Handling PDF files online is very simple with our PDF editor. You can fill in modification request here and try out many other options we provide. The editor is consistently upgraded by us, receiving cool features and turning out to be better. Here is what you'll need to do to get going:

Step 1: First, open the editor by clicking the "Get Form Button" in the top section of this page.

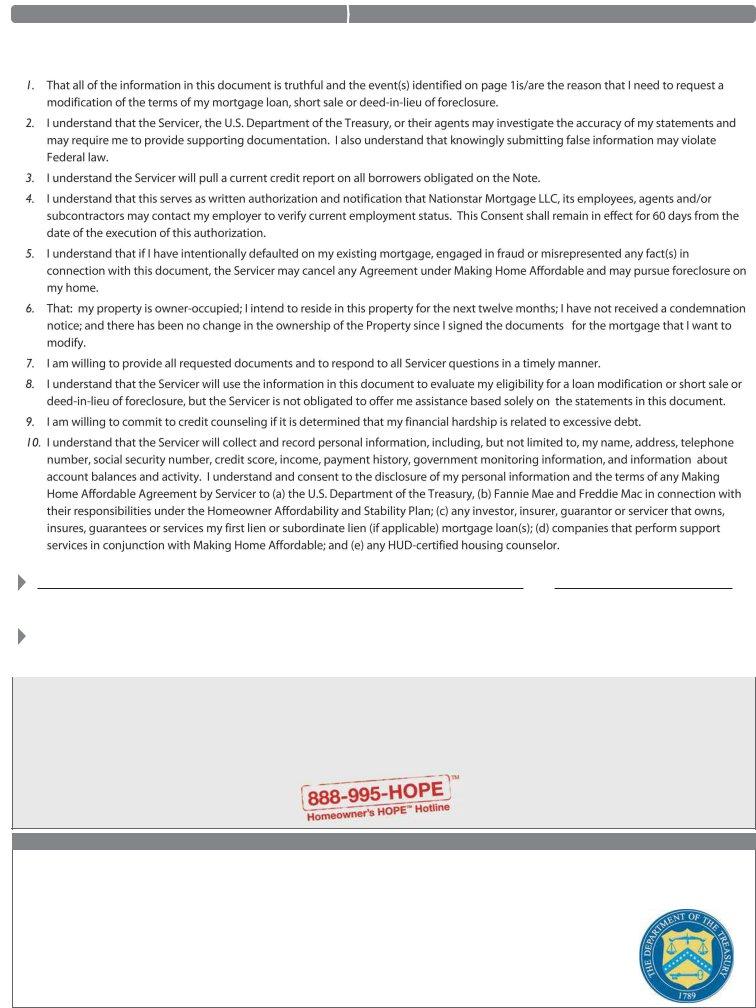

Step 2: Once you open the file editor, there'll be the form made ready to be completed. Besides filling out different blanks, it's also possible to perform some other things with the form, particularly putting on any textual content, changing the initial textual content, adding illustrations or photos, signing the document, and a lot more.

This form requires specific information; in order to guarantee accuracy, you should consider the subsequent tips:

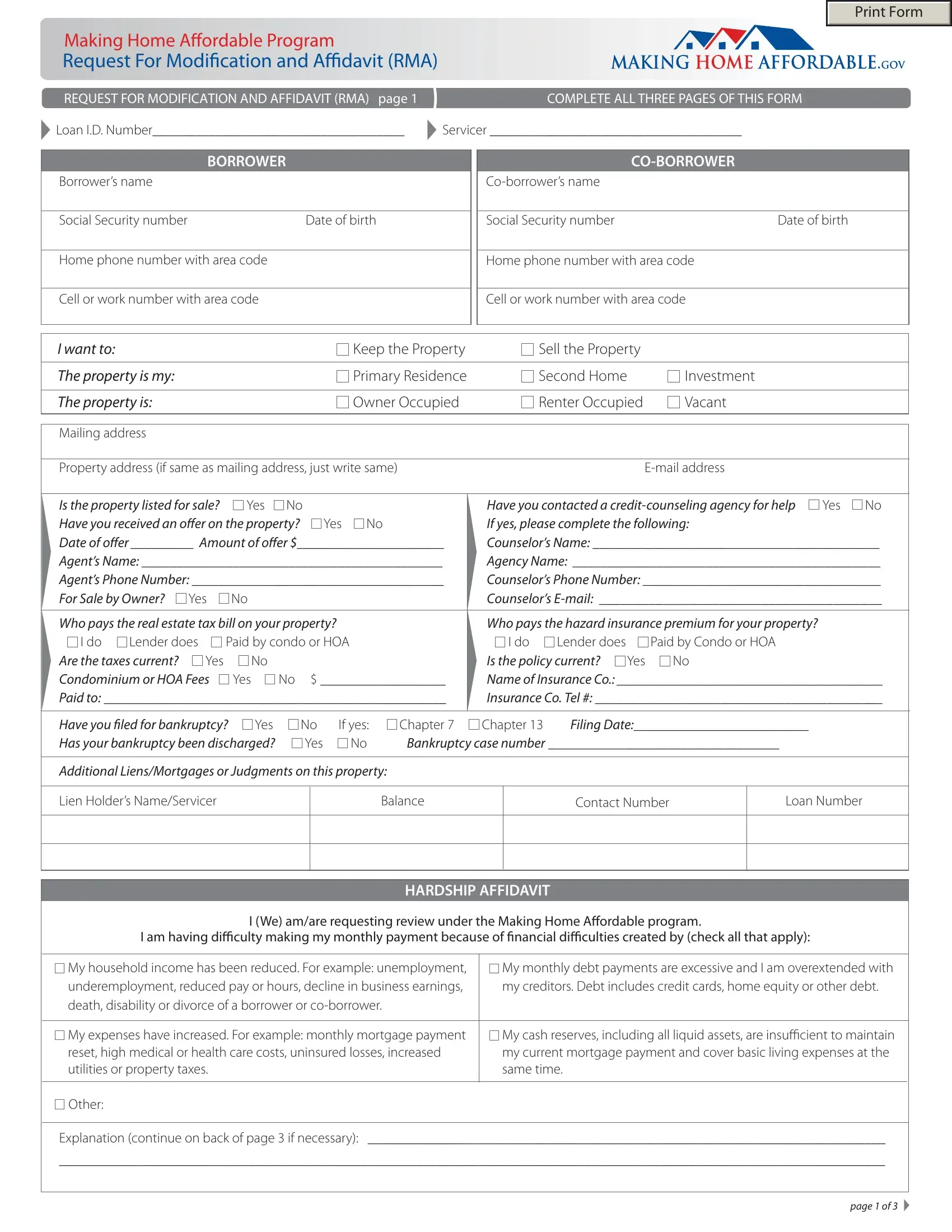

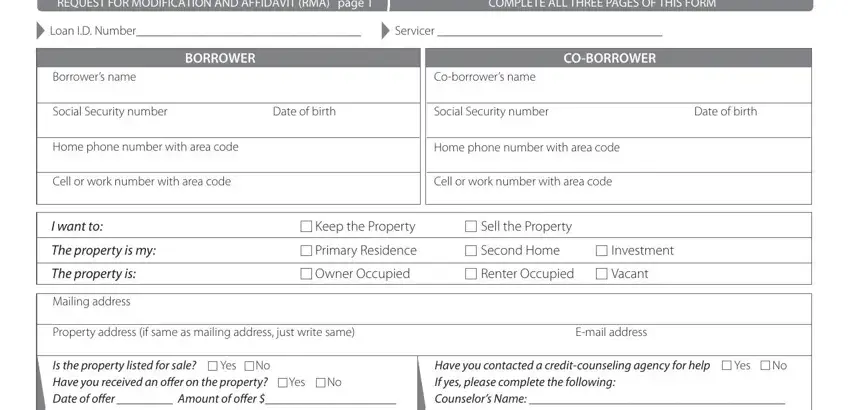

1. It is very important complete the modification request properly, so be mindful while working with the sections containing these blanks:

