Are you a business owner looking to fill out and submit the Pit 110 form? If so, understanding how to properly use this form is critical for filing your taxes accurately. It pays to understand what this form requires and its different sections – because it can be quite complicated! In this blog post, we'll take an in-depth look at the information needed for this documentation including which boxes need to be completed, when it's due, potential penalties if not submitted correctly, as well as any helpful tips from professionals in the industry when filling out and submitting paperwork. Read on to make sure that you have all of the necessary info before moving forward with the Pit 110 form.

| Question | Answer |

|---|---|

| Form Name | Pit 110 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | new mexico form pit 110, pit 110, nm pit 110, 110 8453 form |

Rev. 07/20/2019 |

State of New Mexico - Taxation and Revenue Department |

|

|

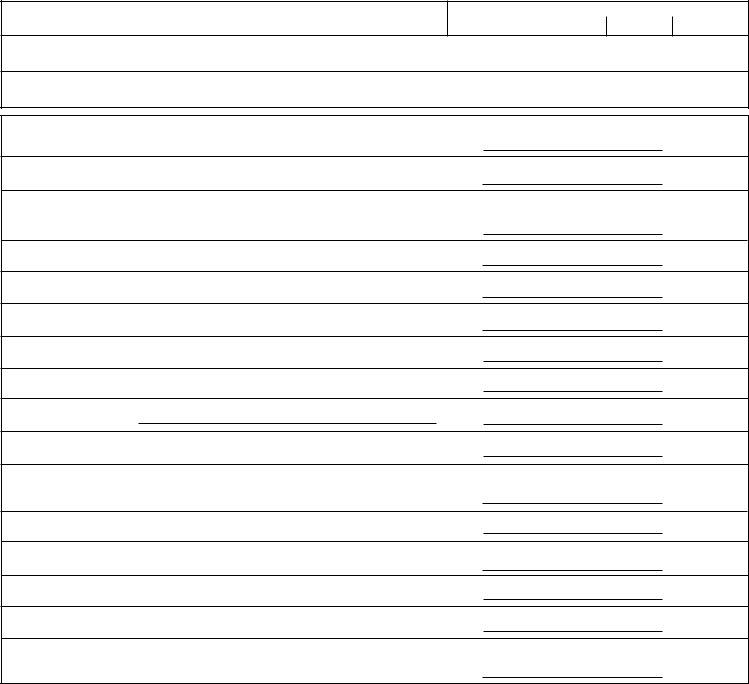

Form

assignment outside of New Mexico. Form

PERSONAL INFORMATION

Name:

Address:

City, State, ZIP Code:

Social Security Number:

1.How many days were you under a different supervisory and control authority outside New Mexico?

2.Total working days during taxable year

3.Percentage of time worked outside New Mexico

(line 1 divided by line 2)

4.Annual leave earned during taxable year

5.Sick leave earned during taxable year

6.Holiday leave earned during taxable year

7.Administrative leave used during taxable year

8.Jury duty leave used during taxable year

9.Other (Specify)

10.Total leave earned or used during taxable year (add lines 4 through 9)

11.Leave earned on days worked outside New Mexico (line 10 times line 3)

12.Total days outside New Mexico (line 11 plus line 1)

13. |

Total wages earned (box 1 of Form |

$ |

14. |

Rate per day (line 13 divided by line 2) |

$ |

15. |

Income earned outside New Mexico (line 14 times line 12) |

$ |

days

days

%

days

days

days

days

days

days

days

days

days

16.New Mexico Income (line 13 minus line 15)

(Enter this amount in column 2, line 1,

NOTE: If more than one

THIS FORM MUST BE SUBMITTED TO THE DEPARTMENT WITH YOUR RETURN. IF YOU

Rev. 07/20/2019

INSTRUCTIONS

Line 1 |

Enter total number of days worked outside New Mexico. |

|

For example: If you have been assigned to temporary duty outside New Mexico where |

|

supervision and control of your duties have also been temporarily transferred to a different |

|

authority for work to be performed outside New Mexico, then these days are counted as days |

|

outside New Mexico. If you are attending a training session outside New Mexico, these days |

|

are not days outside New Mexico because supervision and control of your duties still remain |

|

with your employer in New Mexico. |

Line 2 |

Enter total working days during taxable year. |

|

For example: If you work a normal |

|

or if you work four days a week, enter 208 days (4 days x 52 weeks). |

Line 3 |

Divide number of days worked outside New Mexico (line 1) by the number of total working |

|

days (line 2). Enter this percentage on line 3. This calculates the percentage of days worked |

|

outside New Mexico. |

Lines 4 - 6 |

Compute the number of days earned for each type of leave. |

|

Note: Use the number of days of leave earned, not taken. |

Lines 7 - 9 |

Enter total number of days (used for administrative leave, jury duty leave, bereavement leave, |

|

and other leave days). |

Line 10 |

Add lines 4 through 9 and enter total. |

Line 11 |

Multiply the number of days entered on line 10 by the percentage calculated on line 3. Enter |

|

the result as a whole number. |

Line 12 |

Total days outside New Mexico (add lines 1 and 11) and enter total. |

Line 13 |

Enter the total wages earned, box 1 of |

Line 14 |

Figure your rate of pay per day (line 13 divided by line 2) and enter amount. |

Line 15 |

Multiply the rate per day (calculated on line 14) by total days outside New Mexico (cal- |

|

culated on line 12) to determine the wage amount that is not taxable in New Mexico. |

Line 16 |

Subtract the amount calculated on line 15 from the amount entered on line 13 to com- |

|

pute New Mexico Income. Enter the amount on the |

If more than one

Also, mark checkbox on line 1a on the

THIS FORM MUST BE SUBMITTED TO THE DEPARTMENT WITH YOUR RETURN. IF YOU

New Mexico Taxation and Revenue Department

Administrative Resolutions Services Bureau

P. O. Box 25122

Santa Fe, New Mexico