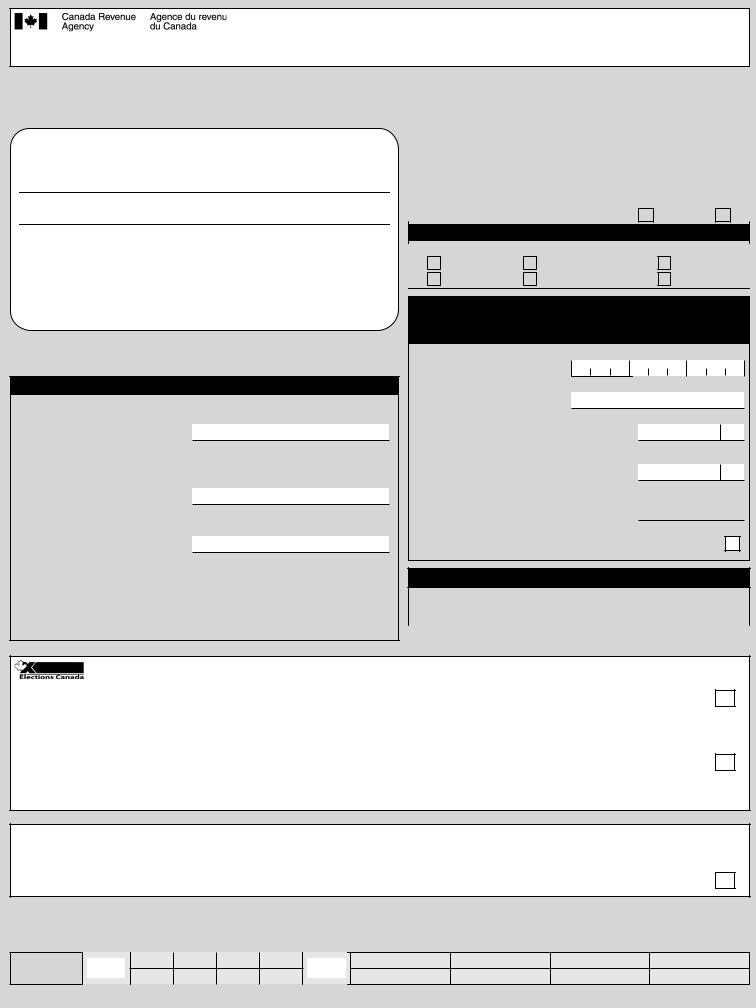

The Income Tax and Benefit Return form, identified as T1 GENERAL for the year 2008, is a comprehensive document designed to be filled out by taxpayers to report their annual income, claim tax deductions, credits, and benefits they are entitled to. This form requires individuals to provide detailed personal identification, including name, mailing address, province or territory of residence, and Social Insurance Number (SIN). It also inquires about specific life circumstances affecting tax calculations, such as marital status, information about a spouse or common-law partner, and residency details if one has become or ceased to be a resident of Canada within the reporting year. Additionally, it covers a broad spectrum of income sources—from employment income, self-employment income, pensions, benefits, and investments to other specific earnings. Taxpayers must report their total income and calculate net income by deducting eligible amounts, thereby determining the taxable income, which forms the basis for computing federal and provincial or territorial taxes owed. The form further allows citizens to manage their contributions to societal and electoral participation through sections for Elections Canada and the GST/HST credit application. Unique aspects such as the Universal Child Care Benefit, RRSP deductions, and credits for varying personal situations are presented for taxpayers to claim, aiming to ensure a fair and accurate reflection of their financial situation over the past year. This document serves not only as a means of reporting to the Canada Revenue Agency but also as a tool for Canadians to understand their tax responsibilities and benefits.

| Question | Answer |

|---|---|

| Form Name | Income Tax And Benefit Return Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | t1 general sample, t1 form, t1 general pdf, t1 general example |

T1 GENERAL 2008

Income Tax and Benefit Return

Complete all the sections that apply to you in order to benefit from amounts to which you are entitled.

Identification

Attach your personal label here. Correct any wrong information.

If you are not attaching a label, print your name and address below.

