax, investment credits, transportation, etc.

3.Internal Revenue Service Publication 946 “How to Depreciate Property” Appendix B - Table of Class Lives and Recovery Periods - column headed “Class Life in Years”, should be used for determining the economic life group of an asset for Ad Valorem Tax purposes. See

examples of economic life groups listed below. ACRS and MACRS should not be used for determining the economic life of an asset for Ad Valorem Tax purposes.

4.Deduct cost of items disposed of or transferred out from the cost of assets acquired during the corresponding year; add cost of items transferred in. (Disposals include only those items which have been sold, junked, transferred or otherwise no longer located at the business on January 1, this year). List disposals and items transferred in or out and reasons for disposals or transfer on page 4 under sections three or four.

5.A copy of the most current asset listing indicating the date of acquisition, original cost, and description of each asset should be submitted with this schedule. If an asset listing is not available please submit a copy of your most current I.R.S. form 4562 Depreciation Schedule and all supplemental schedules utilized to develop depreciation deduction for A.C.R.S. assets and assets listed under the column headed “Other Depreciation” as well as supplemental depreciation schedule used for M.A.C.R.S. assets. This information is needed for verification purposes and is not available for public inspection (O.C.G.A.§ 48-5-314).

DEPRECIATION GROUPING EXAMPLES

|

GROUP 1: ECONOM IC LIFE OF 5 - 7 YEARS |

GROUP 2: ECONOM IC LIFE OF 8 - 12 YEARS |

GROUP 3: ECONOM IC LIFE OF 13 YEARS OR M ORE |

GROUP 4: ECONOM IC LIFE OF 1 - 4 YEARS |

|

|

|

|

|

|

|

|

|

|

ALSO ASSET CLASS 00 . 12 IRS PUBLICATION 946 |

|

|

|

|

|

|

|

|

|

|

1) |

Copiers, Duplicating Equip., Typew riters |

01) |

Office Furniture, Fixtures and Equipm ent |

01) |

Petroleum Refining Equipm ent |

1) |

Com puters - Non Production |

|

2) |

Calculators, Adding and Accounting M achines |

02) |

Agriculture M achiner y and Equipm ent |

02) |

Grain and Grain M ill Products (M fg.) |

2) |

Peripheral Com puter Equipm ent |

|

3) |

Electronic Instrum entation M fg. |

03) |

Recreation or Entertainm ent Ser vices |

03) |

M fg. of Sugar and Sugar Products |

3) |

Jigs, Dies, M olds, Patterns |

|

4) |

Construction Equipm ent |

04) |

M ining and Quarr ying |

04) |

M fg. of Vegetable Oils and Products |

4) |

Special Tools and Gauges |

|

5) |

Tim ber Cutting Equipm ent |

05) |

M fg. of Textile Pr oducts |

05) |

M fg. of Tobacco and Tobacco Products |

5) |

Returnable Containers |

|

|

|

|

|

|

|

|

6) |

M fg. of Electronic Com ponents & Products |

06) |

M fg. of Wood Products and Furniture |

06) |

M fg. of Pulp and Paper |

6) |

Special Transfer and Shipping Devices |

|

7) |

Radio and T.V. Broadcasting Equipm ent |

|

|

|

|

|

07) |

Perm anent Saw m ills |

07) |

M fg. of Rubber Products |

7) |

Pallets |

|

8) |

Drilling of Oil and Gas Wells |

|

|

|

|

|

08) |

M fg. of Chem icals and Allied Products |

08) |

M fg. of Cem ent |

8) |

Rental M ovies |

|

9) |

Tem porar y Saw m ills |

09) |

M fg. of finished Plastics Products |

09) |

M fg. of Stone and Clay Products |

|

9) |

Card Readers |

|

10) |

Any Sem iconductor M fg. Equipm ent |

10) |

M fg. of Leather and Leather Products |

