Once you open the online PDF editor by FormsPal, you can easily fill out or change Rct Fill Form here. To maintain our editor on the leading edge of practicality, we aim to integrate user-oriented capabilities and improvements regularly. We are always looking for suggestions - help us with revampimg how we work with PDF forms. With just a few easy steps, you'll be able to start your PDF journey:

Step 1: Just click the "Get Form Button" in the top section of this page to open our form editor. Here you'll find everything that is required to fill out your document.

Step 2: Using this handy PDF editor, you'll be able to accomplish more than merely fill in blank form fields. Edit away and make your forms look faultless with custom text put in, or tweak the file's original content to excellence - all backed up by an ability to add any images and sign the file off.

Pay close attention when filling out this pdf. Make certain every single field is filled out correctly.

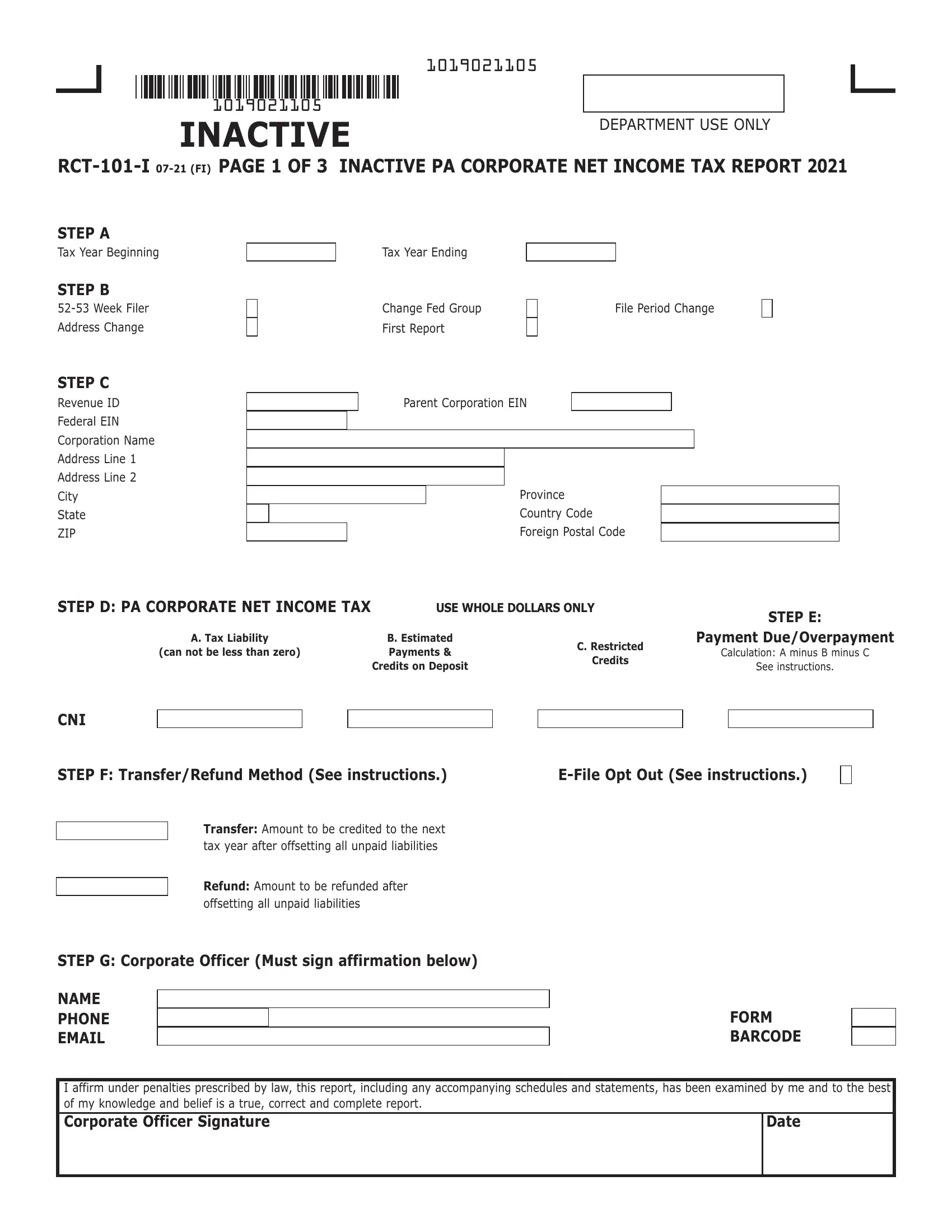

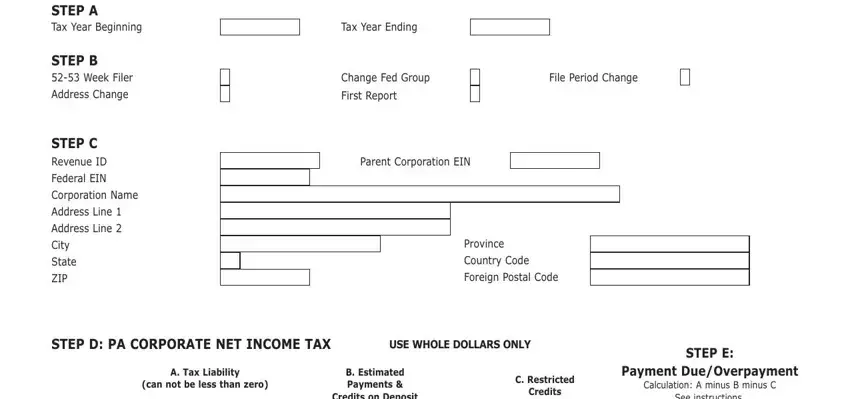

1. Fill out the Rct Fill Form with a selection of major fields. Note all the information you need and ensure there is nothing forgotten!

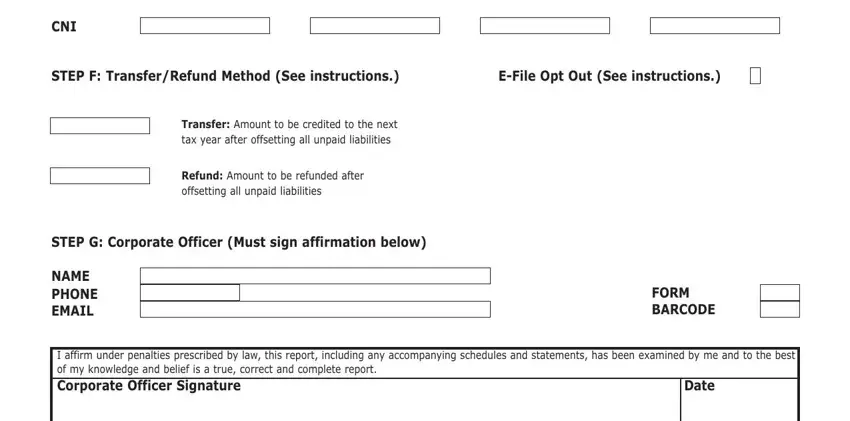

2. Your next part would be to submit the next few blank fields: Cni, STep F TransferRefund method See, eFile opt out See instructions, Transfer Amount to be credited to, Refund Amount to be refunded after, STep g Corporate officer must sign, name phone email, FoRm BaRCoDe, and I affirm under penalties.

