aicpa prp 4400 can be completed in no time. Just open FormsPal PDF editor to accomplish the job without delay. The tool is constantly upgraded by us, getting additional functions and becoming greater. Getting underway is effortless! Everything you should do is follow the following simple steps directly below:

Step 1: Click the "Get Form" button at the top of this page to get into our PDF editor.

Step 2: Once you start the file editor, you will get the document made ready to be completed. Besides filling in various fields, you could also perform several other things with the form, particularly writing your own text, editing the original textual content, inserting graphics, affixing your signature to the PDF, and a lot more.

As for the fields of this specific document, this is what you need to do:

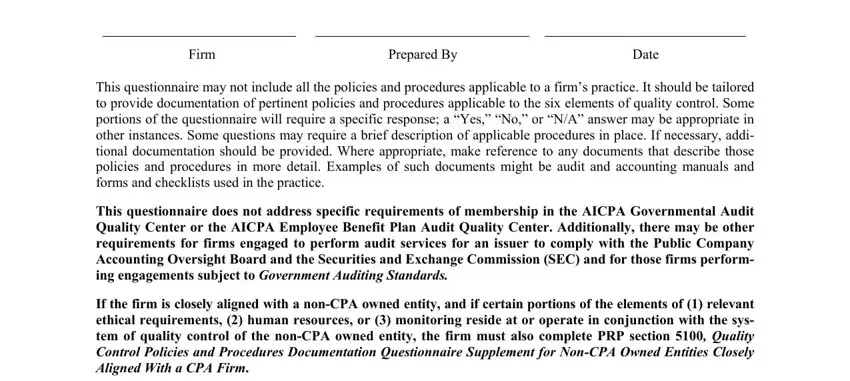

1. It is recommended to fill out the aicpa prp 4400 properly, hence be careful while filling in the segments comprising all these blank fields:

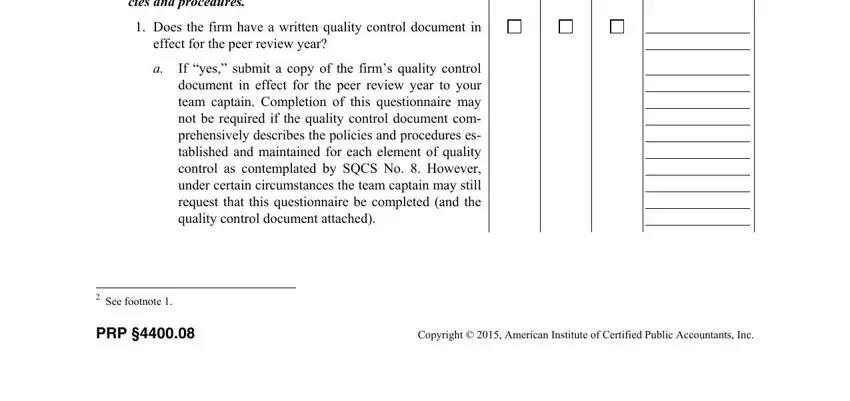

2. Right after the first section is done, go on to enter the suitable information in all these - Quality control policies and, Does the firm have a written, effect for the peer review year, If yes submit a copy of the firms, See footnote, PRP, and Copyright American Institute of.