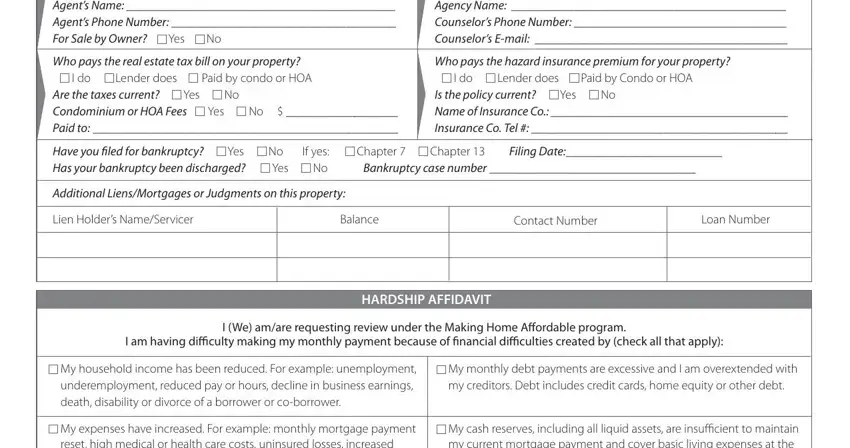

2. The subsequent part is to fill out all of the following blank fields: Is the property listed for sale, Have you contacted a, Who pays the real estate tax bill, Who pays the hazard insurance, Have you iled for bankruptcy Yes, Additional LiensMortgages or, Lien Holders NameServicer, Balance, Contact Number, Loan Number, HARDSHIP AFFIDAVIT, I am having diiculty making my, I We amare requesting review under, My household income has been, and My monthly debt payments are.

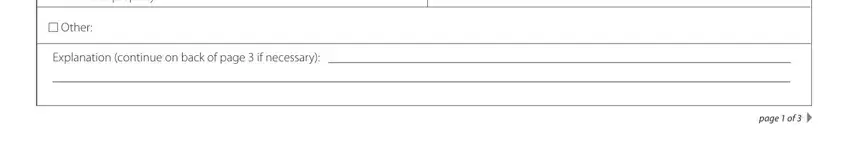

3. In this step, have a look at My expenses have increased For, My cash reserves including all, Other, Explanation continue on back of, and page of. Every one of these have to be completed with highest accuracy.

People who work with this document generally make some errors while filling in Explanation continue on back of in this area. Be sure you re-examine whatever you enter right here.

