Using PDF files online is actually very simple with our PDF tool. Anyone can fill in form 41326 nm healthcare credit here effortlessly. The editor is constantly updated by our staff, acquiring additional features and growing to be greater. With a few easy steps, you are able to start your PDF journey:

Step 1: Access the PDF in our tool by clicking the "Get Form Button" in the top section of this page.

Step 2: Once you open the file editor, you will get the form made ready to be filled in. Apart from filling in various fields, you might also perform several other actions with the file, including writing custom textual content, modifying the initial textual content, inserting illustrations or photos, placing your signature to the document, and much more.

It is actually simple to complete the form using this detailed tutorial! This is what you should do:

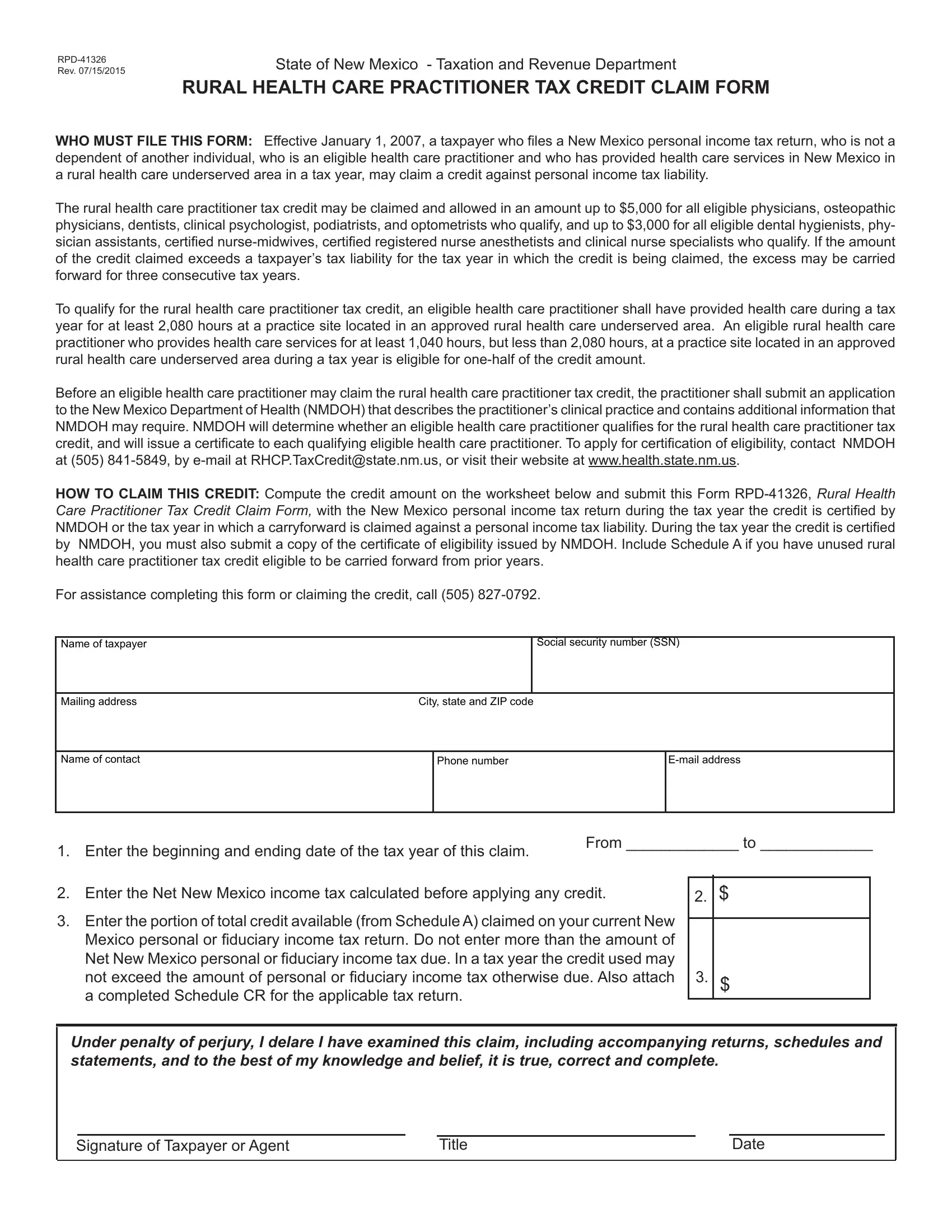

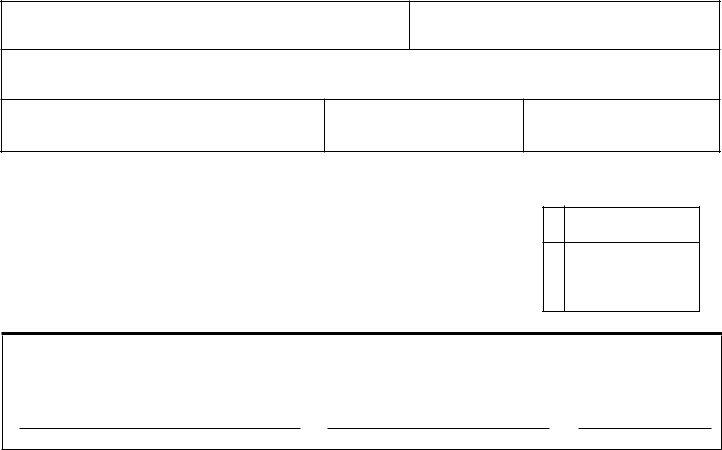

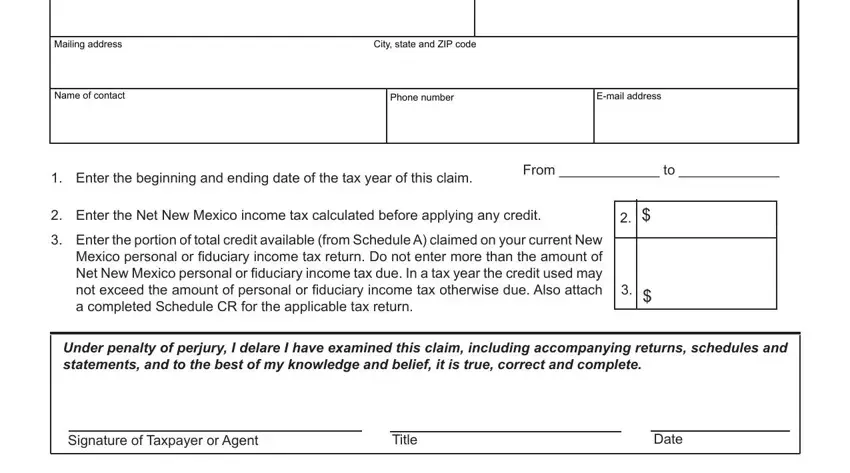