10) |

M fg. of Prim ar y Nonfer rous M etals |

|

10) |

High Speed Printers |

|

11) |

Telegraph and Satellite Com m unications |

11) |

M fg. of Electrical and Non- electrical M achinery |

11) |

M fg. of Foundr y Products |

|

11) |

Data Entr y Devices |

|

12) |

Vending Equipm ent, Coin Operated |

12) |

M fg. of Athletic, Jew elr y and Other Goods |

12) |

M fg. of Prim ar y Steel M ill Products |

|

12) |

Teleprinters |

|

13) |

Rental Appliances and Televisions |

13) |

Retail Trades Furniture, Fixtures and Equipm ent |

13) |

Tanks and Storage |

|

13) |

Plotters |

|

14) |

Hand Tools |

14) |

Restaurant and Bar Equipm ent |

14) |

Billboards/Signs |

|

14) |

Term inals, Tape Drives, Disc Drives |

|

15) |

Nuclear Fuel Assem blies |

15) |

Hotel and M otel Furnishing and Equipm ent |

15) |

Radio/T.V. Antennas and Tow ers |

|

15) |

M agnetic Tape Feeds |

|

16) |

Fishing Equipm ent |

16) |

Autom obile Repair and Shop Equipm ent |

16) |

Cold Storage and Ice M aking Equipm ent |

|

16) |

Optical Character Readers |

|

17) |

Cattle, Breeding, or Dair y Equipm ent |

17) |

Personal and Professional Ser vices |

17) |

M fg. of Glass Products |

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR PAGE FOUR - BUSINESS PERSONAL PROPERTY SCHEDULE B - INVENTORY

1.Inventory should be reported at 100% cost on January 1, this year. Cost should include, but not be limited to, freight in, overhead or burden, Federal, State, or Local Taxes, or any other charges imposed upon the item that makes it more valuable to the owner. Costs will be arrived at by converting anything other than current cost back to cost. “LIFO” is not acceptable.

2.The name and address of the legal owner of any consigned goods or any other type goods not owned by you and not reported under Schedule B should be listed under Section 1, Consigned Goods. This will insure that the taxes are charged to the legal owner.

3.Schedule C - Construction in Progress - if you had any unallocated cost for Construction in Progress, which is personal property in nature, that was not reported under Schedule A it should be reported under Schedule C. A description of the property, year acquired, useful life in years, and total cost should be reported.

4.If you had in your possession on January 1 any leased or rented equipment, machinery, furniture, fixtures, tools, vending machines, or other types of property, the legal owners name and address should be listed under Section 2 headed Leased or Rented Equipment. This will insure that the taxes are charged to the legal owner.

NOTE: Schedules A, B, and C and all documents furnished by the taxpayer are considered confidential and not open to public inspection. O.C.G.A.,§ 48-5-314. Returns are public information.

BUSINESS PERSONAL PROPERTY |

TAX YEAR |

|

IF ASSISTANCE NEEDED CALL |

ACCOUNT NUMBER |

TAX RETURN |

|

|

|

|

|

|

THIS RETURN IS CONSIDERED PUBLIC INFORMATION |

|

|

|

|

|

|

DUE DATE |

|

MAP AND PARCEL I.D. NO. |

|

NAICS NO. |

AND WILL BE OPEN FOR PUBLIC INSPECTION |

|

|

|

|

|

|

|

|

RETURN COMPLETED FORM TO ADDRESS LISTED BELOW. |

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY NAME AND RETURN ADDRESS |

|

|

TAXPAYER NAME AND ADDRESS |

|

|

|

|

|

|

BUSINESS PHYSICAL LOCATION |

|

|

|

|

To avoid a 10% penalty on items not previously returned, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

