If you're a business owner, you may be familiar with the Ph Rf 1 Form. This form is utilized to formally register businesses in the Philippines and allow them to legally operate within the country’s regulations. By completing this document, a business can gain legal recognition so that they have access to important resources like loans and contracts, as well as economic rights such as taxation requirements and employee benefits. Understanding what a Ph Rf 1 Form is and how it should be filled out can be key for creating financial stability and success in your venture. In this blog post we'll provide an overview of what a Ph RF1 Form is, when it should be used, its importance for establishing credibility with lenders or vendors, plus step-by-step instruction on how to complete the form correctly.

| Question | Answer |

|---|---|

| Form Name | Ph Rf 1 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | downloadable blank philhealth id template, rf1 excel format, rf1, philhealth id editor |

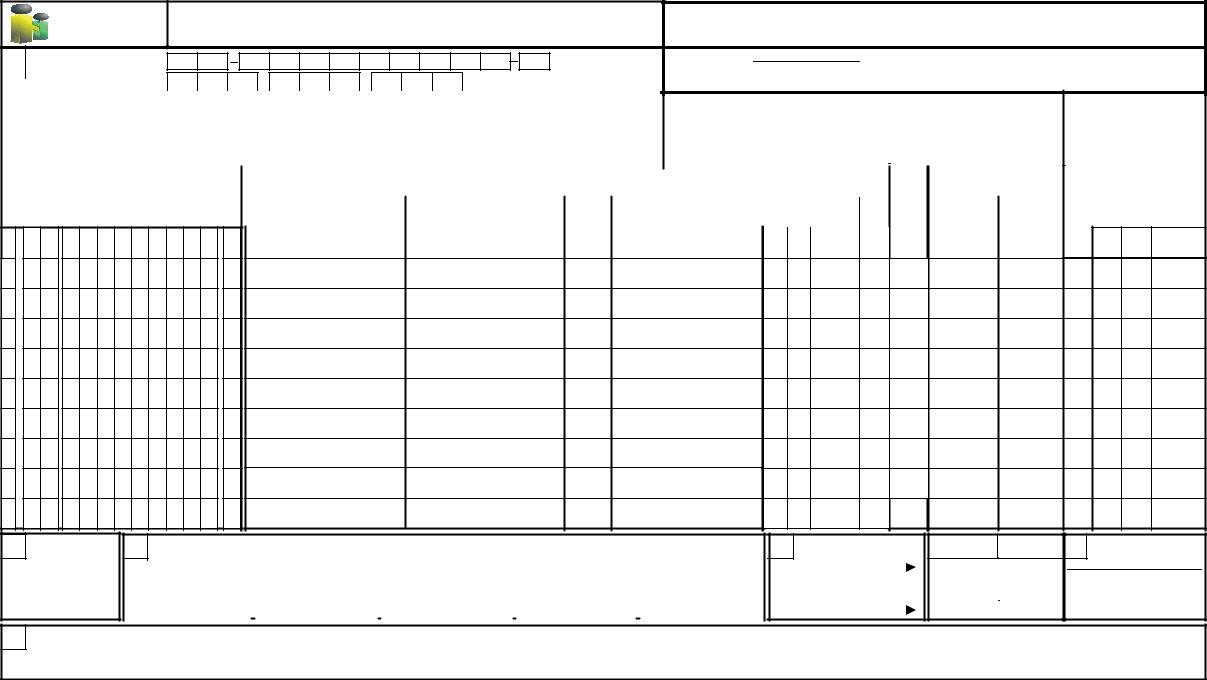

This form may be reproduced and is NOT FOR SALE

|

Republic of the Philippines |

|

|

|

|

PHILIPPINE HEALTH INSURANCE CORPORATION |

EMPLOYER’S REMITTANCE REPORT |

FOR PHILHEALTH USE |

|

|

actioncenter@philhealth.gov.ph |

|||

|

|

Healthline 441 7444 www.philhealth.gov.ph |

|

|

|

Revised February 2014 |

|

|

|

1 |

PHILHEALTH NO. |

|

Date Received: |

Action Taken: |

|

|

|

By:

|

EMPLOYER TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature Over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER TYPE |

|

|

|

|

|

|

REPORT TYPE |

|

|

|

|

|

|

|

|||||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

4 |

|

|

|

|

|

|

|

5 |

|

APPLICABLE |

|

||||||||||

COMPLETE EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIVATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

