In navigating the complexities of individual income tax returns, the Government of Puerto Rico provides a detailed yet comprehensive framework through its Form 482.0, revised in February 2019. Designed to cater to a wide range of circumstances, this form encapsulates the financial details for the 2018 calendar year or any taxable year beginning within that period, including provisions for amended returns and specifications for taxpayers who have experienced the death of a spouse. It carefully outlines the information required from both the taxpayer and spouse, if applicable, covering personal data, income sources, filing status, and specifications related to residency in Puerto Rico. Moreover, it goes beyond to address various income types and deductibles, extending to government contracts, residency specifics, and detailed sections for computing taxes owed or refunds due, including options for direct deposit. Accommodating particular scenarios like military service in combat zones, the form also offers a nuanced approach to deductions with specific schedules for varied income types and potential contributions, facilitating a precise yet user-friendly process for determining tax liabilities or refunds. Its elaborate structure aims to streamline the tax filing process while ensuring accuracy and compliance, reflecting a tailored approach to the diverse financial landscapes of Puerto Rico's residents.

| Question | Answer |

|---|---|

| Form Name | Pr 482 Form |

| Form Length | 49 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 12 min 15 sec |

| Other names | tax return form 482, formulario 482, form 482 puerto rico 2020, puerto rico tax return form 482 pdf |

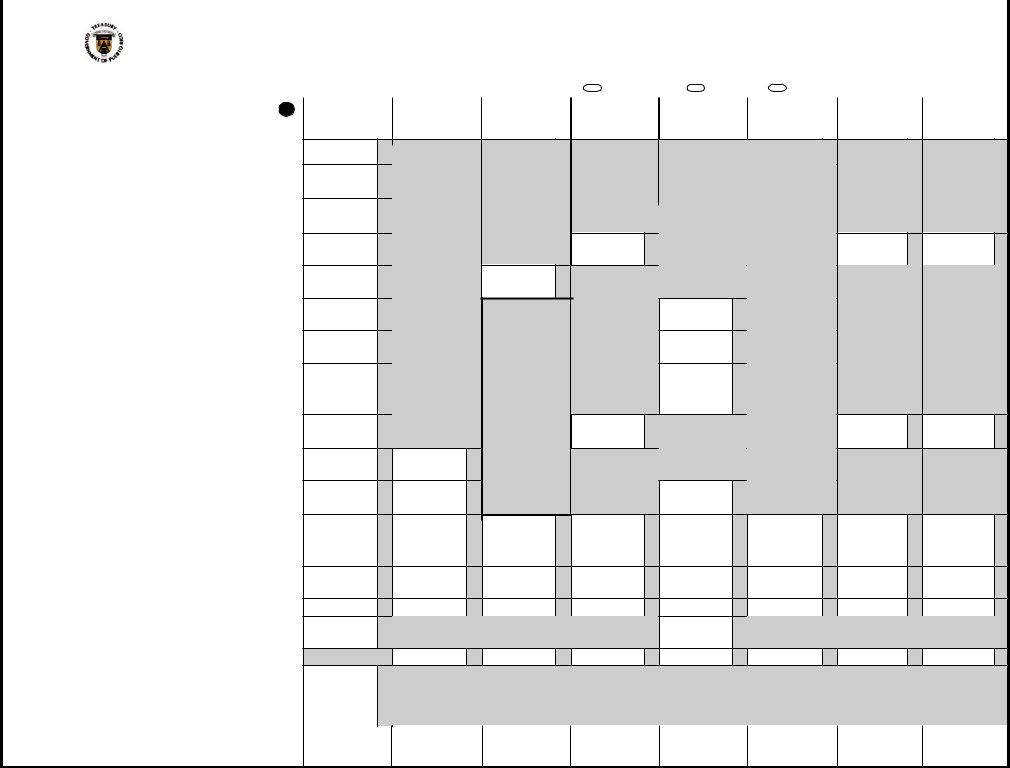

Form 482.0 Rev. Feb 20 19

|

|

|

Liquidator |

|

Reviewer |

|

GOVERNMENT OF PUERTO RICO |

|

|

|

|

Serial Number |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

DEPARTMENT OF THE TREASURY |

2018 |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL INCOME TAX RETURN |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR CALENDAR YEAR 2018 OR TAXABLE YEAR BEGINNING ON |

