This PDF editor makes it easy to fill out the 425 ivp form document. You will be able to obtain the form effortlessly through using these simple actions.

Step 1: Choose the button "Get Form Here".

Step 2: Now it's easy to change the 425 ivp form. The multifunctional toolbar will allow you to include, erase, adapt, and highlight text or perhaps conduct other sorts of commands.

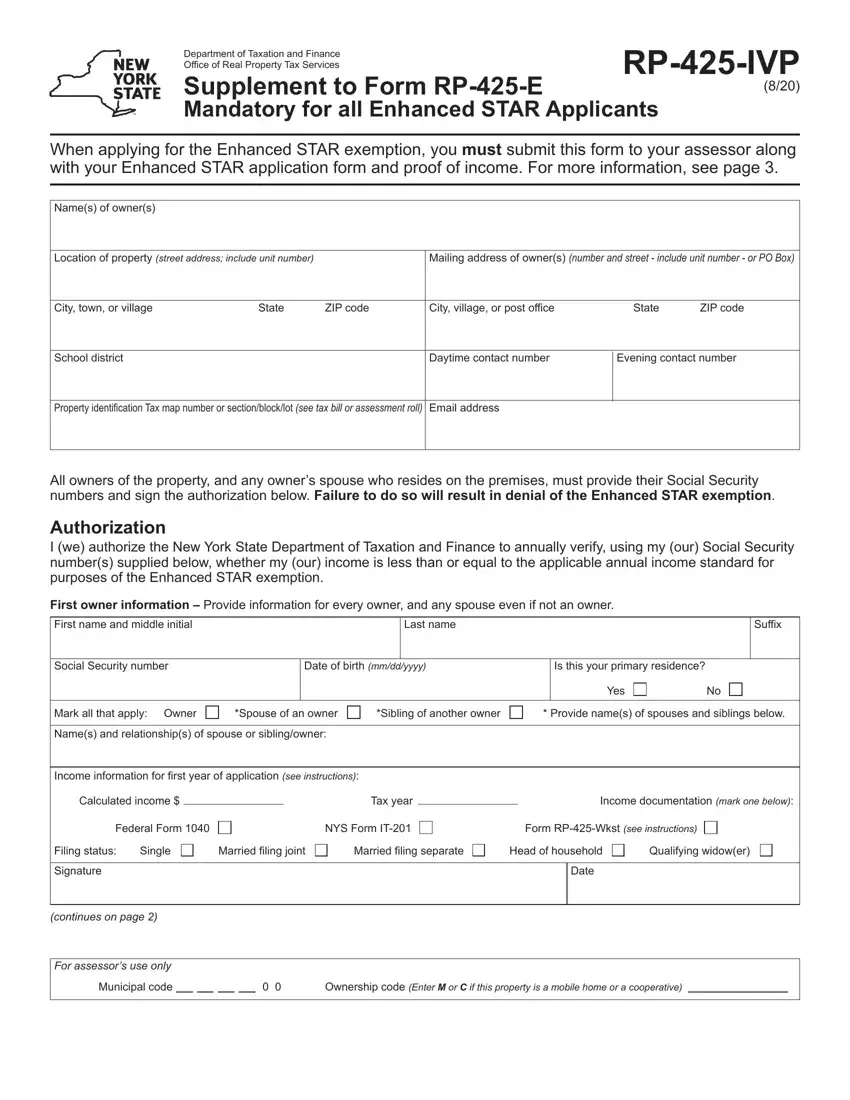

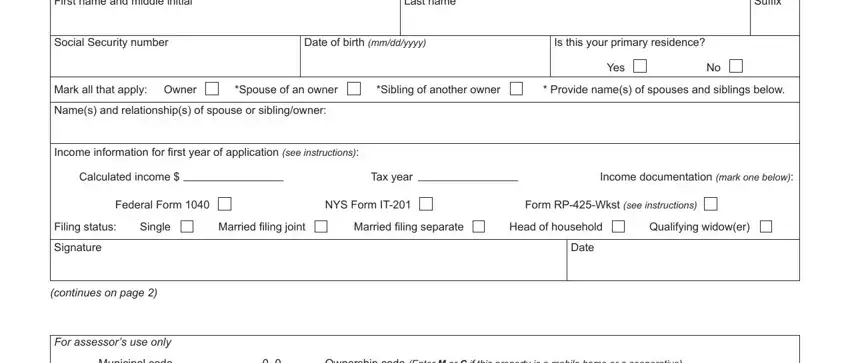

Complete the next parts to complete the document:

You should submit the First name and middle initial, Last name, Suffix, Social Security number, Date of birth mmddyyyy, Is this your primary residence, Mark all that apply Owner, Spouse of an owner, Sibling of another owner, Provide names of spouses and, Yes, Names and relationships of spouse, Income information for first year, Calculated income, and Tax year field with the appropriate information.