COMPLETE MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGULAR |

|

|

|

|

|

PERIOD |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOVERNMENT |

|

|

|

|

|

|

|

ADDITION TO PREVIOUS |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

TELEPHONE NO. |

|

, EMAIL ADDRESS |

|

|

|

|

|

|

|

|

HOUSEHOLD |

|

|

|

|

|

|

|

DEDUCTION TO PREVIOUS |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N H I P PREM I U M |

11 |

|

|

|

|

||||

6 |

|

|

|

7 |

|

|

|

|

EMPLOYEE/S INFORMATION |

|

|

|

|

|

|

|

|

8 |

declared employee/s has not |

9 |

|

|

10 |

|

|

EM PLOYEE ST AT U S |

|

||||||||||||||

PHILHEALTH IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CO N TRI BU TI ON |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

yet been issued his/her PIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(PIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTHLY |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME EXT. |

|

|

|

|

|

|

|

|

DATE OF BIRTH |

SEX |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

LAST NAME |

|

|

|

FIRST NAME |

MIDDLE NAME |

|

|

SALARY |

|

|

|

|

PS |

ES |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

(Sr./Jr.) |

|

|

|

(M/F) |

BRACKET |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MSB) |

|

|

|

|

|

|

|

|

|

Effectivity Date |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

12 |

13 |

ACKNOWLEDGEMENT RECEIPT (PAR/POR/TRANSACTION REFERENCE NO.) |

14 |

SUBTOTAL |

(PS + ES) |

15 |

PREPARED BY: |

|

|

|

|

APPLICABLE PERIOD |

REMITTED AMOUNT |

ACKNOWLEDGEMENT |

TRANSACTION DATE |

NO. OF EMPLOYEES |

|

(To be accomplished on every page) |

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

RECEIPT NO. |

|

|

|

|

|

|

|

|

|

||||||

Indicate Total Number of |

|

|

|

|

|

|

GRAND TOTAL (PS + ES) |

|

|

|

|

|

|

|

||||

employees per page |

|

|

|

|

|

|

|

|

|

|

OFFICIAL DESIGNATION |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(To be accomplished on every page) |

|

|

|

|

|

|

|

D A T E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16

UNDER THE PENALTY OF THE LAW, I HEREBY ATTEST THAT THE ABOVE INFORMATION PROVIDED HEREIN ARE TRUE AND CORRECT. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature over printed name |

|

Official Designation |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PLEASE READ INSTRUCTIONS ( FOR EACH NUMBERED BOX) AT THE BACK BEFORE ACCOMPLISHING THIS FORM |

17 |

PAGE |

|

OF |

|

PAGE/S |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS

Note: Instructions for each numbered box are enumerated below:

Write the complete PHILHEALTH NUMBER and EMPLOYER TIN in the corresponding boxes. “ If without PEN, employers may register with the Philippine Business BOX 1 Registry (PBR) and the Corporation shall no longer require submission of documents. However, should the employer be unable to register through the PBR, it shall

be required to attach a duly accomplished ER1 form and any of the following documents, whichever is applicable: a. For single proprietorships – Department of Trade and Industry (DTI) registration;

b. For partnerships and corporations – Securities and Exchange Commission (SEC) registration; c. For foundations and other non‐profit organizations – SEC registration;

d. For cooperatives – Cooperative Development Authority (CDA) registration;

e. For backyard industries/ventures and micro‐business enterprises – Barangay Certification and/or Mayor‟s Permit.

BOX 2 Write the COMPLETE Employer Name, Mailing Address , Telephone Number and Email Address ( DO NOT ABBREVIATE).

BOX 3 Check applicable box for the EMPLOYER TYPE.

BOX 4 |

Check the applicable box for the REPORT TYPE. For adjustment on remittance report on previous month, use a separate RF‐1 form and check the box |

|

corresponding to “Addition to Previous RF‐1” or “Deduction to Previous RF‐1”, whichever is applicable. Write only the names of the employees with erroneous |

|

contributions and the difference between the correct amount and the amount that was previously reported. If an underpayment results due to correction, please |

|

remit the amount due to PhilHealth. Use separate/different sets of RF‐1 form for each month when reporting previous payments or late payments made on |

|

previous month(s). |

BOX 5 |

Always indicate the applicable month and year of premium contributions paid. The month and year coverage in the RF‐1 should correspond with the month and |

|

year coverage indicated in the PAR/POR/Transaction Reference Number. |

BOX 6 Indicate the corresponding PHILHEALTH IDENTIFICATION NUMBER (PIN) opposite the respective names of your employees. For initial registration or updating of member data record and/or declaration of dependents, require the employee/s to properly accomplish the PhilHealth Member Registration Form (PMRF). The employer shall be required to submit the same together with the Employment Report Form (ER2) duly signed by the employer to facilitate registration and