|

AMENDED RETURN |

|

|

||||||||

|

R |

G |

RO |

V1 |

V2 |

P1 |

P2 |

N |

D1 |

D2 |

E |

A |

M |

|

|

|

|

|

|

|

|

|

|

DECEASED DURING THE YEAR: ______/______/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________, ______AND ENDING ON __________________, ______ |

|

Day Month Year |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER |

SPOUSE |

|

|||||||||

|

Taxpayer's First Name |

|

Initial |

Last Name |

|

Second Last Name |

|

|

Taxpayer's Social Security Number |

|

|

|||||||||||||||

|

|

|

|

|

|

SURVIVING SPOUSE FILES ANOTHER RETURN FOR THE |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXABLE YEAR (Submit social security number and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date of death of the deceased spouse: |

|

|

|

Postal Address |

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

Sex |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

Receipt Stamp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Day |

Month |

Year |

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's Social Security |

Number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's Date of Birth |

|

Sex |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's First Name and Initial |

|

|

Last Name |

Second Last Name |

|

|

|

Day |

Month |

Year |

|

F |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Telephone |

|

|

|

|

|

||

Home Address (Town or Urbanization, Number, Street)

|

|

Work Telephone |

|

|

|

|

|

Zip Code |

CHANGE OF ADDRESS: |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

EXTENSION OF TIME: |

Yes |

No GOVERNMENTCONTRACT: |

Taxpayer |

Spouse |

|

|

|

|||||

Questionnaire

YES |

NO |

I. HIGHEST SOURCE OF INCOME: |

|

|

||||

A. |

United States Citizen? (See instructions) |

1. |

Government, Municipalities or |

4. |

Retired/Pensioner |

|||

B. |

Resident of Puerto Rico during the entire year? |

|||||||

|

Public Corporations Employee |

5. |

||||||

|

If “No”, indicate one of the following: |

|

||||||

|

2. |

Federal Government Employee |

|

industry or business) |

||||

|

1. |

Date moved to P.R. (Day____ Month____ Year____) |

|

|||||

|

3. |

Private Business Employee |

6. |

Other _________________________ |

||||

|

2. |

Date moved from P.R. (Day____ Month____ Year____) |

||||||

|

3. |

Nonresident during the entire year |

J. FILING STATUS AT THE END OF THE TAXABLE YEAR: |

|||||

C . |

Did you generate income during the period that you were not resident of PR |

|||||||

1. |

Married |

|

|

|

||||

|

that is not included on this return? (If you answered “Yes”, indicate the amount): |

|

|

|

||||

|

1. |

Attributable to the taxpayer $_________ |

|

(Fill in here |

if you choose the optional computation and go to |

|||

|

2. |

Attributable to the spouse $_________ |

|

Schedule CO Individual) |

|

|

||

D. |

Other excluded or tax exempt income? |

2. |

Individual taxpayer |

|

|

|||

E. F .

G. H.

(Submit Schedule IE Individual) |

|

|

Resident individual investor? (Submit Schedule F1 Individual) |

|

|

Partner of a partnership subject to tax under the Federal Internal |

|

|

Revenue Code? |

3. |

|

Active military service in a combat zone during the taxable year? (Date |

||

|

||

in which you ceased in the service: Day____ Month____ Year____) |

|

|

Qualified physician under Act |

|

1.Taxpayer (Decree No. __________________________)

2.Spouse (Decree No. __________________________)

(Fill in and submit spouse's name and social security number if you are: Married with a complete separation of property prenuptial agreement Married not living with spouse)

Married filing separately

(Submit spouse’s name and social security number above)

Your occupation

Spouse's occupation

Deposit Payment Refund

GO TO PAGE 2 TO DETERMINE YOUR REFUND OR PAYMENT.

