rp50 redundancy form can be filled out in no time. Just try FormsPal PDF editing tool to get it done promptly. Our editor is constantly evolving to deliver the best user experience possible, and that's because of our resolve for continual improvement and listening closely to customer feedback. To get the ball rolling, go through these basic steps:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: With our advanced PDF tool, you'll be able to do more than just fill in blank form fields. Edit away and make your documents appear high-quality with custom textual content incorporated, or modify the file's original input to excellence - all supported by the capability to add any type of pictures and sign the PDF off.

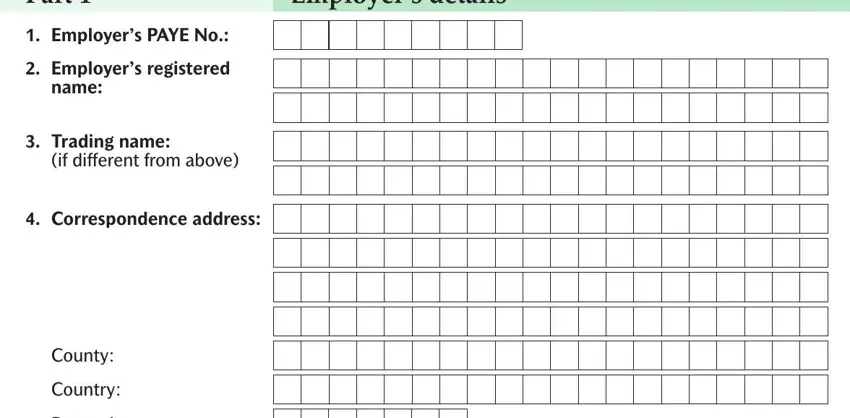

As for the blank fields of this precise form, this is what you need to do:

1. First, once completing the rp50 redundancy form, begin with the page with the next blank fields:

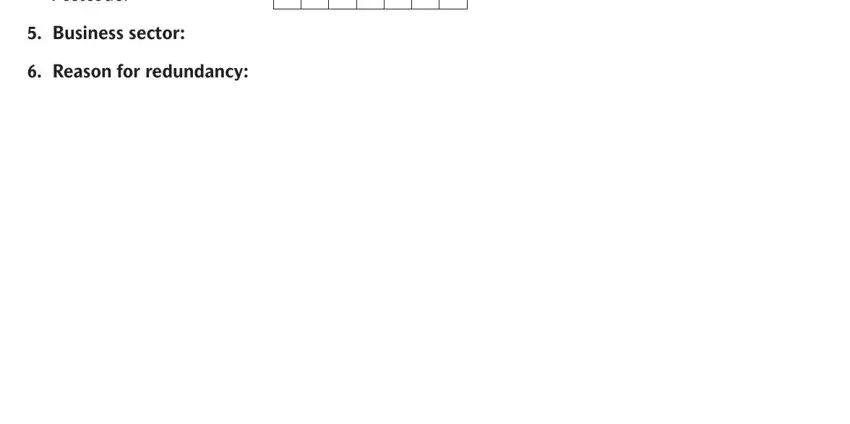

2. Once your current task is complete, take the next step – fill out all of these fields - Postcode, Business sector, and Reason for redundancy with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

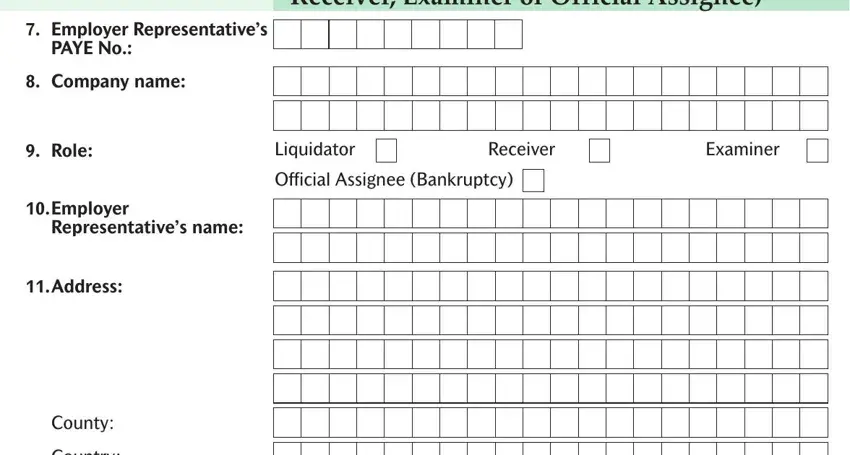

3. Completing Employer Representative details, Employer Representatives, PAYE No, Company name, Role, Liquidator, Receiver, Examiner, Official Assignee Bankruptcy, Employer, Representatives name, Address, County, and Country is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

