13844 irsgovform can be filled out online very easily. Just make use of FormsPal PDF tool to perform the job promptly. Our tool is continually developing to give the best user experience achievable, and that's because of our resolve for constant enhancement and listening closely to customer comments. Here is what you'd have to do to get going:

Step 1: Simply press the "Get Form Button" above on this page to access our pdf file editing tool. This way, you will find all that is necessary to fill out your document.

Step 2: Using this online PDF editing tool, you could do more than just fill out blank fields. Express yourself and make your documents appear sublime with customized text incorporated, or tweak the original input to perfection - all supported by an ability to add stunning images and sign the document off.

This document needs some specific details; to guarantee consistency, please make sure to take into account the subsequent guidelines:

1. When filling in the 13844 irsgovform, make sure to include all needed blanks within the corresponding part. This will help hasten the process, enabling your information to be processed quickly and appropriately.

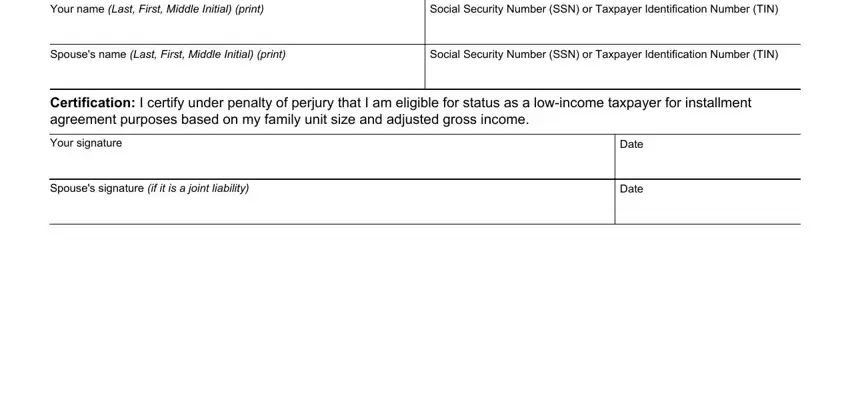

2. Once this array of blanks is completed, go to type in the suitable information in these - Your name Last First Middle, Social Security Number SSN or, Spouses name Last First Middle, Social Security Number SSN or, Certification I certify under, Your signature, Spouses signature if it is a joint, Date, and Date.

Always be really careful when completing Spouses name Last First Middle and Your signature, because this is where many people make some mistakes.

Step 3: Check the details you've inserted in the form fields and press the "Done" button. Right after creating a7-day free trial account at FormsPal, it will be possible to download 13844 irsgovform or send it via email immediately. The PDF form will also be readily available through your personal account menu with your edits. FormsPal offers secure document tools with no personal data recording or distributing. Be assured that your data is safe with us!