1. AMOUNT OVERPAID (Part 3, line 29. Indicate distribution on lines A, B, C and D) |

..............................................................................01 |

(01) |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||

A) To be credited to estimated tax for 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(02) |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||

B) Contribution to the San Juan Bay Estuary Special Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(03) |

|

|||||||||||||||||||||||||||||||

C) Contribution to the University of Puerto Rico Special Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(04) |

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||

D) TO BE REFUNDED (If you want your refund to be deposited directly into an account, complete the Deposit Part) |

(05) |

|

|

|

|

|

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||

2. AMOUNT OF TAX DUE (Part 3, line 29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(06) |

|

00 |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||

3. Less: Amount paid (a) |

With Return or Electronic Transfer through a Certified Program |

(07) |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

(b) |

Interests |

(08) |

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

(c) Surcharges ___________ and Penalties ___________ |

(09) |

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

.........................................................................................4. BALANCE OF TAX DUE (Subtract line 3(a) from line 2 and add lines 3(b) and 3(c)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10) |

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZATION FOR DIRECT DEPOSIT OF REFUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Type of account |

|

Routing/transit number |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

Checking |

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account in the name of: ______________________________________________________ and _______________________________________________________________

(Print complete name as it appears on your account. If married and filing jointly, include your spouse’s name)

I hereby declare under penalty of perjury that I have examined the information included in this return, schedules and other documents attached to it, and it is true, correct and complete. The declaration of the person that prepares this return (except the taxpayer) is based on the information available, and this information has been verified.

Taxpayer’s Signature |

Date |

Spouse’s Signature |

Date |

X |

|

X |

|

|

04 Specialist’s Name (Print) |

|

Name of the Firm or Business |

|

|

|

|

|

|

|

|

|

|

|

|

Specialist’s Signature |

Date |

Self - employed Specialist |

Registration Number |

|

X |

|

(fill in here) |

|

|

|

|

|

|

|

|

|

|

|

|

NOTE TO TAXPAYER: Indicate if you made payments for the preparation of your return: |

Yes |

No. If you answered "Yes", require the Specialist's signature and registration number. |

||

|

|

|

|

|

Retention Period: Ten (10) years

Rev. Feb 20 19 |

Form 482.0 - Page 2 |

If you choose the optional computation of tax for married individuals living together and filing a joint return, do not complete Parts 1 and 2, neither lines 14 through 20 of Part 3, and go to Schedule CO Individual.

1. Wages, Commissions, Allowances and Tips |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

ATTACH ALL YOUR WITHHOLDING STATEMENTS |

|

|

|

|

Act |

.... |

|

00 |

|

|

|

|

|

|

00 |

||||

|

|

|

|

Act |

.... |

|

|||

(Forms |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

as applicable). |

|

|

|

|

Act |

.... |

|

00 |

|

|

|

|

|

|

|

00 |

|||

|

|

|

|

|

Act |

.... |

|

||

|

02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(02) |

|

00 |

||

Total of withholding statements with this return |

|

|

|

|

|

||||

C- Federal Government Wages |

Exempt wages under Sec. 1031.02(a)(36) of the Code |

|

Income Tax Withheld |

||||||

(Total of |

) ..... (01) |

|

|

00 |

Act |

(03) |

|

00 |

|

2. Other Income (or Losses): |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Allowances and Tips

|

|

00 |

|

|

|

00 |

|

|

|

00 |

|

|

|

00 |

|

|

|

|

|

(04) |

|

00 |

|

|

Federal Wages |

|

|

(05) |

|

00 |

|

Part 1

Part 2

Part 3

|

A) |

............................................................Total distributions from qualified retirement plans (Schedule D Individual, Part IV, line 25) |

|

(06) |

|

00 |

|

|||||

|

B) |

Gain (or loss) from sale or exchange of capital assets (Schedule D Individual, Part V, line 35 or 36, as applicable) |

(07) |

|

00 |

|

||||||

|

C) |

Interests (Schedule FF Individual, Part I, line 5) |

|

|

|

(08) |

|

00 |

|

|||

|

|

|

|

|

00 |

|

||||||

|

D) |

Dividends from corporations (Schedule FF Individual, Part II, line 4) |

|

|

|

(09) |

|

|

||||

|

E) |

Distributions from Governmental Plans (Schedule F Individual, Part II, line 3) |

.......................................................................... |

|

(10) |

|

00 |

|

||||

|

F) |

Distributions from Individual Retirement Accounts and Educational Contribution Accounts (Schedule F Individual, Part I, line 2) |

