modification form can be completed online with ease. Simply make use of FormsPal PDF tool to do the job quickly. The editor is constantly upgraded by us, getting powerful functions and becoming even more convenient. Here is what you would have to do to begin:

Step 1: First of all, open the editor by clicking the "Get Form Button" above on this site.

Step 2: Using this state-of-the-art PDF editor, you are able to accomplish more than simply fill out blank fields. Try each of the features and make your forms seem perfect with customized text added, or optimize the original input to excellence - all that comes along with an ability to add almost any pictures and sign the file off.

Completing this document requires attention to detail. Make sure all required areas are done properly.

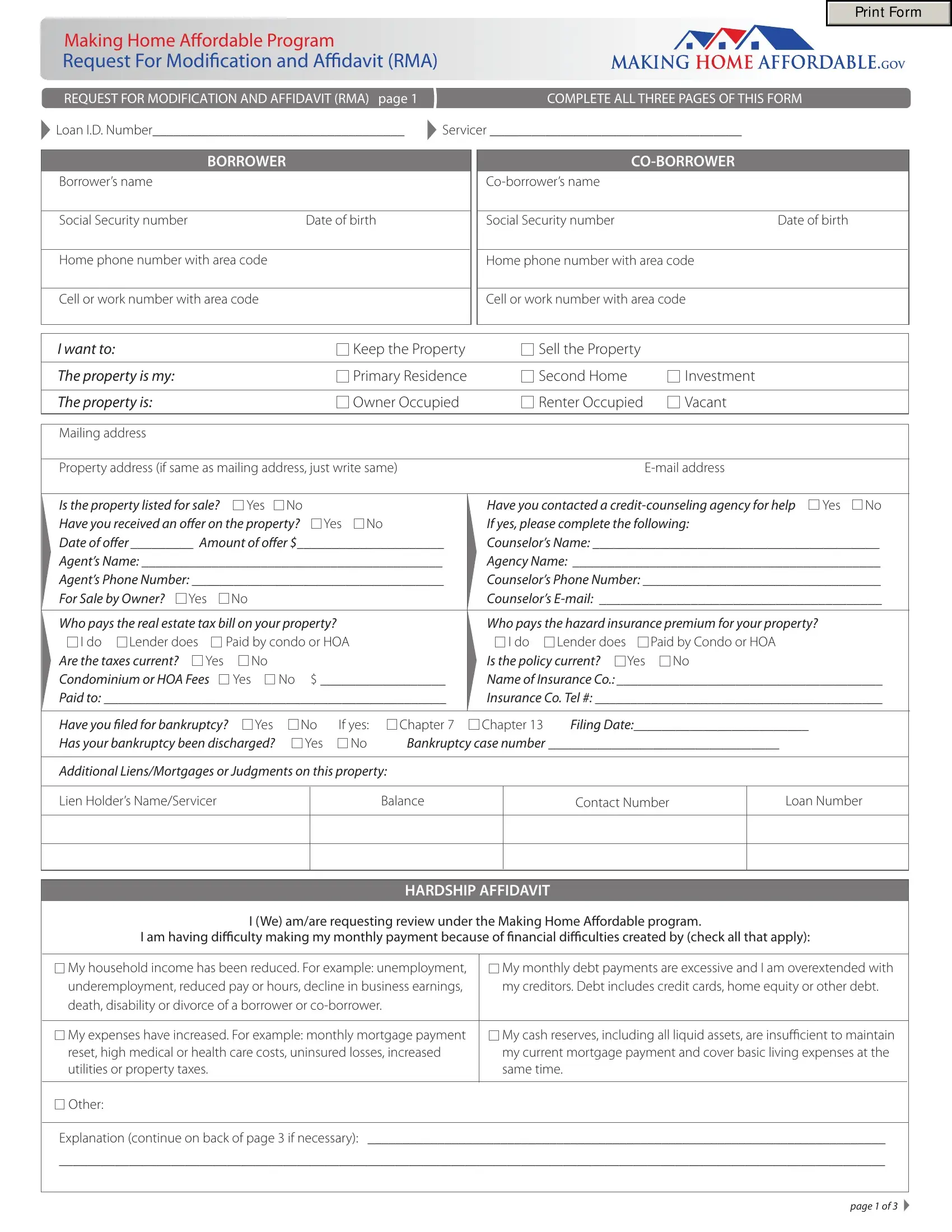

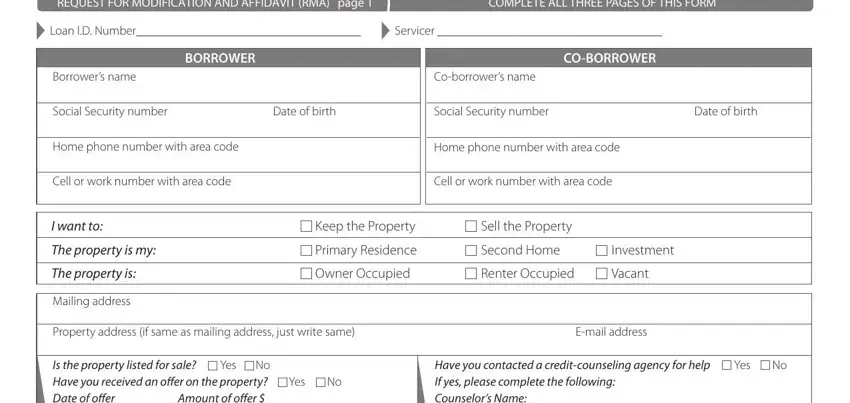

