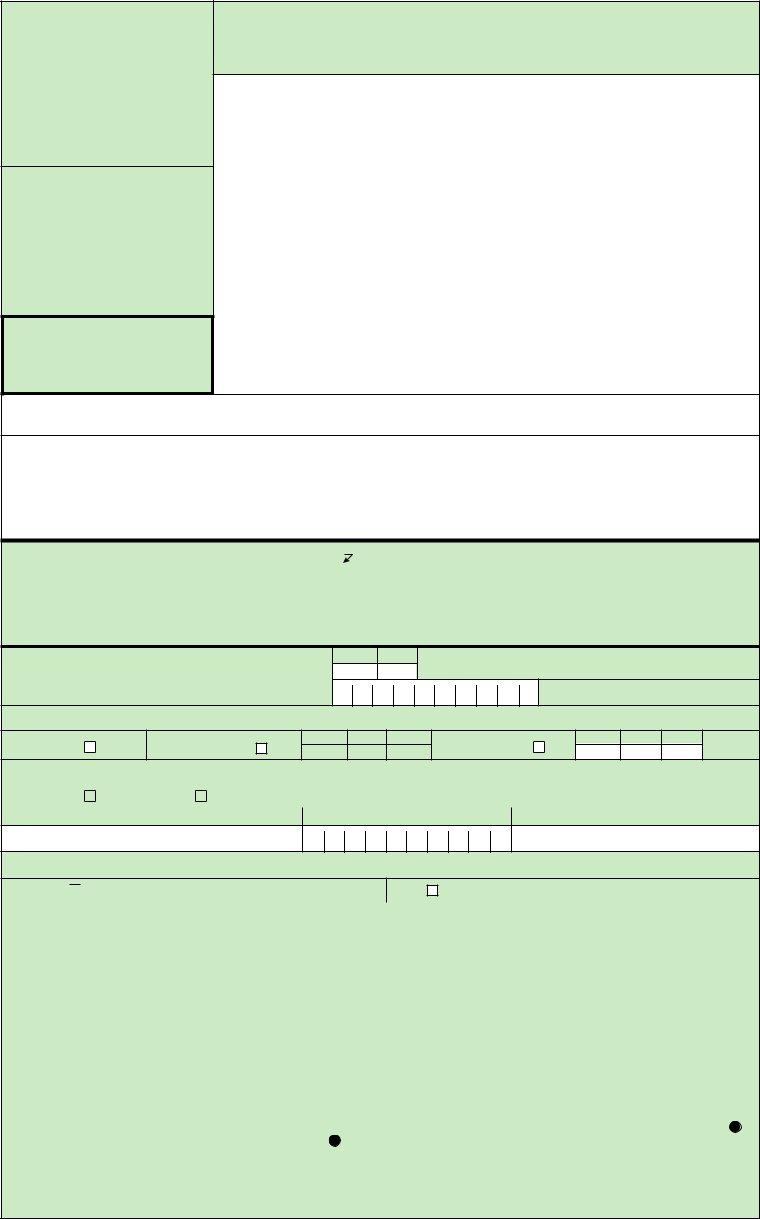

The U.S. Census Bureau, operating under the Department of Commerce, mandates the completion of the Quarterly Financial Report (QFR-200) for sectors like manufacturing, mining, retail, and wholesale trade. Located in Jeffersonville, Indiana, and reachable through a dedicated helpline, the form is part of a regulatory requirement that emphasizes the confidentiality of the submitted information, adhering strictly to Title 13 of the United States Code. This form, which carries the OMB approval number 0607-0432 valid until October 31, 2021, details the financial performance of corporations, requiring inputs on various operational, income, and balance sheet items. Notably, the form allows estimates for unavailable actual data, signaling a degree of flexibility in compliance. Internet submission is encouraged for efficiency, supplemented with support channels for any needed assistance. Furthermore, the QFR-200 outlines specific regulations for the consolidation of financials, clearly directing the inclusion or exclusion of subsidiaries based on set criteria, thereby ensuring uniformity and comparability of the reported data. Its comprehensive nature demands detailed disclosures ranging from sales and operating revenues to the specifics of balance sheet items, all reported in thousands, underscoring the relevance of this form in providing a snapshot of a corporation's financial health and operational success within the stipulated sectors.

| Question | Answer |

|---|---|

| Form Name | Qfr 200 Fillable Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | census 2020, qfr 200, qfr form pdf, qfr 200 mt form |

OMB No.

