kcmo rd 109nr form can be filled in with ease. Just try FormsPal PDF editor to accomplish the job promptly. To retain our tool on the cutting edge of convenience, we work to implement user-oriented capabilities and enhancements regularly. We're routinely pleased to receive feedback - join us in reshaping PDF editing. With just several simple steps, you may begin your PDF editing:

Step 1: Access the PDF form in our tool by clicking the "Get Form Button" in the top area of this page.

Step 2: The editor offers you the capability to customize nearly all PDF files in many different ways. Enhance it with customized text, adjust existing content, and put in a signature - all manageable within minutes!

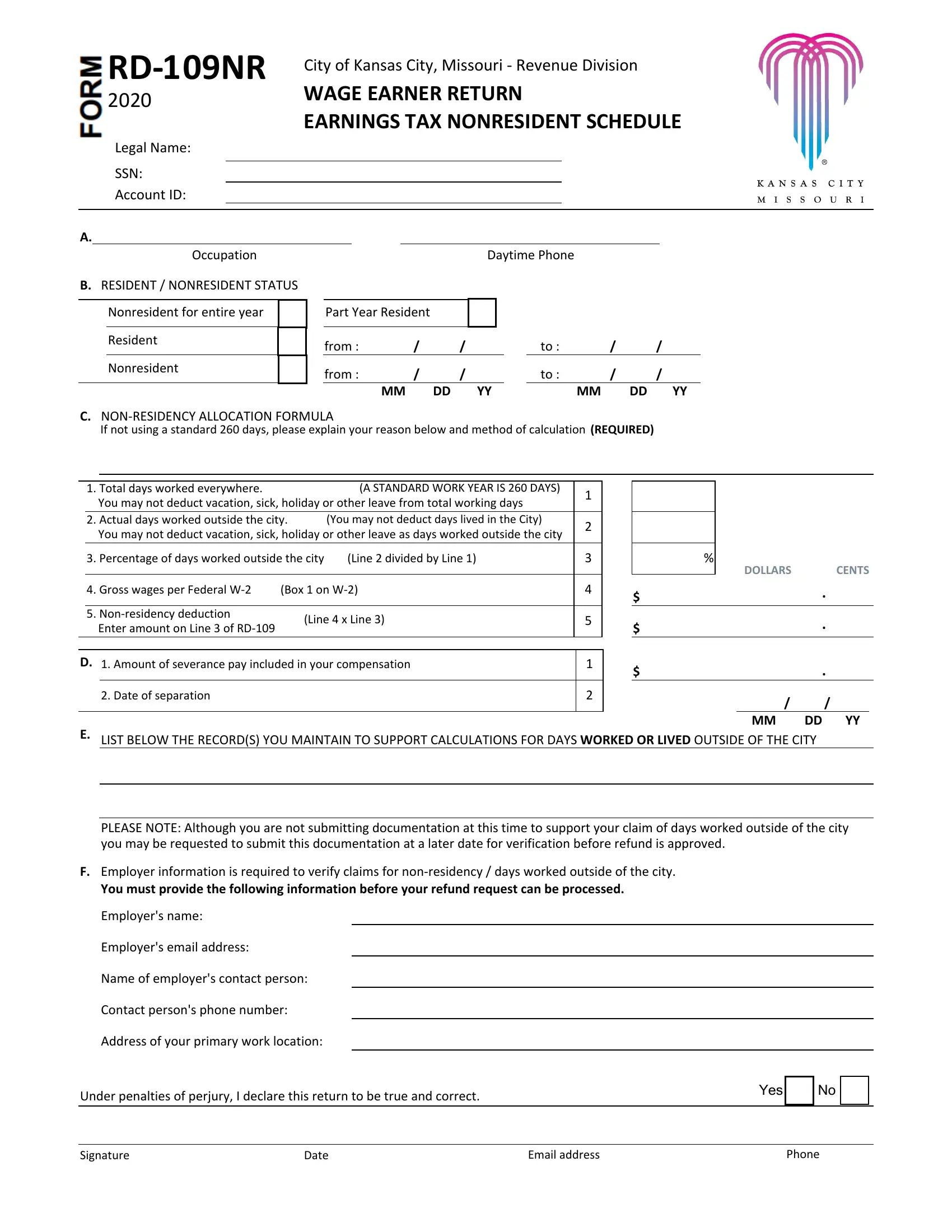

With regards to the fields of this particular PDF, here is what you need to know:

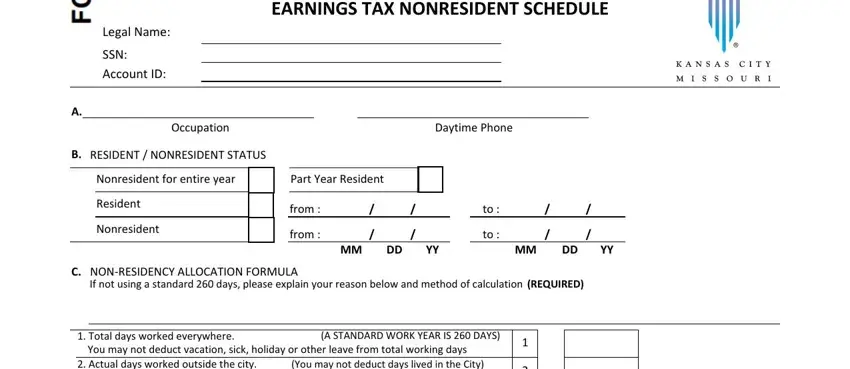

1. It's very important to fill out the kcmo rd 109nr form properly, so be mindful when filling out the areas that contain all of these fields:

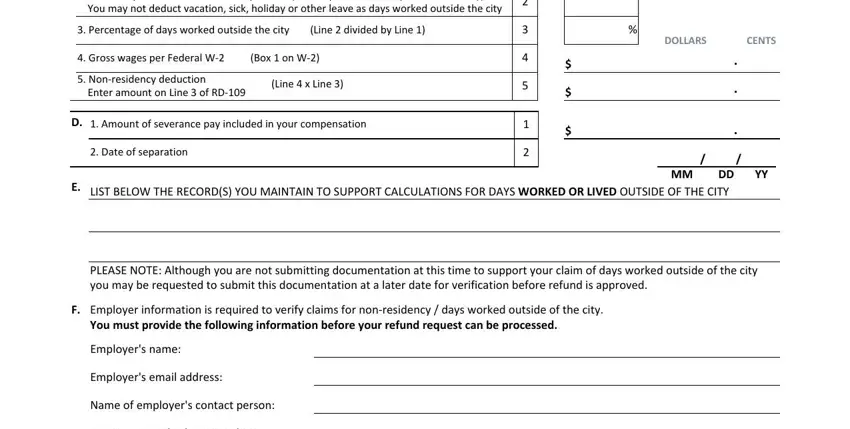

2. After the last section is done, you'll want to include the needed details in Total days worked everywhere You, You may not deduct days lived in, You may not deduct vacation sick, Percentage of days worked outside, Gross wages per Federal W Box on, Enter amount on Line of RD, Line x Line, D Amount of severance pay, Date of separation, DOLLARS, CENTS, DD LIST BELOW THE RECORDS YOU, PLEASE NOTE Although you are not, Employers email address, and Name of employers contact person so that you can go further.

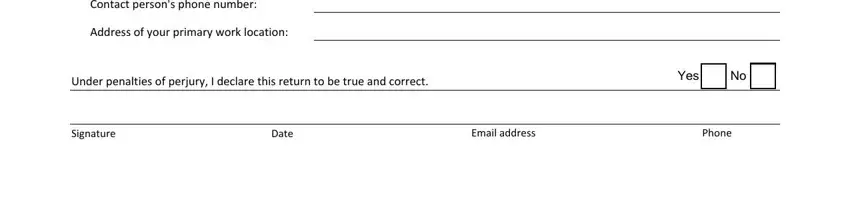

3. This next step is usually simple - fill out all the fields in Contact persons phone number, Address of your primary work, Under penalties of perjury I, Yes, Signature, Date, Email address, and Phone to complete this part.

In terms of Date and Email address, ensure you review things in this section. The two of these are considered the most important fields in this PDF.

Step 3: You should make sure your details are accurate and then simply click "Done" to proceed further. Join FormsPal now and instantly use kcmo rd 109nr form, prepared for download. All changes made by you are preserved , letting you change the pdf at a later stage if necessary. Here at FormsPal, we do our utmost to make sure your information is stored secure.