(11) |

|

00 |

|

||||||

|

G) |

Other income (Schedule F Individual, Part V, line 4 and Schedule FF Individual, Part III, line 4) |

|

(12) |

|

00 |

|

|||||

|

H) |

Income from annuities and pensions (Schedule H Individual, Part II, line 12) |

|

|

(13) |

|

00 |

|

||||

|

I) |

Gain (or loss) from industry or business (Schedule K Individual, Part II, line 12) |

|

(14) |

|

00 |

|

|||||

|

J) |

Gain (or loss) from farming (Schedule L Individual, Part II, line 14) |

|

|

|

(15) |

|

00 |

|

|||

|

K) |

Gain (or loss) from professions and commissions (Schedule M Individual, Part II, line 8) |

|

(16) |

|

00 |

|

|||||

|

L) |

Gain (or loss) from rental business (Schedule N Individual, Part II, line 9) |

|

|

(17) |

|

00 |

|

||||

|

M) |

Dividends from Capital Investment or Tourism Fund (Submit Schedule Q1) |

|

|

(18) |

|

00 |

|

||||

|

|

|

|

00 |

|

|||||||

|

N) |

Net |

|

|

|

(19) |

|

|

||||

|

|

|

|

|

00 |

|

||||||

|

O) |

Distributable share on profits from partnerships, special partnerships and corporations of individuals (Submit Schedule R Individual) .... |

(20) |

|

|

|||||||

|

P) |

Distributions from deferred compensation plans and/or qualified retirement plans (partial or |

|

|

00 |

|

||||||

|

|

or plan termination) (Schedule F Individual, Part III or IV, line 1, as applicable) …............….............................…………………………. |

(21) |

|

|

|||||||

|

Q) |

|

00 |

|

||||||||

|

Income from salaries, wages, compensations or public shows received by a nonresident individual (Form 480.6C) |

(22) |

|

|

||||||||

|

R) |

Alimony received (Payer’s social security No. _________________________ ) |

(23) |

|

(24) |

|

00 |

|

||||

|

S) |

Eligible distributions due to hurricane María (See instructions) (Schedule F Individual, Part VI, line 1, Columns A and B or 10, as applicable).. |

(25) |

|

00 |

|

||||||

3. Total Income (Add lines 1B, 1C and 2A through 2S) |

|

|

|

(26) |

|

00 |

|

|||||

4. Alimony Paid (Recipient’s social security No. _________________)(27) (Judgment No. ___________)(28) |

|

(29) |

|

00 |

|

|||||||

5. Adjusted Gross Income (Subtract line 4 from line 3) |

|

|

|

|

(30) |

|

00 |

|

||||

|

|

|

|

|||||||||

6. |

.......................................................................................................Total Deductions (Schedule A Individual, Part I, line 11 or Part II, line 6) |

|

|

03 |

(01) |

|

00 |

|

||||

|

|

|

|

|

|

00 |

|

|||||

7. |

...............................................Personal Exemption (Married - $7,000; Individual taxpayer - $3,500; Married filing separately - $3,500) |

|

(02) |

|

|

|||||||

8. |

Exemption for Dependents (Complete Schedule A1 Ind., see instructions): |

A) (03) |

______ x $2,500 .… |

(05) |

|

(003) |

|

|

|

|||

|

|

|

|

Joint custody or married filing separately |

B) (04) |

______ x $1,250 .… |

(06) |

|

00 |

|

|

|

|

Total Exemption for Dependents (Add lines 8A and 8B) ………………………….......................................................………….……......….. |

(07) |

|

00 |

|

|||||||

9. |

Additional Personal Exemption for Veterans ($1,500 per veteran. If both spouses are veterans, $3,000) |

|

(08) |

|

00 |

|

||||||

10. |

Total Deductions and Exemptions (Add lines 6 through 9) |

|

|

|

(09) |

|

00 |

|

||||

11. |

Net income before the deduction under Act |

(10) |

|

00 |

|

|||||||

12. |

Allowable deduction under Act |

|

|

|

|

(11) |

|

00 |

|

|||

|

|

|

|

|

||||||||

13. |

........................................................NET TAXABLE INCOME (Subtract line 12 from line 11. If line 12 is more than line 11, enter zero) |

|

(12) |

|

00 |

|

||||||

14. |

TAX: (21) |

1 Tax Table |

2 Preferential rates (Schedule A2 Individual) |

3 Nonresident alien |

..........4 Form SC 2668 |

(22) |

|

00 |

|

|||

15. |

Gradual Adjustment Amount (Determine adjustment if the amount indicated on line 13 or Schedule A2 Ind., line 11 is more than $500,000) (Schedule P Ind., line 7) |