FORM

U.S. DEPARTMENT OF COMMERCE

U.S. CENSUS BUREAU

QUARTERLY FINANCIAL

REPORT

MANUFACTURING,

MINING, RETAIL, AND WHOLESALE TRADE

PLEASE READ the accompanying instructions before answering the questions.

NEED HELP?

USE Secure Messaging Center at Internet Website: econhelp.census.gov/qfr/contactus

Call 1 (800)

NOTE – Audited figures are not required. Estimates are acceptable for line items where actual data are not available.

Submit VIA Internet Reporting at: econhelp.census.gov/qfr

OR MAIL TO:

OR FAX TO:

NOTICE – YOUR RESPONSE IS REQUIRED BY LAW. Title 13 United States Code (U.S.C.), Section 91, authorizes this collection and requires your response. The U.S. Census Bureau is required by Section 9 of the same law to keep your information CONFIDENTIAL and can use your responses only to produce statistics. The Census Bureau is not permitted to publicly release your responses in a way that could identify your business, organization, or institution. Per the Federal Cybersecurity Enhancement Act of 2015, your data are protected from cybersecurity risks through screening of the systems that transmit your data. This collection has been approved by the Office of Management and Budget (OMB). The eight digit OMB approval number is

INTERNET REPORTING — You may complete this survey online at: econhelp.census.gov/qfr

Username: |

Password: |

Use your firm’s unique username and original password. |

●1 Person to contact regarding this report – Print or type

011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

013 |

Area code |

Number |

|

|

|

|

|

Extension |

014 Fax |

Area code |

Number |

|

|||||||||||||||||||||

Telephone |

( |

) |

|

|

|

– |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

ITEMS 2 THROUGH 7 REFER TO THE CORPORATION NAMED IN THE ADDRESS BOX

●2 a. Annual closing date of this corporation |

021 |

|

b. Federal Employer Identification Number (FEIN) 022

Month Day

–

●3 Corporation status – Mark "X" only ONE box. Insert discontinued or merged date if corporation is no longer operating.

a.Active

b.Discontinued

034

Month Day

Year

c.Merged

035

Month

Day

Year

●4 Is this corporation owned more than 50 percent by another corporation? (Mark "X" only ONE box.)

|

a. No |

|

|

b. Yes |

|

– Provide the name, FEIN, and address assigned to this corporation below. |

|||

|

|

|

|

||||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

043 |

Name |

|

|

|

044 |

FEIN |

045 |

Address |

|

|

|

|

|

|

|

|

|||

–

●5 Does this corporation own more than 50 percent of any other corporation – Mark "X" only ONE box.

a. Yes STOP! Read Consolidation Rules below.

b.No

–Proceed to page 2.

|

●6 What is the total number of domestic and foreign corporations directly or indirectly (all tiers) owned |

|

Number |

|

|

|

|

|

more than 50 percent by this corporation? |

061 |

|

|

●7 a. After reviewing the Consolidation Rules below, how many corporations are consolidated in this report? |

071 |

|

|

b. How many corporations are not consolidated in this report? |

072 |

|

|

|

|

|

CONSOLIDATION RULES: This is a

EXCEPTION: Do not fully consolidate domestic subsidiaries that are primarily engaged in foreign operations, banking, finance, or insurance (as defined in the North American Industry Classification System (NAICS) Sector 52, United States, 2007).

Do not fully consolidate foreign subsidiaries or foreign operations. Nonconsolidated subsidiaries must be reported using the equity method or cost method of accounting.

Equity method of accounting – Report net equity earnings (losses) of all nonconsolidated domestic and foreign operations on 8 line I of the Income Statement. Report the investment on 9 line I on the Balance Sheet. For purposes of this report, domestic operations refer to operations that are within the 50 United States and the District of Columbia. Commonwealths such as Puerto Rico and territories such as the Virgin Islands are not considered domestic.

