W2-G can be filled out online effortlessly. Just make use of FormsPal PDF editor to perform the job in a timely fashion. FormsPal team is aimed at providing you with the ideal experience with our tool by consistently presenting new features and upgrades. Our editor is now a lot more useful as the result of the newest updates! So now, filling out PDF files is easier and faster than before. By taking some simple steps, you are able to start your PDF editing:

Step 1: Access the PDF form in our editor by clicking the "Get Form Button" in the top area of this webpage.

Step 2: When you launch the online editor, you will see the document ready to be completed. Aside from filling out different blank fields, you could also perform several other things with the file, such as writing any text, changing the initial textual content, adding graphics, placing your signature to the document, and more.

It is actually easy to complete the pdf following this practical guide! Here's what you must do:

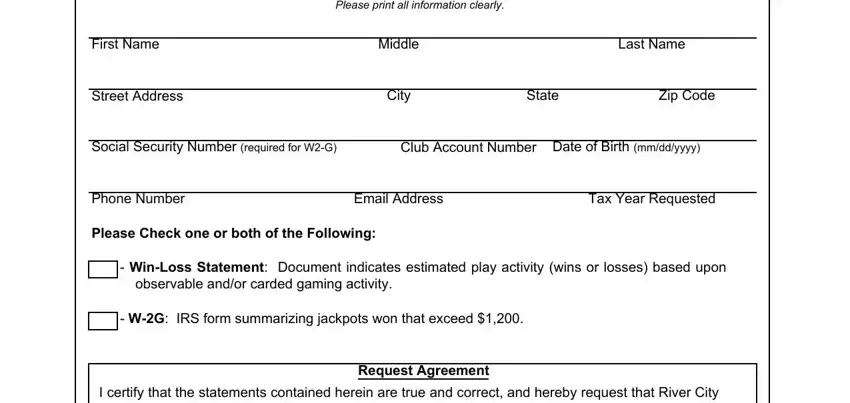

1. The W2-G involves particular information to be inserted. Make certain the next fields are filled out:

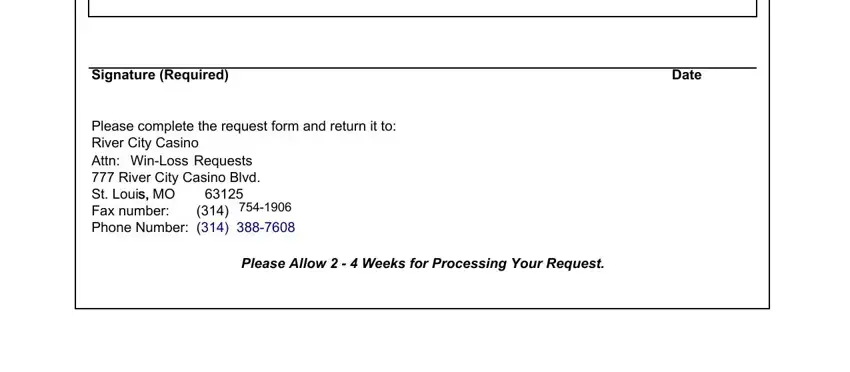

2. Once your current task is complete, take the next step – fill out all of these fields - Signature Required, Date, Please complete the request form, and Please Allow Weeks for with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As to Date and Please complete the request form, ensure you review things in this current part. Both of these could be the most important fields in this form.

Step 3: Proofread what you have entered into the form fields and click the "Done" button. Sign up with us today and easily access W2-G, all set for download. All alterations you make are kept , making it possible to customize the pdf further when required. FormsPal guarantees your information confidentiality by using a secure method that in no way saves or shares any sort of personal information involved in the process. You can relax knowing your docs are kept safe any time you use our editor!