file not later than the due date listed above. This return is |

IF MAILING ADDRESS OR NAME IS INCORRECT, PLEASE |

|

|

subject to audit by the Board of Tax Assessors under |

CORRECT IN THE SPACE PROVIDED BELOW. |

|

NAME: |

|

|

|

|

|

|

O.C.G.A. §48-5-299 and §48-5-300. The return and |

|

|

|

|

|

|

supporting schedule must be completed and returned in |

|

|

|

|

|

|

ADDRESS: |

|

|

|

|

|

|

order for property to be properly returned. Department of |

|

|

|

|

|

|

Revenue Rule 560-11-10-.08 (3) (C) |

|

|

|

|

|

|

CITY, STATE, ZIP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

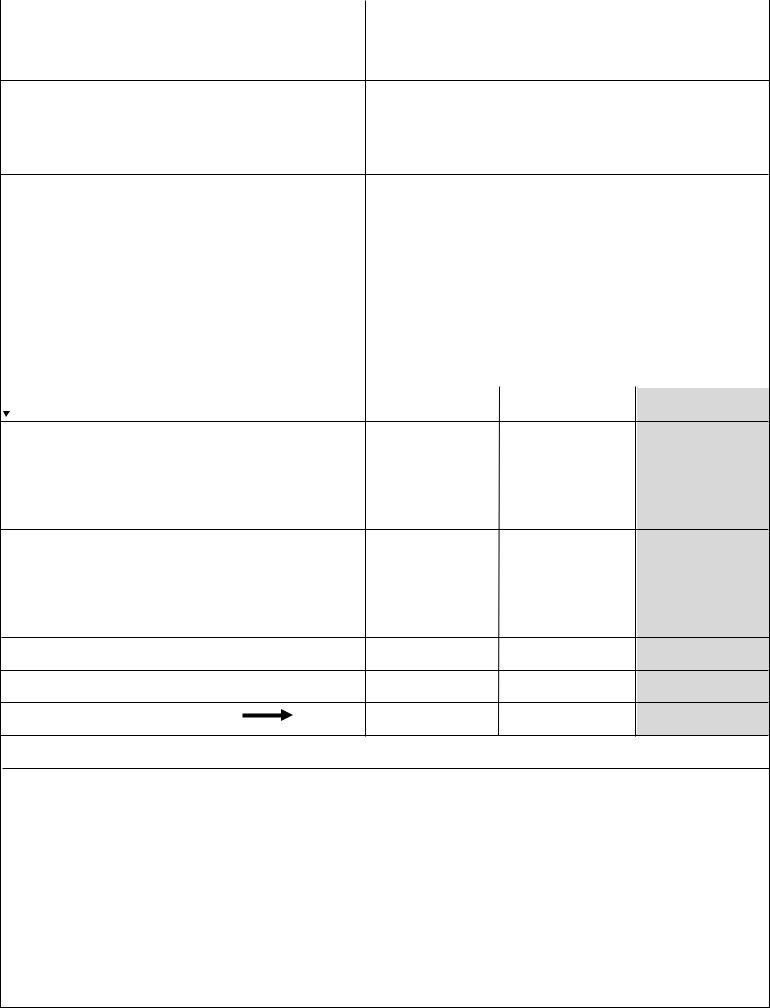

The values from Schedules A, B, and C should be listed below. If these |

|

|

values, in your opinion, do not reflect fair market value then declare |

|

|

I |

|

|

|

|

your estimate of value under the column headed Taxpayers Returned Value. |

|

N |

PERSONAL PROPERTY STRATA |

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER RETURNED |

INDICATED VALUE FROM |

FOR TAX |

|

|

|

|

VALUE, AS OF JAN. 1 |

SCHEDULES A, B, & C |

OFFICE USE |

|

|

|

|

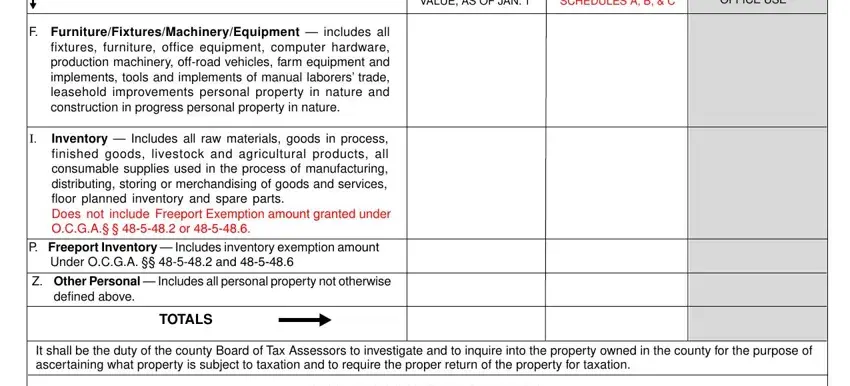

F.Furniture/Fixtures/Machinery/Equipment — includes all fixtures, furniture, office equipment, computer hardware, production machinery, off-road vehicles, farm equipment and implements, tools and implements of manual laborers’ trade, leasehold improvements personal property in nature and construction in progress personal property in nature.

