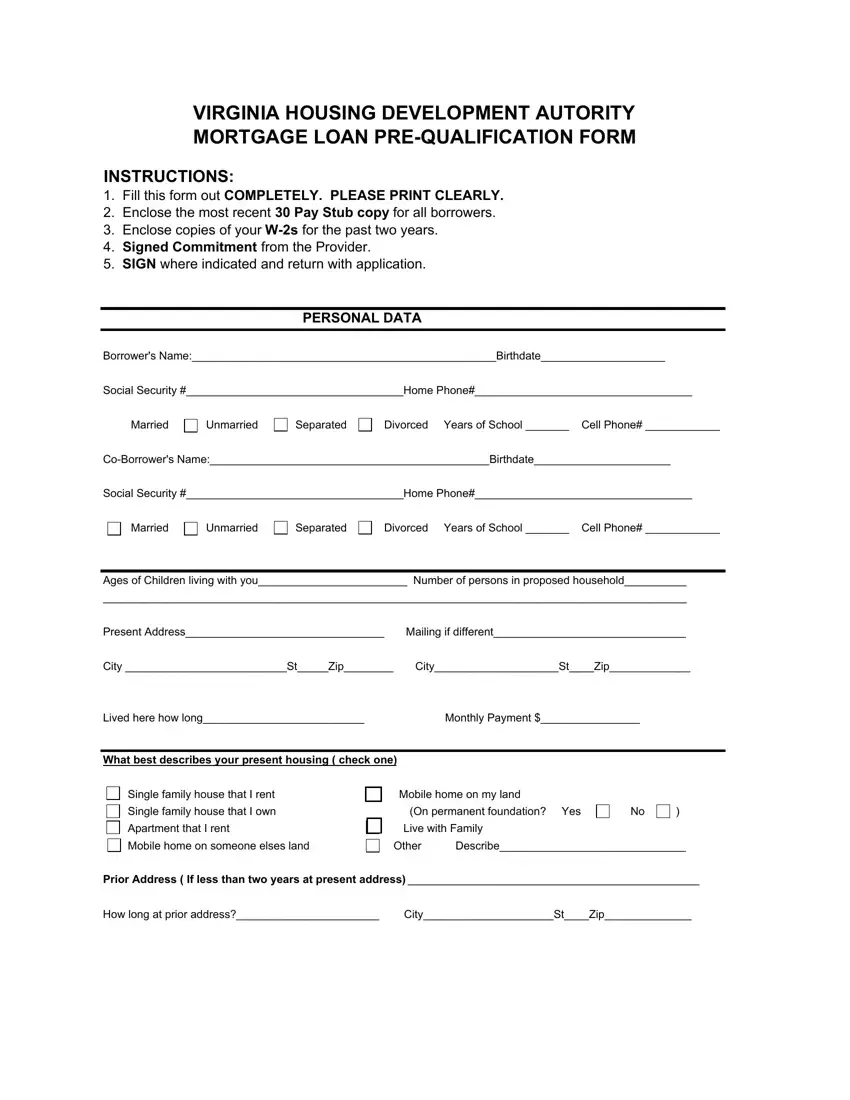

VIRGINIA HOUSING DEVELOPMENT AUTORITY

MORTGAGE LOAN PRE-QUALIFICATION FORM

INSTRUCTIONS:

1.Fill this form out COMPLETELY. PLEASE PRINT CLEARLY.

2.Enclose the most recent 30 Pay Stub copy for all borrowers.

3.Enclose copies of your W-2s for the past two years.

4.Signed Commitment from the Provider.

5.SIGN where indicated and return with application.

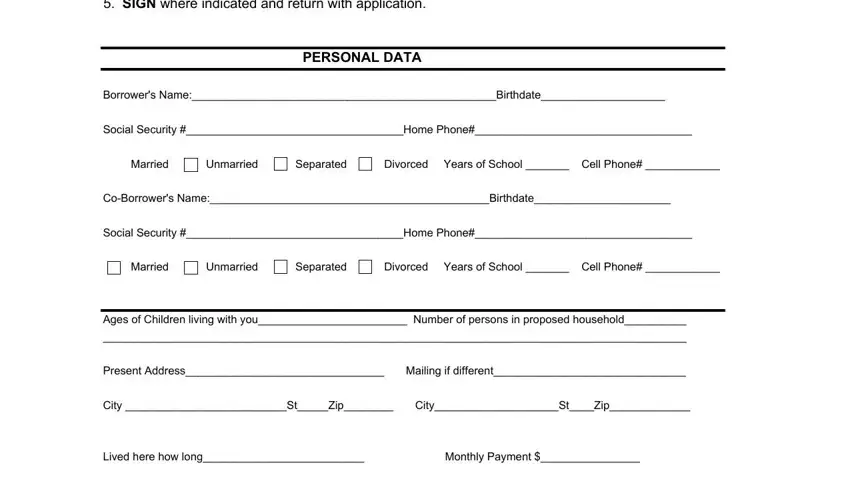

PERSONAL DATA

Borrower's Name:_________________________________________________Birthdate____________________

