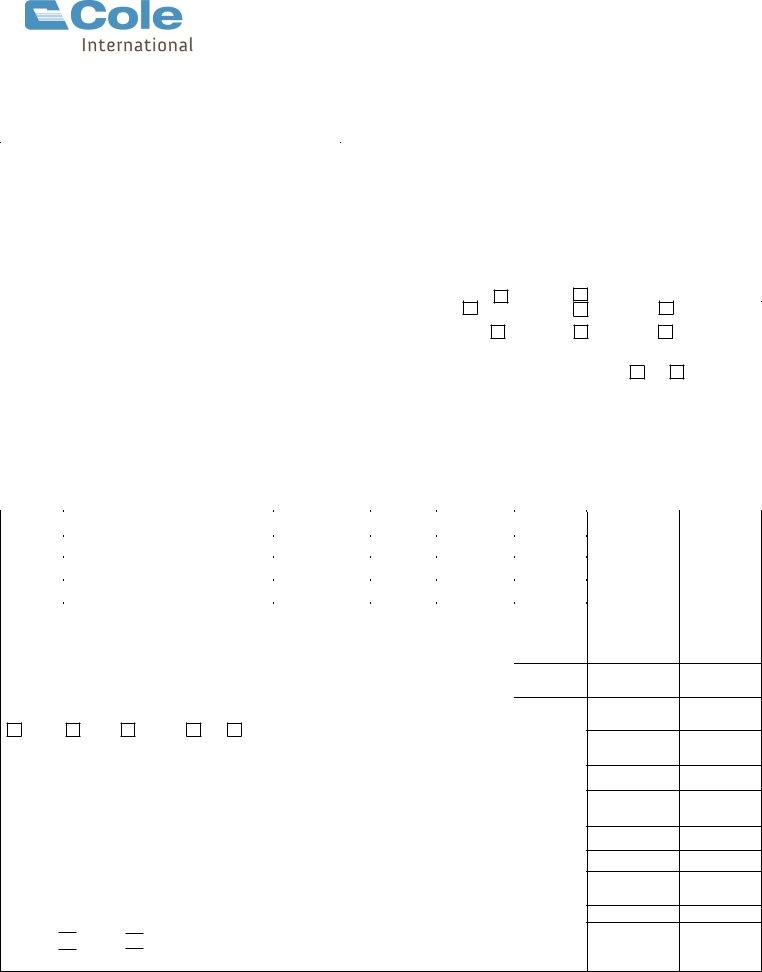

The Proforma Invoice form is a critical financial document used primarily in international trade that outlines the goods and services a seller intends to provide to a buyer, including detailed descriptions and terms of sale. It plays a fundamental role in the customs clearance process, acting as a preliminary bill of sale that helps authorities determine the value of goods for tax and duties purposes. The form captures key details such as the exporter's information, the tax ID of involved parties, the consignee and buyer details, and specifics about the transaction including the terms of sale, delivery, payment, and the total invoice value inclusive of brokerage fees, freight, duty, and taxes. Also enumerated are the various aspects of the shipped goods like the number of packages, their gross and net weights, the currency of the sale, and an itemized description with Harmonized Tariff Schedule (HTS) numbers, providing clear insight into the transaction. Its comprehensive nature requires the shipper's certification that all provided information is complete and accurate, a step that underscores its legal importance in trade and logistics. Notably, the document allows for the indication of goods not sold but exported for other reasons, such as repair or processing, rounding out its utility in facilitating international commerce efficiently and reliably.

| Question | Answer |

|---|---|

| Form Name | Proforma Invoice Form |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 71 |

| Avg. time to fill out | 14 min 31 sec |

| Other names | proforma proforma invoicepdffillercom |

P R O F O R M A I N V O I C E

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US CUSTOMS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exporter: |

|

|

Customs Clearance by: |

|

|

|

|

|

Exporter Reference Number: |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of invoice pages: |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page ___ of |

____ |

|

|

Tax ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consignee: |

|

|

Buyer, if other than consignee: |

|

|

|

|

|

|

|

|

||||||

Tax ID: |

|

|

Tax ID Number: |

|

|

|

|

|

|

|

|

|

|

|

|

||

Local Carrier: |

|

|

Terms of Sale – Delivery – Payment: |

|

|

|

|

|

|

||||||||

Exporting Carrier: |

|

|

Parties to this transaction are: |

Related |

|

|

Not Related |

|

|

|

|||||||

Port of Lading (country/province): |

|

Invoice value includes: |

Brokerage fee |

|

|

Freight |

Duty & Tax |

|

|||||||||

US Port of Entry: |

|

|

Total freight: |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Destination (country/state): |

|

Bill Customs charges to: |

|

|

|

Exporter |

|

|

Consignee |

Buyer |

|

||||||

|

Marks and Numbers: |

Numbers and Kind of Packages: |

|

|

Currency of Sale: |

|

|

|

|

||||||||

Country |

|

|

|

|

|

|

|

Gross Weight: |

|

|

LB |

|

KG |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Origin |

|

Invoice Item Description |

HTS Number |

Unit Net |

Total Net |

|

|

|

|

|

|

|

|

||||

(MFGR) |

|

Weight |

Weight |

|

Quantity |

Unit Price |

|

Total |

|

||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If goods are not sold, state reason for export (loan, repair, processing, etc.) |

Ttl Net |

Ttl Qty |

||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Mode of Transportation from point of exit: |

|

|

|

|

Export Permit Number |

|||

Road |

Rail |

Ocean |

Air |

Other |

|

|

||

|

|

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THE INFORMATION GIVEN ABOVE AND ON THE CONTINUATION SHEET(S), IF ANY, IS TRUE AND COMPLETE IN EVERY RESPECT.

GIVE FIRM NAME AND ADDRESS IF DIFFERENT FROM EXPORTER BOX ABOVE:

Shipper Signature: ________________________________________ Date: ________________________

Status: Owner Agent

Ttl All Items

Packaging

Ocean/Int’l

Freight/Transp

Domestic Freight Chg

Insurance

Misc. Transp.

Commission

Container

Assists

TOTAL

INVOICE

February 24, 2012