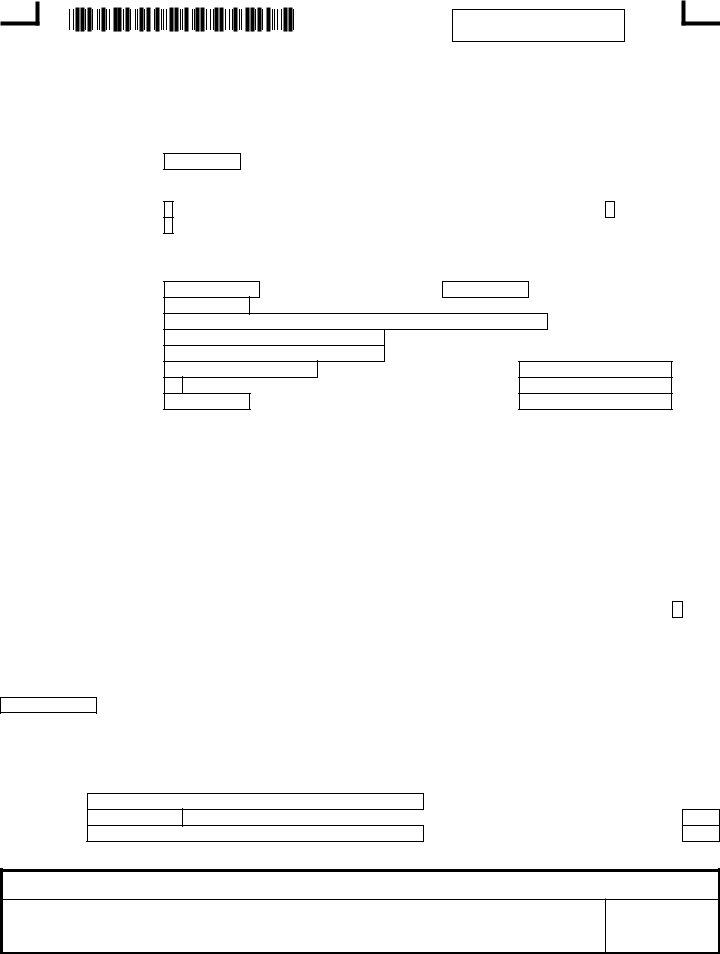

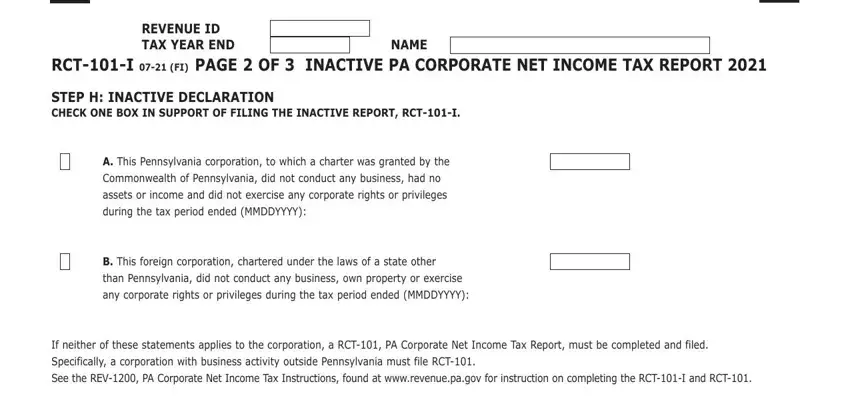

3. The third part is usually easy - fill in every one of the empty fields in Revenue iD Tax yeaR enD, name, RCTi Fi page oF inaCTive pa, STep h inaCTive DeClaRaTion CheCk, a This Pennsylvania corporation to, Commonwealth of Pennsylvania did, assets or income and did not, during the tax period ended, B This foreign corporation, than Pennsylvania did not conduct, any corporate rights or privileges, If neither of these statements, Specifically a corporation with, and See the REV PA Corporate Net to finish this process.

It is easy to make a mistake while completing the STep h inaCTive DeClaRaTion CheCk, hence make sure to reread it before you'll submit it.