First name and initial

Last name

Mailing address: Apt No – Street No Street name

PO Box |

RR |

|

||||||

|

|

|

|

|

|

|||

City |

Prov./terr. Postal code |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information about your residence

Enter your province or territory of residence on December 31, 2008:

Enter the province or territory where you currently reside if it is not the same as that shown

above for your mailing address:

If you were

If you became or ceased to be a resident of Canada in 2008, give the date of:

|

Month Day |

|

|

Month Day |

||||||||

entry |

|

|

|

|

|

or |

departure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ON |

8 |

|

||

Information about you |

|

|

|

|

|

|

|

|||||||

Enter your social insurance number (SIN) |

|

|

|

|

|

|

|

|

|

|

|

|

||

if it is not on the label, or if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

you are not attaching a label: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Month Day |

||||||||||||

|

|

|

||||||||||||

Enter your date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your language of correspondence: |

|

English |

|

Français |

||||||||||

Votre langue de correspondance : |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tick the box that applies to your marital status on December 31, 2008:

(see the "Marital status" section in the guide for details)

1 |

|

Married |

2 |

|

Living |

3 |

|

Widowed |

4 |

|

Divorced |

5 |

|

Separated |

6 |

|

Single |

|

|

|

Information about your spouse or

(see the guide for more information)

Enter his or her SIN if it is not on the label, or if you are not attaching a label:

Enter his or her first name:

Enter his or her net income for 2008 to claim certain credits:

Enter the amount of Universal Child Care Benefit included

on line 117 of his or her return:

Enter the amount of Universal Child Care Benefit repayment included on line 213 of his or her return:

Tick this box if he or she was |

1 |

Person deceased in 2008

If this return is for a deceased |

|

|

Year |

|

Month Day |

|

|||||||

person, enter the date of death: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not use this area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elections Canada (see the Elections Canada page in the guide for details) |

|

|

|

|

A) |

Are you a Canadian citizen? |

Yes |

|

|

No |

|

1 |

||||

Answer the following question only if you are a Canadian citizen. |

|

|

|

|

|

B) |

As a Canadian citizen, do you authorize the Canada Revenue Agency to give your name, |

|

|

|

|

|

address, date of birth, and citizenship to Elections Canada for the National Register of Electors? |

Yes |

|

No |

|

|

|

1 |

|||

|

Your authorization is valid until you file your next return. This information will be used only by |

|

|

|

|

|

Elections Canada for purposes permitted under the Canada Elections Act. |

|

|

|

|

2

2

Goods and services tax/harmonized sales tax (GST/HST) credit application

See the guide for details.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Are you applying for the GST/HST credit? |

Yes |

|

1 No |

2

Do not use

this area

172

171

2

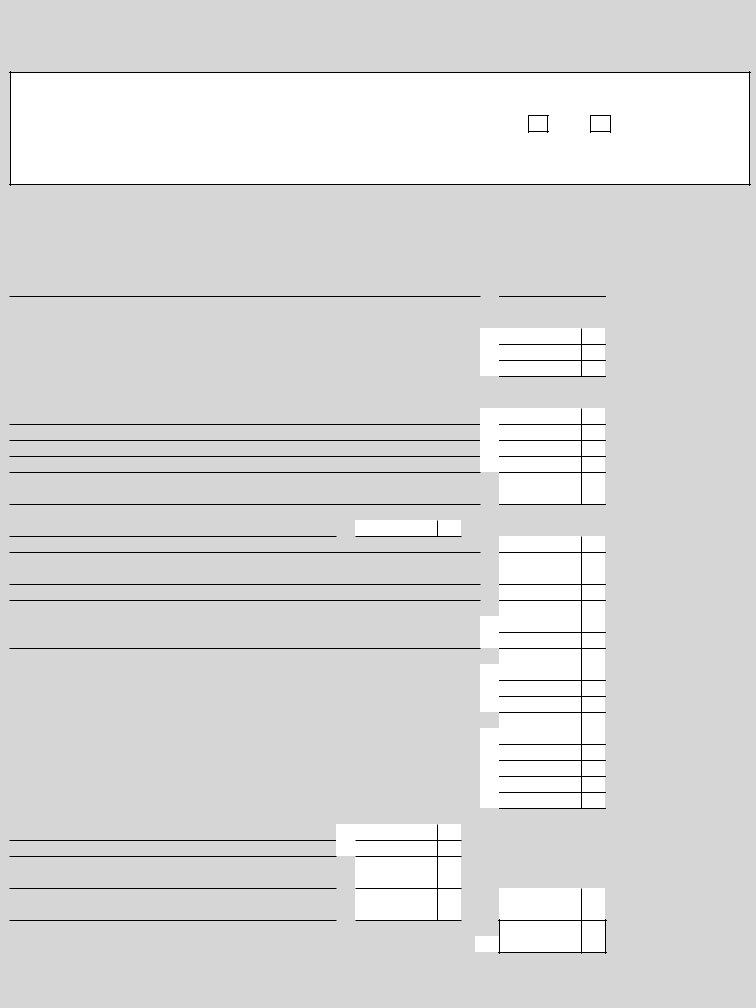

Your guide contains valuable information to help you complete your return.