(23) |

|

00 |

|

|||||||

16. |

REGULAR TAX BEFORE THE CREDIT (Add lines 14 and 15) …………………………………………...................................................…. |

(24) |

|

00 |

|

|||||||

17. |

..........Credit for taxes paid to foreign countries, the United States, its territories and possessions (Submit Schedule C Individual) (See instructions) |

(25) |

|

00 |

|

|||||||

18. |

......................................................................................................................NET REGULAR TAX (Subtract line 17 from line 16) |

|

|

|

(26) |

|

00 |

|

||||

19. |

Excess of Net Alternate Basic Tax over Net Regular Tax (Schedule O Individual, Part II, line 7) (See instructions) ……….....................…. |

(27) |

|

00 |

|

|||||||

20. |

..................................................................................................Credit for alternate basic tax (Schedule O Individual, Part III, line 4) |

|

|

|

(28) |

|

00 |

|

||||

21. |

.......TOTAL TAX DETERMINED (Subtract line 20 from the sum of lines 18 and 19 or enter the amount from Schedule CO Individual, line 24, as applicable) |

(29) |

|

00 |

|

|||||||

22. |

.....................................................................................Recapture of credit claimed in excess (Schedule B Individual, Part I, line 3) |

|

|

|

(30) |

|

00 |

|

||||

23. |

Tax credits (Schedule B Individual, Part II, line 23) |

|

|

|

(31) |

|

00 |

|

||||

24. |

TAX LIABILITY (Subtract line 23 from the sum of lines 21 and 22. If it is less than zero, enter zero) |

|

(32) |

|

00 |

|

||||||

|

|

|

|

|||||||||

25.TAX WITHHELD AND PAID

|

A) Tax withheld on wages (Add lines 1A and 1C of Part 1 or lines 1A and 2A of Schedule CO Individual) |

(33) |

|

00 |

|

|

|

|

|

|

00 |

|

|

|

|

||

|

B) Other payments and withholdings (Schedule B Individual, Part III, line 22) |

(34) |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

||

|

C) Amount paid with automatic extension of time …………………………………………………………........…….......… |

(35) |

|

|

|

|

|

|

|

D) Total Tax Withheld and Paid (Add lines 25A through 25C) ……..........................................……………...........................................… |

(36) |

|

|

00 |

|

||

26. |

AMOUNT OF TAX DUE (If line 25D is less than line 24, enter the difference here, otherwise, enter on line 27) |

................................... |

(37) |

|

|

00 |

|

|

27. |

Excess of Tax Withheld, Paid and Reimbursable Credit …………………………................................................…......…………..… |

(38) |

|

|

00 |

|

||

|

|

|

||||||

|

|

00 |

|

|||||

28. |

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Individual, Part II, line 21) ……….............................................…. |

(39) |

|

|

|

|||

29. |

BALANCE: .If line 27 is more than the sum of lines 26 and 28, you have an overpayment. Enter the difference here and on line 1 of page 1. |

|

|

|

|

|

||

|

.If line 27 is less than the sum of lines 26 and 28, you have a balance of tax due. Enter the difference here and on line 2 of page 1. |

|

|

|

|

|

||

|

.If the difference between line 27 and the sum of lines 26 and 28 is equal to zero, enter zero here and sign your return on page 1. |

(50) |

|

|

00 |

|

||

THE AMOUNT SHOWN ON LINE 29 SHALL BE TRANSFERRED TO THE CORRESPONDING LINE OF PAGE 1.

Retention Period: Ten (10) years

Schedule A Individual |

DEDUCTIONS APPLICABLE TO INDIVIDUAL TAXPAYERS |

2018 |

Rev. Feb 20 19 |

|

|

|

|

|

|

Taxable year beginning on _______________, _____ and ending on _______________, _____ |

|

|

|

|

Taxpayer's name |

|

Social Security Number |

|

|

|

Part I

Deductions Applicable to Individual Taxpayers (See instructions)

1. Home mortgage interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Name of entity to which payment was made |

|

Mortgage |

|

|

|

Loan Number |

|

|

|

Employer Identification Number |

|

Amount |

|

|

|

|

|

|

|||||||||||||||||||||||||

a) Principal residence: |

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(01) |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(05) |

|

||||||||||

b) |

|

|

|

|

|

|

|

|

|

|

Second |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(02) |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(06) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c) Second residence: |