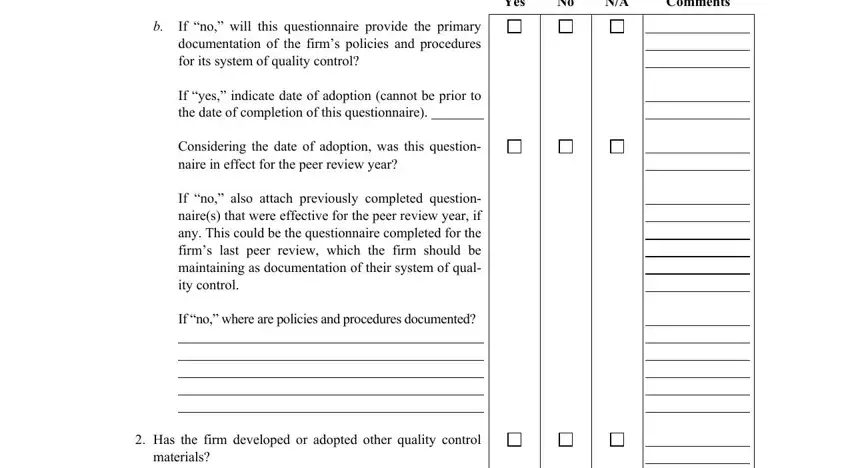

3. In this part, have a look at Yes, Comments, If no will this questionnaire, If yes indicate date of adoption, Considering the date of adoption, If no also attach previously, If no where are policies and, Has the firm developed or adopted, and materials. All of these will have to be filled in with highest focus on detail.

Many people frequently make mistakes when filling in Yes in this section. Be certain to review what you type in right here.

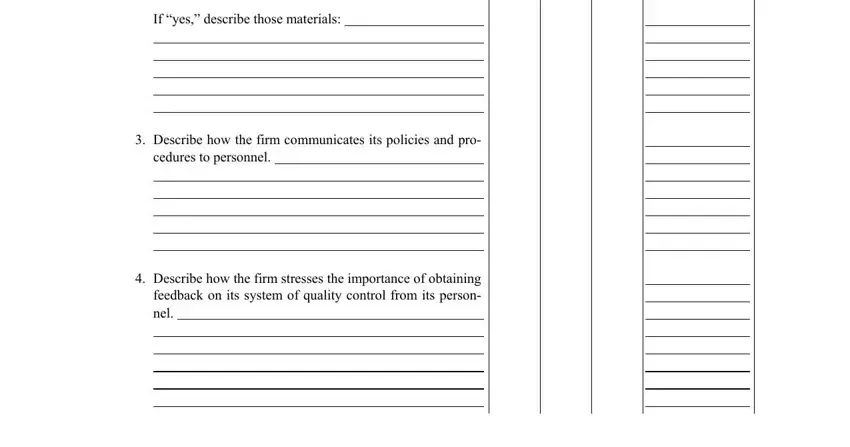

4. Filling out If yes describe those materials, Describe how the firm, cedures to personnel, and Describe how the firm stresses is paramount in this fourth form section - be sure to spend some time and fill out every single field!

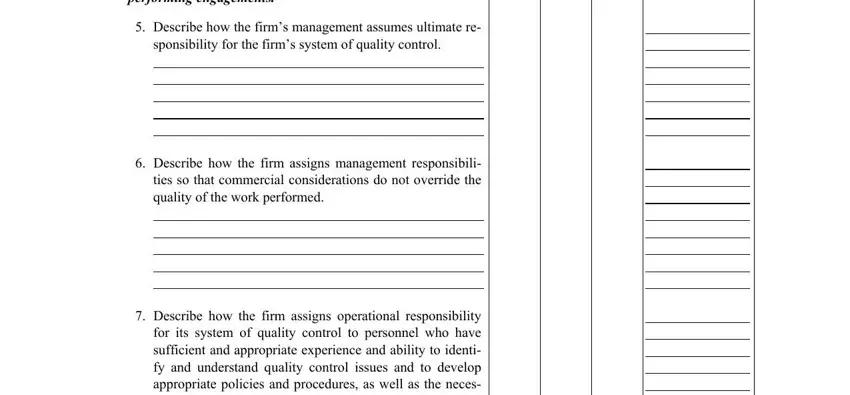

5. This last section to finalize this document is essential. Be sure to fill out the necessary blanks, and this includes Quality control policies and, Describe how the firms management, sponsibility for the firms system, Describe how the firm assigns, and Describe how the firm assigns, prior to using the document. If you don't, it could result in an unfinished and potentially unacceptable paper!

Step 3: Soon after going through your fields you've filled in, press "Done" and you're all set! Obtain the aicpa prp 4400 after you register online for a 7-day free trial. Easily view the document from your FormsPal account, with any edits and changes being conveniently synced! FormsPal is focused on the personal privacy of our users; we always make sure that all personal information entered into our system remains secure.