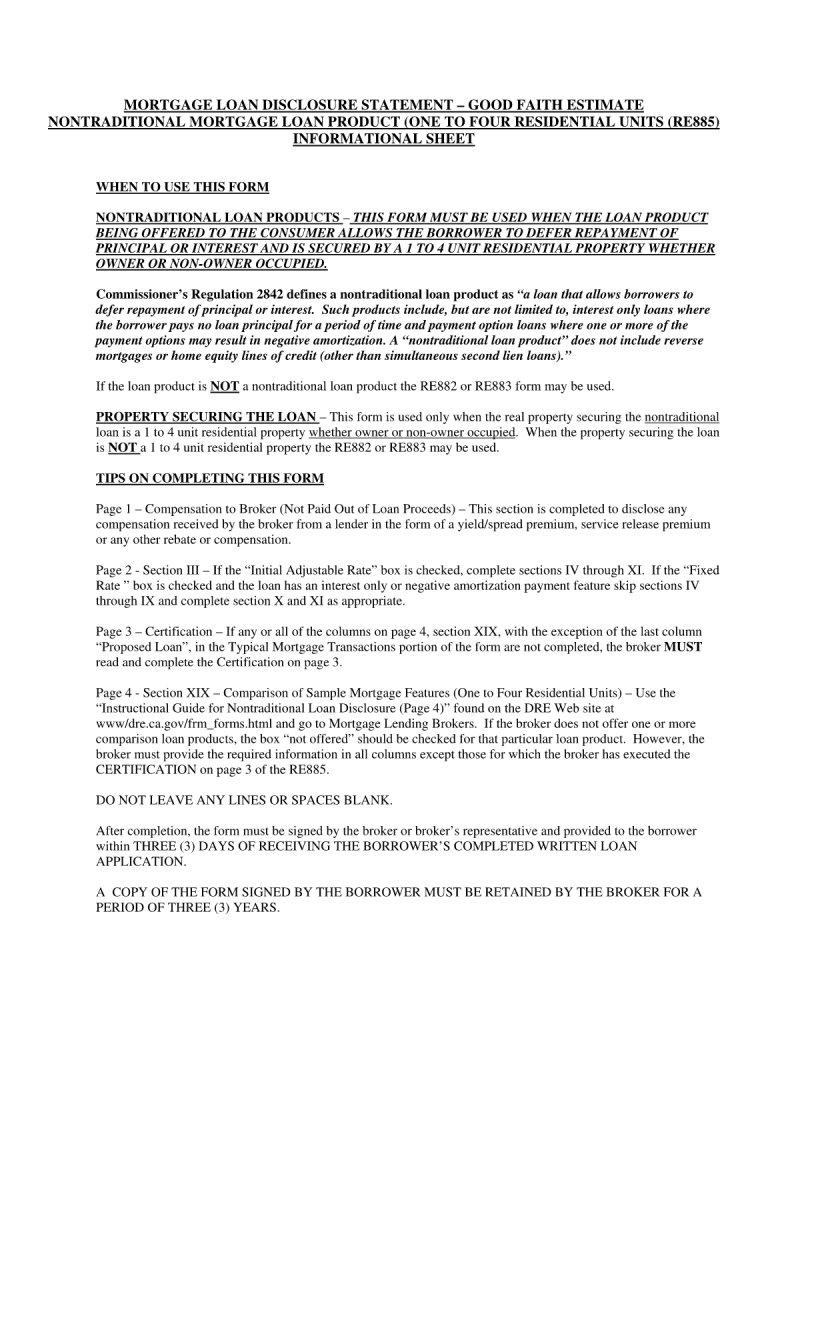

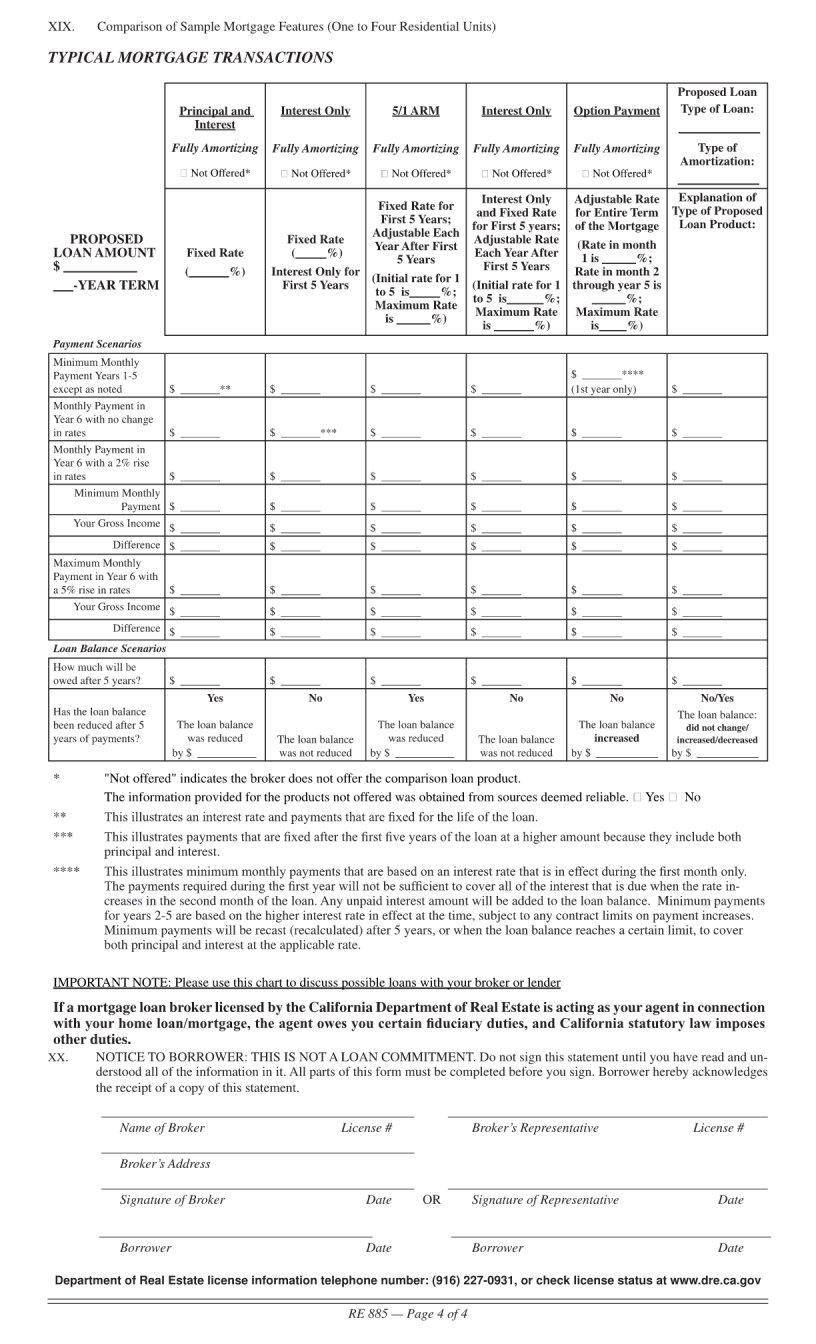

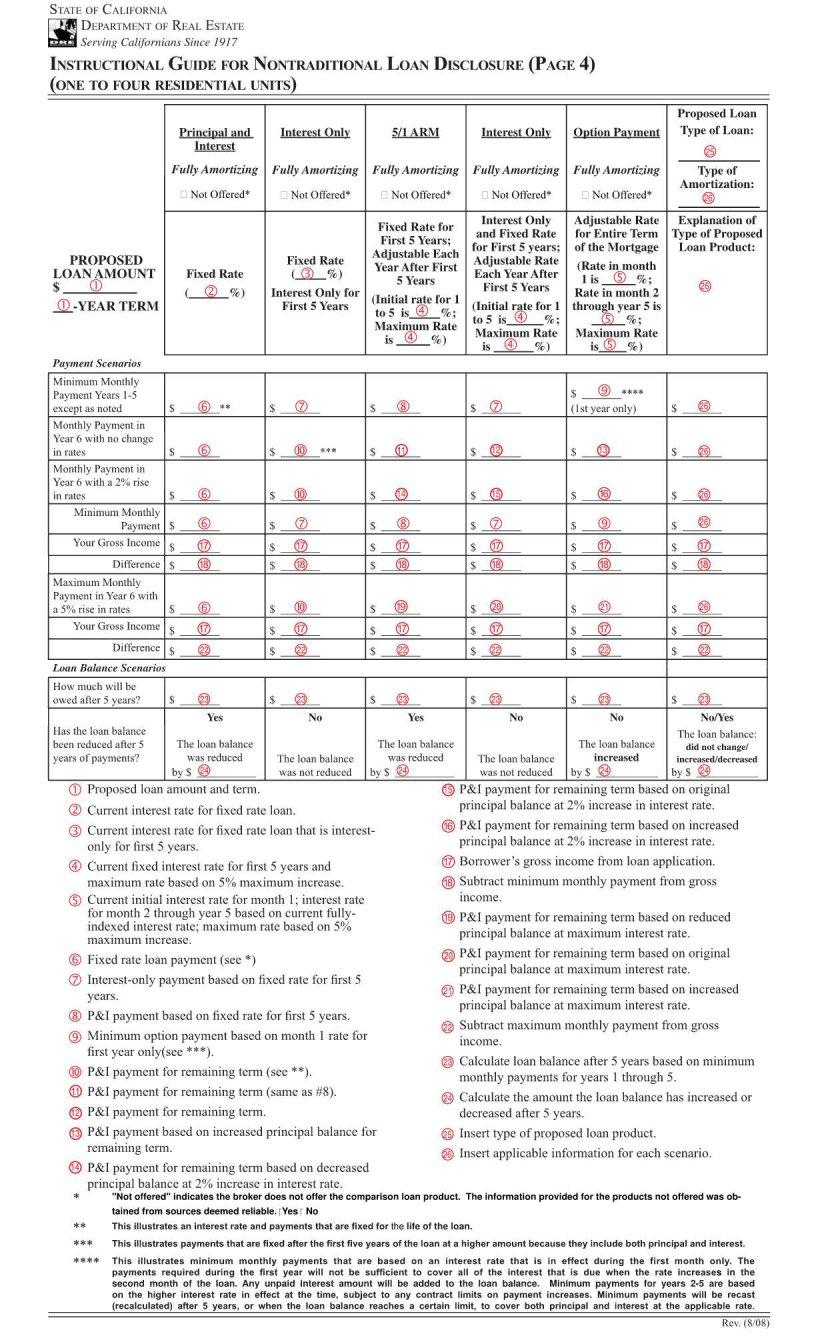

Do you need to file a return for the estate of a deceased person? The IRS requires that an estate tax return (Form 885) be filed in all cases where the value of the gross estate is over $11.4 million dollars, or where the executor elects to file it regardless. Here, we'll look at what Form 885 is and how you can complete and submit it accurately and on time!

| Question | Answer |

|---|---|

| Form Name | Re 885 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | mlds form, hm 885 re885 form, california mortgage loan disclosure statement, ca 885 |