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(03) |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(07) |

|

||||||||||

d) |

|

|

|

|

|

|

|

|

|

|

Second |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(04) |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(08) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e) Home mortgage interest of the principal residence not reported on Form 480.7A (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

1 CC RI |

|

|

|

|

|

|

|

2 Form 1098 and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Borrower's Social Sec. No. (10) ________________________ |

|

|

|

|

|

|

(12) $_______________________ |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

Joint Borrower's Social Sec. No. (11) ________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(13) |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

f) Loan Origination Fees (Points) Paid Directly by Borrower (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(14) |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

g) Loan Discounts (Points) Paid Directly by Borrower (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(15) |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

h) Total home mortgage interest paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

(16) |

|

||||||||

i) |

|

Limit (Multiply the sum of Part 1, line 5 of the return and line 1, Part III of Schedule IE Individual by 30% and enter here) |

|

|

|

|

|

00 |

(17) |

|

||||||||||||||||||||||||||||||||||||

j) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowable deduction for mortgage interest (Enter the smaller of lines 1(h), 1(i) or $35,000. If the total interest does not exceed 30% of the income |

|

|

|

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

|

for any of the 3 previous years, fill in here |

|

1 ) (18)(See |

instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(19) |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

2. Casualty loss on your principal residence (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(20) |

|

00 |

||||||||||||||||||||||

...................................................................................................................................3. Medical expenses (Part III, line 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(21) |

|

00 |

||||||||||||

4. Charitable contributions (Part III, line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(22) |

|

00 |

|||||||||||||

..................................................................5. Loss of personal property as a result of certain casualties (See instructions) |

|

|

|

|

|

|

|

|

(23) |

|

00 |

|||||||||||||||||||||||||||||||||||

.........................................................................................6. Contributions to governmental pension or retirement systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(24) |

|

00 |

||||||||||||||||||||||

7. Contributions to individual retirement accounts (Do not exceed from $5,000 or $10,000 if married): |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

Financial inst. |

|

Account No. |

Employer Ident. No. |

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

(25) |

|

|

|

|

|

|

|

|

|

|

|

(28) |

|

|

|

|

(31) |

1Taxpayer |

2 Spouse |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(26) |

|

|

|

|

|

|

|

|

|

|

(29) |

|

|

|

|

|

(32) |

1Taxpayer |

2 Spouse |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

(27) |

|

|

|

|

|

|

|

|

|

|

|

(30) |

|

|

|

|

|

(33) |

1Taxpayer |

2 Spouse |

|

|||||||||||||||

|

|

Total contributions to individual retirement accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(34) |

|

00 |

||||||||||||||||||||

8. Contributions to health savings accounts with a high annual deductible medical plan (See instructions): |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

Institution |

|

|

|

Account No. |

|

|

|

|

|

|

|

Employer Ident. No. |

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|||||||||||||||||||

|

______________________________ |

______________________________ |

(39) __________________________ |

(41) |

|

|

_________________________ |

|

|

|

|

|

||||||||||||||||||||||||||||||||||

Annual Deductible (35) ________ |

Type of |

(37) |

|

1 Individual |

2 Individual and age 55 or older |

|

|

|

|

|

Effective date |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

coverage: |

|

|

3 Family |

4 Family and age 55 or older |

|

|

|

|

|

(42)___________________ |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Institution |

|

|

|

Account No. |

|

|

|

|

|

|

|

Employer Ident. No. |

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|||||||||||||||||||

|

______________________________ |

|

______________________________ |

(40) __________________________ |

(43) |

|

|

_________________________ |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Annual Deductible (36) ________ |

Type of |

(38) |

|

1 Individual |

2 Individual and age 55 or older |

|

|

|

|

|

Effective date |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

coverage: |

|

|

3 Family |

4 Family and age 55 or older |

|

|

|

|

|

(44)___________________ |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Total contributions (Add the smaller amount between the contribution and the annual deductible of each account) |