CONTINUE ON PAGE 2

PLEASE KEEP A COPY OF THIS FORM FOR YOUR RECORDS

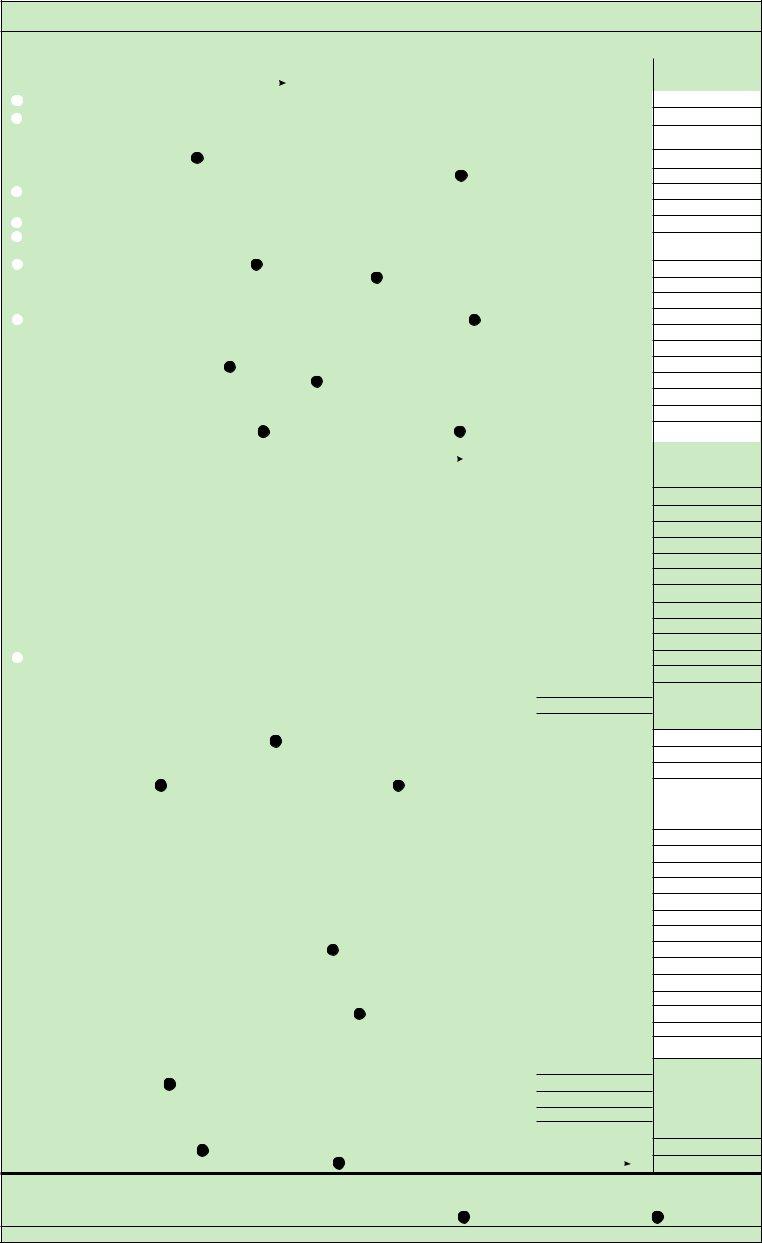

BEFORE COMPLETING THIS REPORT, READ THE CONSOLIDATION RULES ON THE PREVIOUS PAGE

AND THE ACCOMPANYING INSTRUCTIONS.

REPORT ALL DOLLAR FIGURES IN THOUSANDS. AUDITED FIGURES ARE NOT REQUIRED.

ESTIMATES ARE ACCEPTABLE FOR LINE ITEMS WHERE ACTUAL DATA ARE NOT AVAILABLE.

●8 |

Schedule A – Statement of Income and Retained |

401 |

FROM: Month |

Day |

Year |

402 |

TO: Month |

Day |

Year |

|

AMOUNT |

|

|

|

|

|

|

|

|

|

|

||||

|

Earnings for your |

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

||

A Sales, receipts, and operating revenues (net of returns and allowances, and excise and sales taxes)1 |

|

|

|

101 |

|

|||||||

. . . . . . . . . . |

. . . . . . |

. . . |

|

|

||||||||

B Depreciation, depletion, and amortization of property, plant, and equipment |

|

|

|

|

|

|

102 |

|

||||

. . . . |

. . . . . |

. . . . |

. . . . . . . . . . |

. . . . . . |

. . . |

|

|

|||||

C All other operating costs and expenses – Include cost of goods sold (net of purchase discounts), selling, general and administrative |