1. Whenever completing the modification form, make certain to complete all needed blank fields within its associated part. This will help to hasten the work, allowing your information to be handled quickly and properly.

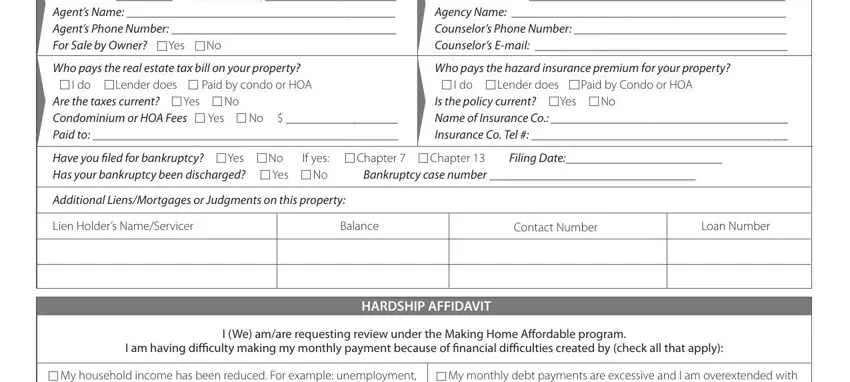

2. Right after performing the previous step, go on to the subsequent step and enter the necessary particulars in these blanks - Is the property listed for sale, Have you contacted a, Who pays the real estate tax bill, Who pays the hazard insurance, Have you cidled for bankruptcy Yes, Additional LiensMortgages or, Lien Holders NameServicer, Balance, Contact Number, Loan Number, HARDSHIP AFFIDAVIT, I am having dicidculty making my, I We amare requesting review under, My household income has been, and My monthly debt payments are.

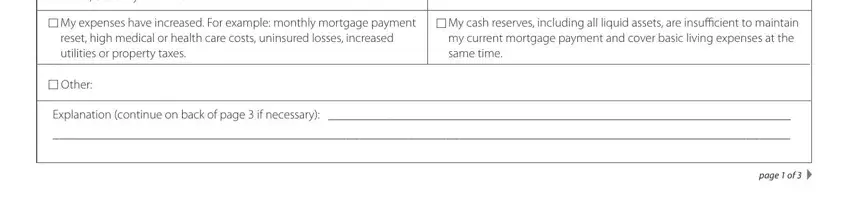

3. Your next part is usually straightforward - fill in all of the blanks in My household income has been, My expenses have increased For, My cash reserves including all, Other, Explanation continue on back of, and page of to conclude this part.