1. When submitting the form 41326 nm healthcare credit, ensure to include all needed blank fields in the associated area. It will help speed up the work, allowing your details to be handled without delay and accurately.

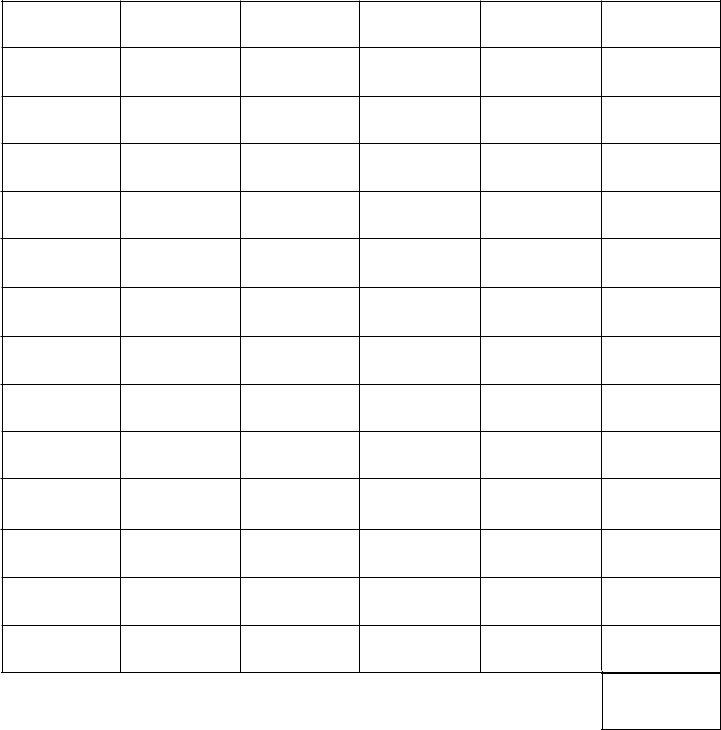

2. Right after performing this part, go to the subsequent part and complete all required particulars in all these blank fields - approved, Total credit claimed in previous, and return.

3. This subsequent section is relatively easy, TOTAL credit available Enter the - these blanks will need to be filled in here.

Many people often get some points incorrect when filling out TOTAL credit available Enter the in this part. You should definitely review what you enter right here.

Step 3: Soon after proofreading your entries, press "Done" and you are all set! Grab your form 41326 nm healthcare credit when you register here for a 7-day free trial. Conveniently view the pdf form from your personal account, together with any edits and changes conveniently synced! We do not share or sell the details you use when completing forms at our site.