public packet ppl can be completed effortlessly. Simply make use of FormsPal PDF editor to get it done without delay. To have our editor on the forefront of efficiency, we work to integrate user-driven features and enhancements on a regular basis. We're routinely looking for suggestions - join us in remolding PDF editing. It merely requires several easy steps:

Step 1: Just hit the "Get Form Button" at the top of this page to start up our pdf form editor. This way, you will find everything that is required to work with your file.

Step 2: The editor enables you to modify most PDF documents in many different ways. Improve it with customized text, correct what's already in the file, and put in a signature - all manageable within minutes!

This PDF form will require some specific information; in order to guarantee accuracy, you should take note of the guidelines just below:

1. Before anything else, once filling out the public packet ppl, beging with the form section that includes the following fields:

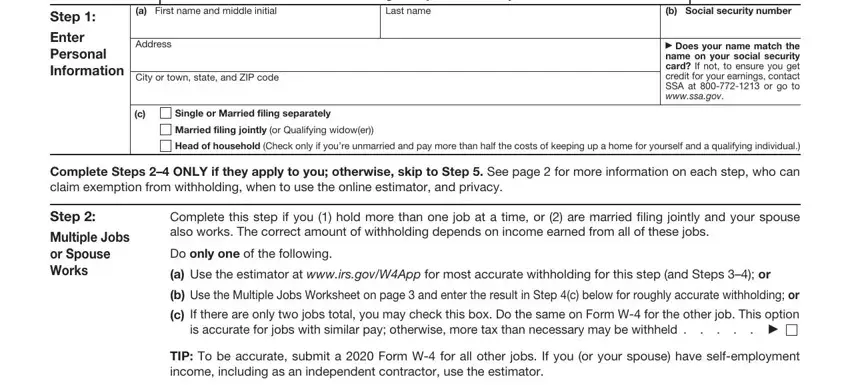

2. The third step is usually to fill in the next few fields: Department of the Treasury, cid Your withholding is subject to, Step, Enter Personal Information, a First name and middle initial, Last name, b Social security number, Address, City or town state and ZIP code, Single or Married filing separately, Married filing jointly or, cid Does your name match the name, Head of household Check only if, Complete Steps ONLY if they apply, and Step.

It is possible to make errors while filling in the b Social security number, hence be sure you go through it again before you decide to send it in.

3. In this part, have a look at Step, Claim Dependents, Step optional, Other Adjustments, Step, Sign Here, If your income will be or less, Multiply the number of qualifying, Multiply the number of other, Add the amounts above and enter, cid, Other income not from jobs If you, Deductions If you expect to claim, c Extra withholding Enter any, and Under penalties of perjury I. All these have to be filled in with highest focus on detail.

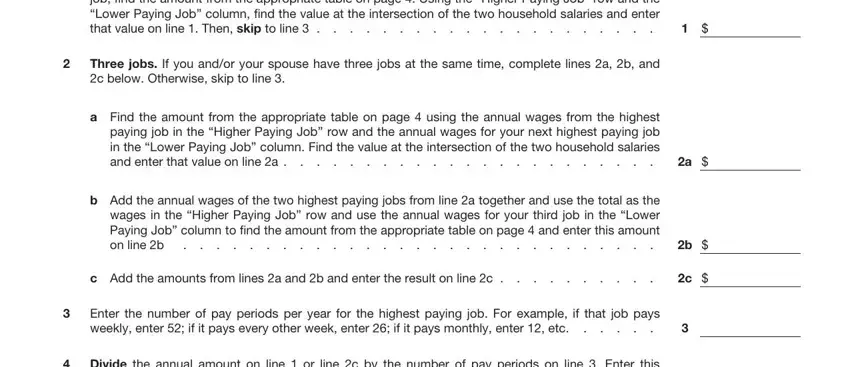

4. It's time to fill in this fourth portion! Here you will get all of these Two jobs If you have two jobs or, Three jobs If you andor your, Find the amount from the, Add the annual wages of the two, c Add the amounts from lines a and, Enter the number of pay periods, and Divide the annual amount on line blanks to fill out.

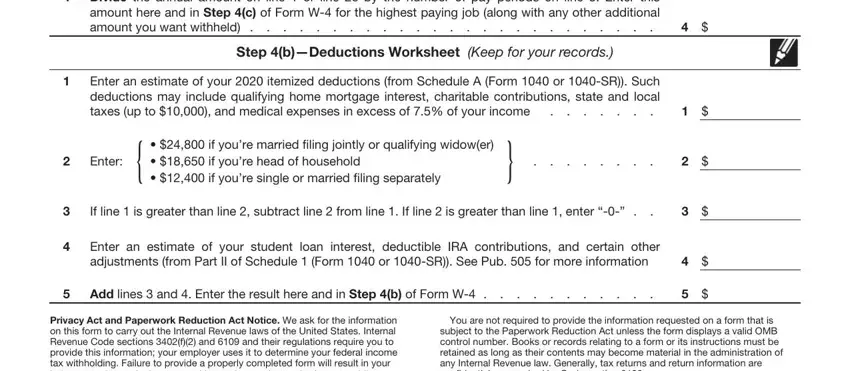

5. To conclude your form, the final part has a couple of extra blank fields. Typing in Divide the annual amount on line, Step bDeductions Worksheet Keep, Enter an estimate of your, Enter if youre married filing, if youre head of household if, If line is greater than line, Enter an estimate of your student, Add lines and Enter the result, Privacy Act and Paperwork, and You are not required to provide will finalize the process and you'll be done in no time!

Step 3: When you've glanced through the information in the document, click on "Done" to finalize your document creation. Find the public packet ppl after you join for a 7-day free trial. Conveniently view the pdf document inside your FormsPal account page, along with any edits and changes being conveniently synced! FormsPal guarantees risk-free document completion devoid of personal data recording or sharing. Feel at ease knowing that your details are in good hands with us!