When you want to fill out prosperity statement bank, you won't have to install any sort of software - simply try our PDF tool. Our team is constantly endeavoring to enhance the editor and insure that it is even better for clients with its extensive features. Enjoy an ever-evolving experience now! It just takes a few easy steps:

Step 1: Click on the "Get Form" button above. It is going to open up our pdf tool so you could start filling out your form.

Step 2: As you access the online editor, you will notice the document all set to be completed. Aside from filling out different blanks, you may as well perform many other actions with the PDF, including putting on custom textual content, changing the original text, adding illustrations or photos, placing your signature to the PDF, and more.

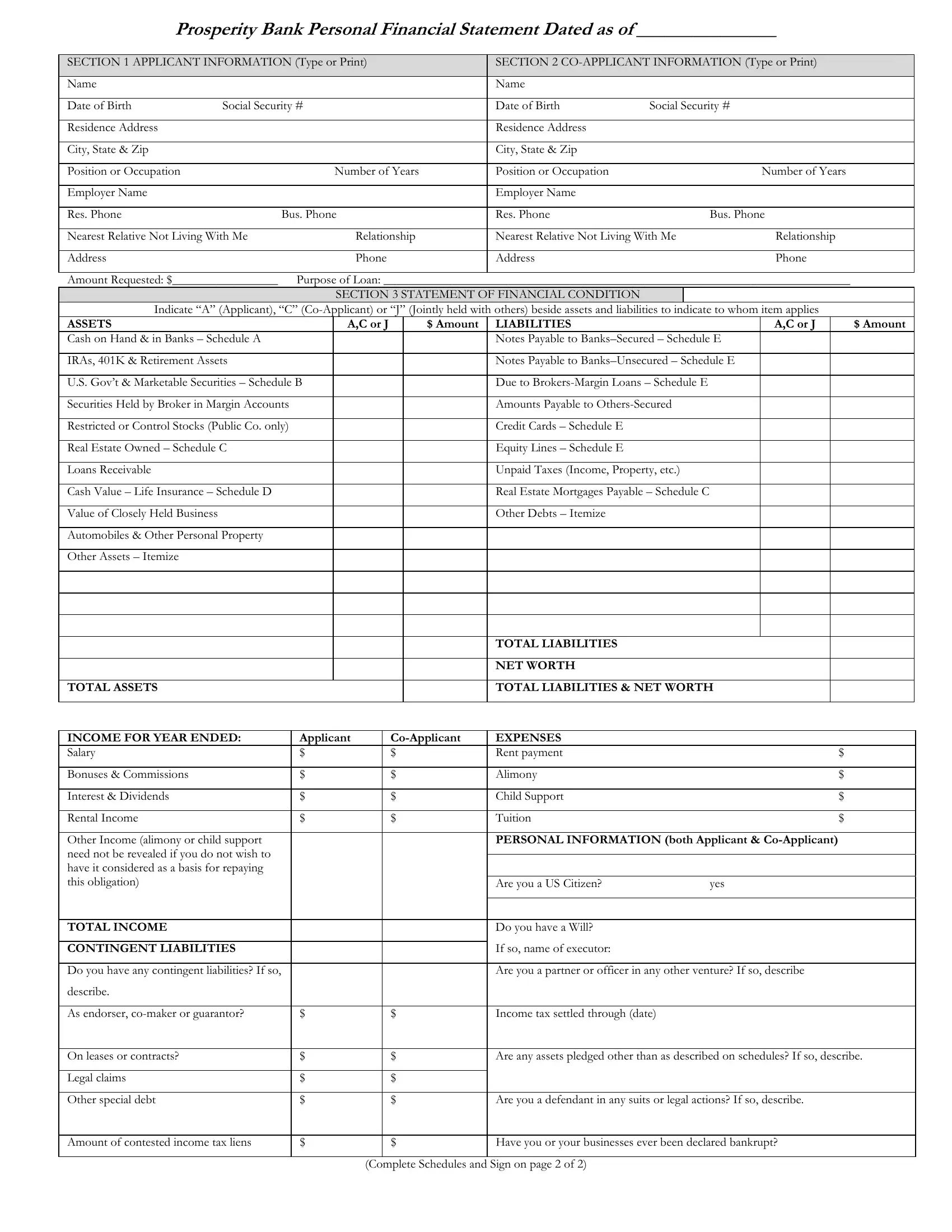

This form will need particular information to be entered, hence ensure you take the time to provide what's asked:

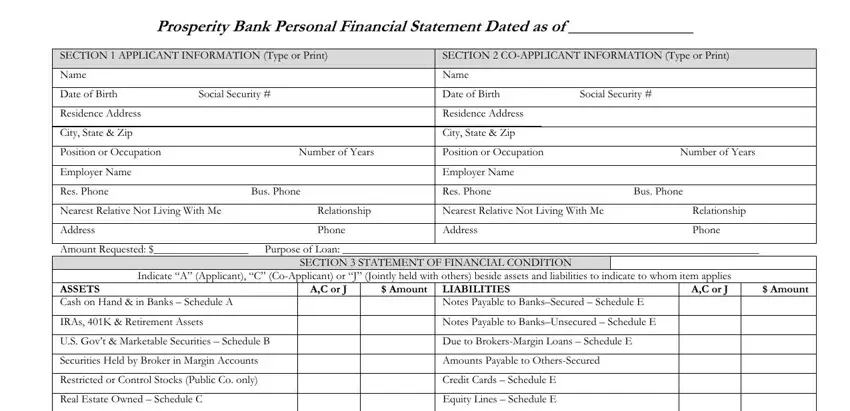

1. You should complete the prosperity statement bank correctly, thus be attentive while filling out the parts containing these blanks:

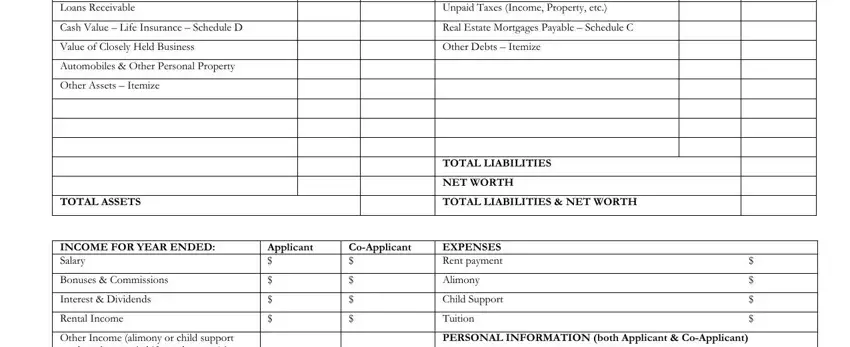

2. The third part is to fill in the next few blank fields: Loans Receivable, Cash Value Life Insurance, Value of Closely Held Business, Automobiles Other Personal, Unpaid Taxes Income Property etc, Real Estate Mortgages Payable, Other Debts Itemize, Other Assets Itemize, TOTAL LIABILITIES, NET WORTH, TOTAL LIABILITIES NET WORTH, Applicant, CoApplicant, EXPENSES Rent payment, and Alimony.

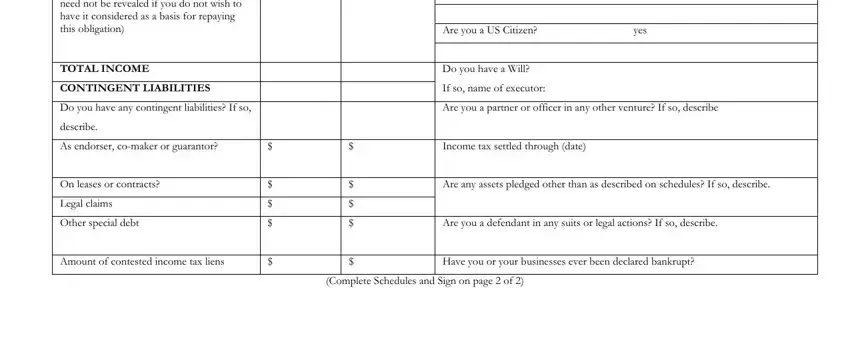

3. The following part is mostly about Are you a US Citizen, yes, Do you have a Will, If so name of executor, Are you a partner or officer in, Other Income alimony or child, TOTAL INCOME, CONTINGENT LIABILITIES, Do you have any contingent, describe, As endorser comaker or guarantor, Income tax settled through date, On leases or contracts, Legal claims, and Other special debt - complete all of these fields.

