By using the online tool for PDF editing by FormsPal, you can easily fill in or edit pa form account here and now. The tool is consistently upgraded by our team, receiving awesome functions and turning out to be better. Here's what you'd have to do to get going:

Step 1: Open the PDF form inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: With our handy PDF editor, you are able to accomplish more than simply fill in blank fields. Edit away and make your forms look high-quality with customized textual content added, or fine-tune the file's original content to perfection - all comes along with the capability to insert almost any graphics and sign it off.

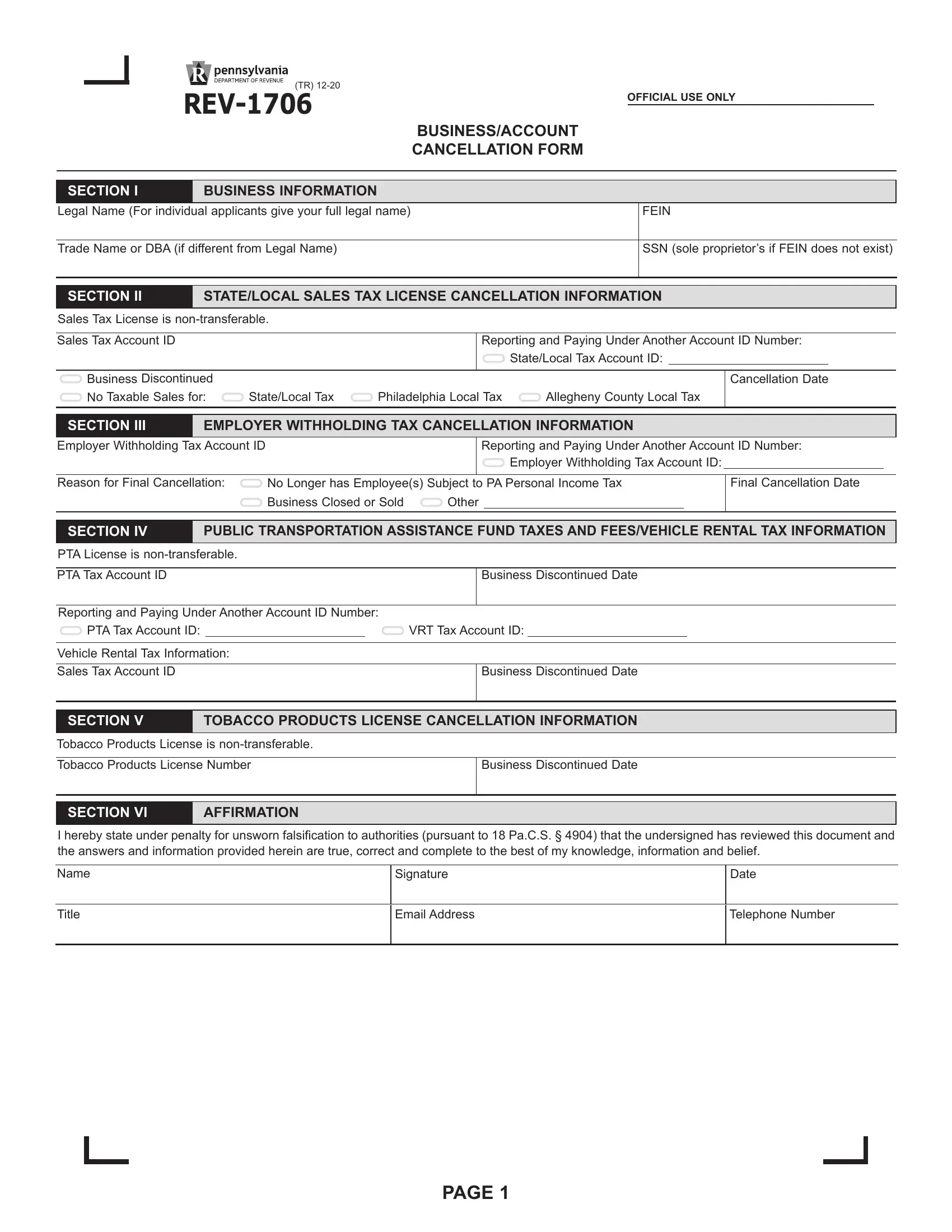

When it comes to blank fields of this particular PDF, here's what you should consider:

1. Start filling out the pa form account with a number of necessary blanks. Note all the important information and make certain there's nothing neglected!

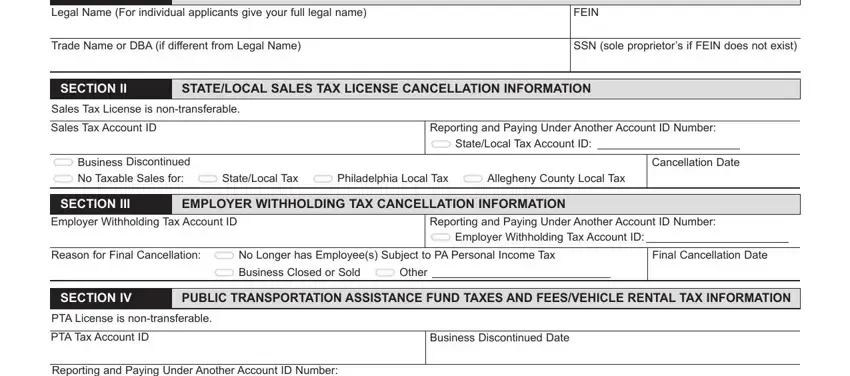

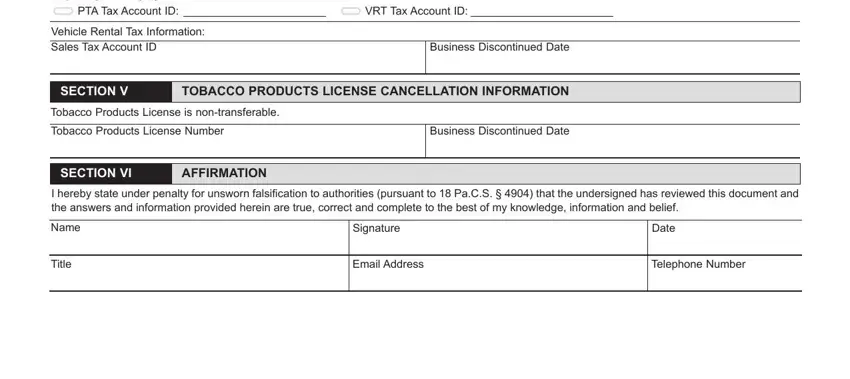

2. The subsequent stage would be to complete the next few blank fields: Reporting and Paying Under Another, PTA Tax Account ID, VRT Tax Account ID, Vehicle Rental Tax Information, Sales Tax Account ID, Business Discontinued Date, SECTION V, TOBACCO PRODUCTS LICENSE, Tobacco Products License is, Tobacco Products License Number, Business Discontinued Date, SECTION VI, AFFIRMATION, I hereby state under penalty for, and Name.

It's easy to make an error when completing your Tobacco Products License is, consequently be sure to look again before you decide to finalize the form.

Step 3: As soon as you have reviewed the information you filled in, click on "Done" to finalize your document generation. After getting a7-day free trial account with us, it will be possible to download pa form account or send it through email without delay. The document will also be readily available in your personal account menu with all of your changes. FormsPal is invested in the personal privacy of our users; we make sure all information entered into our system stays protected.