I.Inventory — Includes all raw materials, goods in process, finished goods, livestock and agricultural products, all consumable supplies used in the process of manufacturing, distributing, storing or merchandising of goods and services,

floor planned inventory and spare parts.

Does not include Freeport Exemption amount granted under

O.C.G.A.§ § 48-5-48.2 or 48-5-48.6.

P.Freeport Inventory — Includes inventory exemption amount Under O.C.G.A. §§ 48-5-48.2 and 48-5-48.6

Z.Other Personal — Includes all personal property not otherwise defined above.

TOTALS

It shall be the duty of the county Board of Tax Assessors to investigate and to inquire into the property owned in the county for the purpose of ascertaining what property is subject to taxation and to require the proper return of the property for taxation.

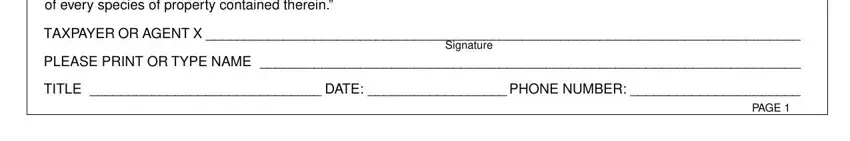

TAXPAYER’S DECLARATION

“I do solemnly swear that I have carefully read (or have heard read) and have duly considered the questions propounded in the foregoing tax list, and that the value placed by me on the property returned, as shown by the list, is the true market value thereof; and I further swear that I returned, for the purpose of being taxed thereon, every species of property that I own in my own right or have control of either as agent, executor, administrator, or otherwise; and that in making this return, for the purpose of being taxed thereon, I have not attempted either by transferring my property to another or by any other means to evade the laws governing taxation in this state. I do further swear that in making this return I have done so by estimating the true worth and value of every species of property contained therein.”

TAXPAYER OR AGENT X _____________________________________________________________________________

Signature

PLEASE PRINT OR TYPE NAME ______________________________________________________________________

TITLE ______________________________ DATE: __________________ PHONE NUMBER: ______________________

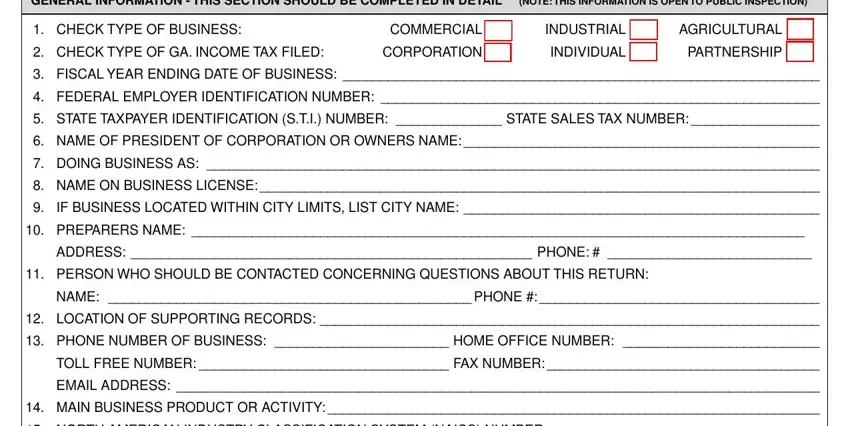

GENERAL INFORMATION - THIS SECTION SHOULD BE COMPLETED IN DETAIL (NOTE: THIS INFORMATION IS OPEN TO PUBLIC INSPECTION)

