Tangibles can be completed effortlessly. Simply try FormsPal PDF tool to finish the job in a timely fashion. To have our tool on the cutting edge of practicality, we strive to integrate user-oriented features and improvements on a regular basis. We're routinely looking for feedback - join us in revampimg how we work with PDF docs. To get started on your journey, go through these simple steps:

Step 1: Open the PDF form in our tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF editing tool, it is possible to do more than simply fill out forms. Express yourself and make your documents appear great with customized textual content added in, or fine-tune the original content to perfection - all that supported by the capability to incorporate stunning photos and sign the PDF off.

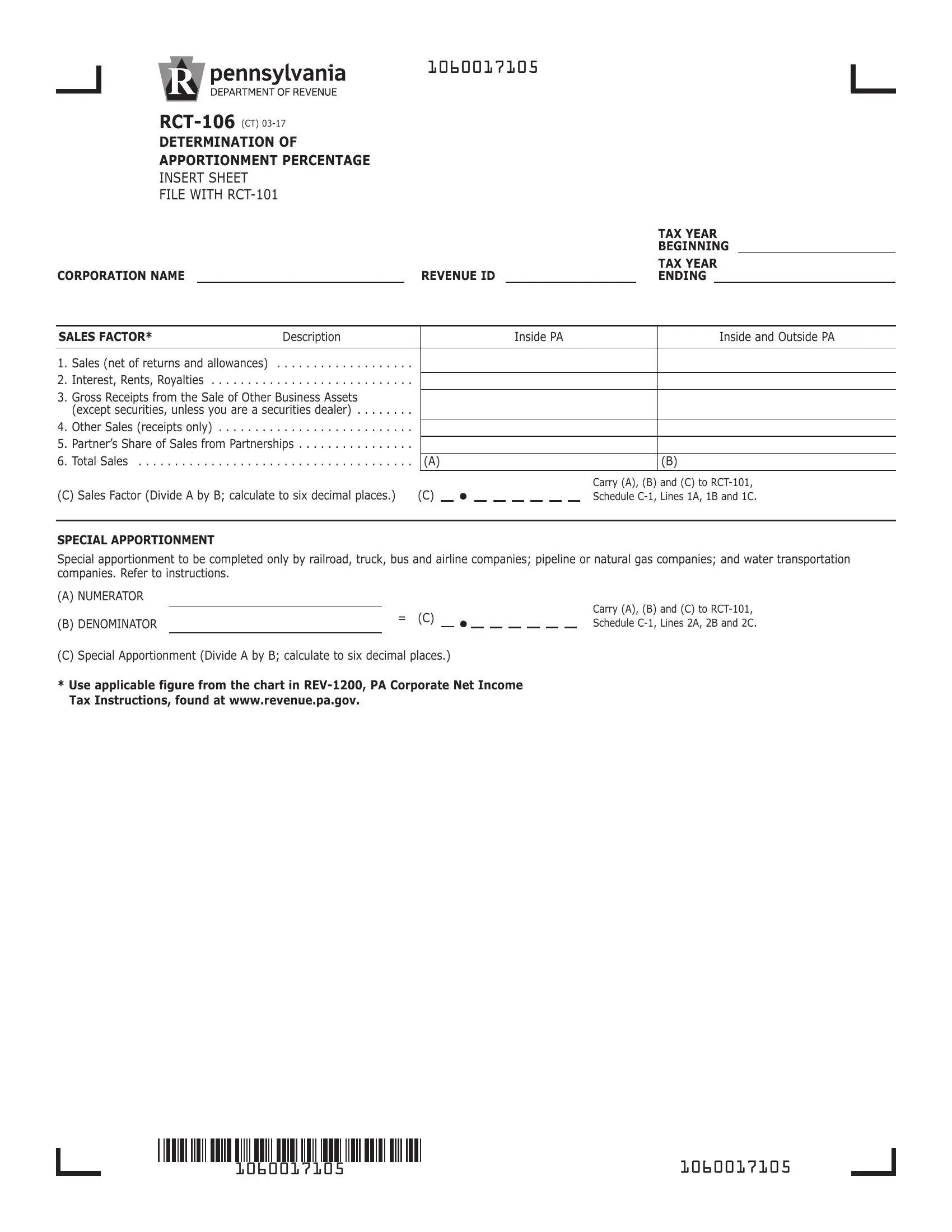

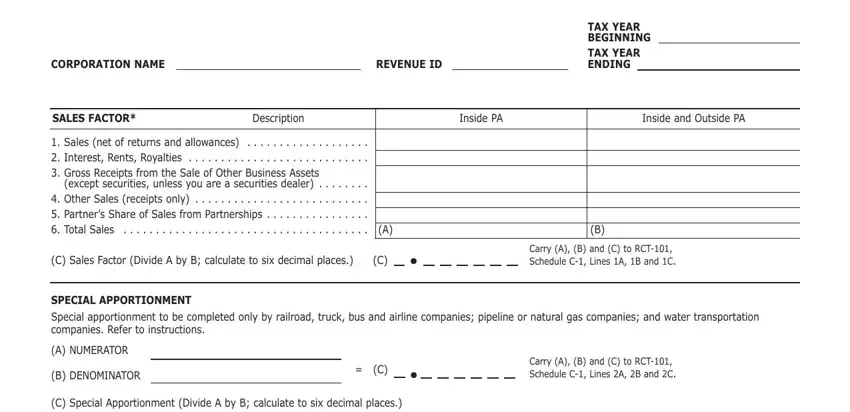

With regards to the blanks of this precise form, here is what you should do:

1. When filling in the Tangibles, be certain to include all of the necessary fields in its corresponding area. This will help expedite the process, which allows your information to be handled quickly and correctly.

Step 3: Soon after looking through your entries, hit "Done" and you are done and dusted! Get hold of your Tangibles the instant you register online for a 7-day free trial. Quickly view the document from your personal account page, with any edits and changes being conveniently preserved! We don't sell or share the details that you provide while dealing with documents at our website.