By using the online PDF editor by FormsPal, you can easily fill in or edit R 1201 Form here and now. The tool is constantly upgraded by our team, getting new features and becoming better. Should you be looking to begin, this is what you will need to do:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This tool lets you work with PDF files in a variety of ways. Modify it by writing any text, adjust original content, and include a signature - all close at hand!

It will be simple to complete the form using out detailed guide! Here's what you need to do:

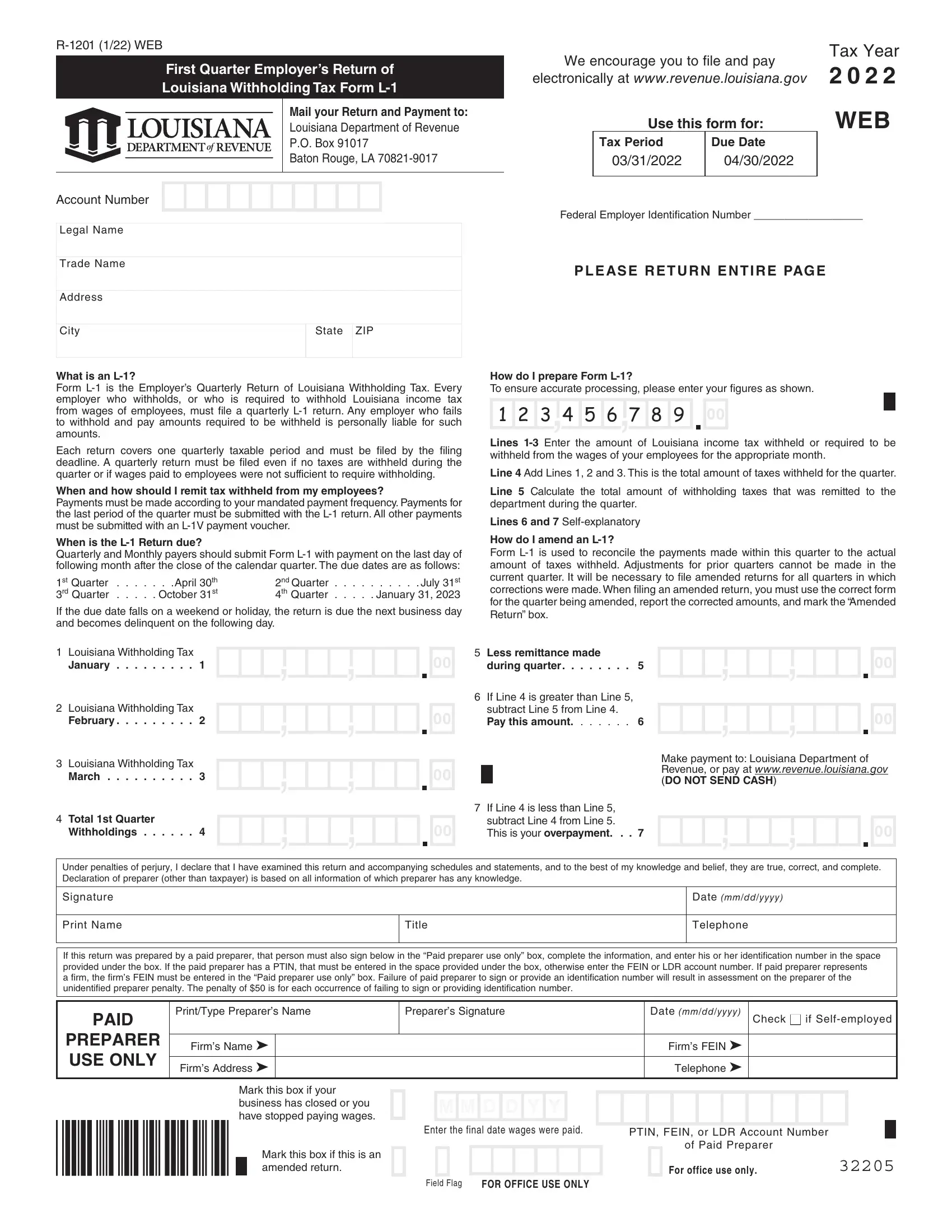

1. It is crucial to complete the R 1201 Form correctly, hence be attentive while filling out the areas that contain these particular blanks:

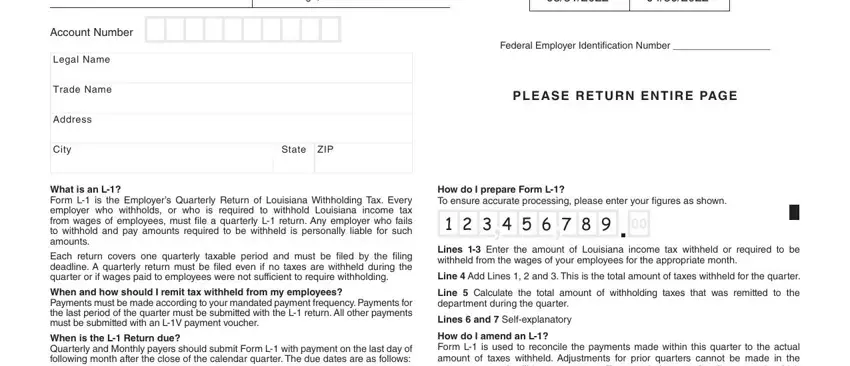

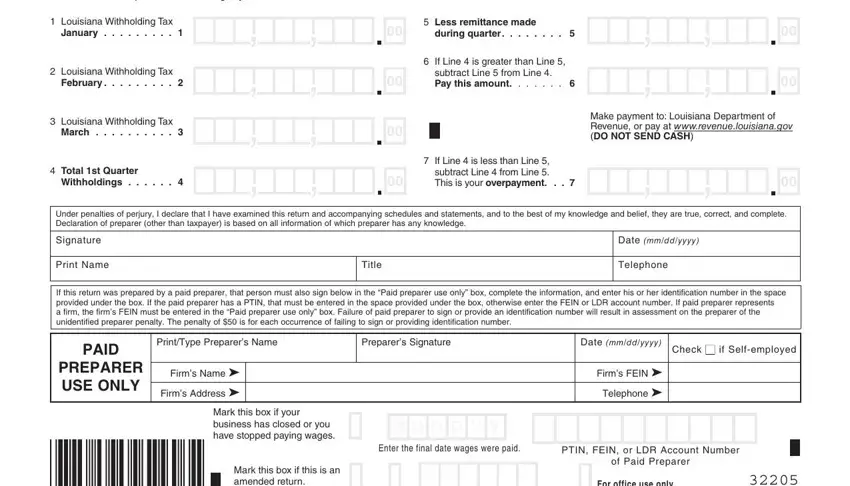

2. Immediately after this part is filled out, go on to type in the applicable details in these: When is the L Return due Quarterly, Louisiana Withholding Tax, January, Louisiana Withholding Tax, February, Louisiana Withholding Tax, March, Total st Quarter, Withholdings, Less remittance made, during quarter, If Line is greater than Line, subtract Line from Line Pay this, If Line is less than Line, and Make payment to Louisiana.

When it comes to Louisiana Withholding Tax and Make payment to Louisiana, make sure that you do everything properly here. Both of these are definitely the most significant fields in this form.

Step 3: Prior to moving forward, double-check that all blank fields were filled in as intended. Once you are satisfied with it, click on “Done." After starting a7-day free trial account with us, you'll be able to download R 1201 Form or email it immediately. The file will also be accessible via your personal cabinet with your modifications. We do not share any information that you provide whenever filling out forms at FormsPal.