1. |

CHECK TYPE OF BUSINESS: |

|

COMMERCIAL [ |

] |

INDUSTRIAL [ |

] |

AGRICULTURAL [ |

] |

2. |

CHECK TYPE OF GA. INCOME TAX FILED: |

CORPORATION [ |

] |

INDIVIDUAL [ |

] |

PARTNERSHIP [ |

] |

3. |

FISCAL YEAR ENDING DATE OF BUSINESS: _______________________________________________________________ |

4. |

FEDERAL EMPLOYER IDENTIFICATION NUMBER: __________________________________________________________ |

5. |

STATE TAXPAYER IDENTIFICATION (S.T.I.) NUMBER: ______________ STATE SALES TAX NUMBER: _________________ |

6. |

NAME OF PRESIDENT OF CORPORATION OR OWNERS NAME: _______________________________________________ |

7. |

DOING BUSINESS AS: _________________________________________________________________________________ |

8. |

NAME ON BUSINESS LICENSE: __________________________________________________________________________ |

9. |

IF BUSINESS LOCATED WITHIN CITY LIMITS, LIST CITY NAME: _______________________________________________ |

10. |

PREPARERS NAME: _________________________________________________________________________________ |

|

|

ADDRESS: _____________________________________________________ PHONE: # ___________________________ |

11. |

PERSON WHO SHOULD BE CONTACTED CONCERNING QUESTIONS ABOUT THIS RETURN: |

|

|

|

|

|

|

|

NAME: ________________________________________________ PHONE #: _____________________________________ |

12. |

LOCATION OF SUPPORTING RECORDS: __________________________________________________________________ |

13. |

PHONE NUMBER OF BUSINESS: _______________________ HOME OFFICE NUMBER: __________________________ |

|

TOLL FREE NUMBER: _________________________________ FAX NUMBER: ____________________________________ |

|

EMAIL ADDRESS: _____________________________________________________________________________________ |

14. |

MAIN BUSINESS PRODUCT OR ACTIVITY: _________________________________________________________________ |

15. |

NORTH AMERICAN INDUSTRY CLASSIFICATION SYSTEM (NAICS) NUMBER: ___________________________________ |

16. |

SQUARE FOOTAGE OF BUILDING: _____________ IF RETAIL, SQUARE FOOTAGE OF RETAIL AREA: ________________ |

17. |

IF YOU CLOSED OR SOLD YOUR BUSINESS, PLEASE LIST NEW OWNER’S NAME AND ADDRESS __________________ |

|

____________________________________________________________________________________________________ |

18. |

DATE BUSINESS BEGAN IN THIS COUNTY: _____________________ WAS RETURN FILED LAST YEAR? YES [ |

] NO [ |

] |

19. |

DO YOU OR YOUR BUSINESS HAVE ASSETS LOCATED IN OTHER COUNTIES IN THIS STATE? |

YES [ |

] |

NO [ |

] |

|

20. |

DOES THE BUSINESS OWN A BOAT AND MOTOR? |

YES [ |

] |

NO [ |

|

] |

|

|

|

|

|

|

|

AIRCRAFT? YES [ |

] |

NO [ |

] IF YES, PLEASE REQUEST MARINE FORM PT-50M OR AIRCRAFT FORM PT 50A. |

|

REFERENCE INFORMATION

1.O.C.G.A. § 48-5-299 requires the Board of Tax Assessors to diligently investigate and inquire into the property owned in the county for the purpose of ascertaining what property, real and personal is subject to taxation in the county and require its proper return for taxation.

2.O.C.G.A. § 48-5-300 grants the Board of Tax Assessors authority to require production of books, papers, or documents, by subpoena, if necessary, which may aid in determining the proper assessment.

3.O.C.G.A. § 48-5-269 grants the State Revenue Commissioner the authority to prescribe the forms, books, and records to be used for standard property tax reporting for all taxing units, including but not limited to, the forms, books, and records to be used in the listing, appraisal and assessment of property and how the forms, books, and records shall be compiled and kept.

4.O.C.G.A. § 48-5-269.1 grants the State Revenue Commissioner the authority to adopt and require the use of uniform procedural manual for appraising tangible real and personal property.

5.In accordance with the above sections of the Georgia Code this return and schedules are submitted to you for your completion. Failure to file a completed copy

of this form may lead to an audit of your records and/or the placing of an assessment on your property from the best information obtainable in accordance with O.C.G.A. § 48-5-299 (a).

6.Freeport Exemption (O.C.G.A. § § 48-5-48.2 and 48-5-48.6) may be available in your county. Applications are available on request and must be completed and filed with the business personal property return and schedules prior to the deadline for filing.

7.Any air and water pollution control facilities owned may be exempt under O.C.G.A. § 48-5-41 (11) which states… “All property used in or which is a part of any facility which has been installed or constructed at any time for the primary purpose of eliminating or reducing air and water pollution of such facilities and has been certified by the Department of Natural Resources as necessary and adequate for the purpose intended” shall be exempt from all Ad Valorem Property Taxes in this state.