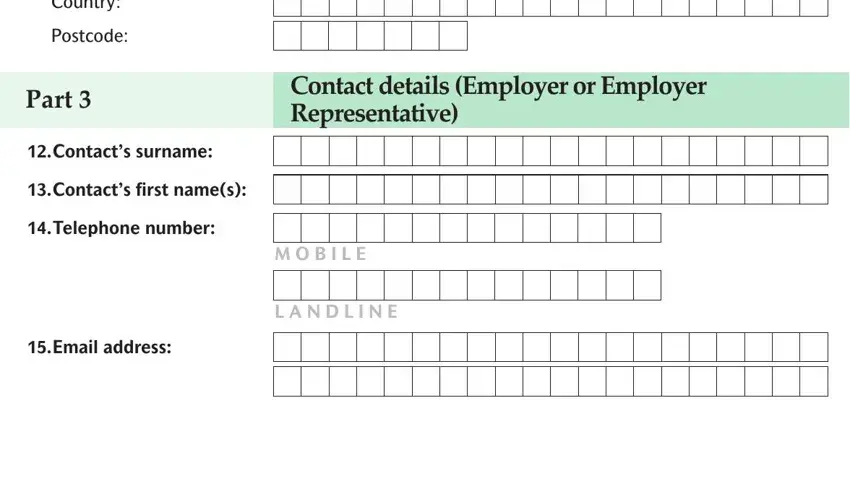

4. This next section requires some additional information. Ensure you complete all the necessary fields - Country, Postcode, Part, Contact details Employer or, Contacts surname, Contacts first names, Telephone number, Email address, M O B I L E, and L A N D L I N E - to proceed further in your process!

People generally make mistakes when filling in Country in this area. Remember to double-check what you enter here.

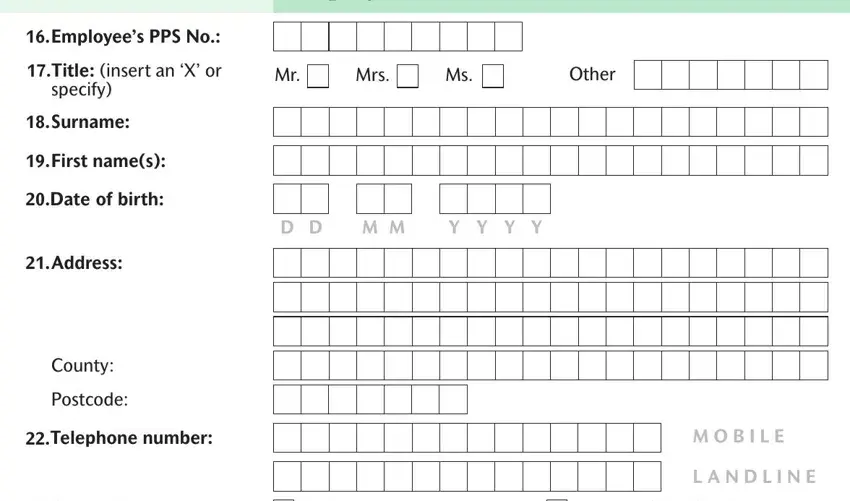

5. The document has to be finalized by filling in this area. Below you will find a full set of fields that need to be filled in with specific information in order for your form submission to be complete: Part, Employees details, Mrs, Other, D D, M M, Y Y Y Y, Employees PPS No, Title insert an X or, specify, Surname, First names, Date of birth, Address, and County.

Step 3: Confirm that your details are accurate and press "Done" to progress further. Sign up with us today and instantly get rp50 redundancy form, all set for downloading. Each and every modification you make is handily preserved , which enables you to modify the form later if necessary. When using FormsPal, you can easily complete documents without worrying about data incidents or data entries being distributed. Our secure software helps to ensure that your private data is kept safe.