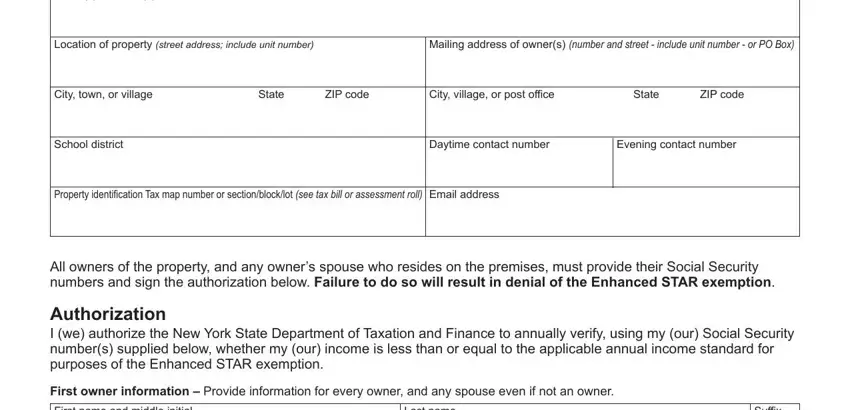

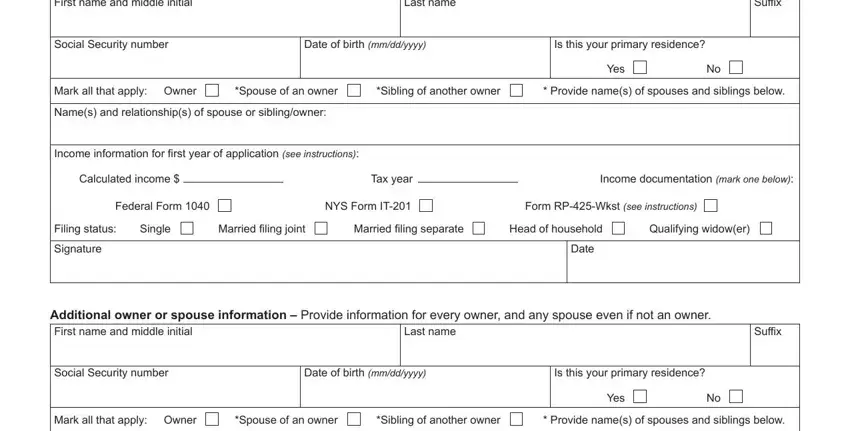

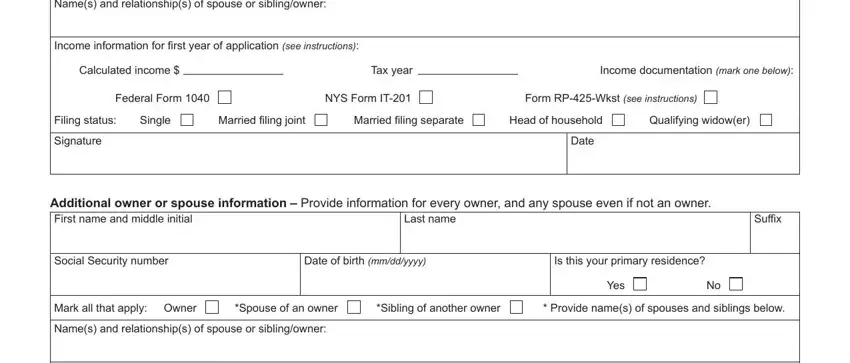

You'll be requested to write down the data to help the platform fill in the part Additional owner or spouse, Last name, Suffix, Social Security number, Date of birth mmddyyyy, Is this your primary residence, Mark all that apply Owner, Spouse of an owner, Sibling of another owner, Provide names of spouses and, Yes, Names and relationships of spouse, Income information for first year, Calculated income, and Tax year.

Through section Names and relationships of spouse, Income information for first year, Calculated income, Tax year, Income documentation mark one below, Federal Form, NYS Form IT, Form RPWkst see instructions, Filing status, Single, Married filing joint, Married filing separate, Head of household, Qualifying widower, and Signature, identify the rights and obligations.

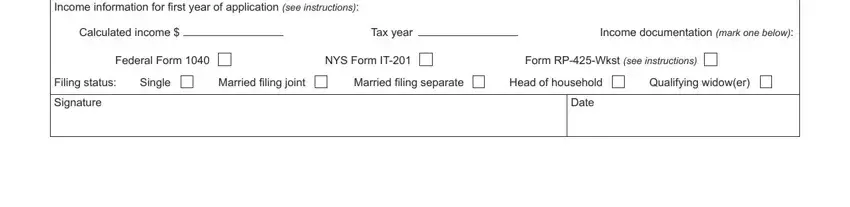

Finalize by reading these fields and writing the appropriate particulars: Income information for first year, Calculated income, Tax year, Income documentation mark one below, Federal Form, NYS Form IT, Form RPWkst see instructions, Filing status, Single, Married filing joint, Married filing separate, Head of household, Qualifying widower, Signature, and Date.

Step 3: Once you press the Done button, your finished form may be transferred to any of your devices or to email provided by you.

Step 4: Try to make as many copies of your document as you can to stay away from potential problems.