103 |

|

||||||||||

|

|

|||||||||||

|

expenses, and amortization of intangible assets |

|

|

|||||||||

DIncome (loss) from operations — 8 line A less the sum of lines B and C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104

EInterest expense — Do not net interest income with interest expense. Report interest income in 8 line G. . . . . . . . . . . . . . . . . 105

F Dividend income — Domestic and foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

106

G Other recurring nonoperating income (expense) — Include interest income, minority interest, etc. 2 . . . . . . . . . . . . . . . . . . . . . 107

HNonrecurring items — Include gain (loss) on sale of assets, restructuring costs, asset writedowns, disposal of business segments, etc. 2. 108

|

|

|

109 |

I |

Income (loss) of foreign branches and equity in earnings (losses) of domestic and foreign nonconsolidated subsidiaries and other |

|

|

|

investments accounted for by the equity method, net of foreign taxes |

. . . . . . . . . . . . . . . . . . . |

|

J |

Income (loss) before income taxes — Sum of 8 lines D, F, G, H, and I less line E |

. . . . . . . . . . . . . . . . . . . |

111 |

K Provision for current and deferred domestic income taxes (accrue payable in 10 lines D and H) |

|

|

|

|

|

|

112 |

|

1. Federal 3 |

. . . . . . . . . . . . . . . . . . . |

|

|

|

|

113 |

|

2. State and local 3 |

. . . . . . . . . . . . . . . . . . . |

|

|

|

|

115 |

L |

Income (loss) before extraordinary items and cumulative effect of accounting changes — 8 |

line J less lines |

|

|

|

|

116 |

M |

Extraordinary gains (losses), net of taxes 2 |

. . . . . . . . . . . . . . . . . . . |

|

N |

Cumulative effect of accounting changes, net of taxes 2 |

. . . . . . . . . . . . . . . . . . . |

117 |

ONet income (loss) for quarter — Sum of 8 lines L, M, and N. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118

PRetained earnings at beginning of quarter — If not the same as 10 lines

Q Cash dividends charged to retained earnings this quarter — Include 1120S cash distributions. . . . . . . . . . . . . . . . . . . . . . . . .

120

R Other direct credits (charges) to retained earnings — Include stock and other

●9 |

Schedule B1 – Balance Sheet – Assets |

403 |

Month |

|

|

Day |

Year |

|

AMOUNT |

|||

Balance Sheet date as of |

|

|

|

|

|

|

|

|

(in thousands) |

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

1. Cash and demand deposits in the U.S |

201 |

|

|||||||||

|

|

|||||||||||

|

2. Time deposits (certificates of deposit) in the U.S |

202 |

|

|||||||||

|

203 |

|

||||||||||

|

3. |

Cash and deposits outside the U.S |

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . |

. . |

. . . |

. . . . . . |

. . . |

204 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

1. U.S. Treasury and Federal agency securities — Subject to agreements to sell |

205 |

|

|||||||||

|

2. U.S. Treasury and Federal agency securities — Other, due in one year or less |

|

||||||||||

|

206 |

|

||||||||||

C 1. Commercial and finance company paper of U.S. issuers |

|

|

|

|

|

|||||||

. . |

. . . |

. . . . . . |

. . . |

207 |

|

|||||||

|

2. |

State and local government securities, due in one year or less |

|

|||||||||

|

208 |

|

||||||||||

|

3. |

Foreign securities, due in one year or less |

|

|||||||||

|

|

|

||||||||||

|

4. |

Other |

|

|

|

|

209 |

|

||||

|

. . |

. . . |

. . . . . . |

. . . |

|

|

||||||

D |

1. Trade receivables from the U.S. Government 4 . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . |

. . |

. . . |

. . . . . . |

. . . |

211 |

|

|

|

2. |

Other trade accounts and trade notes receivable (less allowance for doubtful accounts) 4 |

|

|

|

|

212 |

|

||||

|

. . |

. . . |

. . . . . . |

. . . |

|

|

||||||

E |

Inventories4 |

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . |

. . |

. . . |

. . . . . . |

. . . |

214 |

|

|

F All other current assets — Include prepaid expenses and income taxes receivable 4 |

|

|

|

|

215 |

|

||||||

216. . |

. . . |

. . . . . . |

. . . |

|

|

|||||||

G |

. . . . . . . . . . . . . . . . . . . . . . .1. Property, plant, and equipment — Include construction in progress |