Be very careful when completing My cash reserves including all and Explanation continue on back of, because this is where most users make some mistakes.

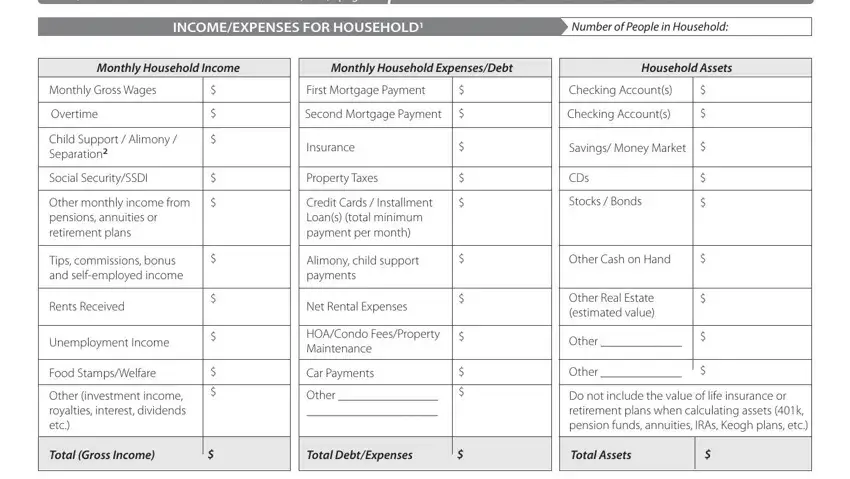

4. Filling out REQUEST FOR MODIFICATION AND, COMPLETE ALL THREE PAGES OF THIS, INCOMEEXPENSES FOR HOUSEHOLD, Number of People in Household, Monthly Household Income, Monthly Household ExpensesDebt, Household Assets, Monthly Gross Wages, Overtime, Child Support Alimony Separation, Social SecuritySSDI, Other monthly income from pensions, Tips commissions bonus and, Rents Received, and Unemployment Income is essential in this fourth stage - ensure that you take the time and fill in every blank!

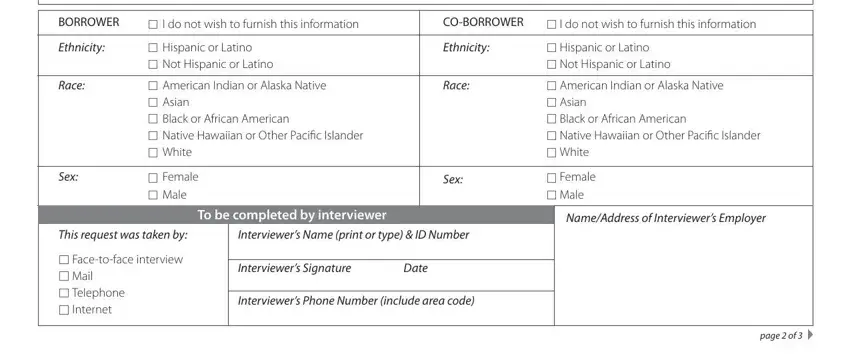

5. When you draw near to the finalization of your document, you'll find several more requirements that need to be fulfilled. Specifically, BORROWER, I do not wish to furnish this, COBORROWER, I do not wish to furnish this, Ethnicity, Race, Hispanic or Latino Not Hispanic or, American Indian or Alaska Native, Ethnicity, Race, Hispanic or Latino Not Hispanic or, American Indian or Alaska Native, Sex, Female, and Male should be filled out.

Step 3: Always make sure that your details are correct and simply click "Done" to continue further. Join us now and instantly access modification form, prepared for download. Each change made is conveniently saved , letting you change the file at a later stage when required. Here at FormsPal, we endeavor to be certain that your information is maintained protected.