When you come to a line on the return that applies to you, look up the line number in the guide for more information.

Please answer the following question:

Did you own or hold foreign property at any time in 2008 with a total cost of more than |

|

CAN$100,000? (see the "Foreign income" section in the guide for details) . . . . . . . . . . 266 Yes |

1 No |

If yes, attach a completed Form T1135.

2

If you had dealings with a

As a Canadian resident, you have to report your income from all sources both inside and outside Canada.

Total income

Employment income (box 14 on all T4 slips)

Commissions included on line 101 (box 42 on all T4 slips) |

|

102 |

|

|

|

Other employment income |

|

|

|

|

|

Old Age Security pension (box 18 on the T4A(OAS) slip) |

|

|

|

|

|

CPP or QPP benefits (box 20 on the T4A(P) slip) |

|

|

|

|

|

Disability benefits included on line 114 |

|

|

|

|

|

(box 16 on the T4A(P) slip) |

|

152 |

|

|

|

Other pensions or superannuation |

|

|

|

|

|

Elected

Universal Child Care Benefit (see the guide)

Employment Insurance and other benefits (box 14 on the T4E slip)

Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations (see the guide and attach Schedule 4)

Taxable amount of dividends other than eligible dividends, |

|

included on line 120, from taxable Canadian corporations |

180 |

101

104

113

114

115

116

117

119

120

Interest and other investment income (attach Schedule 4)

Net partnership income: limited or

Registered disability savings plan income (from all T4A information slips)

Rental income |

Gross |

160 |

|

|

Net |

|

|

|

|

|

|

Taxable capital gains (attach Schedule 3)

Support payments received |

Total |

156 |

|

|

Taxable amount |

||

RRSP income (from all T4RSP slips) |

|

|

|

||||

Other income |

Specify: |

|

|

|

|

|

|

|

|||||||

|

Business income |

|

Gross |

162 |

|

|

Net |

|

Professional income |

|

Gross |

164 |

|

|

Net |

|

Commission income |

|

Gross |

166 |

|

|

Net |

|

Farming income |

|

Gross |

168 |

|

|

Net |

|

Fishing income |

|

Gross |

170 |

|

|

Net |

|

|

|

|

|

|

|

|

121

122

125

126

127

128

129

130

135

137

139

141

143

Workers' compensation benefits (box 10 on the T5007 slip)

Social assistance payments

Net federal supplements (box 21 on the T4A(OAS) slip)

Add lines 144, 145, and 146 (see line 250 in the guide).

144

145

146

147

Add lines 101, 104 to 143, and 147.

This is your total income. 150

Attach your Schedule 1 (federal tax) and Form 428 (provincial or territorial tax) |

3 |

|

here. Also attach here any other schedules, information slips, forms, receipts, |

|

|

|

|

|

|

and documents that you need to include with your return. |

|

Net income

Enter your total income from line 150. |

150 |

||||

Pension adjustment |

|

|

|

|

|

(box 52 on all T4 slips and box 34 on all T4A slips) |

206 |

|

|

|

|

Registered pension plan deduction (box 20 on all T4 slips and box 32 on all T4A slips) |

207 |

|

|

|

|

|||||||

RRSP deduction (see Schedule 7 and attach receipts) |

|

208 |

|

|

|

|||||||

Saskatchewan Pension Plan deduction |

(maximum $600) |

209 |

|

|

|

|||||||

|

|

|

|

|

|

|

||||||

Deduction for elected |

210 |

|

|

|

||||||||

|

|

|

|

|

|

|||||||

Annual union, professional, or like dues (box 44 on all T4 slips, and receipts) |

212 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||

Universal Child Care Benefit repayment (box 12 on all RC62 slips) |

|

213 |

|

|

|

|||||||

Child care expenses (attach Form T778) |

|

214 |

|

|

|

|||||||

Disability supports deduction |

|

|

|

|

|

|

215 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Business investment loss |