It is easy to make errors while filling in the Are you a US Citizen, therefore you'll want to take another look prior to when you finalize the form.

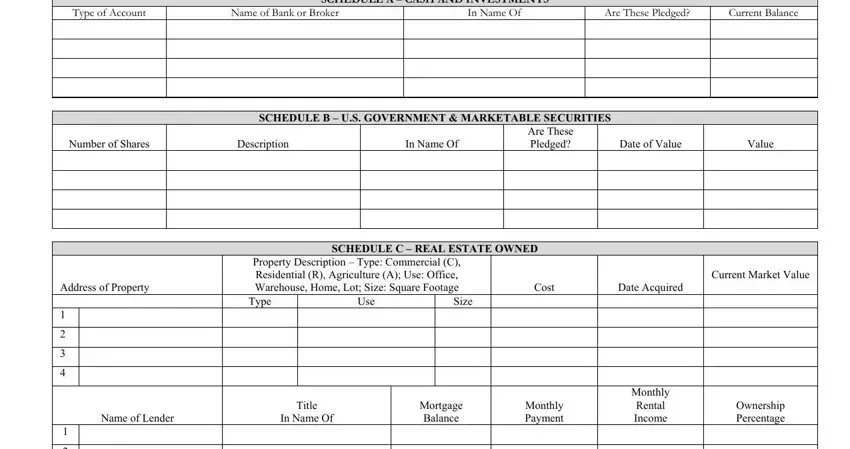

4. The following paragraph needs your involvement in the following areas: Date of Value, Value, Current Market Value, Date Acquired, Monthly Rental Income, Ownership Percentage, SCHEDULE C REAL ESTATE OWNED, Property Description Type, Type, Use, Title, In Name Of, Size, Mortgage Balance, and Cost. Remember to give all of the requested details to move forward.

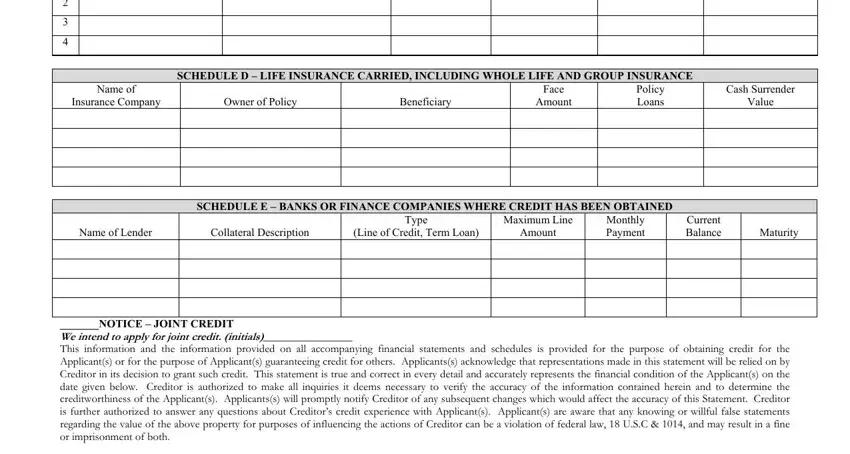

5. And finally, this last subsection is precisely what you'll want to wrap up prior to using the PDF. The blanks in this instance are the following: SCHEDULE D LIFE INSURANCE CARRIED, Name of, Insurance Company, Owner of Policy, Beneficiary, Face, Amount, Policy Loans, Cash Surrender, Value, SCHEDULE E BANKS OR FINANCE, Type, Maximum Line, Name of Lender, and Collateral Description.

Step 3: Spell-check the details you've entered into the blank fields and hit the "Done" button. Make a free trial plan with us and acquire instant access to prosperity statement bank - downloadable, emailable, and editable in your personal account. FormsPal provides safe document editor with no personal data recording or sharing. Be assured that your data is secure with us!