|

|

|

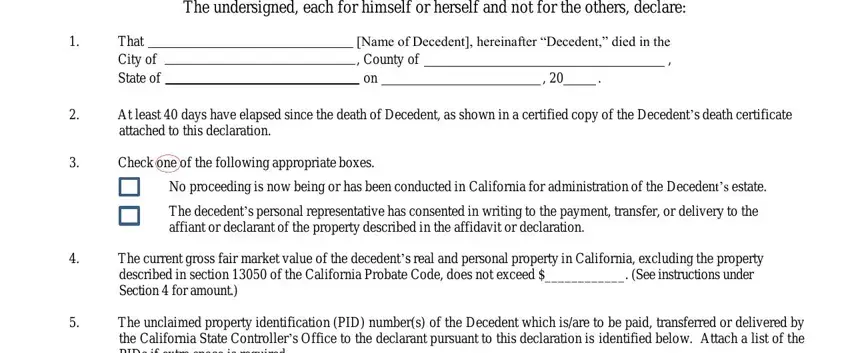

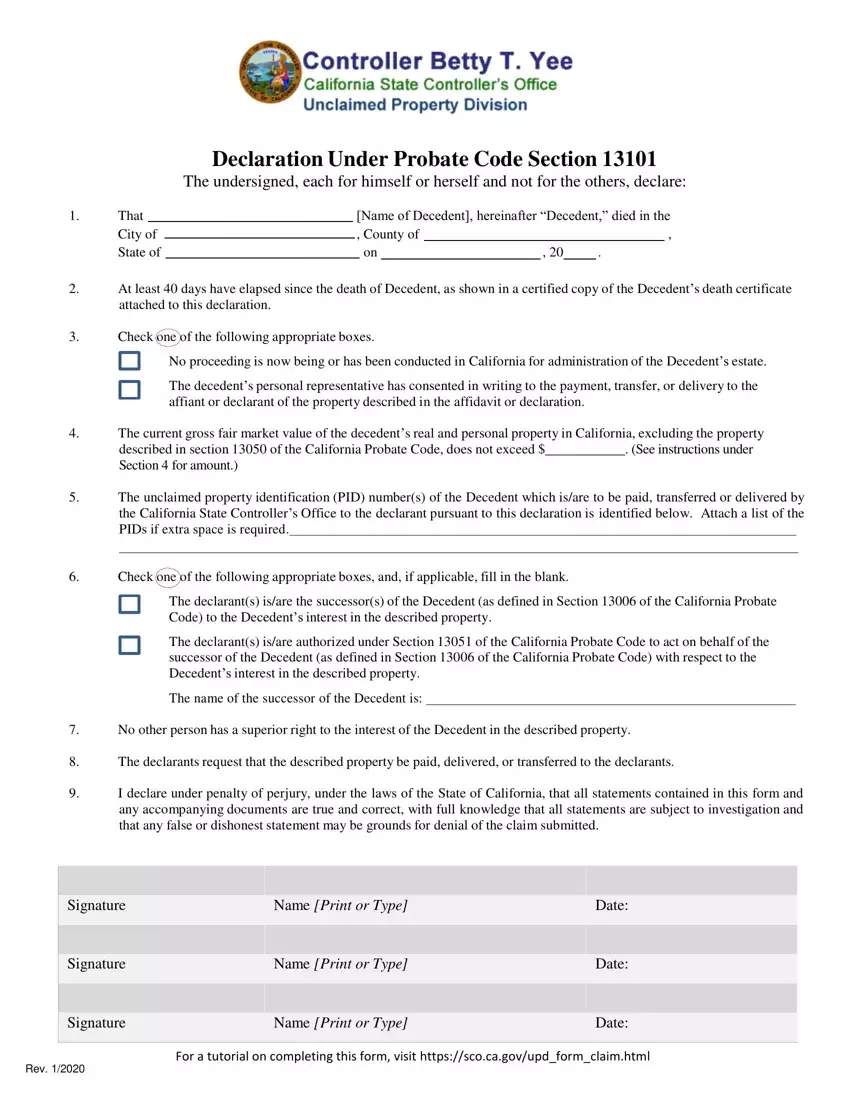

Declaration Under Probate Code Section 13101 |

|

|

|

The undersigned, each for himself or herself and not for the others, declare: |

1. |

That |

|

|

|

[Name of Decedent], hereinafter “Decedent,” died in the |

|

City of |

|

|

, County of |

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

State of |

|

|

|

on |

|

|

, 20 |

|

. |

|

2.At least 40 days have elapsed since the death of Decedent, as shown in a certified copy of the Decedent’s death certificate attached to this declaration.

3.Check one of the following appropriate boxes.

No proceeding is now being or has been conducted in California for administration of the Decedent’s estate.

The decedent’s personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration.

4.The current gross fair market value of the decedent’s real and personal property in California, excluding the property described in section 13050 of the California Probate Code, does not exceed $____________. (See instructions under Section 4 for amount.)