.... (45) |

|

00 |

||||||||||||||||||||||||||||||||||||||||||

...........................................9. Educational Contribution Account (Schedule A1 Individual, Part II, line (21)) (See instructions) |

|

|

|

|

|

|

|

|

(46) |

|

00 |

|||||||||||||||||||||||||||||||||||

10. Interest paid on students loans at university level (See instructions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Financial Inst. |

|

|

|

|

Loan No. |

|

|

|

|

|

|

|

Employer Ident. No. |

|

|

|

|

|

Amount |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(47) |

|

|

|

|

|

|

|

|

|

|

|

|

(52) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(48) |

|

|

|

|

|

|

|

|

|

|

|

|

(53) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(49) |

|

|

|

|

|

|

|

|

|

|

|

|

(54) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(50) |

|

|

|

|

|

|

|

|

|

|

|

|

(55) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(51) |

|

|

|

|

|

|

|

|

|

|

|

|

(56) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total interest paid on students loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(57) |

|

00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

11.Total deductions applicable to individual taxpayers (Add lines 1 through 10 and transfer to Part 2,

|

|

line 6 of the return. If you answered "No" to question B of the questionnaire on page 1 of the return, continue with Part II) .. |

(58) |

|

00 |

|

|

Part II |

Computation of Allowable Amounts of Deductions to Nonresident or |

|

|

|

|

|

1. |

Total gross income earned during the period of residence in Puerto Rico (Part 1, line 5 of the return) …………… |

(59) |

|

00 |

|

|

2. |

Total gross income earned during the period of nonresidence in Puerto Rico (Question C of the questionnaire on page 1 |

|

|

|

|

|

|

of the return) ……………………………………….…………………………….........…………………………………………...….. |

(60) |

|

00 |

|

|

3. |

|

00 |

|||

|

Total Gross Income (Add lines 1 and 2) ………………………………………………………………………… |

(61) |

|

|||

|

4. |

Percentage of income related to the period of residence in Puerto Rico (Divide line 1 by line 3. Enter the result rounded to |

|

|

% |

|

|

|

two decimal places) …...............................................………………………………………………………………………………. |

(62) |

|

||

|

5. |

|

|

|||

|

Total deductions applicable to individual taxpayers (Part 1, line 11) …………………..................................…………………… |

(63) |

|

00 |

||

|

6. |

Total deductions attributable to the period of residence in Puerto Rico (Multiply line 5 by line 4 and transfer to |

|

|

|

|

|

|

Part 2, line 6 of the return) ……………………………………….……………………………………………………...............…… |