8.Most counties do not accept metered mail dates as filing dates unless counter stamped by the post office. Be sure that the date of deposit and the postmark date are the same if mailing close to the deadline.

9.O.C.G.A. § 48-5-41.1 states… “All farm products grown in this state and remaining in the hands of the producer during the one year beginning immediately after their production and harvested agricultural products which have a planting-to-harvest cycle of 12 months or less, which are customarily cured or aged for a period in excess of one year after harvesting and before manufacturing, and which are held in this state for manufacturing and processing purposes and all qualified farm products grown in this state shall be exempt from Ad Valorem Property Taxes.”

10.O.C.G.A. § 48-5-43 states… “Consumers of commercial fertilizers shall not be required to return for taxation any commercial fertilizer or any manures commonly used by farmers and others as fertilizers if the land upon which the fertilizer is to be used has been properly returned for taxation.”

11.Boats and motors and aircraft should be reported on a separate reporting form which will be provided upon request.

12.Computer software (O.C.G.A. § 48-1-8) .shall constitute personal property only to the extent of the value of the unmounted or uninstalled medium on or in which

it is stored or transmitted except that held as inventory ready for sale. |

PAGE 2 |

|

|

|

BUSINESS PERSONAL PROPERTY SCHEDULE B |

INVENTORY |

|

|

THIS SCHEDULE IS CONSIDERED CONFIDENTIAL AND NOT OPEN TO PUBLIC INSPECTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE B - INVENTORY - SEE INSTRUCTION SHEET |

|

|

|

|

|

|

|

|

|

|

|

|

|

Did you or your business own any inventory on January 1, this year? Yes |

( ) |

No |

( |

) |

. |

|

|

|

1. |

Indicate your inventory accounting method (Lower of Cost or Market, Retail |

|

If yes, please list in space provided below. Show total 100% cost, do |

|

include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

not |

|

|

|

|

Method, Weighted Average, Physical, etc.) |

|

licensed motor vehicles, or dealer heavy duty equipment for sale weighing over |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,000 pounds and to be used for construction purposes. |

|

|

|

2. |

Check Cost Method as it applies to your inventory: |

( ) |

Actual |

( ) |

LIFO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) |

FIFO LIFO not acceptable |

|

|

|

|

|

|

|

|

|

|

1. |

Merchandise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Fiscal Year ending date of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Raw Materials |

|

|

|

|

|

|

If your Fiscal Year ends at a point in time other than January 1, you should attach |

|

|

|

|

|

|

a breakdown of how you arrived at your January 1 inventory. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Goods in Process |

|

|

|

|

|

|

|

|

4. |

Inventory reported on previous year Georgia Income Tax Return: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

The 100% delivered cost should include freight, burden and overhead at your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Finished Goods |

|

|

|

|

|

|

|

|

|

|

level of trade on January 1. |

|

|

|

|

|

|

|

|

|

|

5. |

Goods in Transit |

|

|

|

|

|

|

|

6. |

If you file a Corporate or Partnership Income Tax Return, a photocopy of your |

|

|

|

|

|

|

|

|

|

|

most current balance sheet (Corporation. Form 1120, Schedule A & L - Partnership, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Warehoused |

|

|

|

|

|

|

|

|

|

|

Form 1065, Schedule A & L) as filed with your U.S. Income Tax Return is requested. |

|

|

|

|

|

|

|

|

|

|

If you filed an Individual or Sole Proprietorship Income Tax Return, a photo copy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Consigned |

|

|

|

|

|

|

|

|

|

|

of your most current Profit or Loss Statement Form 1040, Schedule C, Pages 1 & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 as filed with your U.S. Income Tax Return is requested. These documents are |

