When working in the online tool for PDF editing by FormsPal, you are able to fill out or change rita form 37 instructions right here and now. Our editor is consistently developing to present the very best user experience attainable, and that is due to our resolve for continual improvement and listening closely to comments from users. To get started on your journey, take these easy steps:

Step 1: Just hit the "Get Form Button" in the top section of this page to launch our pdf file editor. There you'll find all that is needed to work with your document.

Step 2: With this state-of-the-art PDF editor, you are able to do more than simply fill out blank fields. Edit away and make your documents seem professional with custom text put in, or modify the file's original content to excellence - all that accompanied by an ability to insert stunning pictures and sign the PDF off.

This document will need some specific information; to guarantee accuracy, don't hesitate to bear in mind the next recommendations:

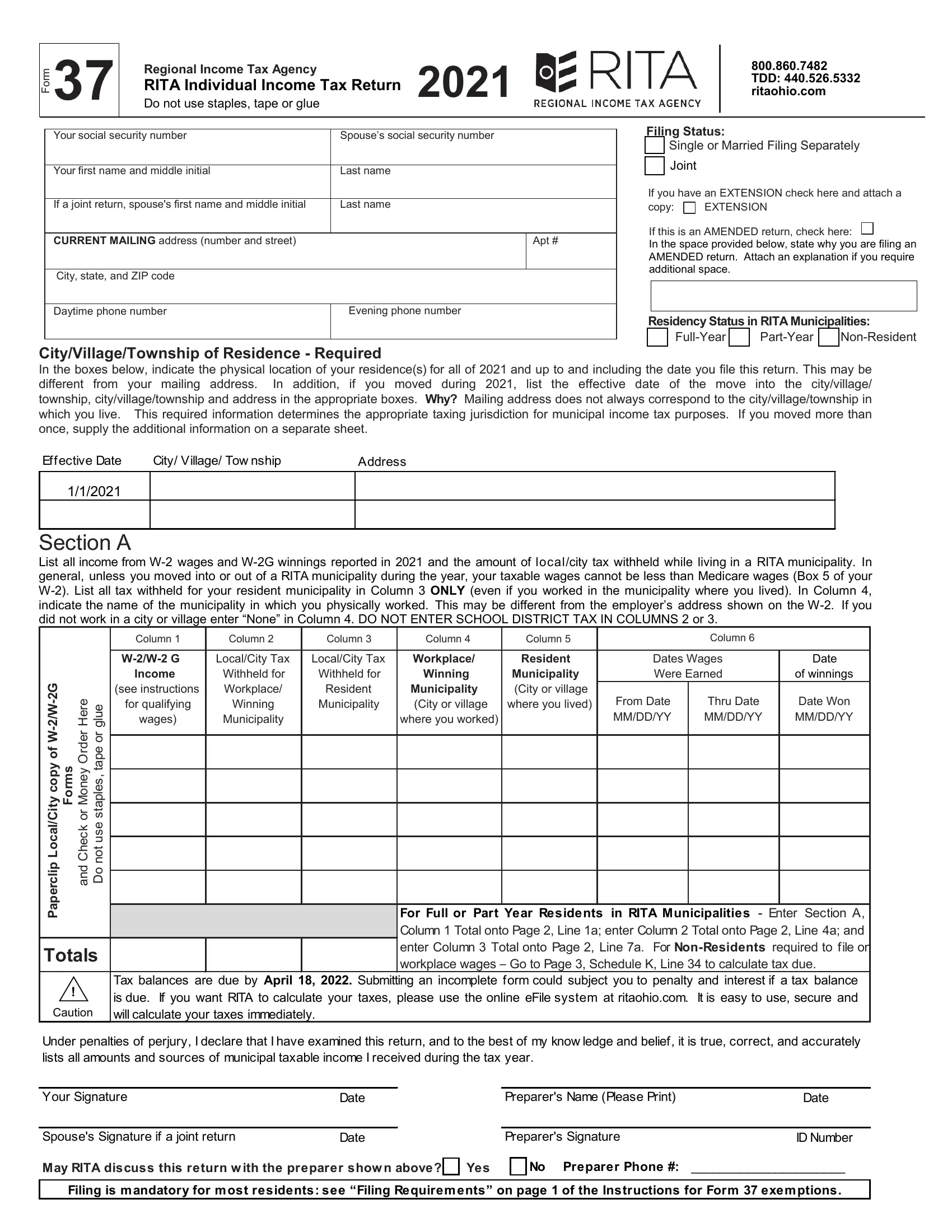

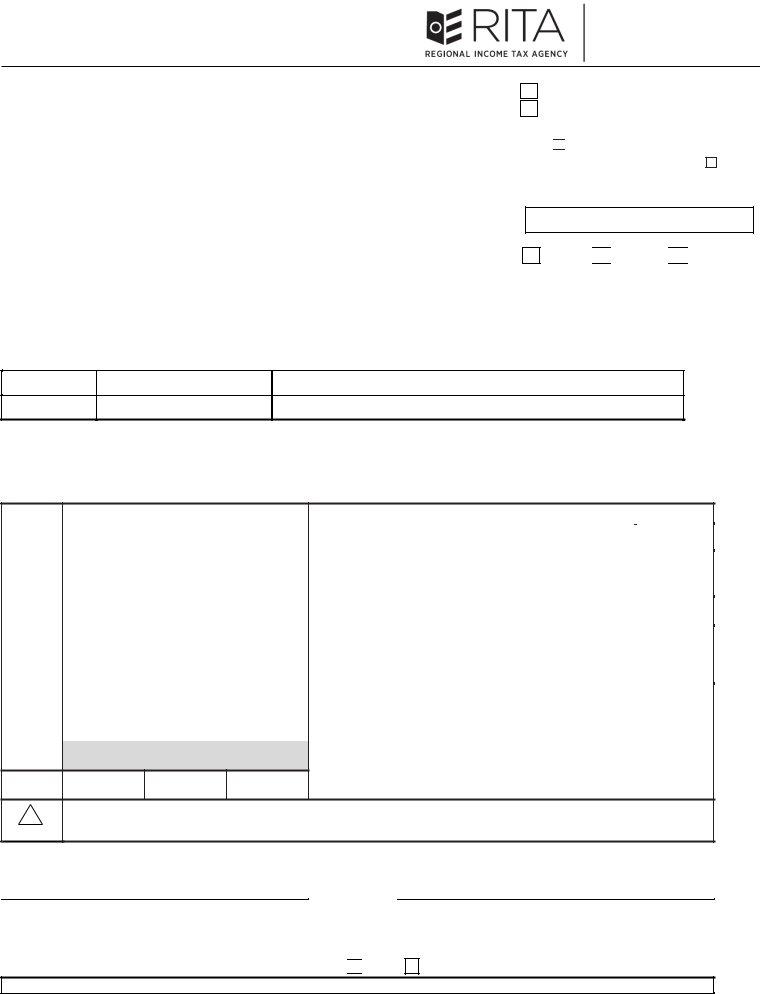

