Switching bank accounts involves a process ensuring all financial activities transition smoothly from one account to another. The Reconciliation Worksheet is a tool designed to assist individuals in this phase, specifically before closing the old account. It serves to confirm that all expected transactions, including checks written and automatic payments or deposits, have effectively been processed or migrated to the new Central Bank Account. Through this worksheet, users can itemize outstanding checks that have not been deducted from their statement balance, add deposits made post-statement, and subtract any totals of checks still pending. This practice helps in achieving an accurate bank balance which, ideally, should match the individual's checkbook balance once any unlisted charges or credits from the statement are considered. The form meticulously guides users through reconciling their accounts as of a specific date, ensuring no transaction is overlooked in the transition, thereby avoiding potential financial discrepancies.

| Question | Answer |

|---|---|

| Form Name | Reconciliation Worksheet Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | reconciliation worksheet online, blank reconciliation worksheet, reconciliation worksheet pdf, tax reconciliation worksheet |

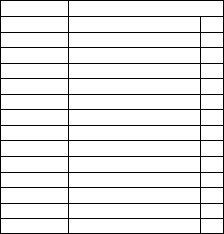

RECONCILIATION WORKSHEET

Before you close your old account, you need to make certain that all checks have paid, and that all of your automatic direct deposit and payments are being received on your new Central Bank Account. You can reconcile your old account below to verify that all entries you expected have cleared.

Checks Outstanding

(Written but not shown on statement)

CHECK # |

AMOUNT |

TOTAL

Reconciled as of _______________, 20____

ENTER Statement Balance $_________________________

ADD Deposits made |

+________________________ |

after Statement Date |

+________________________ |

|

+________________________ |

TOTAL $__________________________

SUBTRACT - $_________________________

Total of Checks Outstanding

BANK BALANCE $_________________________

Should agree with your checkbook balance after deducting Charges and adding credits listed on statement but not shown in checkbook.