Gross 228 |

|

|

|

Allowable deduction |

217 |

|

|

|

|||

|

|

|

|

|

|

|||||||

Moving expenses |

|

|

|

|

|

|

|

219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Support payments made |

|

Total 230 |

|

|

|

Allowable deduction |

220 |

|

|

|

||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Carrying charges and interest expenses (attach Schedule 4) |

|

221 |

|

|

|

|||||||

Deduction for CPP or QPP contributions on |

|

|

|

|

|

|||||||

(attach Schedule 8) |

|

|

|

|

|

|

|

222 |

|

|||

Exploration and development expenses (attach Form T1229) |

|

224 |

|

|

|

|||||||

Other employment expenses |

|

|

|

|

|

|

229 |

|

|

|

||

Clergy residence deduction |

|

|

|

|

|

|

231 |

|

|

|

||

Other deductions |

Specify: |

|

|

|

|

|

|

232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Add lines 207 to 224, 229, 231, and 232. |

233 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 150 minus line 233 (if negative, enter "0"). This is your net income before adjustments. 234 |

||||||||||||

Social benefits repayment (if you reported income on line 113, 119, or 146, see line 235 in the guide) |

|

|

||||||||||

Use the federal worksheet to calculate your repayment. |

|

|

|

|

235 |

|||||||

Line 234 minus line 235 (if negative, enter "0"). If you have a spouse or

|

|

|

This is your net income. 236 |

||||||||

Taxable income |

|

|

|

|

|

|

|

|

|

|

|

Canadian Forces personnel and police deduction (box 43 on all T4 slips) |

|

244 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||

Employee home relocation loan deduction (box 37 on all T4 slips) |

|

248 |

|

|

|

|

|

||||

Security options deductions |

|

|

249 |

|

|

|

|

|

|||

Other payments deduction |

|

|

|

|

|

|

|

|

|

|

|

(if you reported income on line 147, see line 250 in the guide) |

|

250 |

|

|

|

|

|

||||

Limited partnership losses of other years |

|

251 |

|

|

|

|

|

||||

|

|

|

252 |

|

|

|

|

|

|||

Net capital losses of other years |

|

|

|

253 |

|

|

|

|

|

||

Capital gains deduction |

|

|

|

254 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

Northern residents deductions (attach Form T2222) |

|

255 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Additional deductions |

Specify: |

|

|

256 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

Add lines 244 to 256. 257 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 236 minus line 257 (if negative, enter "0") |