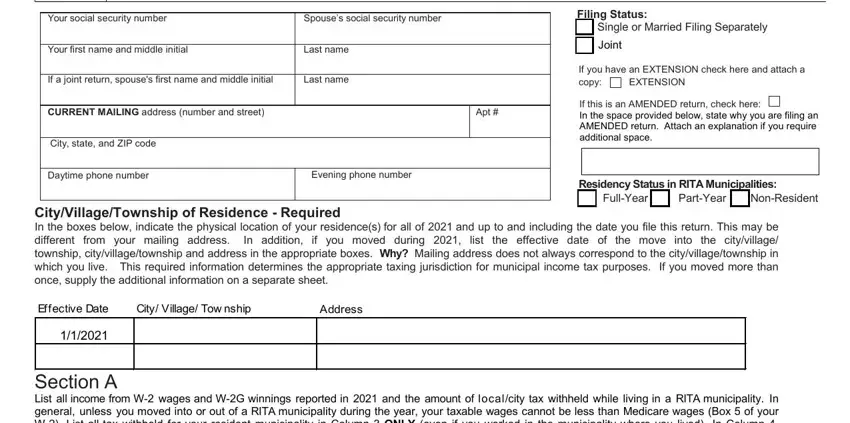

1. Before anything else, while filling in the rita form 37 instructions, start in the part that features the following blanks:

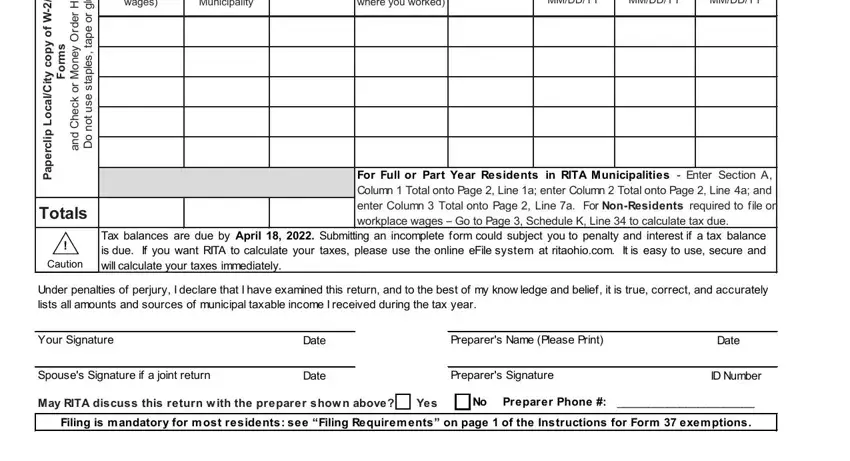

2. Right after filling out the previous part, go on to the next part and complete the essential details in all these fields - wages, Municipality, where you worked, From Date MMDDYY, Thru Date MMDDYY, Date Won MMDDYY, For Full or Part Year Residents in, Tax balances are due by April, e r e H, r e d r, O y e n o M, r o, k c e h C d n a, G W W, and f o y p o c y t i.