5.The unclaimed property identification (PID) number(s) of the Decedent which is/are to be paid, transferred or delivered by the California State Controller’s Office to the declarant pursuant to this declaration is identified below. Attach a list of the PIDs if extra space is required.

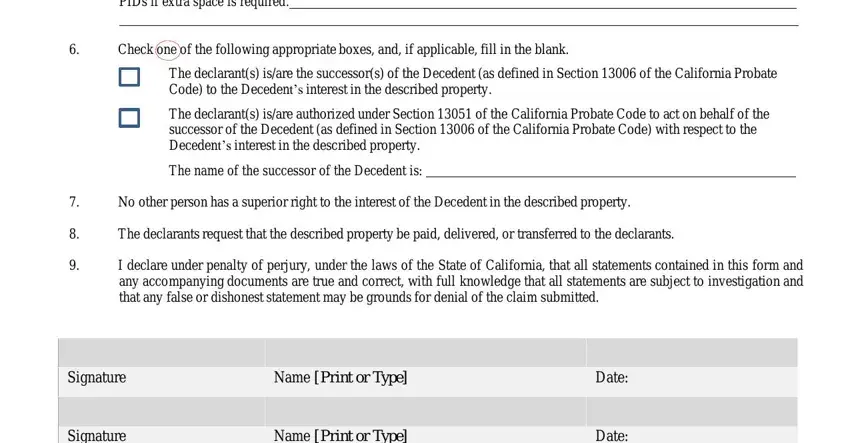

6.Check one of the following appropriate boxes, and, if applicable, fill in the blank.

The declarant(s) is/are the successor(s) of the Decedent (as defined in Section 13006 of the California Probate Code) to the Decedent’s interest in the described property.

The declarant(s) is/are authorized under Section 13051 of the California Probate Code to act on behalf of the successor of the Decedent (as defined in Section 13006 of the California Probate Code) with respect to the Decedent’s interest in the described property.

The name of the successor of the Decedent is:

7.No other person has a superior right to the interest of the Decedent in the described property.

8.The declarants request that the described property be paid, delivered, or transferred to the declarants.

9.I declare under penalty of perjury, under the laws of the State of California, that all statements contained in this form and any accompanying documents are true and correct, with full knowledge that all statements are subject to investigation and that any false or dishonest statement may be grounds for denial of the claim submitted.

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

For a tutorial on completing this form, visit https://sco.ca.gov/upd_form_claim.html

Rev. 1/2020

Instructions for Completing

Declaration Under Probate Code Section 13101

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent’s will if you are entitled to the decedent’s property under Section 13101 of the California Probate Code. In order for the Unclaimed Property Division to determine if you are entitled to collect the unclaimed property of the decedent, please complete this form and submit it along with your Claim Affirmation Form and all other required documents.

Section 1: Fill out name, location, and date of death for decedent which can be found on the decedent’s death certificate.

Section 2: In signing the form, you declare the statement in Section 2 is true.

Section 3: Check the applicable box. Only one of the boxes shall apply:

Check the first box if there are no court proceedings pending, nor have any been conducted to administer the decedent’s estate, and that no personal representative or special administrator has been appointed by the court to administer the decedent’s estate.

Check the second box if there is written consent from the decedent’s personal representative providing for you to receive payment, transfer or delivery of the properties listed in Section 5.

Section 4: By signing the form, you attest that the statement in Section 4 is true. Please refer to Section 13050 of the

California Probate Code to identify properties that may be excluded from the value of the decedent’s estate. Please insert the amount that corresponds with the decedent’s date of death as set forth in the below table:

If the decedent died on or before December 31, 2019 |

$150,000 |

If the decedent died on or between January 1, 2020, and March 31, 2022 |

$166,250 |

Section 5: In the space provided, list all of the State Controller's Office’s (SCO) property identification numbers (PID) you are claiming. Attach a separate sheet if extra space is needed. Please note that the claim identification number (CID) will not be accepted in lieu of listing each property identification number. Please refer to the information on your Claim Form, if

you received it from our office, or to the property detail pages you were instructed to print from the SCO’s website for the PID numbers.

Section 6: Check the applicable box. Only one of the boxes shall apply:

Check the first box if one of the following applies:

The claimant is a beneficiary listed in the decedent’s will; or,

The decedent did not leave a will, but the claimant is the decedent’s successor as defined in Section 13006 of the California Probate Code.

Check the second box if one of the following applies:

The claimant is the guardian or conservator of the estate of the person entitled to any of the decedent’s property.

The claimant is the trustee of the decedent’s trust.

The claimant is a personal representative of beneficiary(ies) of the decedent’s estate.

The claimant is an attorney-in-fact pursuant to a legally executed Durable Power of Attorney.

Fill in the name of the person or the name of the trust entitled to the decedent’s property, whichever is applicable. Please refer to the California Probate Code section 13051 and 13006 for more information.

Section 7, 8 and 9: In signing the form, you declare the statements in Sections 7, 8 and 9 are true.

Signature and Date: All claimants must print their name, sign, and date this form.

For a tutorial on completing this form, visit https://sco.ca.gov/upd_form_claim.html

Rev. 1/2020