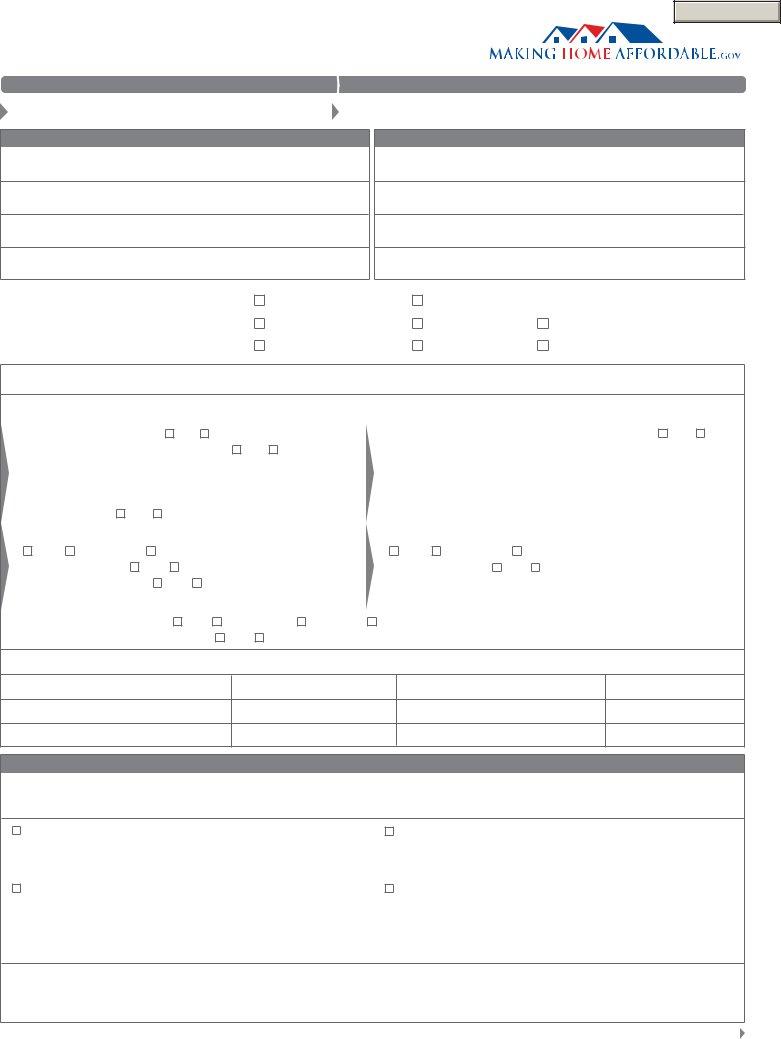

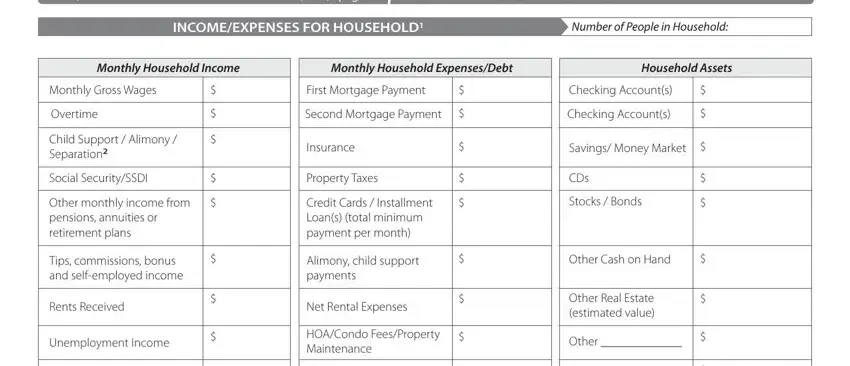

4. To go forward, this fourth stage involves filling out a couple of blank fields. Examples include REQUEST FOR MODIFICATION AND, COMPLETE ALL THREE PAGES OF THIS, INCOMEEXPENSES FOR HOUSEHOLD, Number of People in Household, Monthly Household Income, Monthly Household ExpensesDebt, Household Assets, Monthly Gross Wages, Overtime, Child Support Alimony Separation, Social SecuritySSDI, Other monthly income from pensions, Tips commissions bonus and, Rents Received, and Unemployment Income, which you'll find vital to going forward with this particular document.