217 |

|

|

|

|

|

|||||

|

2. |

Land and mineral rights |

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . |

|

|

|

|

|

|

||

|

3. |

Accumulated depreciation, depletion, and amortization |

218 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||

|

4. |

Net property, plant, and equipment — Sum of 109 |

lines |

|

|

|

|

219 |

|

|||

|

. . |

. . . |

. . . . . . |

. . . |

|

|

||||||

H U.S. Treasury and Federal agency securities, due in more than one year |

|

|

|

|

220 |

|

||||||

. . |

. . . |

. . . . . . |

. . . |

|

|

|||||||

IAll other noncurrent assets — Include investment in nonconsolidated entities,

JTOTAL ASSETS – Sum of 109 lines

●10 |

Schedule B2 – Balance Sheet – Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Loans from banks |

301 |

|

|

|||

|

|

|

{ |

302 |

|

|

||||

A |

2.Commercial paper |

|

|

|||||||

|

|

|

303 |

|

|

|||||

|

|

|

|

3.Other |

305 |

|

|

|||

B Advances and prepayments by the U.S. Government4 |

|

|

|

|

|

|

|

|

||

. . . . . . . . . . . . . . |

. |

. . . . |

. . . . . . . |

. . . . . . . . . . . . |

306 |

|

|

|||

C |

Trade accounts and trade notes payable |

|

|

|||||||

|

|

|

||||||||

D |

Domestic income taxes accrued, prior and current years, net of payments — |

{ |

1. Federal |

307 |

|

|

||||

|

|

|

||||||||

|

Include overpayments |

. . . . . . . . . . . . . |

2. State and local |

308 |

|

|

||||

|

|

|

310 |

|

|

|||||

|

|

|

|

1. Loans from banks |

|

|

||||

|

|

|

|

|

|

|||||

E |

Current portion of |

10 line G. |

{ 2.Bonds and debentures |

311 |

|

|

||||

|

|

|

||||||||

|

|

|

312 |

|

|

|||||

|

|

|

|

3.Other |

314 |

|

|

|||

F All other current liabilities — Include excise and sales taxes, accrued expenses, and current portion of operating leases 4 |

|

|

||||||||

|

|

|||||||||

|

|

|

|

1.Loans from banks |

316 |

|

|

|||

|

|

|

|

|

|

|||||

G |

317 |

|

|

|||||||

318 |

|

|

||||||||

|

|

|

|

3. Other |

320 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

H All other noncurrent liabilities — Incl. deferred taxes, minority stockholders’ interest, and |

|

|

||||||||

I 1. Capital stock and other capital — Include additional paid in capital |

|

|

321 |

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

. |

. . . . |

. . . . |

|

|

|

|

|

|||

|

10 |

|

|

|

322 |

|

|

|

|

|

|

2. Retained earnings (same as 8 line S) |

. . . . . . . . . . . . . . |

. |

. . . . |

. . . . |

|

|

|

|

|

|

3. Cumulative foreign currency translation adjustment |

|

|

|

323 |

|

|

|

|

|

|

. . . . . . . . . . . . . . |

. |

. . . . |

. . . . |

|

|

|

|

|

|

|

4. Other stockholders’ equity items — Include unearned compensation and ESOP debt guarantees |

324 |

|

|

|

|

|

|||

|

. . . . |

|

|

|

|

|

||||

|

5. Treasury stock at cost |

|

|

|

325 |

|

|

|

|

|

|

. . . . . . . . . . . . . . |

. |

. . . . |

. . . . |

|

|

|

|

|

|

|

6. Stockholders equity — Sum of 10 lines |

|

|

|

|

|

327 |

|

|

|

|

. |

. . . . |

. . . . . . . |

. . . . . . . . . . . . |

328 |

|

|

|||

J |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY — Sum of 10 lines |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

1Report sales and costs from the normal business activities of discontinued operations in the same manner as sales and costs from continuing operations.

2Attach a list and explain, on a separate sheet, the principal debits and credits reflected during the quarter.

3Attach a brief explanation on a separate sheet if tax provision is not shown (e.g., "net operating loss," "1120S," etc.).

4Progress payments and billings from U.S. Government and others should not be deducted from 109 lines

IMPORTANT: IN ALL CORRESPONDENCE WITH US, PLEASE REFER TO THE

FORM |

Page 2 |