The Royal Farms Account Application form is a comprehensive document aimed at businesses seeking to establish a credit line for fuel and service expenditures through Wright Express Financial Services Corporation. This form gathers detailed information from applicants, including legal company name, contact details, business type (e.g., corporation, partnership), and financial data to evaluate creditworthiness. It underlines the necessity for applicants to consent to credit verifications and adhere to the terms set forth in the Business Charge Account Agreement. Additionally, for specific business structures, like partnerships or proprietorships, it requires personal credit checks and guarantees. The option to choose between different card types based on fuel and service needs further customizes the account to the applicant's operational requirements. Upon application approval, the account setup comes with certain fees, emphasizing the importance of reading and agreeing to all conditions. For businesses estimated to have substantial monthly expenses, it mandates the submission of financial statements, ensuring a thorough review process. This form also incorporates clauses for information sharing, aligned with legal regulations such as the USA PATRIOT Act, and outlines the consequences of non-payment or breach of agreement terms. Importantly, it calls for an authorized signature, verifying the applicant's authority and the business's legitimacy, underscoring the form's function as not just a credit application but a contractual agreement between the applicant and the card issuer.

| Question | Answer |

|---|---|

| Form Name | Royal Farms Account Application Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | yyyy, SSN, FEIN, Issuer |

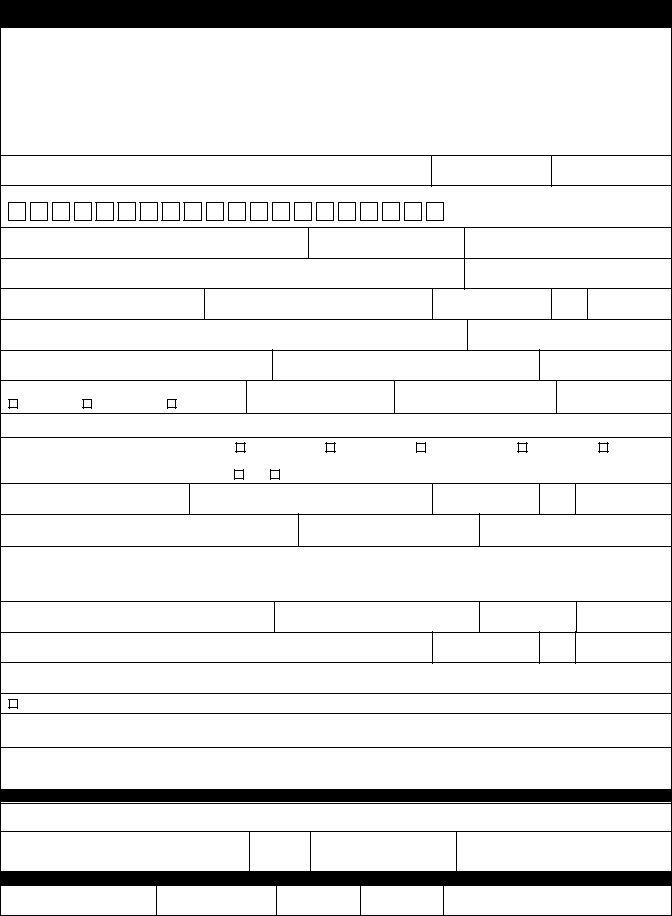

ROYAL FARMS ACCOUNT APPLICATION

1)The undersigned applicant/buyer (“Applicant”) represents that the information given in this application is complete and accurate and authorizes Card Issuer to check with credit reporting agencies, credit references and other sources disclosed to confirm information given; 2) Applicant requests a business charge account, if approved for credit, and one or more business charge cards from the card issuer, which is Wright Express Financial Services Corporation (“Card Issuer”); 3) Applicant agrees to the terms and conditions set forth in the Business Charge Account Agreement provided with this application and/or provided with the business charge card(s). Use of any card issued pursuant to this application confirms Applicant’s agreement to said terms and conditions; 4) If this Account is for a partnership or a proprietorship, a partner or principal must sign this application and the undersigned’s personal credit will be used in making a credit decision and they hereby authorize Card Issuer to obtain a consumer report. In the event that this application is denied based upon information contained in a consumer credit report of the undersigned, they authorize the Card Issuer to report the reason for the denial to the Applicant. Direct inquiries of businesses where the undersigned maintains accounts may also be made; 5) Applicant agrees that in the event the account is not paid as agreed, Card Issuer may report the undersigned’s liability for and the status of the account to credit bureaus and others who may lawfully receive such information. If you have any questions regarding this application, please call

Full Legal Company Name of Applicant/Buyer

Phone #

Fax#

Write company name as you wish it to appear on cards. Limit of 20 characters including spaces. Unless specified, no company name will appear on cards.

DBA or AKA

Subsidiary of

Applicant’s Taxpayer ID # (TIN, FEIN or SSN)

Headquarters Name, Physical Address and Phone # (Do not include PO Box)

SIC Code or Type of Business

Billing Contact

Billing Address

City

State

Zip+4

Principal(s)/Authorized Officer(s)

Title(s)

In Business Since (yyyy)

Year of Incorporation (yyyy)

Fiscal Year Start (mm)

Choose Card Type(s)

All Fuel Only |

All Unrestricted |

Some of each |

Avg Monthly Fuel Expenditures

$

Avg Monthly Service Expenditures

$

Number of Vehicles

IMPORTANT: If your estimated monthly vehicle expenditures equal $6,600 or more, please attach your most recent annual and current financial statements.