Social Security #___________________________________Home Phone#___________________________________

Married |

Unmarried |

Separated |

Divorced |

Years of School _______ |

Cell Phone# ____________ |

Co-Borrower's Name:_____________________________________________Birthdate______________________ |

Social Security #___________________________________Home Phone#___________________________________ |

Married |

Unmarried |

Separated |

Divorced |

Years of School _______ |

Cell Phone# ____________ |

Ages of Children living with you________________________ Number of persons in proposed household__________

______________________________________________________________________________________________

Present Address________________________________ |

Mailing if different_______________________________ |

City __________________________St_____Zip________ |

City____________________St____Zip_____________ |

Lived here how long__________________________ |

Monthly Payment $________________ |

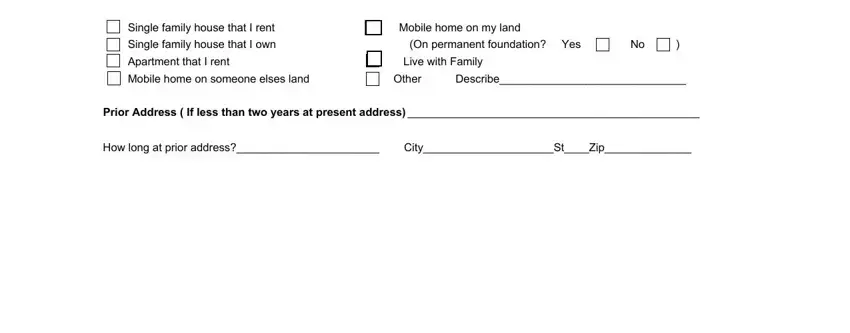

What best describes your present housing ( check one)

Single family house that I rent Single family house that I own Apartment that I rent

Mobile home on someone elses land

|

|

|

|

Mobile home on my land |

|

|

(On permanent foundation? Yes |

No |

) |

Live with Family |

|

|

Other |

Describe______________________________ |

Prior Address ( If less than two years at present address) _______________________________________________

How long at prior address?_______________________ |

City_____________________St____Zip______________ |

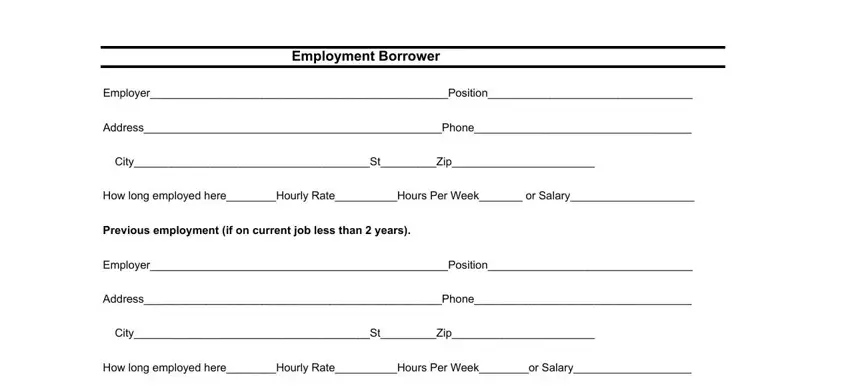

Employment Borrower

Employer________________________________________________Position_________________________________

Address________________________________________________Phone___________________________________

City______________________________________St_________Zip_______________________

How long employed here________Hourly Rate__________Hours Per Week_______ or Salary____________________

Previous employment (if on current job less than 2 years).

Employer________________________________________________Position_________________________________

Address________________________________________________Phone___________________________________

City______________________________________St_________Zip_______________________

How long employed here________Hourly Rate__________Hours Per Week________or Salary___________________

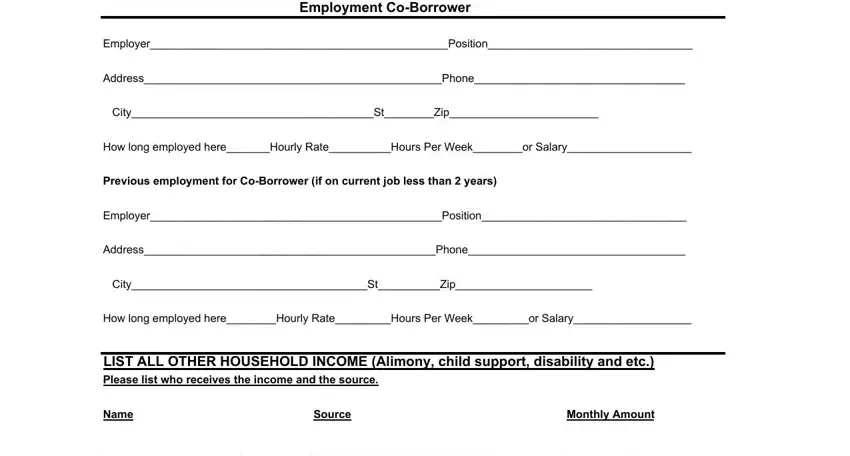

Employment Co-Borrower

Employer________________________________________________Position_________________________________