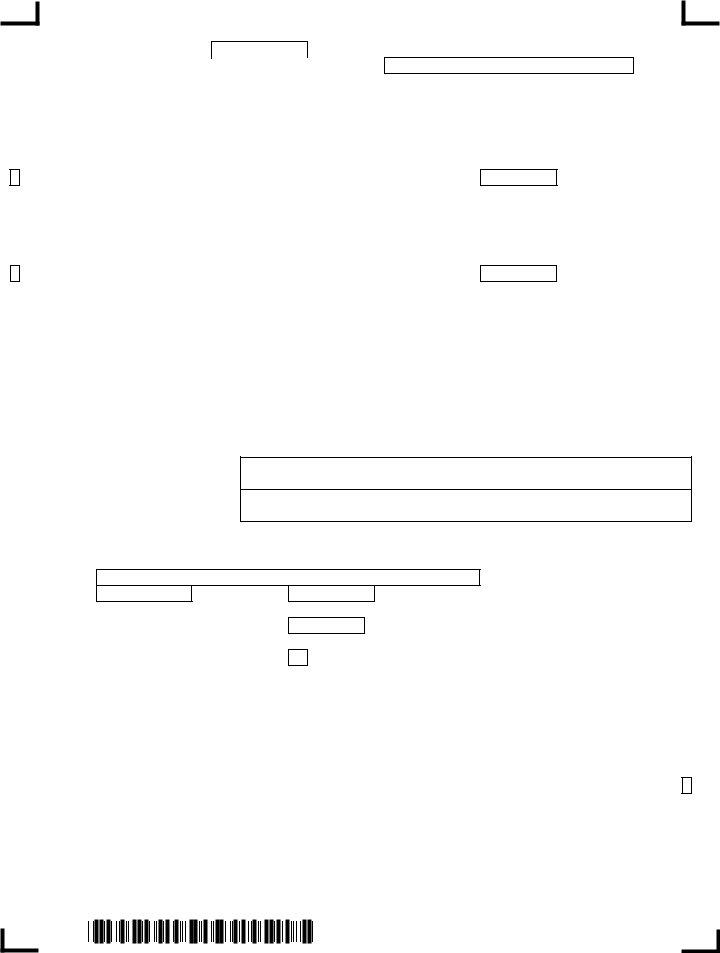

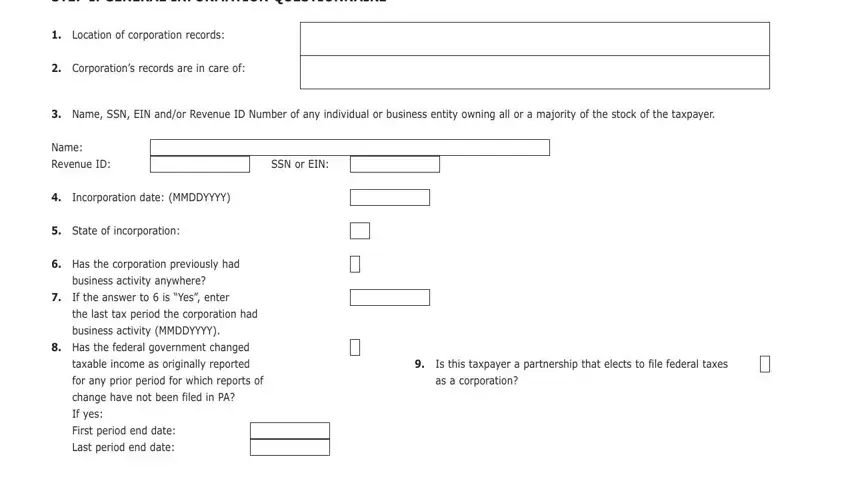

4. All set to proceed to this fourth portion! Here you have all these STep i geneRal inFoRmaTion, Location of corporation records, Corporations records are in care, Name SSN EIN andor Revenue ID, Name, Revenue ID, SSN or EIN, Incorporation date MMDDYYYY, State of incorporation, Has the corporation previously had, business activity anywhere, If the answer to is Yes enter, the last tax period the, business activity MMDDYYYY, and Has the federal government changed fields to do.