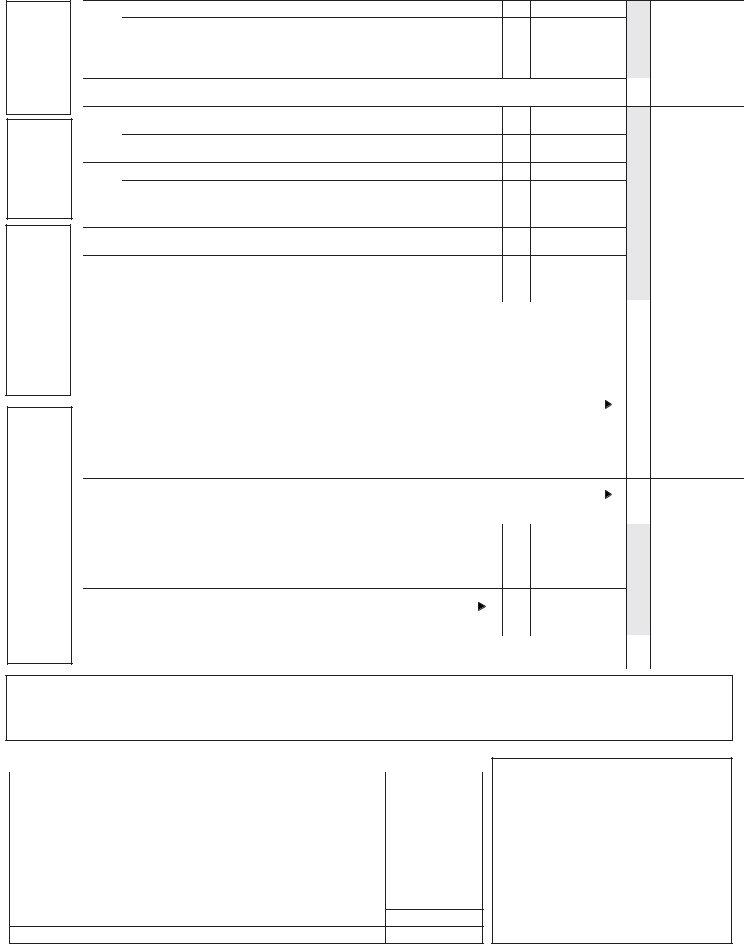

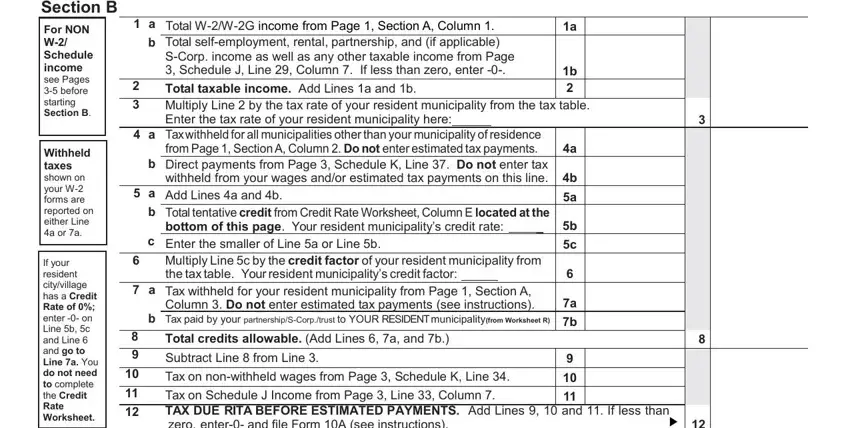

3. This next step is mostly about Form Section B, For NON W Schedule income see, Withheld taxes shown on your W, If your resident cityvillage has a, a b, Total WWG income from Page, Subtract Line from Line Tax on, and Tax on Schedule J Income from Page - type in these blank fields.

