You are able to fill out city tax phoenix easily using our online PDF editor. To retain our tool on the forefront of practicality, we strive to put into action user-oriented capabilities and enhancements regularly. We're routinely glad to receive feedback - join us in remolding how we work with PDF forms. Should you be seeking to begin, this is what it requires:

Step 1: Simply click the "Get Form Button" above on this webpage to get into our pdf file editing tool. There you'll find everything that is required to work with your file.

Step 2: Using our state-of-the-art PDF editor, it's possible to do more than just fill in forms. Edit away and make your documents seem faultless with customized textual content incorporated, or tweak the original input to perfection - all supported by the capability to add stunning photos and sign the PDF off.

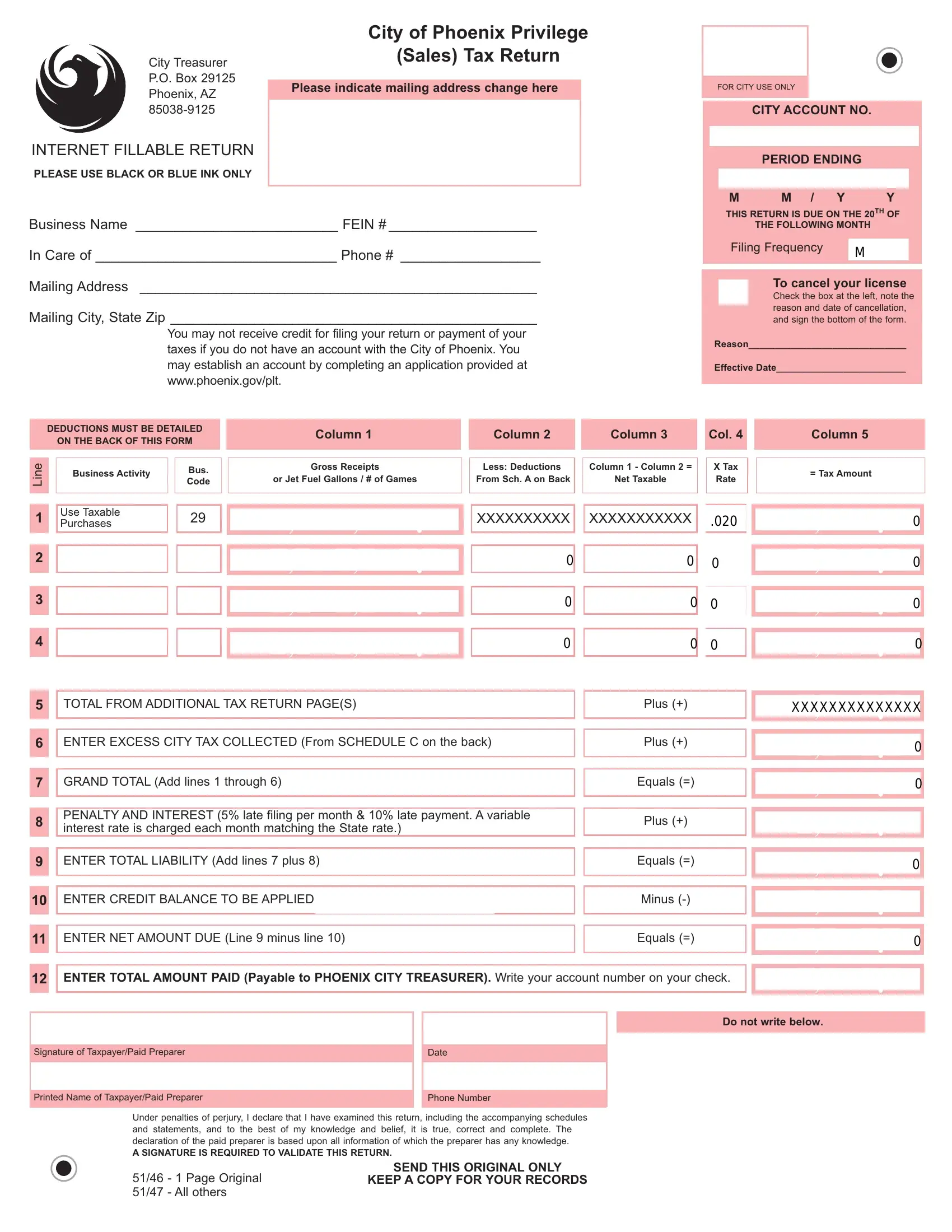

This form will need specific info to be filled out, so make sure to take some time to provide exactly what is required:

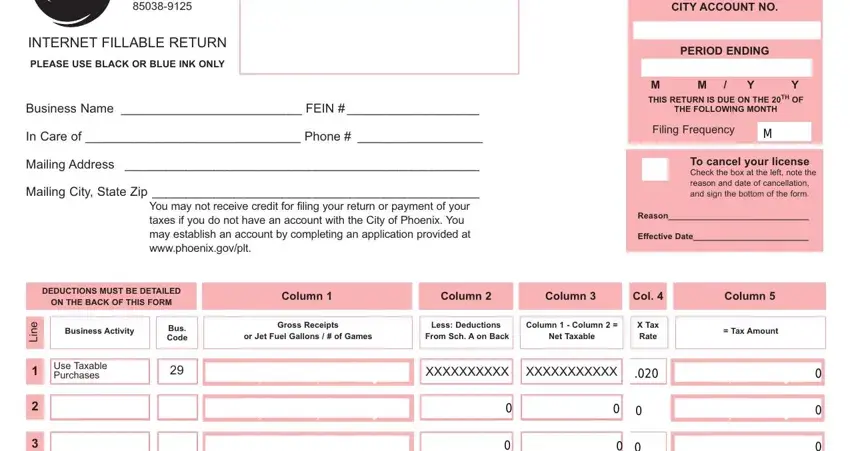

1. It's vital to complete the city tax phoenix correctly, therefore be careful while filling out the sections including these specific blank fields:

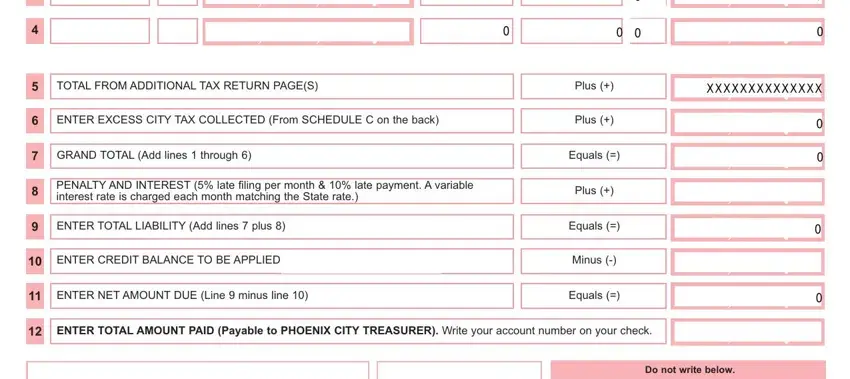

2. After the first section is done, go on to type in the applicable information in all these: TOTAL FROM ADDITIONAL TAX RETURN, ENTER EXCESS CITY TAX COLLECTED, GRAND TOTAL Add lines through, PENALTY AND INTEREST late filing, ENTER TOTAL LIABILITY Add lines, ENTER CREDIT BALANCE TO BE, ENTER NET AMOUNT DUE Line minus, Plus, Plus, Equals, Plus, Equals, Minus, Equals, and ENTER TOTAL AMOUNT PAID Payable.

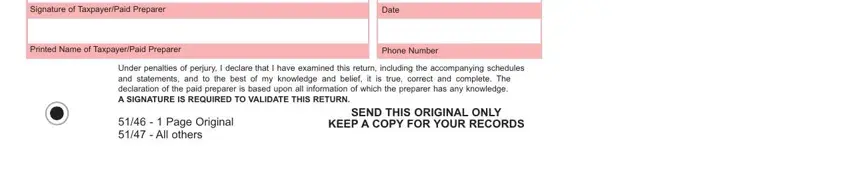

3. Within this part, look at Signature of TaxpayerPaid Preparer, Date, Printed Name of TaxpayerPaid, Phone Number, Under penalties of perjury I, Page Original All others, SEND THIS ORIGINAL ONLY, and KEEP A COPY FOR YOUR RECORDS. Every one of these will need to be filled out with highest precision.