Address________________________________________________Phone__________________________________

City_______________________________________St________Zip________________________

How long employed here_______Hourly Rate__________Hours Per Week________or Salary____________________

Previous employment for Co-Borrower (if on current job less than 2 years)

Employer_______________________________________________Position_________________________________

Address_______________________________________________Phone___________________________________

City______________________________________St__________Zip______________________

How long employed here________Hourly Rate_________Hours Per Week_________or Salary___________________

LIST ALL OTHER HOUSEHOLD INCOME (Alimony, child support, disability and etc.)

Please list who receives the income and the source.

Name |

|

Source |

|

Monthly Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower |

Co-Borrower |

Yes or No |

Yes or No |

Are either of you U.S. Veterans or Reservists? |

|

|

|

|

|

Are there any outstanding judgments or collections against you? |

|

|

|

|

|

|

|

|

|

|

Have you been declared Bankrupt within the past 7 years? |

|

|

|

|

|

|

|

|

|

|

If yes, date of discharge:______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you had property foreclosed upon or repossessed? |

|

|

|

|

|

|

Have you owned a home during the last three years? |

|

|

|

|

|

Do you operate a business from your home? |

|

|

|

|

|

|

Do you have to pay Alimony, Child Support or Separate Maintenance? |

|

|

|

|

|

|

If yes, amount paid per month $________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

Name of Bank or Credit Union |

Current Balance |

|

401(K) Value |

|

$ |

|

|

|

|

__________________________________ |

$___________ |

|

|

IRA Value |

|

$ |

|

|

|

|

__________________________________ |

$___________ |

|

Value of Stocks and Bonds |

$ |

|

|

|

__________________________________ |

$___________ |

|

|

|

|

|

|

|

|

|

|

|

Auto: Make____________ Year______ Value $ |

Make |

|

|

|

Year______ Value $________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Debt Payments

Note: Include payroll deducted loans and student loans, even if the payment is deferred.

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Note: Completion of this form does not constitute a loan application. This is a preliminary screening to assist us in deter- mining your eligibility under VHDA's program guidelines. Credit and property eligibility will be determined only after a full loan application has been processed on your behalf.

BORROWER SIGNATURE AUTHORIZATION

Part 1 - General Information

Borrower |

|

Lender Name and Address |

|

|

VHDA |

Co-Borrower |

|

601 S. Belvidere Street |

|

|

Richmond, VA 23220 |

Part II - Borrower Authorization

I hereby authorize the Lender to verify my past and present employment earning records, bank acounts, stock holdings and any other asset balances that are needed to process my mortagage loan application. I further authorize the Lender to order a consumer credit report and verify other credit information, including past and present mortgage and landlord references. It is understood that a copy of this form will also serve as authorization.

The information the Lender obtains is only to be used in the processing of my application for a mortgage loan.

Borrower Signature___________________________________________________Date _____________________

Co-Borrower Signature________________________________________________Date _____________________

Notice to Borrowers: This is notice to you as required by the Right to Financial Privacy Act of 1978 that HUD/FHA has a right of access to financial records held by financial institutions in connection with the consideration or administration of assistance to you. Financial records involving your transaction will be available to HUD/FHA without further notice or authorization but will not be disclosed or released by this institution to another Government Agency or Department without your consent except as required or permitted by law.

**********************************************************************************************************************************************

CONSENT FOR DISCLOSURE OF PERSONAL INFORMATION

I/We hereby consent to the disclosure by the Virginia Housing Development Authority (VHDA), acting on its own be- half and any of its employees, contractors, agents and representatives to ___________________________________

_________________________________________ of all personal information, including information which may be

covered or protected by federal or state law, about me/us which they may now or hereafter have relating to my application for a loan for the financing of the residence located at__________________________________________

_______________________________________. This consent is given voluntarily and for my/our benefit.

I/We understand that VHDA is not obligated by this consent to make any disclosure of such personal information and shall not be liable for the completeness or correctness of any personal information so disclosed.

This consent:

Does include medical records and information. Does not include medical records and information.

I/We agree that this consent shall remain in effect until the receipt by VHDA of written notice from me/us that this consent has been revoked. A photo-copy or facsimile of this consent shall have the same force

and effect as the original. This consent is executed this _______________day of _______________________, 20_____.

_________________________________________ |

_____________________________________________ |

Borrower signature |

Co-Borrower signature |