It is possible to fill in Rev 677 Le Form effortlessly in our PDF editor online. Our development team is continuously working to improve the tool and make it even better for people with its multiple functions. Discover an endlessly revolutionary experience now - check out and find new possibilities along the way! With a few simple steps, you can begin your PDF journey:

Step 1: Press the orange "Get Form" button above. It is going to open our pdf editor so you could start completing your form.

Step 2: The tool gives you the opportunity to change PDF files in various ways. Transform it by writing your own text, correct original content, and place in a signature - all readily available!

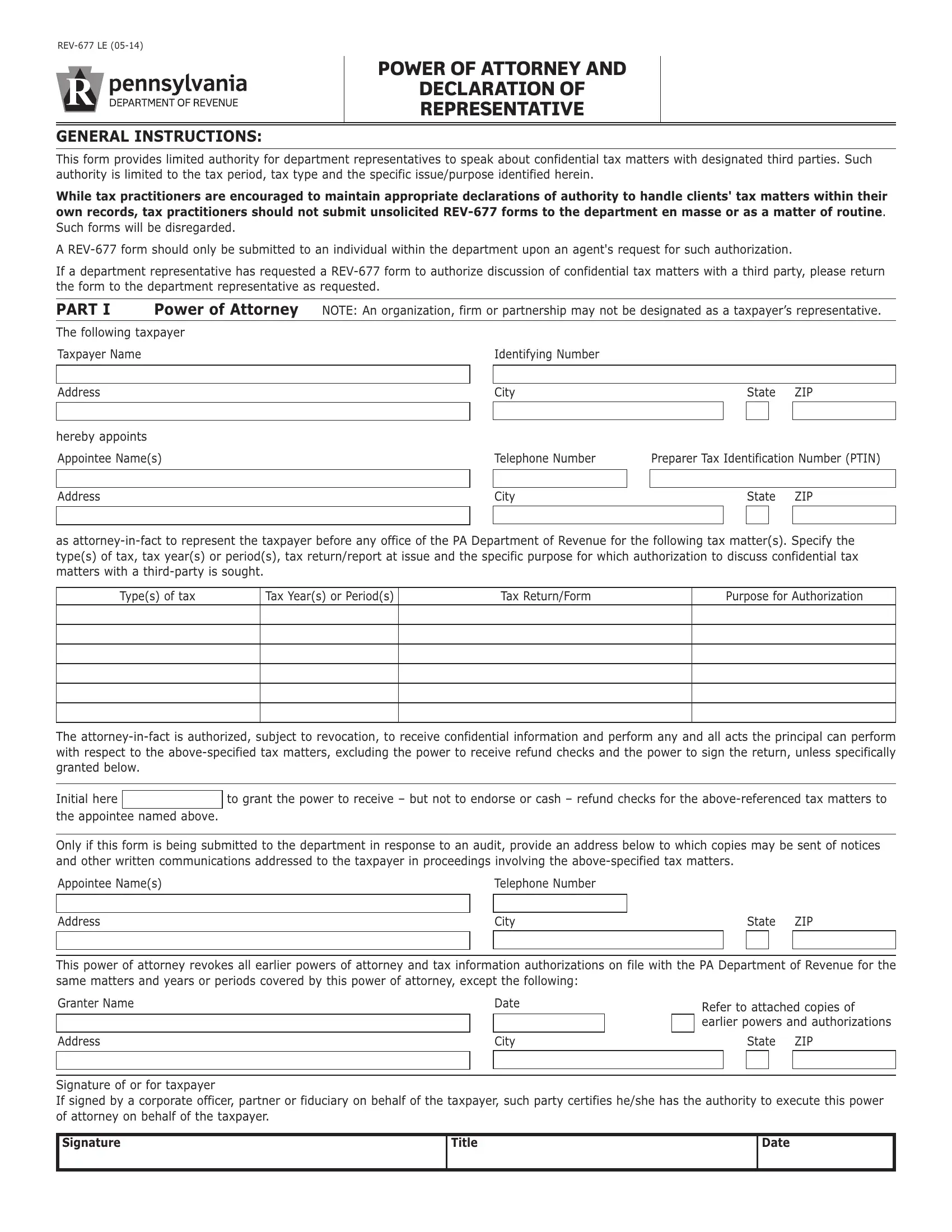

This document will involve specific information; to guarantee accuracy and reliability, you should bear in mind the subsequent steps:

1. The Rev 677 Le Form requires certain information to be entered. Make sure the next blank fields are finalized:

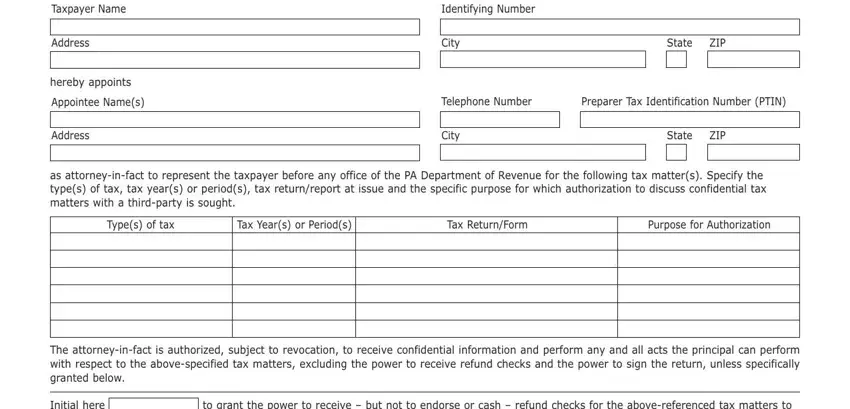

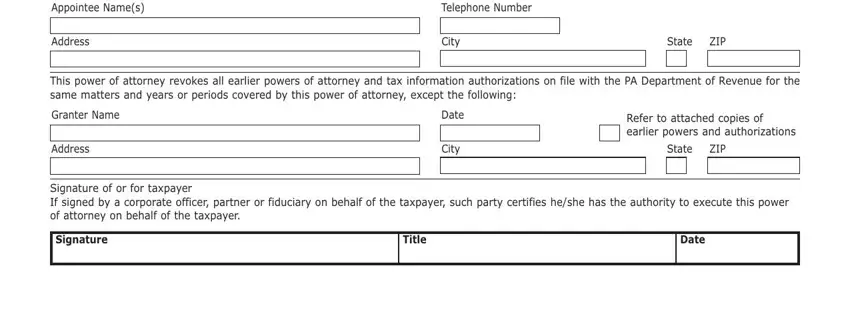

2. Just after finishing this part, go on to the subsequent part and enter the essential details in all these blanks - Appointee Names, Address, Telephone Number, City, State, ZIP, This power of attorney revokes all, Granter Name, Address, Date, City, Refer to attached copies of, State, ZIP, and Signature of or for taxpayer If.

Many people frequently get some points incorrect when filling out Appointee Names in this area. Be sure you review what you type in right here.

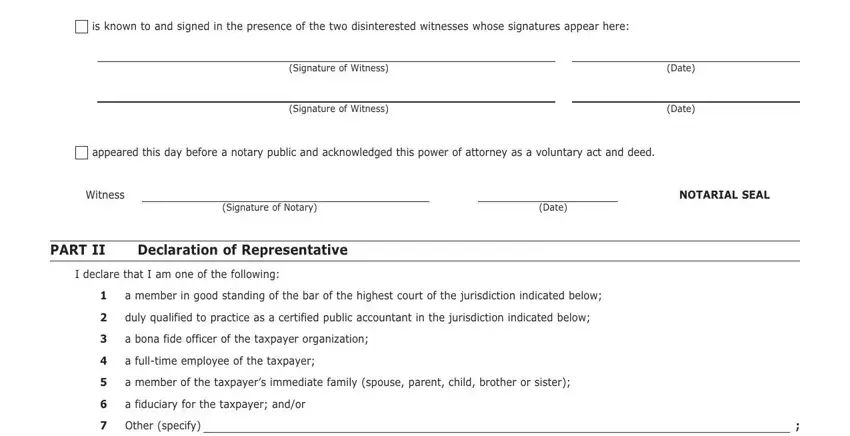

3. The next stage is generally straightforward - fill in all the fields in is known to and signed in the, Signature of Witness, Signature of Witness, Date, Date, appeared this day before a notary, Witness, NOTARIAL SEAL, Signature of Notary, Date, PART II, Declaration of Representative, I declare that I am one of the, a member in good standing of the, and duly qualified to practice as a to finish the current step.

4. To go ahead, this next section involves filling out a handful of blank fields. These comprise of FROM ABOVE LIST, which you'll find integral to going forward with this particular process.

Step 3: Soon after double-checking the entries, click "Done" and you are all set! Download your Rev 677 Le Form after you join for a 7-day free trial. Instantly access the form inside your personal cabinet, together with any edits and adjustments being automatically synced! FormsPal guarantees your information privacy by using a protected method that never saves or distributes any type of private information involved in the process. Rest assured knowing your documents are kept confidential whenever you use our editor!