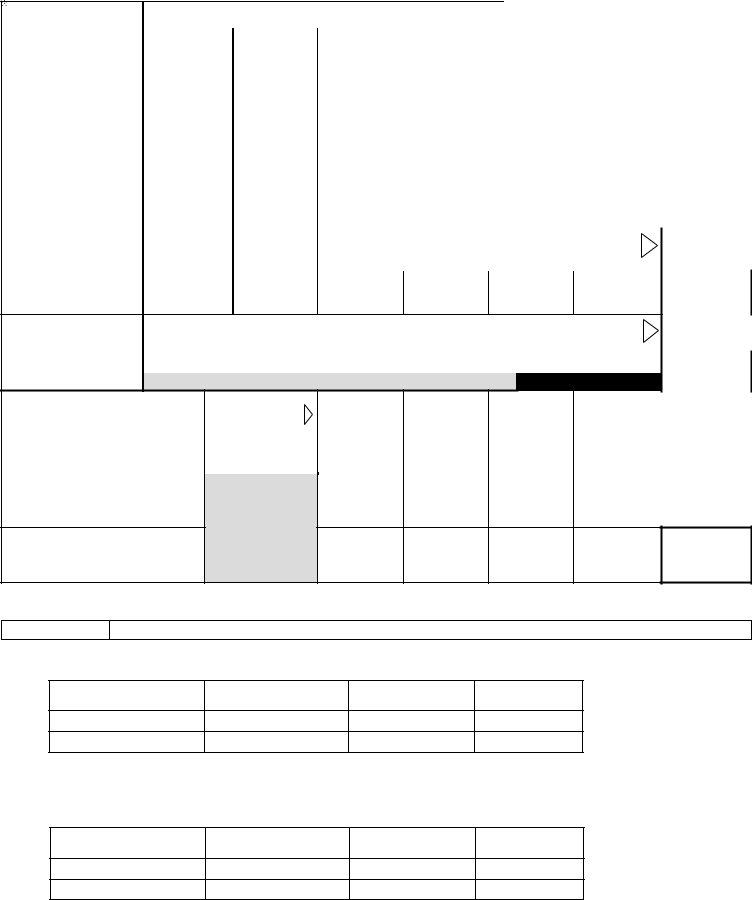

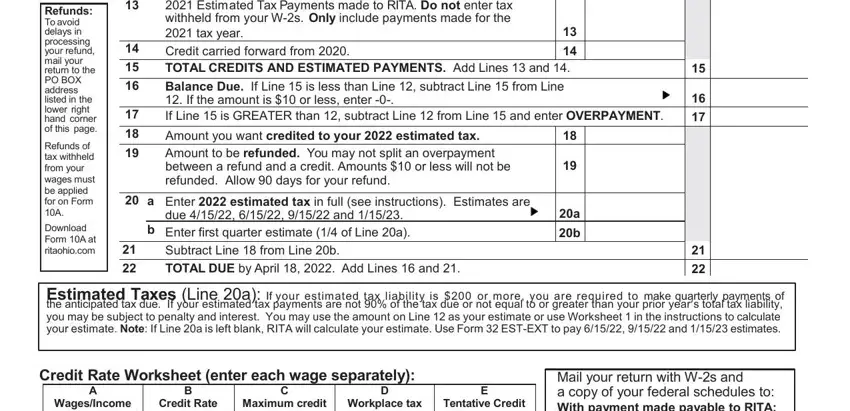

4. This next section requires some additional information. Ensure you complete all the necessary fields - Refunds To avoid delays in, Refunds of tax withheld from your, Download Form A at ritaohiocom, Tax on Schedule J Income from Page, a Enter estimated tax in full, due and b Enter first quarter, Subtract Line from Line b TOTAL, Estimated Taxes Line a If your, Credit Rate Worksheet enter each, WagesIncome earned outside of, Credit Rate, Maximum credit multiply Column A, Workplace tax withheldpaid, Tentative Credit, and Mail your return with Ws and a - to proceed further in your process!

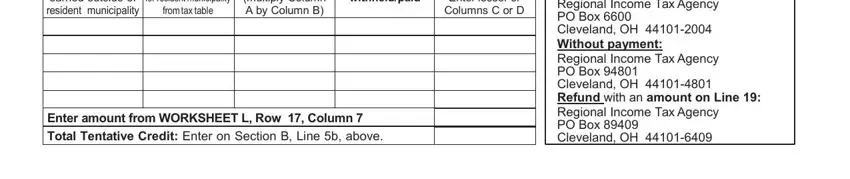

5. The last step to finalize this PDF form is essential. Ensure to fill out the required blanks, including WagesIncome earned outside of, for resident municipality, from tax table, Maximum credit multiply Column A, Workplace tax withheldpaid, Enter lesser of Columns C or D, Enter amount from WORKSHEET L Row, and Mail your return with Ws and a, prior to finalizing. Otherwise, it might produce an unfinished and possibly unacceptable form!

Always be extremely careful when filling in Enter lesser of Columns C or D and Maximum credit multiply Column A, as this is the part in which a lot of people make mistakes.

Step 3: Check what you have inserted in the form fields and click on the "Done" button. After setting up afree trial account at FormsPal, it will be possible to download rita form 37 instructions or send it via email at once. The form will also be easily accessible via your personal account menu with all your edits. With FormsPal, you can complete documents without having to be concerned about data incidents or data entries getting distributed. Our protected system makes sure that your personal details are kept safe.