Complete this Section Accurately. Select One:

Corporation

Partnership

Proprietorship

PC or PA

LLC

Is this account for a company that has been incorporated less than three years, a partnership, a proprietorship, a professional corporation

or association, or a limited liability company? |

No |

Yes (If YES, complete and attach the Personal Guaranty on page 2.) |

Primary Business Bank

Address

City

State

Zip+4

Bank Contact Person

Phone #

Commercial Account No.

Designate the person authorized to receive all charge cards, reports, and other such information we provide from time to time and to take actions with respect to your account and account access. This is also the person designated by your company to provide all fleet vehicle, driver and other information we may request. By signing below, you also (i) designate representatives from your card program sponsor ("Sponsor") to have access to your account information in order to facilitate customer service and account maintenance requests on your behalf, and (ii) authorize the Card Issuer to accept account maintenance requests and other instructions from Sponsor on your behalf.

Authorized Contact Name

Title

Phone #

Fax #

Mailing Address (if different from billing address)

City

State

Zip+4

Email address

Check here if business is exempt from motor fuels tax (sales representative will provide further details)

INFORMATION SHARING DISCLOSURE: Card Issuer or its affiliates may, to the extent allowed by law, share information disclosed by or generated as a result of this application with each other, and with merchants accepting the card. In addition, information regarding your transactions may be provided to accepting merchants or their service providers to facilitate discounts or other promotional campaigns of interest to you.

Program Costs: $40.00 |

|

Instructions: Complete and sign application. To speed processing, fax your application to us at |

. |

AUTHORIZED SIGNATURE REQUIRED

Any person signing on behalf of a business attests that the Applicant is a valid business entity, that, if applicable, the execution of this application has been duly authorized by all necessary action of Applicant's governing body, and that the undersigned is authorized to make this application on Applicant's behalf.

Signature

X

Date

Print Name

Title

FOR OFFICE USE ONLY

Opportunity Number

Sales Code

Plastic Type

AFF4

Coupon Code

RFO

Account Number

0454

Our bank complies with Section 326 of the USA PATRIOT Act which requires all financial institutions to obtain, verify, and record information that identifies each company or person who opens an account. What this means for you: when you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents for your business.

454.RF.APP (10/07)

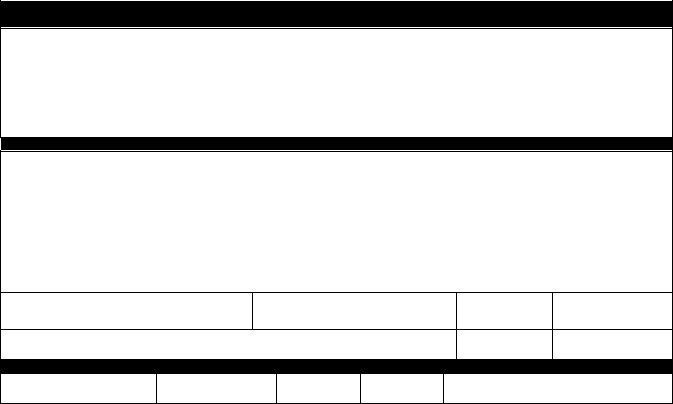

ROYAL FARMS ACCOUNT APPLICATION – CONTINUED

Complete the Personal Guaranty below only if this account is for a:

Company that has been incorporated less than three years,

Partnership,

Proprietorship,

Professional corporation or association, or

Limited liability company.

PERSONAL GUARANTY (SEE ABOVE)

In consideration of Card Issuer financing purchases under the Business Charge Account Agreement (as the same may hereafter be modified, extended or amended, "the Agreement"), the undersigned guarantor (“Guarantor”) hereby agrees to unconditionally personally guarantee payment and performance under any account established pursuant to this application, of any obligation of Applicant to Card Issuer or any assignee of Card Issuer, in the event the above Applicant fails to do so. This is a guaranty of payment and not merely of collection. Guarantor agrees to pay, upon demand, any amount owed by Applicant to Card Issuer and due under the Agreement. Card Issuer shall not be required to initiate any action against, nor exhaust any remedies with respect to Applicant or any other guarantor prior to making demand upon Guarantor. Guarantor hereby waives any notices regarding Applicant’s account or this guaranty and agrees that this guaranty shall be applicable until the Agreement has terminated and all amounts due have been paid in full. Guarantor agrees that in the event the account is not paid as agreed, Card Issuer may report Guarantor’s liability for and the status of the account to credit bureaus and others who may lawfully receive such information. Guarantor hereby agrees that Card Issuer may extend the time for payment and release any other security for the agreement without affecting in any way the obligations of Guarantor. Guarantor waives any and all suretyship defenses. Personal credit of Guarantor will be used in making a credit decision and Guarantor hereby authorizes Card Issuer to obtain a consumer credit report of Guarantor. Direct inquiries of businesses where the undersigned maintains accounts may also be made. In the event this application is denied based upon information in a consumer credit report of Guarantor, Guarantor authorizes the Card Issuer to report the reason for the denial to Applicant.

Guarantor’s Signature |

Print Name |

Date of Birth |

Social Security No. |

X |

|

|

Guarantor’s Residential Address – street, city, state, zip (Do not include PO Box) |

Phone # |

Date (mmddyy) |

FOR OFFICE USE ONLY

Opportunity Number

Sales Code

Plastic Type

AFF4

Coupon Code

RFO

Account Number

0454

454.RF.APP (10/07)