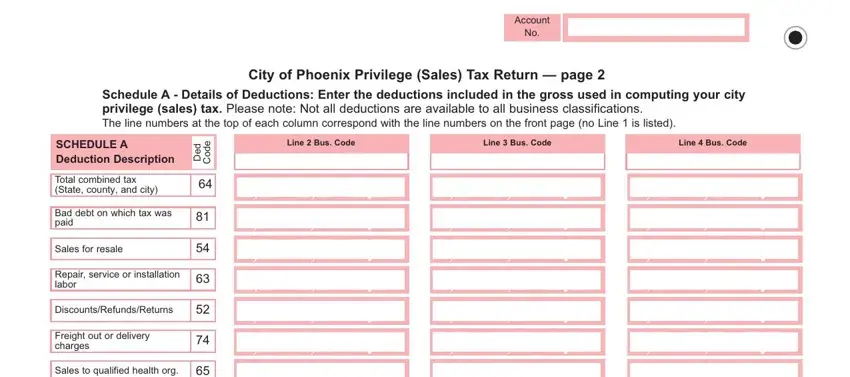

4. This specific part arrives with these form blanks to complete: Account, City of Phoenix Privilege Sales, Schedule A Details of Deductions, Line Bus Code, Line Bus Code, Line Bus Code, SCHEDULE A Deduction Description, Total combined tax State county, Bad debt on which tax was paid, Sales for resale, Repair service or installation, DiscountsRefundsReturns, Freight out or delivery charges, Sales to qualified health org, and d e D.

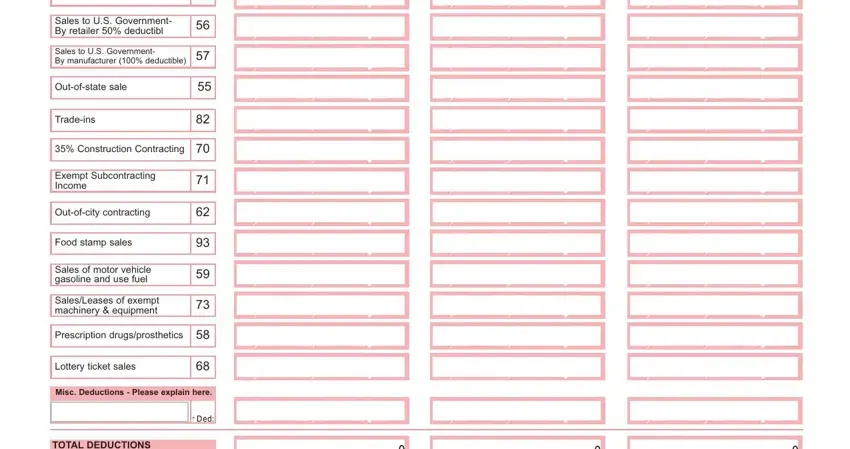

5. To conclude your form, the final part includes a few additional fields. Filling in Sales to US Government By retailer, Sales to US Government By, Outofstate sale, Tradeins, Construction Contracting, Exempt Subcontracting Income, Outofcity contracting, Food stamp sales, Sales of motor vehicle gasoline, SalesLeases of exempt machinery, Prescription drugsprosthetics, Lottery ticket sales, Misc Deductions Please explain, and TOTAL DEDUCTIONS Copy to Front will certainly wrap up the process and you will be done very fast!

A lot of people frequently make errors when completing Sales of motor vehicle gasoline in this area. You should definitely review everything you enter here.

Step 3: Right after you have reviewed the information in the file's blank fields, press "Done" to finalize your form. Sign up with us today and easily gain access to city tax phoenix, all set for downloading. Every last edit you make is handily preserved , enabling you to customize the form later as required. When using FormsPal, you can complete forms without stressing about personal information breaches or records getting distributed. Our protected platform makes sure that your private information is stored safe.