(70) |

|

00 |

|

Retention Period: Ten (10) years

Rev. Feb 20 19 |

Schedule A Individual - Page 2 |

Taxpayer's name

Social Security Number

|

Part III |

Medical expenses and Charitable Contributions |

|

|

|

|

|

|

46 |

|||||

|

Name of person or institution |

Employer Identification |

|

|

|

|

|

Nature |

(C) Conservacion |

|

(D) Contributions to |

|||

|

(A) |

Medical Expenses |

|

(B) Contributions |

|

of |

Easement and |

|

|

Municipalities and |

||||

|

to whom payment was made |

Number |

|

|

|

|

||||||||

|

|

|

|

|

|

Organization |

Museological Institutions |

|

Others |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

(01) |

|

00 |

(18) |

|

00 |

(35) |

(49) |

00 |

|

|

00 |

|

|

|

(02) |

|

00 |

(19) |

|

00 |

(36) |

(50) |

00 |

|

|

00 |

|

|

|

(03) |

|

00 |

(20) |

|

00 |

(37) |

(51) |

00 |

|

|

00 |

|

|

|

(04) |

|

00 |

(21) |

|

00 |

(38) |

(52) |

00 |

|

|

00 |

|

|

|

(05) |

|

00 |

(22) |

|

00 |

(39) |

(53) |

00 |

|

|

00 |

|

|

|

(06) |

|

00 |

(23) |

|

00 |

(40) |

(54) |

00 |

|

|

00 |

|

|

|

(07) |

|

00 |

(24) |

|

00 |

(41) |

(55) |

00 |

|

|

00 |

|

|

|

(08) |

|

00 |

(25) |

|

00 |

(42) |

(56) |

00 |

|

|

00 |

|

|

|

(09) |

|

00 |

(26) |

|

00 |

(43) |

(57) |

00 |

|

|

00 |

|

|

|

(10) |

|

00 |

(27) |

|

00 |

(44) |

(58) |

00 |

|

|

00 |

|

|

|

(11) |

|

00 |

(28) |

|

00 |

(45) |

(59) |

00 |

|

|

00 |

|

|

|

(12) |

|

00 |

(29) |

|

00 |

(46) |

(60) |

00 |

|

|

00 |

|

|

|

(13) |

|

00 |

(30) |

|

00 |

(47) |

(61) |

00 |

|

|

00 |

|

|

|

(14) |

|

00 |

(31) |

|

00 |

(48) |

(62) |

00 |

|

|

00 |

|

1. Total Columns A, B, C and D ……..................…….… (15) |

|

00 |

(32) |

|

00 |

|

(63) |

00 |

(66) |

|

00 |

||

|

2. Multiply the adjusted gross income (Part 1, line 5 of the |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

|

return or line 6, Columns B and C of Schedule CO |

|

|

|

|

|

|

|

|

|

|

|

||

|

Individual) by 6% and enter here (See instructions) ..... (16) |

|

00 |

|

|

|

|

|

|

|

|

|

||

3.Allowable deduction for medical expenses (Subtract line 2 from line 1. Enter here and in Part I, line 3 of this

|

Schedule or on Schedule CO Individual, line 7C) ….... (17) |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Multiply the adjusted gross income (Part 1, line 5 of the return or line 6, |

|

|

|

|

|

|

|

|

|

|

|

Columns B and C of Schedule CO Individual) by 50% and enter here (See instructions) . .. |

(33) |

|

00 |

|

|

|

|

|

|

|

5. |

Deduction for contributions (Enter the smaller of lines 1B and 4) … |

(34) |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. Multiply the adjusted gross income (Part 1, line 5 of the return or line 6, Columns B and C of Schedule CO Individual) by |

|

|

|

|

|

||||||

|

30% and enter here (See instructions) ……...................................................................................…..............…. |

(64) |

|

00 |

|

|

|||||

|

|

00 |

|

|

|||||||

7. Deduction for contributions to Conservation Easements and Museological Institutions (Enter the smaller of lines 1C and 6) ... |

(65) |

|

|

|

|||||||

8. Total allowable deductions for contributions (Add lines 1D, 5 and 7. Enter here and in Part I, line 4 of this Schedule or on Schedule CO |

|

|

|

||||||||

|

Individual, line 7D) ........................................................................................................................................................................................… |

(70) |

|

00 |

|||||||

Retention Period: Ten (10) years

Schedule A1 Individual |

|

|

Rev. Feb 20 19 |

DEPENDENTS AND BENEFICIARIES |

|

|

2018 |

|

|

OF EDUCATIONAL CONTRIBUTION ACCOUNTS |

|

|

Taxable year beginning on _______________, _____ and ending on _______________, ____ |

|

Taxpayer’s name |

Social Security Number |

|

|

|

|

Part I

Dependent’s Information (See instructions) |

55 |

IMPORTANT INFORMATION

Do not include the spouse on this schedule. A married individual who lives with his/her spouse for tax purposes, should not include the spouse as part of the dependents. Submit this Schedule with your return in order to consider the exemption for dependents.

Fill in the oval for joint custody if the dependent is subject to this condition. The exemption will be $1,250 for each taxpayer.

First Name, Initial |

Last |

Second Last |

Joint |

Date of Birth |

Relationship |

Category * |

Social Security Number |

|

Name |

Name |

Custody |

Day / Month / Year |

(N)(U)(I) |

||||

|

|

|||||||

|

|

|

(01)

(02)

(03)

(04)

(05)

(06)

(07)

(08)

(09)

(10)

(11)

(12)

(13)

(14)

(15)

(16)

(17)

(18)

(19)

(20)

* See instructions. |

Retention Period: Ten (10) years |

Rev. Feb 20 19Schedule A1 Individual - Page 2

Part II |

Beneficiaries of Educational Contribution Accounts (See instructions) |

|

|

57 |

|

|||||||

(01) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(02) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(03) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(04) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(05) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

||

(06) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(07) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(08) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(09) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(10) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

||

(11) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(12) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(13) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(14) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Número de la cuenta |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(15) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(16) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

||

(17) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

1 Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2 Spouse |

|

00 |

(18) |

First Name, Initial |

Last Name |

Second Last Name |

Date of Birth (Day/Month/Year) |

|

Relationship |

|

Social Security Number |

Who contributes |

Contributed Amount |

|

|

|

|

|

|

|

|

|

|

|

|

1 Taxpayer |

(Not to exceed from $500 each) |

|

|

|

|

Financial Institution |

|

Account Number |

|

|

Employer Identification Number |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|