8. |

Floor Planned |

|

|

|

|

|

|

|

|

|

|

requested for inventory verification purposes and will not be available for public |

|

|

|

|

|

|

|

|

|

|

9. |

Spare Parts |

|

|

|

|

|

|

inspection (O.C.G.A. § 48-5-314). Under GA Law you cannot be required to furnish |

|

|

|

|

|

|

any Income Tax Records or Returns. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Supplies |

|

|

|

|

|

|

|

|

|

7. |

Inventory is subject to audit and verification from your records or those you have |

|

|

|

|

|

|

|

|

|

|

filed with the State of Georgia Department of Revenue. |

|

|

Includes computer, medical, office and operating |

|

|

|

|

|

|

|

|

supplies, fuel, and tangible prepaid expensed items) |

|

|

|

|

|

8. |

Do not make any deductions for anticipated mark-down or shrinkage. Do not |

11. |

Packaging Materials |

|

|

|

|

|

|

|

|

|

|

|

discount, figures are to be taken directly from your books. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Livestock |

|

|

|

9. |

If inventory is less than the previous year an explanation for the decrease should |

|

|

(Non Exempt 48-5-41.1) |

|

|

|

|

|

|

|

|

|

|

|

|

be submitted. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

TOTAL INVENTORY |

|

|

|

|

|

|

|

|

|

10. |

Gross Sales for the previous calendar year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter total on page 1 Line I schedule column. If Freeport account |

|

11. |

All taxable livestock and farm products should be reported as inventory. See |

|

|

|

|

|

O.C.G.A. § 48-5-41.1 for details of exemption. |

|

enter exempt amount on Line P and taxable amount on Line I. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE C - CONSTRUCTION IN PROGRESS

Did you have unallocated costs for construction in progress on January 1 this year? Yes |

( |

) |

No |

( ) |

. If yes, did you have tangible personal property connected with |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this construction in progress that has not been reported in any other section of this schedule? Yes |

( ) |

No |

( |

) |

If yes, please list in the space provided below. Add |

Indicated Value to Total on Page 1 Line F Schedule Column. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DETAILED DESCRIPTION OF ITEMS |

YEAR |

USEFUL |

|

|

TOTAL |

X |

MARKET |

= |

INDICATED |

OFFICE USE |

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED) |

ACQUIRED |

LIFE |

|

|

COST |

VALUE |

VALUE |

ONLY |

|

(YEARS) |

|

|

|

|

FACTOR |

|

|

|

|

|

|

|

|

|

|

|

|

X |

.75 |

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 1: CONSIGNED GOODS

Did you have any consigned goods, floor planned merchandise, or any other type of goods that were loaned, stored or otherwise held on January 1, this year, and

not owned by you and was not reported in your inventory value in schedule B above of this report? Yes ( ) No ( ). If yes, list in the space provided below.

|

DESCRIPTION OF GOODS |

FULL |

NAME AND ADDRESS OF LEGAL OWNER |

|

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED) |

COST |

|

|

|

|

|

|

|

|

|

|

SECTION 2: LEASED OR RENTED EQUIPMENT

Did you have in your possession or was there located at your business on January 1, this year, any machinery, equipment, furniture, fixture, tools, vending machines (coffee, cigarette, candy, games etc.) or other type personal property which was leased, rented, loaned, stored or otherwise located at your business and not owned by you? Yes ( ) No ( ). If yes, list the equipment in the space provided below (exclude licensed motor vehicles). Attach supplemental sheet if necessary.

|

|

|

SELLING |

RENTAL |

DATE OF |

DATE |

LENGTH |

|

NAME/ADDRESS OF OWNER |

DESCRIPTION OF ITEM |

AMOUNT |

|

PRICE |

MANUFACTURE |

INSTALLED |

OF LEASE |

|

|

|

PER MONTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 3: ADDITIONS OR ITEMS TRANSFERRED IN

Did you have items which were added or transferred in for prior years or the current year that were not previously reported? Yes |

( |

) |

No |

( ). If yes, list in the space provided below. |

|

|

|

|

|

|

DETAILED DESCRIPTION OF ITEMS (ATTACH SUPPLEMENTAL SHEETS IF NEEDED) |

|

YEAR ACQUIRED |

ORIGINAL COST NEW |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 4: DISPOSALS OR ITEMS TRANSFERRED OUT

Did you have items which have been sold, junked, transferred or otherwise no longer located at the business January 1 this year? Yes ( ) No ( ). If yes, list in the space provided below.

DETAILED DESCRIPTION OF ITEMS |

YEAR |

DATE |

ORIGINAL COST |

REASON |

IF EQUIPMENT SOLD, NAME AND ADDRESS OF |

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED) |

ACQUIRED |

DISPOSED |

NEW |

|

PURCHASER SHOULD BE LISTED BELOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|