|

|

|

|

|||||

|

|

|

This is your taxable income. |

260 |

|

||||||

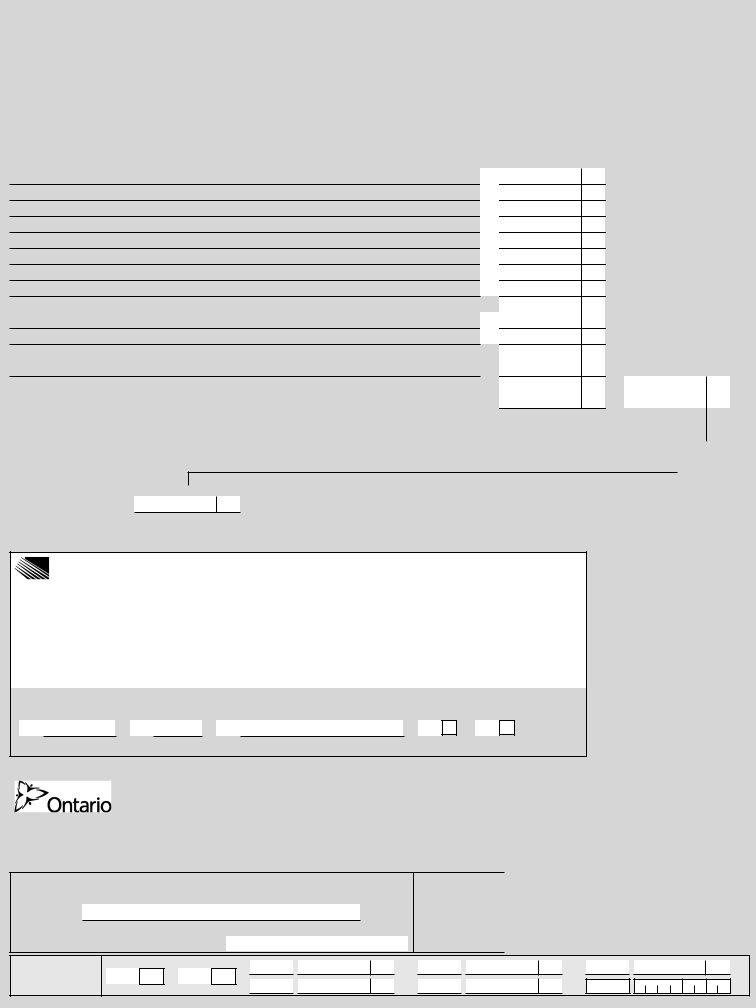

Use your taxable income to calculate your federal tax on Schedule 1 and your provincial or territorial tax on Form 428.

Refund or Balance owing

Net federal tax: enter the amount from line 53 of Schedule 1 (attach Schedule 1, even if the result is "0") |

420 |

|

|

|

CPP contributions payable on |

421 |

|

||

Social benefits repayment (enter the amount from line 235) |

422 |

|

||

|

|

|

|

|

Provincial or territorial tax (attach Form 428, even if the result is "0") |

|

428 |

|

|

Add lines 420 to 428. |

|

|

|

|

This is your total payable. |

|

435 |

|

|

4

Total income tax deducted (see the guide)

Refundable Quebec abatement

CPP overpayment (enter your excess contributions)

Employment Insurance overpayment (enter your excess contributions)

Refundable medical expense supplement (use federal worksheet)

Working Income Tax Benefit (WITB) (attach Schedule 6)

Refund of investment tax credit (attach Form T2038(IND))

Part XII.2 trust tax credit (box 38 on all T3 slips)

Employee and partner GST/HST rebate (attach Form GST370)

Tax paid by instalments

Provincial or territorial credits (attach Form 479 if it applies)

Add lines 437 to 479.

These are your total credits.

437

440

448

450

452

453

454

456

457

476

479

482

Refund 484

|

|

|

|

Line 435 minus line 482 |

|

|

||||

If the result is negative, you have a refund. If the result is positive, you have a balance owing. |

|

|||||||||

|

|

|

Enter the amount below on whichever line applies. |

|

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

|

Generally, we do not charge or refund a difference of $2 or less. |

|

|

|

|

|||||

|

Balance owing (see line 485 in the guide) |

|

|

|

||||||

|

485 |

|||||||||

|

|

|

|

|||||||

|

|

|

|

Amount enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

486 |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Direct deposit – Start or change (see line 484 in the guide)

You do not have to complete this area every year. Do not complete it this year if your direct deposit information has not changed.

Refund, GST/HST credit, and WITB advance payments – To start direct deposit or to change account information only, attach a "void" cheque or complete lines 460, 461, and 462.

Notes: To deposit your CCTB payments (including certain related provincial or territorial payments) into the same account, also tick box 463.

To deposit your UCCB payments into the same account, also tick box 491.

Branch |

Institution |

|

|

|

number |

number |

Account number |

CCTB |

UCCB |

460 |

461 |

462 |

463 |

491 |

(5 digits) |

|

(3 digits) |

(maximum 12 digits) |

|

Attach to page 1 a cheque or money order payable to the Receiver General. Your payment is due no later than April 30, 2009.

|

Ontario Opportunities Fund |

|

Amount from line 484 above |

|

|

|

|

1 |

|

|

|

|

|

|

|||

You can help reduce Ontario's debt by completing this area to |

|

Your donation to the |

|

|

|

|

|

|

|

Ontario Opportunities Fund |

465 |

|

2 |

||||

donate some or all of your 2008 refund to the Ontario |

|

|

||||||

|

Net refund (line 1 minus line 2) |

466 |

|

3 |

||||

Opportunities Fund. Please see the provincial pages for details. |

|

|

||||||

|

|

|

|

|

|

|

|

|

I certify that the information given on this return and in any documents attached is correct, complete, and fully discloses all my income.

Sign here

It is a serious offence to make a false return.

Telephone |

|

Date |

490 |

For |

Name: |

|

|

|

Address: |

|

|

|

professional |

|

|

||

|

|

|

||

tax preparers |

|

|

|

|

|

|

|

||

|

only |

|

|

|

|

|

Telephone: |

||

Do not use

this area

487 |

488 |

Privacy Act Personal Information Bank number