|

updating of the membership data record of such employee/s. |

|

BOX 7 |

Print names of Employees in alphabetical order. Write the complete name of each employee by providing the Last Name, First Name, Name Extension (Sr., Jr., |

|

|

or II, III, if there be any) and Middle Name (Leave Blank for employee without Middle Name). Do not skip lines when listing down their names. Write “NOTHING |

|

|

FOLLOWS” on the line immediately following the last listed employee. |

|

BOX 8 |

In case that the employee/s listed in the submitted RF‐1 has not yet been issued his/her permanent PIN, indicate his/her DATE OF BIRTH and SEX in the column |

|

provided to facilitate the immediate assignment and generation of PIN. Otherwise, leave the column blank and ensure that the PIN/s in box no. 6 is/are correctly |

||

|

||

|

indicated. |

|

BOX 9 |

Indicate the employees’ respective MONTHLY SALARY BRACKET (MSB) corresponding to the MONTHLY SALARY RANGE where the employee’s monthly salary |

|

|

falls. Please refer to the NHIP MONTHLY PREMIUM CONTRIBUTION SCHEDULE on the right for your reference. Corresponding MSB not filled‐out shall mean that |

|

|

such employee’s compensation for the particular period shall belong to the highest bracket. |

BOX 10 Indicate the corresponding PERSONAL SHARE (PS) and EMPLOYER SHARE (ES) on the boxes provided for each remittance. The Total Premium Contribution (PS +

|

ES) for the month must fall within the prescribed bracket. |

BOX 11 |

In the “EMPLOYEE STATUS” column indicate the letter – “S” if the employee is Separated, “NE” if with No Earnings and “NH” if employee is Newly Hired. |

|

Supply the Date of effectivity in the column provided. |

BOX 12 |

Indicate total number of employee/s listed in the submitted RF‐1. Ensure that the total number of employees’ listed in box no. 7 shall correspond to the |

|

number of employees in box no. 12. |

BOX 13 |

Supply needed information on the “ACKNOWLEDGEMENT RECEIPT (PAR/POR/Transaction Reference Number)” boxes. Indicate in the corresponding box the |

|

“Applicable Period”, “Remitted Amount”, “Acknowledgement Receipt Number”, “Transaction Date” and “Number of Employees”. |

BOX 14 |

Add all contribution in the PERSONAL SHARE (PS) column and EMPLOYER SHARE (ES) column for the applicable month and reflect the sum in the “SUBTOTAL” box |

|

for each page, if more than one (1) page, thereafter, add all subtotals/page totals and reflect the sum in the “GRAND TOTAL” box in the last sheet of the |

|

accomplished RF‐1 to indicate total amount of contributions paid for the said applicable month. |

BOX 15 |

Affix signature over complete printed name of the authorized officer preparing the report, his/her official designation and date. |

BOX 16 |

Affix signature over complete printed name of the authorized officer certifying the report, his/her designation and date. |

BOX 17 |

Always indicate correct page number and the total number of pages for each form. |

