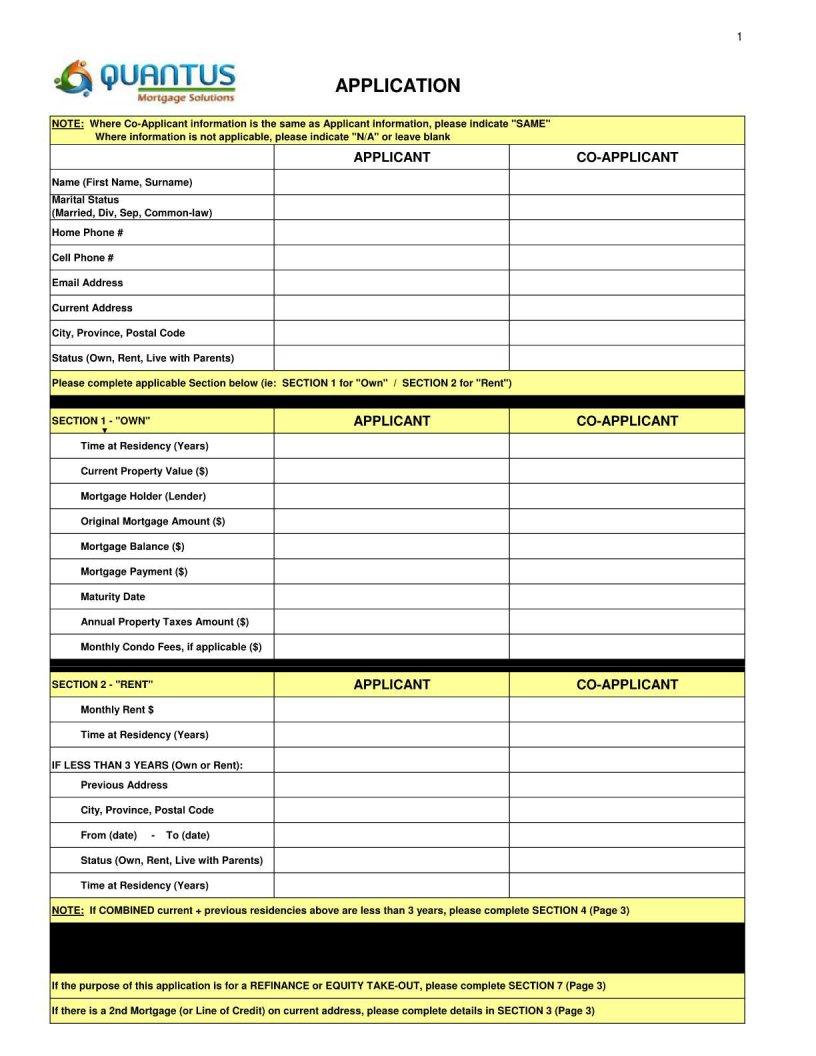

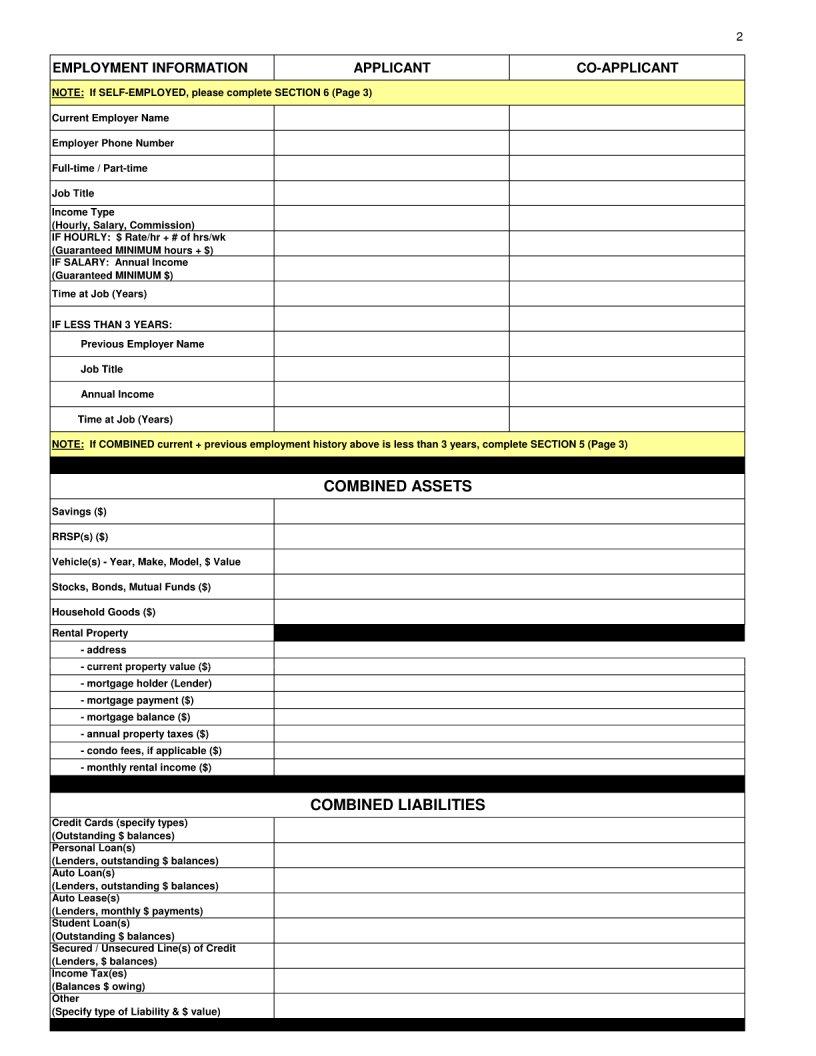

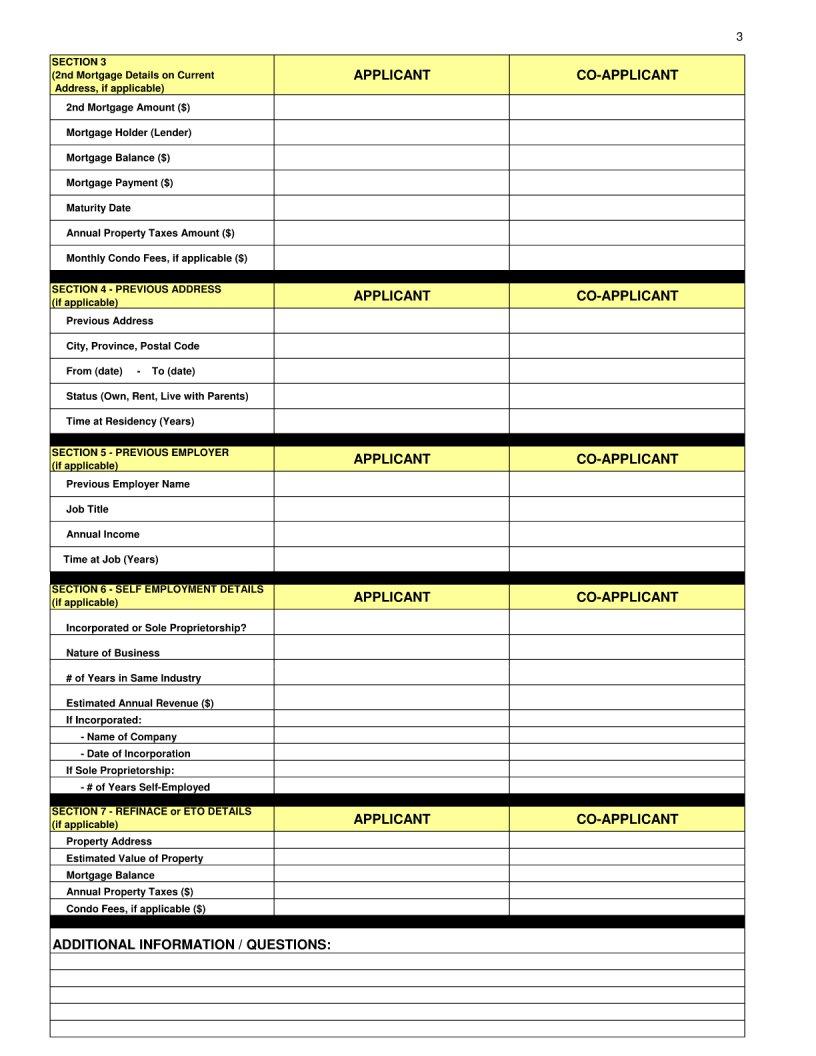

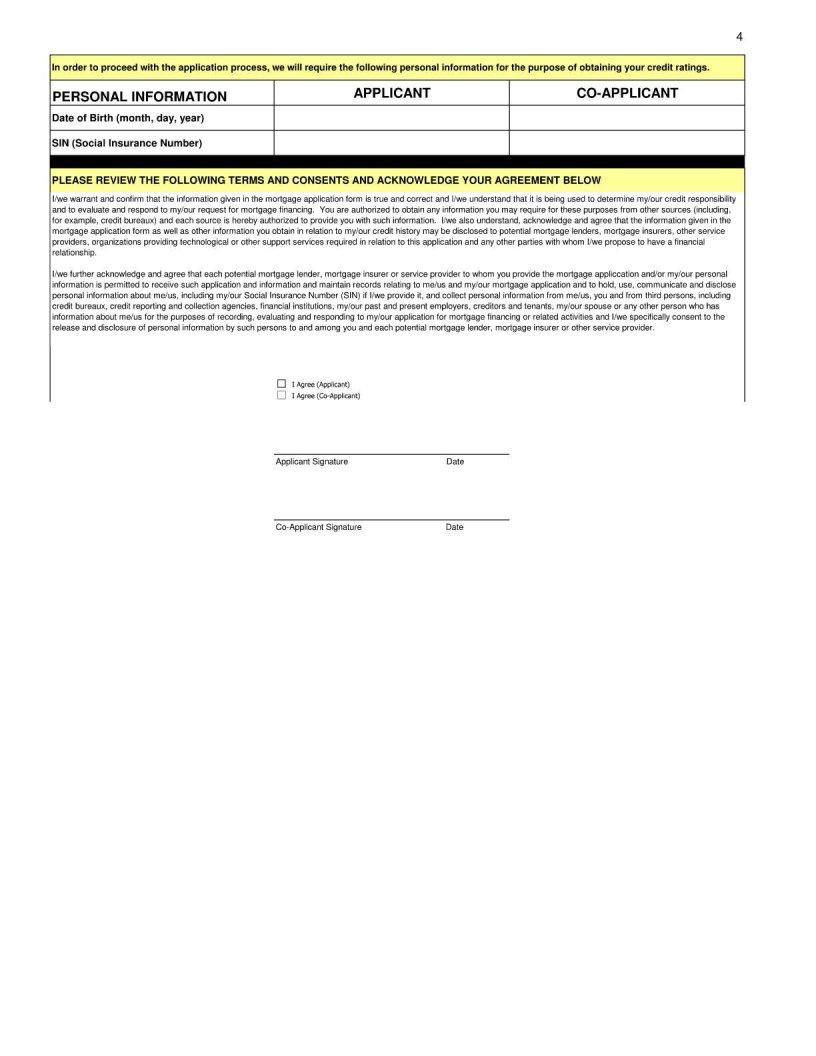

Navigating the process of securing a loan can often feel overwhelming, yet with the right tools and information, it becomes considerably more manageable. One such tool is the Qms Loan Application form, a crucial document designed to streamline the lending process. This form serves as the first step for potential borrowers to provide necessary information to lenders, including personal details, financial history, and the specifics of the loan being sought. The objective is clear: to assess the applicant's creditworthiness and determine eligibility for the loan. What makes the Qms form especially noteworthy is its comprehensive nature, covering all the critical aspects lenders need to make an informed decision. From employment history to current debts, the form ensures no stone is left unturned. It's designed with the user in mind, simplifying what can often be a complicated procedure. For applicants, completing the Qms Loan Application form accurately is pivotal, as it significantly impacts the lending decision and terms offered by financial institutions. Through this initial screening tool, lenders can effectively gauge the risk and potentiality of each application, making the Qms form an indispensable part of the loan application puzzle.

| Question | Answer |

|---|---|

| Form Name | Qms Loan Application Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | qms loan aplication form, qms loans forms, qms loans, qms consulting loans |