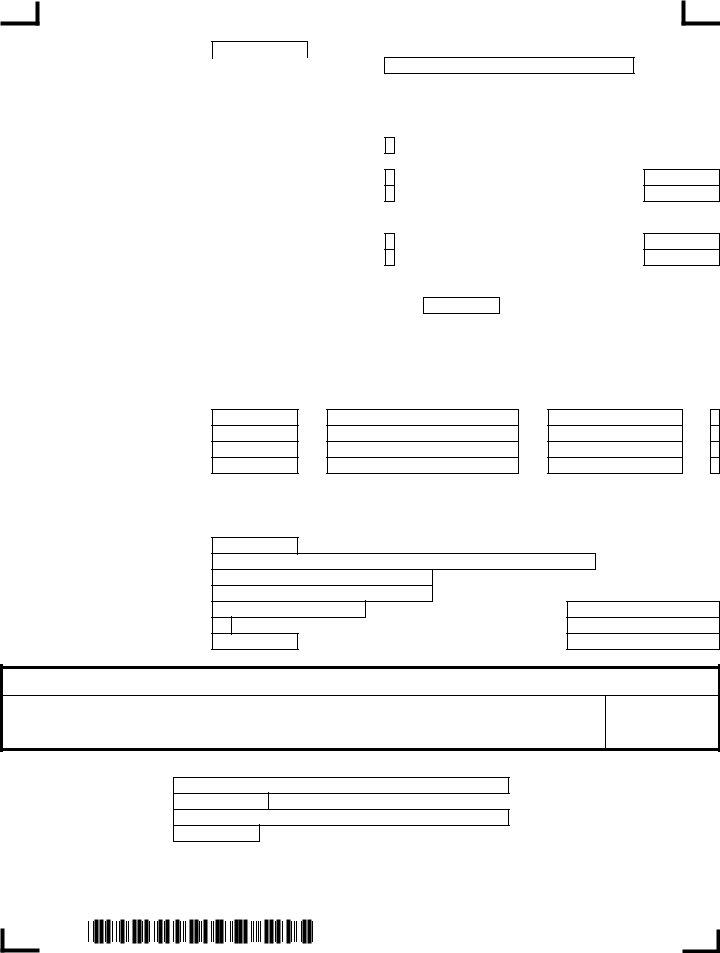

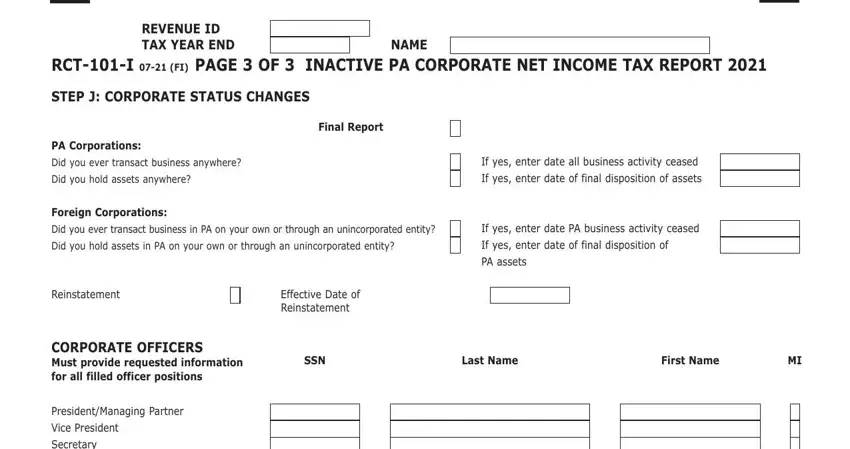

5. This very last notch to finalize this document is critical. Be sure to fill out the necessary blank fields, for example Revenue iD Tax yeaR enD, name, RCTi Fi page oF inaCTive pa, STep j CoRpoRaTe STaTuS ChangeS, Final Report, pa Corporations, Did you ever transact business, Did you hold assets anywhere, Foreign Corporations, If yes enter date all business, If yes enter date of final, Did you ever transact business in, If yes enter date PA business, Did you hold assets in PA on your, and If yes enter date of final, prior to using the form. Failing to do so might result in an incomplete and possibly unacceptable document!

Step 3: Just after rereading the fields, click "Done" and you're good to go! Join us today and easily gain access to Rct Fill Form, set for downloading. Each and every edit made is handily preserved , helping you to customize the pdf further when required. Here at FormsPal.com, we aim to ensure that all your information is maintained private.