NHIP MONTHLY PREMIUM CONTRIBUTION SCHEDULE FOR 2014

MSB |

Monthly Salary Range |

Salary Base |

(SB) |

Total Monthly |

Personal Share |

Employer Share |

|

Contribution |

(PS) |

(ES) |

|||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

1 |

8,999.99 and below |

8,000.00 |

|

200.00 |

100.00 |

100.00 |

|

|

|

|

|

|

|

|

|

2 |

9,000.00 to 9,999.99 |

9,000.00 |

|

225.00 |

112.50 |

112.50 |

|

|

|

|

|

|

|

|

|

3 |

10,000.00 to 10,999.99 |

10,000.00 |

|

250.00 |

125.00 |

125.00 |

|

|

|

|

|

|

|

|

|

4 |

11,000.00 to 11,999.99 |

11,000.00 |

|

275.00 |

137.50 |

137.50 |

|

|

|

|

|

|

|

|

|

5 |

12,000.00 to 12,999.99 |

12,000.00 |

|

300.00 |

150.00 |

150.00 |

|

|

|

|

|

|

|

|

|

6 |

13,000.00 to 13,999.99 |

13,000.00 |

|

325.00 |

162.50 |

162.50 |

|

|

|

|

|

|

|

|

|

7 |

14,000.00 to 14,999.99 |

14,000.00 |

|

350.00 |

175.00 |

175.00 |

|

|

|

|

|

|

|

|

|

8 |

15,000.00 to 15,999.99 |

15,000.00 |

|

375.00 |

187.50 |

187.50 |

|

|

|

|

|

|

|

|

|

9 |

16,000.00 to 16,999.99 |

16,000.00 |

|

400.00 |

200.00 |

200.00 |

|

|

|

|

|

|

|

|

|

10 |

17,000.00 to 17,999.99 |

17,000.00 |

|

425.00 |

212.50 |

212.50 |

|

|

|

|

|

|

|

|

|

11 |

18,000.00 to 18,999.99 |

18,000.00 |

|

450.00 |

225.00 |

225.00 |

|

|

|

|

|

|

|

|

|

12 |

19,000.00 to 19,999.99 |

19,000.00 |

|

475.00 |

237.50 |

237.50 |

|

|

|

|

|

|

|

|

|

13 |

20,000.00 to 20,999.99 |

20,000.00 |

|

500.00 |

250.00 |

250.00 |

|

|

|

|

|

|

|

|

|

14 |

21,000.00 to 21,999.99 |

21,000.00 |

|

525.00 |

262.50 |

262.50 |

|

|

|

|

|

|

|

|

|

15 |

22,000.00 to 22,999.99 |

22,000.00 |

|

550.00 |

275.00 |

275.00 |

|

|

|

|

|

|

|

|

|

16 |

23,000.00 to 23,999.99 |

23,000.00 |

|

575.00 |

287.50 |

287.50 |

|

|

|

|

|

|

|

|

|

17 |

24,000.00 to 24,999.99 |

24,000.00 |

|

600.00 |

300.00 |

300.00 |

|

|

|

|

|

|

|

|

|

18 |

25,000.00 to 25,999.99 |

25,000.00 |

|

625.00 |

312.50 |

312.50 |

|

|

|

|

|

|

|

|

|

19 |

26,000.00 to 26,999.99 |

26,000.00 |

|

650.00 |

325.00 |

325.00 |

|

|

|

|

|

|

|

|

|

20 |

27,000.00 to 27,999.99 |

27,000.00 |

|

675.00 |

337.50 |

337.50 |

|

|

|

|

|

|

|

|

|

21 |

28,000.00 to 28,999.99 |

28,000.00 |

|

700.00 |

350.00 |

350.00 |

|

|

|

|

|

|

|

|

|

22 |

29,000.00 to 29,999.99 |

29,000.00 |

|

725.00 |

362.50 |

362.50 |

|

|

|

|

|

|

|

|

|

23 |

30,000.00 To 30,999.99 |

30,000.00 |

|

750.00 |

375.00 |

375.00 |

|

|

|

|

|

|

|

|

|

24 |

31,000.00 to 31,999.99 |

31,000.00 |

|

775.00 |

381.50 |

381.50 |

|

|

|

|

|

|

|

|

|

25 |

32,000.00 to 32,999.99 |

32,000.00 |

|

800.00 |

400.00 |

400.00 |

|

|

|

|

|

|

|

|

|

26 |

33,000.00 to 33,999.99 |

33,000.00 |

|

825.00 |

412.50 |

412.50 |

|

|

|

|

|

|

|

|

|

27 |

34,000.00 to 34,999.99 |

34,000.00 |

|

850.00 |

425.00 |

425.00 |

|

|

|

|

|

|

|

|

|

28 |

35,000.00 and up |

35,000.00 |

|

875.00 |

437.50 |

437.50 |

|

|

|

|

|

|

|

|

COPY DISTRIBUTION

Form |

No. of Copies |

1st |

2nd |

3rd |

4th |

|

RF‐1 |

2 |

PHIC |

PAYOR |

X |

X |

|

PAYOR |

COLLECTING AGENT’S |

PHIC |

PHIC |

|||

PAR |

4 |

|||||

|

|

COPY |

|

|

||

|

|

|

|

|

REMINDERS:

Submit original copy of this duly accomplished form with the corresponding copies of the validated PAR/POR/Transaction Reference Number to the Collection Section/Unit of the respective PhilHealth Regional or Local Health Insurance Office within five (5) days after payment. The schedule for the payment of contributions is on the 11th to 15th day for employers with PENs ending in 0‐4; and 16th to 20th day for employers with PENs ending in 5‐9 following the applicable month. As provided for under Section 18, Rule III, Title III of the Implementing Rules and Regulations (IRR) of National Health Insurance Act of 2013, the failure of the employer to remit the required contribution and to submit the required remittance list shall make the employer liable for reimbursement of payment of a properly filed claim in case the concerned employee or dependent/s avails of Program benefits, without prejudice to the imposition of other penalties.

THIS FORM MAY BE REPRODUCED AND IS NOT FOR SALE