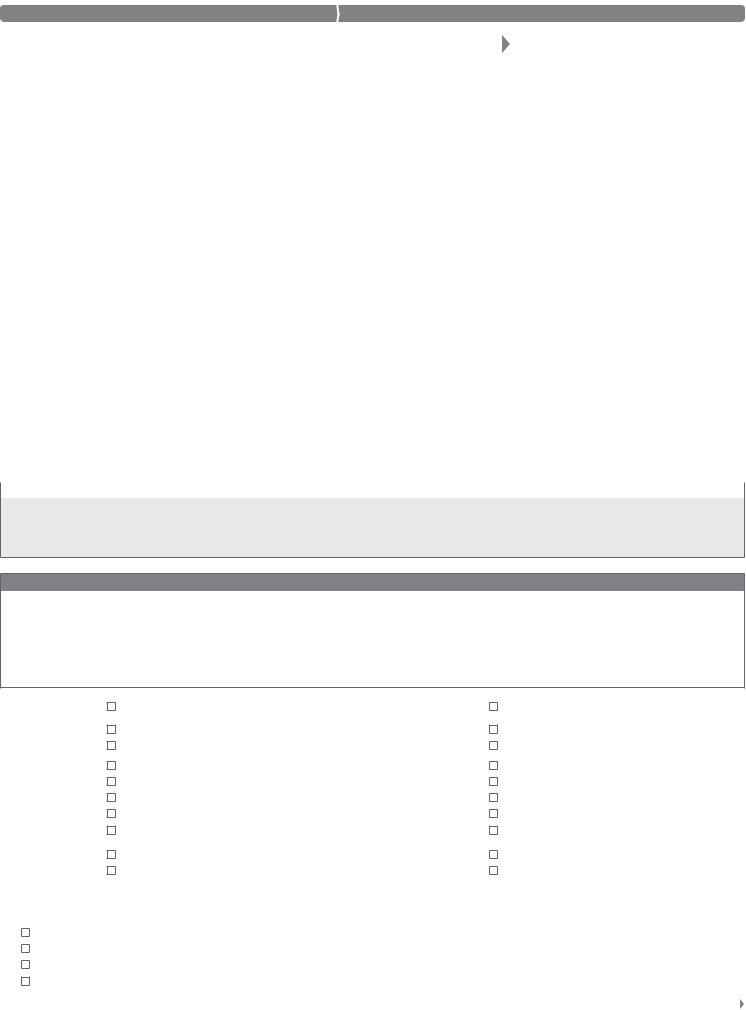

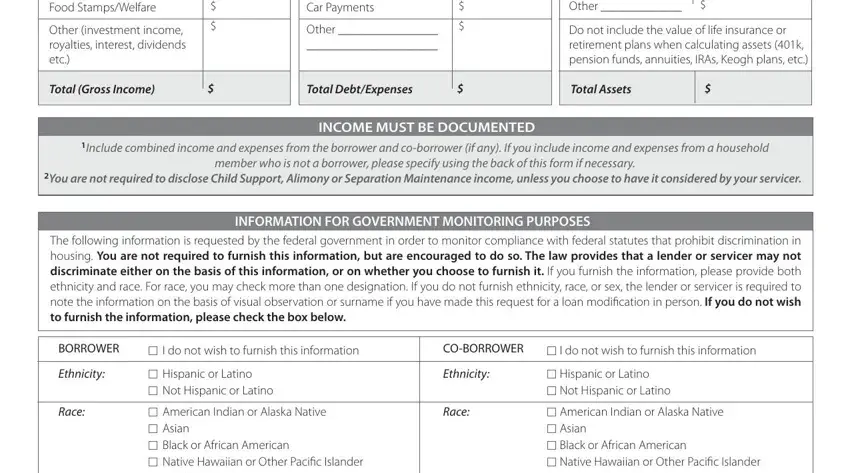

5. This pdf needs to be wrapped up with this particular section. Here there's a comprehensive list of form fields that need accurate details for your document submission to be faultless: Food StampsWelfare, Other investment income royalties, Car Payments, Other, Other, Do not include the value of life, Total Gross Income, Total DebtExpenses, Total Assets, Include combined income and, member who is not a borrower, You are not required to disclose, INCOME MUST BE DOCUMENTED, INFORMATION FOR GOVERNMENT, and The following information is.

Step 3: Right after you have reread the details entered, press "Done" to conclude your FormsPal process. Create a free trial option at FormsPal and get instant access to modification request - download, email, or edit inside your FormsPal account. FormsPal is focused on the privacy of our users; we always make sure that all personal information entered into our system continues to be confidential.